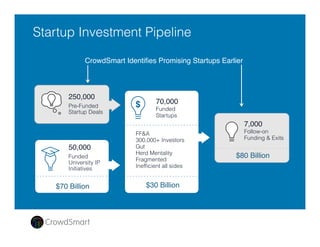

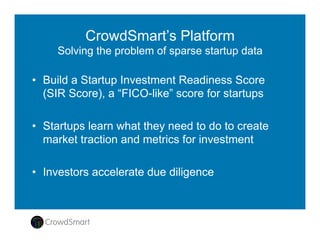

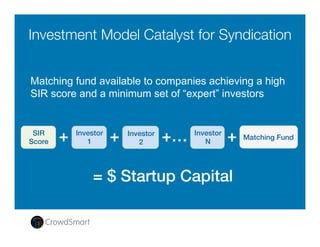

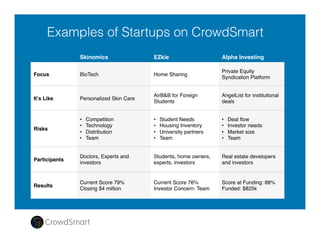

Crowdsmart is a SaaS technology company focused on identifying and investing in promising startups by leveraging machine intelligence and expert communities. The platform predicts startup success with a unique scoring system and supports family office investors in acquiring high-quality investments. Since its launch in 2016, Crowdsmart has gained significant traction with over 50 rated startups and has garnered a community of more than 1,000 participants.