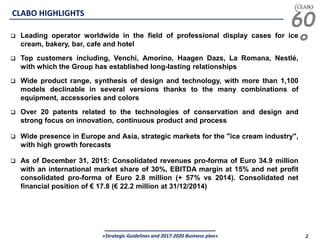

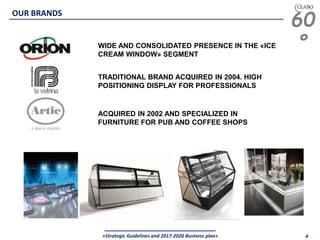

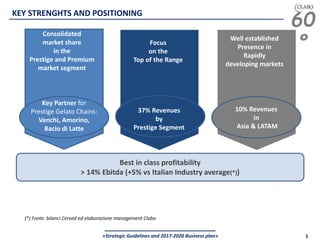

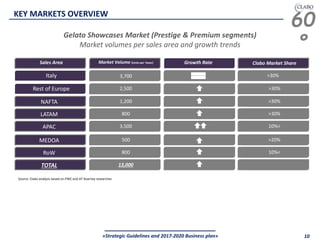

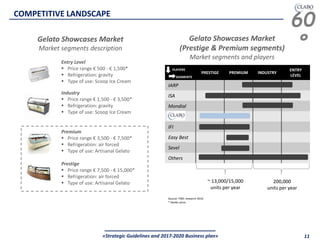

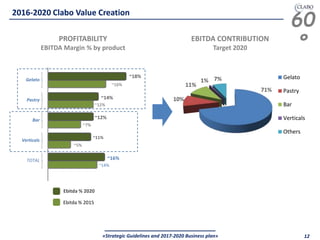

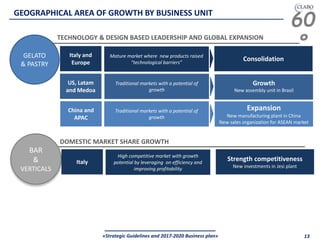

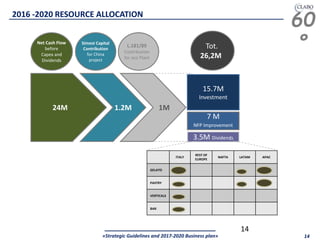

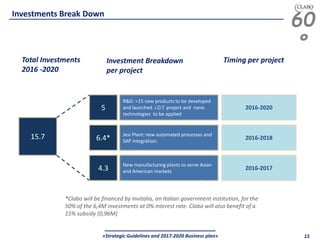

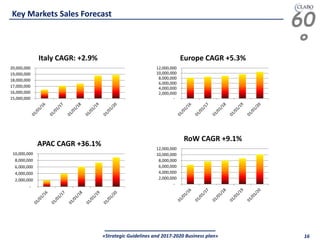

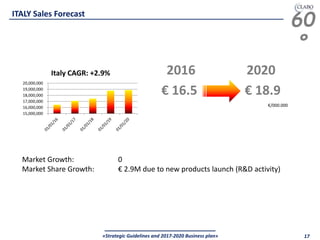

Clabo is a leading global manufacturer of professional display cases for ice cream, bakery, bar, and cafe industries. It has over 30% market share in the premium and prestige segments in Europe and Asia. Clabo's strategic plan for 2017-2020 focuses on expanding in growing Asian and Latin American markets through new local manufacturing plants in China and Brazil. The plan also aims to improve efficiency at the Jesi, Italy plant and invest heavily in R&D to drive innovation. Clabo forecasts strong revenue growth, especially in Asia, and margin expansion through these initiatives to strengthen its leadership position and create shareholder value.