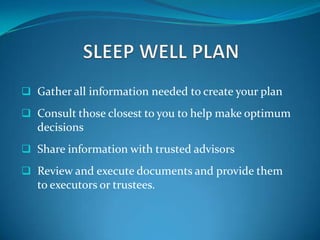

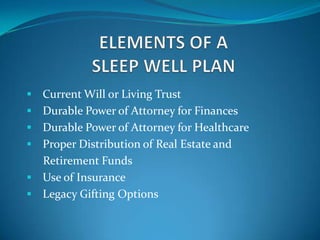

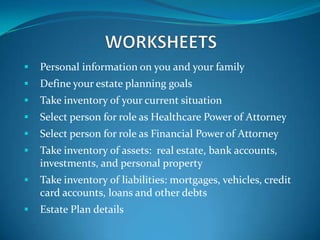

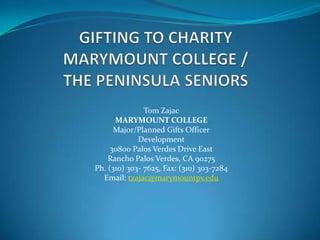

This document provides information about estate planning and discusses wills, living trusts, powers of attorney, healthcare directives, inheritance, and strategies for distributing property after death. It emphasizes gathering accurate information, consulting advisors and family, and periodically reviewing and updating estate planning documents. The document also discusses avoiding unintended inheritance distributions, leveraging tools like life insurance and retirement accounts, and including charitable gifts and legacies in one's estate plan.