CIM assignment

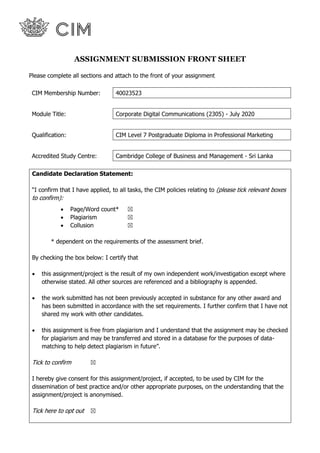

- 1. ASSIGNMENT SUBMISSION FRONT SHEET Please complete all sections and attach to the front of your assignment CIM Membership Number: 40023523 Module Title: Corporate Digital Communications (2305) - July 2020 Qualification: CIM Level 7 Postgraduate Diploma in Professional Marketing Accredited Study Centre: Cambridge College of Business and Management - Sri Lanka Candidate Declaration Statement: “I confirm that I have applied, to all tasks, the CIM policies relating to (please tick relevant boxes to confirm): • Page/Word count* ☒ • Plagiarism ☒ • Collusion ☒ * dependent on the requirements of the assessment brief. By checking the box below: I certify that • this assignment/project is the result of my own independent work/investigation except where otherwise stated. All other sources are referenced and a bibliography is appended. • the work submitted has not been previously accepted in substance for any other award and has been submitted in accordance with the set requirements. I further confirm that I have not shared my work with other candidates. • this assignment is free from plagiarism and I understand that the assignment may be checked for plagiarism and may be transferred and stored in a database for the purposes of data- matching to help detect plagiarism in future”. Tick to confirm ☒ I hereby give consent for this assignment/project, if accepted, to be used by CIM for the dissemination of best practice and/or other appropriate purposes, on the understanding that the assignment/project is anonymised. Tick here to opt out ☒

- 3. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 1 Table of Contents Task 01..........................................................................................................................................................3 Task 1 (a). Company Background ............................................................................................................4 Task 1 (b)..................................................................................................................................................6 Task 1 (C). ..............................................................................................................................................10 Task 02.......................................................................................................................................................13 Task 2 (a). ...............................................................................................................................................14 Task 2 (b)................................................................................................................................................18 Task 2 (c). ...............................................................................................................................................22 Task 03........................................................................................................................................................24 Task 3 (a). ...............................................................................................................................................25 Task 3 (b)................................................................................................................................................28 Task 3 (c). ...............................................................................................................................................32 Appendices..................................................................................................................................................36 1. BOC SWOT Analysis.....................................................................................................................37 2. Identity Audit..................................................................................................................................38 3. External Environment Analysis ......................................................................................................43 4. Internal Environment – Corporate resources and competencies.....................................................45 5. Culture Audit – Cultural Web (Johnson, Scholes and Whittington, 2005).....................................46 6. Media Usage ...................................................................................................................................47 7. BOC social media followers vs competitor ....................................................................................48 8. Green Banking ................................................................................................................................48 9. Customer Feedbacks .......................................................................................................................50 10. Hierarchy of Decision Making....................................................................................................51 11. Recent Promotional materials.....................................................................................................51 12. Milestones...................................................................................................................................52 13. Theoretcal models- Loylty..........................................................................................................52 a. Service Profit Chain........................................................................................................................52 b. Virtuous Circle................................................................................................................................53 c. Loylty ladder...................................................................................................................................53 d. Herzberg two factor principle .........................................................................................................53 14. User persona................................................................................................................................54 References...................................................................................................................................................55 Bibliography ...............................................................................................................................................56

- 4. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 2 List of Tables Table 1: Role of BOC’s CR, Identity and Image to Support the Achievement of Loyalty ..........................9 Table 2: Stakeholders impact to CR and customer loyalty.........................................................................12 Table 3:Organization’s current corporate strategy, structure, systems, and culture ...................................15 Table 4: Gaps between image and identity.................................................................................................17 Table 5: Critical Evaluation of stakeholders’ digital behavior ...................................................................27 Table 6: Critically appraise the effectiveness of available digital channels ...............................................29 List of Figures Figure 1: Freeman's Stakeholder Map ..........................................................................................................5 Figure 2: Dowling’s (204) Family of CR Construct.....................................................................................6 Figure 3:The CR chains ................................................................................................................................8 Figure 4: Drivers of CR ................................................................................................................................9 Figure 5: Stakeholders ................................................................................................................................10 Figure 6: Customer bases brand equity.......................................................................................................18 Figure 7:Building corporate character ........................................................................................................20 Figure 8: Facebook users in SL (Sri Lanka) ...............................................................................................25 Figure 9: Digital Growth in SL...................................................................................................................25 Figure 10: Corporate comms. model adapted from Frombrun, 2007 .........................................................32 Figure 11: Evaluation of Social media monitoring tools based ..................................................................35 Abbreviation SL : Sri Lanka BOC : Bank of Ceylon CL : Customer Loyalty CR : Corporate Reputation

- 5. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 3 Task 01

- 6. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 4 Task 1 (a). Company Background Name of the Organization The of Bank of Ceylon (BOC) is a licensed commercial bank began on 1st of August 1939 under Bank of Ceylon Ordinance No. 53 of 1938. Sri Lanka’s first state-owned commercial bank and Sri Lanka No.01 Bank (Brand Finance-2020) AA+(lka) Stable Fitch Ratings Lanka (SL) AAA Stable ICRA Lanka Limited Organization Type BOC is a licensed commercial bank established under the Banking Act No. 30 of 1988 8,724 Total employees LKR 338.0 million Investment in training and development LKR 24.2 billion Value created to the Government LKR 2.3 trillion Assets LKR 1.8 trillion Deposits Largest financial institution of SL in terms of assets, loans and advances, deposits and profit 13.4 million Customers (62% of population) 1,721 Customer touch points (direct) Size of Organization 0 50000 100000 2015 2016 2017 2018 Financial Performance Net Interet Income LKR million Profit Before Tax LKR million Customer Bases Products and Services Lending Products Personal loans Housing Loans Commercial loans Micro-Credit Pawing Leasing Facilities Investment Products Retirement schemes Time deposits Senior citizens savings Minor savings & Youth savings Savings for ladies Transactional Products Current accounts Credit cards & Debit cards ATM cards Internet banking Mobile banking Travel Cards

- 7. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 5 Key Customer Segments Base Premium Mass Affluent Mass Corporate Banking Demographic Age Age 40 and above Age 25 - 40 Age below 25 Occupation Wealthy professionals, retired, Housewives, Young Professionals Housewives, students Corporate bodies Investments in the bank Relationship above LKR 10Mn Relationship between LKR 500,000 - LKR 10Mn Relationship below LKR 500,000 Corporate customers (facilities over LKR 50Mn), SME clients (Facilities <50Mn) Geographic Popn density Mostly urban Urban, suburban Rural, suburban Urban Psychographic Social class Upper class Upper middle class Lower middle class Lifestyle Achievers Achievers Strivers, achievers Behavioural Benefits Convenience Convenience Economy Media Consumed Traditional Media Digital and Traditional Media Digital Media Corporate reputation and image are considered as important factors in establishing and maintaining loyalty among customers (Raj, 1985). In addition, loyalty and corporate image have a significant positive relationship (Ishaq,2011). Customers are believed to be more loyal to the products of firms with a good reputation (Morley, 2002). Added, Customer loyalty becoming an important element of banking strategy in today’s increasingly competitive environment and it is a key success for a banking industry (UK_Essays,.2018). On the other hand, referring to the SWOT analysis (Appendix 1) strengths of the company such as favorable customer-oriented company culture, high investment on customer relationship and loyalty program. senior management support for the improving loyalty along with the favorable opportunities are also a reason to choose loyalty for improving company image and reputation. Market Competitors Indicators for Yr 18/19 Profit for the Year (Bn) 19.4 12.143 17.1 17.83 Earnings per Share (Rs.) 1,044.78 45.13 17,095 17.55 Staff Strength 8724 4189 8093 4982 Customer Touch Points 1721 229 738 280 Rating by Fitch(lka) AA+ A+ AA+ AA How Loyalty Impact to the Company Image and Reputation Figure 1: Freeman's Stakeholder Map

- 8. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 6 Task 1 (b). Critical Evaluation of the Role of BOC’s Corporate Reputation, Identity and Image to Support the Achievement of the Objectives The Importance of Managing BOC’s Corporate Reputation (CR) to Improve Customer Loyalty Managing reputation importance for organization thus, a positive reputation is a key source of differentiation; linked to favorable customer attitudes towards the company (Jeng, 2011; Gorondutse, et al., 2014); building support and trust in the organization; helping to attract and retain quality staff and business partners ( Fombrun & van Kiel, 2004); make a significant contribution to satisfaction, commitment and customer loyalty (Jeng, 2011); higher company market share ; improved financial performance and competitive advantage (Gronroos, 2000). On the other hand, In the service organizations like BOC, where is no tangibility or transfer of ownership involved in the purchase, building and managing strong CR is key differentiating factor, and an important part of the overall value package. (Ali, et al., 2012). Role of BOC’s CR, Identity and Image to Support the Achievement of Loyalty. According to Dowling’s (2004) Family of CR Constructs shown in figure 2 the identity and corporate brand are driven by corporate imagery and reputation held by stakeholder perceptions that could potentially produce positive outcomes such trust, loyalty and reputation capital. It is further explained in below table 1. Figure 2: Dowling’s (204) Family of CR Construct

- 9. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 7 Factor Critical Evaluation Support of objective (CL) Identity As shown in figure identity consist with three elements. Based on the BOC identity audit carried out in Appendix 03, following positive and negative influences have identified. Positive aspects of identity, which have a positive effect on customer satisfaction and brand commitment, lead to customer loyalty. (Kazemi & et.al,2014) Symbolism Communications Behavior Consistency of brand logo over 24 years impact on customers to positively perceive BOC as an oldest and government bank. Well defined and communicated vision, mission and values along with usage of different channels , ensure the continuity of BOC 's brand association with trust and stability. High service performance in term of Sales and market share, ratings, awards and sustainability lead positive reputation and customer satisfaction Less focus on products and services, customer experience, responsible banking and the bank 's sustainable practice in communication along with large used of traditional medias couse to communicational issues Creative idea making takes long time to process due to high hierarchy decision making and autocratic leadership style.It may lead customer dissatisfaction.

- 10. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 8 Image Figure 3:The CR chains The application of model (Figure -3) in the context of BOC, identity and image management was concerned. It shows the image of the brand that has led to the customer's satisfaction with the services provided by the BOC. According to the reputation chain, satisfaction is influence CL followed by an increase in company sales. Kim and Lee (2010) stated that corporate image had impact on CL, and that corporate image and customer expectations regarding the nature and quality of services had an impact on CL (Rowley & Dawes,1999).

- 11. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 9 Corporate Reputation Fombrun (1996) argues that, in order to build a good reputation, an organization must develop four key attributes shown in figure Figure 4: Drivers of CR Great performance in key attributes leads to high business performance through dynamics such as retention and, satisfaction and customer loyalty. Credibility Reliability Responsibility Trustworthiness High profit and growth prospects (Appendix-4) Negative feedback on customer services (Appendix-9) serving community and initiatives for green banking (Appendix-8) Highly trustable financial institution with great pride thus SL first national bank. (Appendix-4) Table 1: Role of BOC’s CR, Identity and Image to Support the Achievement of Loyalty

- 12. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 10 Task 1 (C). Critical evaluation, using stakeholder analysis, the ways in which BOC stakeholders could influence the organization’s corporate reputation (CR). As a financial services provider, BOC considers stakeholder engagement to be a strategic focus in the process of creating sustainable business. Although all stakeholders identified through the Freeman Stakeholder Map (1984) (Figure 01) are considered to be key partners contributing to and witnessing the succession of growth over the years, given the size, depth and reach of the Bank's operations, it is critical to proactively identify and respond to the diverse expectations of its large stakeholder base. Key stakeholders are therefore identified using the Mendelow Matrix (1991) and the priority key stakeholder group for BOC is comprised of customers, employees and government who have a strong influence on corporate reputation and loyalty. For a summary of the stakeholder audit, see Figure 05. Figure 5: Stakeholders

- 13. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 11 Type Evaluation of stakeholder Impact on CR Impact on Customer Loyalty Investors The Bank’s investors are primarily parties who invest in our debentures ▪ Earnings per Share = Rs.3.96 ▪ Net Assets Value per Share = Rs.30.12 Expectations: ▪ Financial Performance ▪ Transparency and disclosures ▪ Business Expansion plans ▪ Risk management Engagement: • One to one meeting. • Engagement through • Annual General Meeting A good relationship with investors adds credibility and positivity towards BOC. Also, the decline in share price would create a negative impression on BOC as it indicates that the organization is struggling financially that would have a negative impact on the CR and that the organization would struggle to find investors. High customer loyalty and high customer retention occur where there is high shareholder loyalty (Payne & Frow, 2013) Further, Some other investors willing to invest in a company with high customer loyalty (Schoenbachler, et al., 2004) Employee ▪ The BOC Team comprises of 1629 employees across the island. ▪ Rs.25.72 Mn investment for Human Capital Development Expectations: ▪ Performance and reward management ▪ Training and Development ▪ Career advancement opportunities ▪ Retirement benefit plan ▪ Value driven corporate culture Engagement: ▪ Employee engagement surveys ▪ Trade union engagement ▪ Grievance handling mechanism ▪ Performance Management Employees create the environment for a coworker to settle in. Good employment is required to drive better performance. Bad review by the BOC employee would reflect on the low retention rate that causes BOC difficulties in hiring staff to provide services to customers that will have a negative impact on CR. Employee satisfaction is directly linked to customer satisfaction and customer loyalty (Subramanian, 2018). A link has been established between having engaged employees and increasing customer loyalty and satisfaction. (Saxena, et al., 2015)

- 14. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 12 Customers Customer touch points includes 85 Branches and 88 ATM and CDMs Rs.122.54Bn Customer Deposits and Rs.117.50Bn Loan & Advances Expectations: ▪ Customer security and privacy ▪ Service quality ▪ Affordability of service and convenience ▪ Financial education and literacy Engagement: ▪ Engagement through branch ▪ Customer Satisfaction surveys ▪ Customer hotline & web Customers are one of the company’s most significant stakeholder groups as they create revenue sources. A company's reputation for customers is becoming increasingly relevant as it affects both commercial outcomes such as profits and non -commercial outcomes such as consumer trust. Word of mouth and trust would have direct effect on BOC's image and reputation as positive or negative. Due to services are intangible, it is very difficult to acquire new customers and build loyalty. Therefore, the loyal customer is a effective source of spreading positive word of mouth and work as advocates in the community. . Government and Regulators The Government of Sri Lanka is the Bank’s sole shareholder while the primary regulator is the CBSL. Expectation: ▪ Compliance with directives and codes ▪ Local overseas expansion ▪ Microfinance and SME development ▪ Consolidation of the financial sector Engagement: ▪ Meetings on matters relating to performance and compliance ▪ Regulatory and compliance reporting Industry forums and meetings The legislations play a role in crafting the success and operations which could affect the reputation. Government and regulators always check how the company adhere to policies and regulations. Then they will publish their view to the general public and it will impact to the company There will be a direct customer behavior change due to the government influence. Customers trust has built through bank’s ownership belongs to government. Therefore, customer loyalty will be affected in a significant level through the government and regulators. Community The Bank’s extensive geographical reach has allowed it to nurture meaningful relationships with communities across the island Expectation: ▪ Ethics and business conduct ▪ Environmental performance ▪ Employment opportunities Engagement: ▪ CSR activities and sponsorships ▪ Press releases and media campaigns A minimum number of stories (CSR, Sponsors, Press Release) that reference or feature the company in leading media would influence the CR of BOC. BOC is currently having few CSR activities and environment activities which have awarded and published through press. Hence, this may can use to build the customer loyalty Table 2: Stakeholders impact to CR and customer loyalty

- 15. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 13 Task 02

- 16. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 14 Task 2 (a). Critical evaluation of the organization’s current corporate strategy, structure, systems, and culture in relation to its positioning and reputation, also assessing the current gaps between image and identity. Recommend how this gap could be addressed to achieve the objectives. Critically evaluate the BOC ’s current corporate strategy, structure, systems, and culture in relation to its positioning and reputation Element Critical Evaluation Impact on positioning & reputation Rating & Ranking Strategy Strategic Intent Position the Bank as Sri Lanka’s first local international bank through widening their footprint in regional economies as on their vision statement. According to mission statement BOC wants to drive customer centric business environment and innovations. Product Market strategy can be identify through the Ansoff metrix. The Bank intends to pursue innovative business models, improved processes, and a multi-channel delivery strategy to enhance customer accessibility. Examples: • Launch of several digital products including BoC DIGI centers. • Expanded the network of smart zones. • Expanded the number of Branch on wheels. 3 Levels of strategy corporate strategy: Facilitate reducing resource consumption by integrating sustainability. Business Strategy: Driving customer centricity was a key area of focus during the year and direct investments towards empowering employees to drive a consistent customer experience. Functional Strategy: Product development - BOC expanding their network by using online and truck operation. Their three levels of strategy are not fully aligned with the company's vision. Company aiming for a global footprint in the vision and not to know much from it. Employees can then feel frustrated because there may be no mitigating steps to be taken by the workers. Creating global presence, drive innovations and teach may position brand as a well innovative bank. Reputation may increase by use of identity from empowered employees and image from well satisfied customers. Expand of customer touch points by using tech innovations and branches on wheels will increase company reputation. High

- 17. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 15 Structure Tall structure: Slower communication and information flow making the organization less flexible. Slower service levels: Organization follows more centralized approach which delays the service levels (Source – Internal credit policy, operational process document). Staff layers: Currently there is higher percentage of staff in the officer staff than in the operational level (Source – reporting lines, human resources). Employees having a high job security because BOC is a government bank. But Rewarding systems does not incentivize performance and centralized approach, seen an increase in service quality complaints. Therefore, BOC has position as a un efficient service provider and reputation of the bank has got a negative impact. High System International Comprehensive Banking System (ICBS): Funds management tools, lending enhancements and efficiency improvements. Customer retention and profitability for financial institutions through feature of product packaging. Online centralized computer system: users are connected to a central server that stores complete network data and user information. Improve customer loyalty and profitability through dynamic product packaging. Increase reputation through effective customer service. Medium Culture As discussed in the culture web in appendix 6, as a first indigenous bank to the SL BOC is well known symbol to the community. Government ownership and control has created central decision making with slow down and inefficient communication. Open communication climate', history, symbol of the bank is leads to positive reputation on the other hand well-structured but hierarchal decision-making power influence negatively in some cases. High Table 3:Organization’s current corporate strategy, structure, systems, and culture

- 18. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 16 Assessing the current gaps between image and identity of BOC to recommend how this gap could be addressed to achieve the objectives. To identify the gap between corporate identity of BOC and image, REDS2 AC2ID Test was conducted. As a first step of the process Audit the five identities (appendix 02) and then Compare each identity interface, to identify gaps. Table 4 illustrates the identified gaps of BOC. Interface Description Recommendation on overcoming gaps Achievements of objective (customer loyalty) Actual Vs Communicated • Although BOC invest in digital banking, they have not been able to communicate it to the target audience successfully. • Trust, Stability and Brand heritage are the main highlight in the campaigns and less focus on Products and Services, Customer Experience, Responsible Banking and the Bank 's sustainable practice. • BOC still highly use traditional than non- traditional media, which is very low used by key customer segment. Revised communication strategy to focus on Bank’s self- service/ digital solutions/green banking while increasing social media presence. Enhancing digital channels with a view attracting and retaining target customers while driving process efficiencies and enhancing the customer experience BOC has an Great opportunity to increase customer loyalty through highlighting responsible banking practices, green banking on their campaign by using correct communication channels and strategies. Actual vs. conceived • Positive perception towards brand Financial, stability and State ownership while negative attitude towards Over- crowding at branches, Need for an inquiry counter, customer care and efficiency of services. • Low user friendliness of digital banking solutions. • Low customer’s awareness and employees commitment towards green banking. • Employees feel a high hierarchy of decision- making. Automated customer complaint handling. Automation of major workflows via Document management system (DMS) to efficiency of services. Upgraded and relaunched the online banking platform with user friendly features Customer engagement initiatives to aware on green banking Delegate power to employees motivate employees and established Innovation lab to enhance capabilities for innovation Increase in service quality, reduces the overcrowding of the branch will give positive impact to customer and employee loyalty. Actual Communi catedd Actual conceived GAP GAP

- 19. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 17 Actual vs Ideal • Current digital solutions should improve to creating future-proof banking through agile, digitally driven platforms • Current implications on green banking should extend more to Converting traditional banking system into the green banking system Strengthened the digital proposition to customers through establishing smart zones and other digital products Implementation of Environmental and Social screening criteria for the development banking portfolio. BOC performs better than its competitors in terms of green banking which can be build corporate reputation and customer loyalty. Revamp of the digi solution will address the customer demand and convenient and make them loyal. Table 4: Gaps between image and identity Actual Ideal GAP

- 20. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 18 Task 2 (b). Recommend an outline strategy for developing corporate reputation to build brand equity for the BOC’s corporate brand, to achieve the objectives, including the role of employees within this strategy. Following strategies are recommending for developing CR to build brand equity for the BOC brand, to achieve the customer loyalty (CL) To build the strongest brand and to create active CL, it is recommended to going up with both rational and emotional route of the pyramid. Element Current Situation Recommendations with justifications Salience BOC not a brand which comes to consumer top of mind in term of lowest interest rates-loan, highest interest rates – saving, customer friendliness, digitalized solution, green banking. (consumer satisfaction and perception survey-2019) Enhance the breadth and depth of the awareness, whenever customers think about financial solution BOC should come to consumers’ mind thus consideration leads to loyalty. -Provide customize financial solutions. Performance Refer Appendix for financial and nonfinancial performance Improve the service efficiency and the service empathy which results in loyalty (Appendix 13) Figure 6: Customer bases brand equity

- 21. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 19 Imagery BOC linked with history, heritage and experiences. Refer figure-3. Thus, BOC brands have a strong, favorable and unique brand association, which is important for the creation of brand equity, recommended to maintain existing associations. Judgments customer feedback (Appendix-9) shows customers have positive attitude towards quality of the bank except service quality of the staff. Further, it revealed brand consideration and credibility is high where brand superiority is less Maintain the credibility of the brand while improving service quality of the staff. need some actions to enhance brand superiority Feeling Customers identity BOC as highly trusted brand with attached to Security as brand feeling. BOC produces safety, comfort and self-confidence that is further enhanced via tag line 'Bankers to the Nation' Current Digitalized world it is better to produce excitement feeling along with safety to emotionally attached more customers and to increase behavioral loyalty Resonance Although, BOC have loyal customers lack of active engagements and attitudinal attachment. Implement following activities to enhance the CL, engagement and attachment. Digital acceleration of customer experience Customer-focused innovation Tailor-made and personalize promotion of sustainable and greenery financial solutions.

- 22. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 20 Current Situation Recommendations with justifications As shown in Figure 7, BOC is a highly competent brand due to its high reliability and success in the financial sector. On the other hand, a high level of 'Sincerity' mapping would be due to a high level of trustworthiness, a major contribution to the well-being of society. (Appendix-4). less adoption of up-to-date technology and low innovativeness leads to low mapping on ‘Excitement’. BOC is the largest state bank who providing financial solutions to customers in every class, leading to a low level of sophistication and comparatively high on ruggedness. level of competence and sincerity should be maintained while paying attention to increasing excitement in order to increase loyalty and to turn the prospect into an advocate level in loyalty ladder. (Appendix44-iterl). to increase the excitement via; • Digital acceleration of customer experience • Customer-focused innovation • Provide unique financial solutions • Use up-to-date technology 0 1 2 3 4 5 6 7 Sophistication Sincerity Ruggedess Excitement Competence Customer Figure 7:Building corporate character

- 23. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 21 Recommendations for managing the role of employees to achieve objectives and corporate branding strategy. Recommendations Actions Justifications Fostering employee loyalty through strong motivation Place a structured performance management system ensuring the equitable treatment of all employees. Conduct the awarding ceremony to recognize outstanding performance by employees. Conduct cultural, entertainment and sporting events to drive employee motivation, engagement and nurture a sense of camaraderie. Conduct Employee satisfaction surveys to ascertain the extent to which employees are motivated to contribute towards organizational success and the commitment. According to Hertzberg's motivation factors (appendix- 13) increases job satisfaction and Hygiene factors decreases job dissatisfaction. The literature suggests that there is a positive correlation between employee and customer satisfaction which in turn leads to employee retention, motivation and CL as highlighted in the service profit chain (appendix-13), internal service quality such employee rewards and recognition, development leads to employee satisfaction which in turn leads to customers’ satisfaction and CL Listening to the employee voice Implement Whistleblowing Policy encourage employees or non-employees to report complaints Maintains an Open-Door Policy with all employees measuring individual contribution towards the strategy and objectives Implement Recognition Programs which value employee contributions Introduce Performance management app Upskill and re skilling employees Conduct Employee Capacity development program to grooming up diverse and talented Bankers who are well competent to face the future Banking with right customer orientation attitudes and skills. Conduct comprehensive training to improve IT skills and knowledge of new technologies in digital transformation As per the Virtuous Circle(appendix-13), Training and empowered employees can lead to employee satisfaction and competence. This result in superior service delivery and customer satisfaction, in turn, lead to Cl.

- 24. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 22 Task 2 (c). Evaluate TWO different approaches to monitoring and measuring brand equity. Customer loyalty and brand equity go hand in hand. Brand equity makes customers look for a brand, not the other way around. It can translate into more repeat customers and make you seem less dependent on the acquisition of new customers through outreach efforts. Customers will be much more likely to recommend your business to others if they have an emotional connection to the brand. Improve and maximize brand equity by measuring brand equity. In order to do this, BOC must aggregate and analyze the following metrics: Model Critically Evaluation Rating Reputation Quotient (RQ) Reputation Quotient (RQ) is calculated from a list of twenty attributes representing six dimensions. The RQ model is using a broader and more multi-faceted range of criteria and involving a wider range of stakeholders. It also examines the interrelationships between the attributes and dimensions and the overall or aggregate rating of corporate reputation, aiding research into reputation drivers. Six dimensions has proven the most powerful predictor of RQ, followed by social responsibility and workplace environment - reinforcing the stakeholder interpretation of reputation (van Riel & Fombrun, 2007). Analyses of stakeholder responses on particular attributes can also help managers to identify leverage points for improving reputation through BOC corporate character: some subgroups may esteem the company more or less than others, and the company may be less favorably rated on some attributes than others - suggesting targeted communication strategies and messages to improve their customer loyalty. However, a few statistical weaknesses were identified in the RQ model (by its originators, among others): the validity and weighting of the attributes; the relationship between the dimensions; and the validity of the scale internationally. High

- 25. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 23 Millward Brown’s loyalty and brand dynamics pyramid (Brandz) Brand dynamics pyramid is an approach to understanding strategy brand equity discussed on task2 (b) and Model is based on ROI on past brand marketing investment. The pyramid shows how many consumers have a relationship with the brand at five key stages. From simple awareness (Presence) through personal (Relevance) and good enough (Performance), to the proportion recognising a clear competitive edge (Advantage) and finally those who are closely connected (Bonded) with the brand In this brand dynamics pyramid research has shown that, bonded consumers at top level of the pyramid build stronger relationships with the brand and spend more on the brand than those at lower levels of pyramid. Most of the consumers are at lower level of pyramid, and it will be the responsibility or challenge for the marketers to convince them and promote them to move up in the pyramid. Brandz provides a proven diagnostic and predictive tool that evaluate the strength of brands and can relate into future changes in market share. Also, this quantifies the extent to which a brand has converted consumers into a pool of bonded, or loyal and committed, consumers (helping company to identify how many loyal customers organization have). company needs to decide on a strategy and understand competitors and where the organizations brand stands in relation to them. But the problem is this model is based on customer-based brands and not so much focus on B2B brands. High

- 26. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 24 Task 03

- 27. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 25 Task 3 (a). Evaluation of environmental trends which are driving changes in stakeholders’ digital behavior and justify appropriate strategies for digital communications to support the BOC’s objectives. Importance of digital communications to engage key stockholders According to Hootsuite stats, Sri Lanka is having high rate of penetration (47%) on internet users. The number of users in sri lanka increased by +4.1% between 2019 – 2020. Total social media users were 6.4 million in jan 2020. Penetration of the social media users are 30% and 7.5% YOY growth. Mobile phone connection compared to total population is 149%. In Sri Lanka 50% of the people using facebook 42% of the instagram users are 25 to 40. Therefore, using digital media is having a good chance of targeting mass effluents easily. (napoleoncat.com, 2020). Figure 8: Facebook users in SL (Sri Lanka) Figure 9: Digital Growth in SL

- 28. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 26 Key Stakehold er Critical Evaluation of trends impacting digital behavior Risk/ Opportunity strategies for digital communications to achieve objectives Justification of strategies Customers Shifting of media habits. Compared to 2018 data, in 2019 there is a 17% increase of internet usage and 1% decline of traditional media viewership (www.kantarlmrb.lk) Reach to the customers by a less cost and engage with more customers directly. Advertise more into digital media Use paid, earn and own media. Social media listening. This will build new customer and make current customers into advocators on social media Customer expectations are changing rapidly with increased demand for personalized services, instant accessibility. Total Transactions increase – 2019 Q4 Mobile Banking – 73.3% Internet Banking – 40.0% (Source: Payments Bulletin, CBSL) • Technological disruption by new entrants and fintech organizations • Increasing competitive intensity • Reduced brand loyalty due to rapidly changing customer expectations • Virtual bank agent facility • Include a chat bot feature in the Bank’s website • Centralized data warehouse with a Big data analytics tool Attracting and retaining customer while increasing loyalty through efficiencies in processes and reinforce the Bank's digital proposition. BOC will be position as an innovative brand in the market with all these digital strategies. Employees Looking for less breakdown in the computer systems for a smooth working process. This includes breakdowns and failures in IT systems, cyberattacks, technological obsolescence, and inadequate infrastructure, among others, to support business volumes. • Embarked on setting up a Security Operations Centre • Improve system availability and reduced the downtime of critical systems Employees will experience a well- organized working process without any down time. Increasing technology acceptance of the employees Continue workflow automation target at paperless banking culture and increase the effectiveness of the service level. Comprehensive training to improve IT skills and knowledge in line with the Bank’s digital transformation Monitoring of NPL – early warning system for vulnerable loans. Employees will delight to learn about the new technologies and use them

- 29. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 27 Government Process automation Ongoing process automations such as the Human Capital Management (HCM) system • Ensuring that appropriate policies and procedures for existing and future IT products and services. • Online banking and self-serving kiosks for new account openings and initial loan applications As a BoC’s sole shareholder, government will get benefit of profits increase by reducing labor and few other cost elements. Digitalize reporting system Encouraging a paperless environment through the workflow automation. Artificial intelligence, in the form of machine learning, cognitive computing Document Management System (DMS), e-audit, BoardPAC Reporting tools themselves will become interactive and personal digital assistant will get engage with the relevant people. Table 5: Critical Evaluation of stakeholders’ digital behavior

- 30. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 28 Task 3 (b). Critically appraise the effectiveness of available digital channels within the market and evaluate the key technology developments in digital tools that could impact on the BOC’s corporate reputation. Critically appraise the effectiveness of available digital channels within the market Available Digital Channels Paid Media Owned Media Earned Media Example Display ads (Pop-ups/ Wallpaper-ads/ Video- ads) Social media advertising SEM/SEO Traditiona advertising - TV, radio and print Company website Content marketing Social media pages Mobile site Blog Media publicity Review sites Word-of-mouth marketing Social media engagement (shares, like, positive comment) Channel Users Refer appendix-14 Consumer persona Evaluation of effectiveness Cost Time to results Control ROI Reach Measurability Credibility

- 31. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 29 Evaluation of appropriateness of channel for BOC Rate Justification Rate Justification Rate Justification Paid media work well for re-targeting or remarketing to those who have already shown interest in business. It can easily attract consumer attention, amplify the reach of the content. Thus, starting the transformation of BOC, this will be appropriate Help to build long term relationship with existing customers and Owned media works best when it offers value for the visitors. BOC able to facilitate online banking, mobile banking via owned media Able to change consumer opinion , attitude and to boost brand awareness but Can bring up negative publicity also Effectiveness of digital channels to increase the loyalty of BOC Combining earned, owned and paid media can be a very powerful and effective means of generating traffic, qualified leads and enhance loyalty. Example: SEO & brand content drive earned media and traffic. Gain more exposure to web properties with SEO &PPC Propel sharing and engagement with paid promotion Table 6: Critically appraise the effectiveness of available digital channels

- 32. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 30 Evaluate the key technology developments in digital tools that could impact on the organization’s corporate reputation. Key technology developments Evaluation Impact on the organization’s CR Cognitive analytics Able to process vast amounts of big data and answer questions posed in natural language from a human via bank web site, app, social media and etc. Require lengthy development cycles with security concerns Cognitive analytics system leads to consumer satisfaction and enhances customer trust which will impact to positive CR. This development can lead to cultural, legal, moral, managerial and executive risks as well as operational, environmental and external risks which could adversely affect the CR. Bridge the gap between the intent of big data and the reality of practical decision-making. Artificial Intelligence (AI) Cost saving High capital investment AI help to make smarter choices, deepen customer relationships, drive more revenue, increase CL and CR Customer identification and authentication, via chatbots, voice assistants provide personalized feedback and advice. Detect and prevent payments fraud in bank and to improve processes. Augmented reality (AR) Facilitate virtual banking Security issues and less human touch AR create opportunity for BOC to differentiate from the Completely unique, customized banking experiences

- 33. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 31 Ensure quick service and accuracy competition and increase customer engagement /excitement /satisfaction in turn increase reputation. Automation allowing bank to efficiently optimize their time by automating tasks that used to require manual effort Less human touch, Loss of flexibility and high investment Through automation can boost revenue, increase spend efficiency and enhance customer satisfaction which positively influence on reputation provide personalized banking solution to customers

- 34. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 32 Task 3 (c). Recommend, with justification, a digital communications strategy to protect and strengthen the BOC’s corporate reputation and stakeholder relationships. Outline TWO digital technologies which could be used to monitor and measure the organization’s reputation. A perception of key stakeholders in corporate communication that influences the identity of the strategy and the brand, which in turn develops the reputation of the company Frombrun (2007). Based on these claims, it can be inferred that digital communication which is a part of the corporate communication has a direct relationship with CR which has an effect on customer loyalty. Therefore, following recommendations made for the BOC. Recommendations, with justification, a digital communications strategy to protect and strengthen the BOC’s corporate reputation and stakeholder relationships. Recommendation 01: Integrated Lifecycle Marketing Where BOC is at Present? It is important to consider the current situation in digital communications before moving towards a plan. Figure 10: Corporate comms. model adapted from Frombrun, 2007

- 35. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 33 When applying Customer Lifecycle Marketing to BOC, it involves many contact points throughout the customer journey. In order to achieve bank objectives, including customer loyalty, a range of online and offline activities must be used. Using the lifecycle marketing model below, BOC is able to achieve an optimum level of digital ladder while achieving CL and enhancing CR.

- 36. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 34 Recommendation 02: 5Ds of Digital Marketing Elements Description Protect and strengthen the CR and stakeholder relationships In order to give the customer, the opportunity to experience more of BOC 's brand, should. • improve web site with interactive features like chatbots • enhance user-friendliness of mobile app • introduce virtual banking using AR technology This provide opportunities for consumers to interact with brands and for BOC to reach and learn from their audiences in different ways. This enables BOC to enhance stakeholder engagement and satisfaction, in turn, to strengthen the stakeholder relationship and BOC 's reputation. Enhance bank visibility stakeholder engagement on digital platforms. Use paid, owned and earned communications channels together for reaching and engaging audiences including advertising, email and messaging, search engines and social networks. collect about bank audience profiles and their interactions with BOC in ethnically. Use different marketing technology that bank to create interactive experiences from websites and mobile apps to in-store kiosks and email campaigns

- 37. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 35 Two digital technologies which could be used to monitor and measure the organisation’s reputation. BOC should look at corporate reputation management tools shown in figure 10. To measure and monitor the channel strategy. The content strategy will be reviewed corresponding to respective strategy time frames. Tool Hootsuite Data captured The full version of the post is collected and grouped into specific categories, such as positive, negative feedback and etc. Hootsuite also has a deep data base convergence from a variety of platforms and channels. Platforms monitored This primarily tracks Facebook, Twitter, LinkedIn, Google+, Instagram, WordPress and YouTube, and has access to more than 100 other partner applications. Review of the website or import of CRM tool data into Hootsuite cannot be carried out. Robust dashboards Hootsuite is strong, with more data than insights from Facebook and IG and traceable links etc. Hootsuite, however, lacks heatmaps and scrolling maps to offer the full picture of user behaviour. Tool Woopra Data captured Woopra focuses primarily on website analytics which limits its channels. FAQs, feedbacks etc. are however thoroughly analyzed to generate insights into sentiment analysis Platforms monitored This also manages the website of the organisation. Woopra can also provide a Mobile application with analytics. Woopra also provides the functionality that needs to be integrated with CRM tools such as Salesforce, Hubspot that gives it access to business insights, industry information etc. This helps to equate the present market with the expectations of organization. Robust dashboards One of the industries 's best with real-time dashboard updates and notifications, and one of the very few tools for monitoring mobile apps. Figure 11: Evaluation of Social media monitoring tools based

- 38. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 36 Appendices Appendix

- 39. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 37 1. BOC SWOT Analysis Strengths Weaknesses • 643 branch networks & 1721 customer touch points • 81 year operational history. • Backing of government ownership. • Budget allocation for customer Education and capacity building. • Financial strength. • Brand attributes of trust and stability • Established track record of nearly eight decades • Numerous awards and accolades • Low budget for marketing. • Autocratic power culture. • More manual operational process. • Lack of innovations. • Lack of customer orientation. Opportunity Threat • Online banking solutions. • Personalization of services. • Replace manual processes with automated processes. • Tap into new markets such as north and east areas. • Increase in middle- and high-income earning segments. Further developments in low income earning group due to government support in providing low cost capital. • Digitalized banking solutions offered by competitors. • Rapid changes in political environment and regulatory changes affecting the industry. • Availability of close substitutes and interest margins controlled by regulators.

- 40. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 38 2. Identity Audit The components of corporate identity Tangibles Branding has been uniformed across all communications and branches. The physical attributes are similar across the island. Bank has yellow colored interior and building front facia with gray background and logo with Name. Mood Pipeline music is playing in the branches. Female staff wearing Sri Lanka traditional dress “saree”. Training Bank’s employees underwent extensive internal, external, and foreign training and development programs. Special structured Certification Programmes for front line employees. Communicating corporate values induction and orientation programme for new recruitments Bank vision: “ To be the Nation’s preferred bank with a strong global presence providing customer centric innovative financial solutions.” Mission: “To provide highly efficient, customer focused, technologically sophisticated, resilient and innovative financial services to the Nation with global access, empowering employees and enhancing value to the stakeholders.” Internal communication through E-mails, internal memos external communication through press, traditional media and less on social media Corporate visual identity The logo of the brand has been consistent for over 24 years. However, in the year before 1996, the bank of Ceylon used the full wording of the name along with the logo and, after that, the bank used the short form of the name BOC with the logo. BOC slogan was changed to "Bankers of the Nation" at the same time as the logo changed in 1996. Culture management The structured training programmes facilitates development of future leaders by identifying high performers and then fast-tracking their career growth in the organisation. Manager skill development Programme and leadership programme. use of HR systems to reinforce desired values and behaviours. Characters Attorney-at-Law Kanchana Ratwatte has been appointed as the new chairman of the Bank of Ceylon (BOC) on 2019. Senarath Bandara appointed GM/CEO at Bank of Ceylon on 2018. Your trusted bank

- 41. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 39 Corporate mix (Symbolism, Behavior, Communication) Identity Mix Description Rate Symbolism The brand logo has shown a consistence of over 24years. However, the bank’s logo poses a close resemblance earlier logo. Hence this might impact on customers to perceive our organization as an oldest and government bank by creating conflict between customer perception and our communication. 4/5 Communications Those are the different channels that BOC uses to express its identity in order to establish its corporate identity. Man Coms This is where keynote addresses will be made by their BoD and other senior management officials. Mark Coms These are the communications that are targeted to the consumers. Org Coms This is where the BOC’s contribution sponsors and CSR activities 3/5 Behavior Above stated communications are carried out mostly to communicate their corporate responsibility. Bank help nurture and sustain the environment through reduce the carbon footprint by going digital, and through energy saving in terms of lighting and heating. 3.5/5

- 42. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 40 REDS2 AC2ID Test Ident ity Techniques used Factor Description Actual Identity Structured survey Internal semi- structured interview External semi- structured interview service performance Sri Lanka’s first state-owned commercial bank and Sri Lanka Sales and market share Largest financial institution of SL in terms of assets, loans and advances, deposits and profit Ratings AA+(lka) Stable Fitch Ratings Lanka (SL) AAA Stable ICRA Lanka Limited Awards No.01 Bank (Brand Finance-2020) Customer feedback Majority of the customers dissatisfied with the customer service of the BOC Other Performance BOC highly invest on digital banking (Investment in digitization infrastructure: LKR 2.0 billion) and also on green banking . In addition, awards that they have won evidently good performance on green banking and digital banking (Annual report, 2019) Management and leadership style • Well defined governance structure consisting of a multi-level Governance bodies, specific roles and responsibility and clear reporting lines ensure accountability and truthfulness. Board of directors serves as the governing body of the apex and the custodian of the corporate bank It's governance. • The Chairman provides leadership to the Board and facilitates the effective functioning of the Board. • Several executive level committees have been established with specific responsibilities and clearly defined mandates. However,It’s been autocratic leadership style since the high hierarchy decision making and creative idea making takes long time to process corporate culture Well defined governance structure has an impact on the culture though the factors and have been discussed in 06

- 43. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 41 Communicated identity Communication audits /media monitoring formal communications and messaging vehicles Shareholders: The Annual Report is presented to the Parliament through the relevant Ministry. Employees: The Bank maintains an open-door policy with all employees while engagement is also facilitated through cordial relations with trade unions, multilevel staff meetings, grievance handling mechanisms and a year- round calendar of cultural, entertainment and sporting events. Customers: Engagement with customers is maintained through branches, relationship managers and multifaceted digital channels for further analysis on communication identity refer identity mix Communication Campaign and media According to the analysis of the Communication Campaign conducted by BOC ‘Trust and Stability’ and Brand heritage via tag bank of the nation are the main themes they highlight in their campaign where they focus less on Products and Services , Customer Experience, Responsible Banking and the Bank 's sustainable practice BOC mostly used traditional medias to communicate than modern medias. There is a consistency on the tone, branding of all communications Conceived Identity individual depth interviews, focus groups and/or survey questionnaires. Stakeholder attributes The Bank’s dedicated Research Unit conducted a comprehensive customer survey during the year, with an island wide coverage of over 10,000 customers to identify customer perceptions. Findings of this survey shows customers have positive perception of trust associated with the brand Financial, stability and State ownership while negative attitude towards Over- crowding at branches, Need for an inquiry counter, Limited parking facilities and efficiency of services. further less focus on Bank’s self-service/digital solutions, green banking

- 44. Corporate Digital Communication (2305) |July 2020 Membership No: 40023523 42 Ideal Identity information elicited through the ongoing strategic planning processes of the organisation, and periodic SWOT strategic capabilities and resources of the organization Largest financial institution of SL in terms of assets, loans and advances, deposits and profit 08 decades of service to nation No.01 Bank in Sri Lanka (Brand Finance-2020) SWOT– appendix 1 opportunities and threats Refer SWOT– appendix 1 Major focus for future Focused on creating future-proof banking through agile, digitally driven platforms • Enhancing virtual banking proposition with new fintec products. • Products to facilitate cashless banking • New virtual banking back-end • Centralized data warehouse with a Big data analytics tool • Continue work flow automation target at paperless banking culture • Innovation lab for the bank • Complete HCM system allowing fully automated HR management System. • BoC 360:Performance management app Converting traditional banking system into the green banking system Desired Identity CEO’s over view and review on the company annual reports and the other internal reports Focus on the objectives clearly outlined in its Corporate Plan with emphasis on driving customer centricity, supporting the country’s SME sector and green banking through fully digitalized banking system

- 45. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 43 3. External Environment Analysis Political Economic Social Technological Environmental Legal Investor 1. Instability and lack of policy consistency 2. Direct lending 3. Economic slowdown 4. Depreciatin g currencies against USD 5. Increasing borrowing cost 6. Increasing Tax burden 7. Demand for non- financial information and long termism 8. Growing demand for more transparency and accountability 9. Increasing impact of social media 10. Unorthodox competition and financial disintermediati on 11. Growing interest toward green bank 12. Implementati on of financial instrument 13. Higher regulatory capital Customers 1. Microfinanc e encouraging government policy 2. Encouragem ent for Greenery ,agribusines s and 3. Import restrictions 4. Slowdown in private sector credit 5. Increasing burn of taxes on 6. Changing Customer Expectation 7. increased demand for personalized services 8. Demand for instant accessibility and convenience. 10. New technological advance such as cloud computing, AI, Robotics and Block chain 11. Digitalization and automation 13. Rising paperless banking systems 14. Growing interest on green banking 15. Compliance requirements under FATCA 16. General Data protection regulation

- 46. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 44 entrepreneur ship though loan scheme savings account interest 9. Experience Seeking behavior 12. Cybersecurity threats Employee 1. Political influence on recruitment process 2. Growing inflation of the country 3. Need of high standard of life 4. Increasing women employment 5. Rising demand for diversity and equal opportunity 6. Technology driving change in job skills 7. Enhancement in employee 8. engagement towards environmenta l sustainability 9. Encouraging environmenta l responsibility 10. Focus on Health and safety at work 11. High attention on the rights of employees

- 47. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 45 4. Internal Environment – Corporate resources and competencies Human Capital • Employees: 8,724 • Average service length: 09 years • Female representation: 60% • Investment in training and development: 338Mn • 98% received performance appraisals • Retention rate: 98% • Value created to employees: LKR 18.9 billion Natural Capital • 5% Reduction in electricity usage • 7 million A4 sheets saved via digital initiatives • 1MW of electricity transferred to national grid via solar installation • LKR 6.3 billion Green Lending • 508 Customers screened for environmental criteria • Enhancing employee engagement towards environmental sustainability Financial Capital • Customer deposits: 1,765Bn • Borrowings: 350Bn • Shareholders’ funds : 121.4Bn • Fitch Rating : AA+(lka) • Crossed LKR 2.0 trillion milestone in assets • Increased SME lending under the Enterprise Sri Lanka Loan scheme • Gross NPL ratio maintained at 3.6% • Total operating income growth of 20% Manufactured Capital • Island-wide Network:643 • Smart Zones: 284 • Branches on Wheels: 06 • 776 ATM, 163 CDMs,118 CRMs,49 bill payment KIOSKs • Branch density: 2.93 BoC branches per 100,000 persons • • ATM density: 4.17 ATM machines per 100,000 persons Social and Relationship Capital • Customer relationships: 13.4Mn • Business partners: 9,722 • Customers benefited via customer education programmes: 14,580 • Spent for CSR: 108Mn • Spent for customer Education and capacity building: 21.9Mn • 113 financial literacy and capacity building sessions for customers Internal Factors Manufactured Capital Natural Capital Intellectual Capital • Brand: 42.9Bn • Maintained position as Sri Lanka’s No.1 brand for the 10th consecutive year- Brand Finance • Recognized as the ‘People’s Service Brand of the Year’ by SLIM – Nielsen Peoples Awards 2018 • 272,975 customers on boarded to mobile banking applications during the year Financial Capital Human Capital Intellectual Capital Social and Relationship Capital

- 48. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 46 5. Culture Audit – Cultural Web (Johnson, Scholes and Whittington, 2005) Factors Description Rating 1 2 3 4 5 Stories and Myths Bank of Ceylon was the nation's first indigenous bank to be incorporated under the Bank of Ceylon Ordinance in 1939 and different milestones have passed through its journey and today it has become the largest financial institution of SL in terms of assets, loans and advances, deposits and profits, along with the best brand of Sri Lanka. Symbols The BOC symbol is well known among the consumers. Further details about the symbolisms has been discussed in Corporate visual identity (appendix 03) Power Structures Power is divided by a well-defined governance structure and has a high hierarchy that slows down communication, which could lead to miscommunication and inefficiency. There are also instances where the first attempt to move into a market can be delayed due to this. This also ruins the creativity of the organization. (appendix 10) Organization Structures Decision making power are up to the board of directors. The Government of Sri Lanka, who holds 100% shareholding in Bank of Ceylon influencing decisions of the bank sometimes Control Systems The Board of Directors has ensured the implementation of an effective and comprehensive system of internal controls in the Bank and risk management and place considerable importance on maintaining a strong control environment to protect and safeguard the Bank’s assets and prevent fraud and mismanagement. Rewarding System: Rewarding systems does not incentivize performance. Hence it is seen an increase in service quality complaints Ritual and Routines Organizing culture with cultural celebrations, activities And special events like Avurudu, Christmas, etc. There are many sport-based events that happen within the context of the Organization and outside of the organization. The company has all the other standard rules and regulations.

- 49. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 47 6. Media Usage

- 50. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 48 7. BOC social media followers vs competitor 8. Green Banking Bank Initiatives Awards Rate BOC • 02 Green Building Certified branches • 5% Reduction in electricity usage • 7 million A4 sheets saved via digital initiatives • 1MW of electricity transferred to national grid via solar installation • LKR 6.3 billion Green Lending • Total GHG emission 13,255.6 tCO2e • Renewable energy generated: 885,238 Kwh • Introduced “Green Loans”a • Green Building Platinum Award Trincomalee Super Grade Branch • Annual Green Building Awards by Green Building Council of Sri Lanka (GBCSL) • The Bank has also obtained the ISO 14064 - 1 certification demonstrating its commitment towards GHG emission management. 4/5 Peoples Bank • Carbon Emission of our Head Office reduced by 22.62 tCO2e • Minimize paper waste by introducing People’s Wave and People’s Wiz Mobile apps • Introduced “Green Team” and “Green Loans • Most Sustainable Bank 2017 – Sri Lanka’ award at the prestigious World Finance Banking Awards in 2017 3/5 Bank Facebook Instagram Twitter BOC 283,995 2225 246 Peoples Bank 219,934 2291 205 Commercial Bank 475,907 19,400 2020 Sampath Bank 443,705 15,800 3491 Saylan 640,556 15,700 4275

- 51. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 49 Sampath Bank • Energy management through exploring energy efficient lighting solutions and alternative energy sources • Measuring direct and indirect emissions using the GHG Protocol Carbon Footprint Calculation process to track environmental performance and benchmark our progress against our peers in the industry • Raising awareness to enable stakeholders (customers, employees, community etc.) to embrace Green Ethics • Environmental CSR and partnerships to ensure sustainable solutions to prevent natural capital loss none 2/5 HNB • Environmental and Social Management System • Million Tree Stories Project none 1/5

- 52. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 50 9. Customer Feedbacks

- 53. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 51 10. Hierarchy of Decision Making 11. Recent Promotional materials

- 54. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 52 12. Milestones 13. Theoretcal models- Loylty a. Service Profit Chain 2015 2012 1992 1989 1939 1988 Fitch Ratings Lanka Ltd upgraded the Bank’s rating to AA+ (lka) stable outlook Issued the first Credit Card in Sri Lanka Entered into the Electronic Banking Era with the introduction ofAutomated Teller Machines and Cheque Guarantee Cards ‘ Ñ ± † M Bank of Ceylon incorporated as the nation’s first indigenous bank under the Bank of Ceylon Ordinance ‘ ‘ Became the first bank in Sri Lanka to surpass LKR One trillion deposit base and Introduced CDMs First Sri Lankan commercial bank to be ranked among the best 200 banks in Asia and 1,000 banks in the world by “Banker” magazine 2011 Became the first bank in Sri Lanka to surpass LKR One trillion asset base Become the largest financial institution of SL in terms of assets, loans and advances, deposits and profits, along with the best brand of sri lanka. 2018

- 55. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 53 b. Virtuous Circle c. b. Loylty ladder d. Herzberg two factor principle

- 56. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 54 14. User persona Heaviest daily engage with the brand, multiple media across multiple networks Always engage with the BOC social media post and other camps. She is an advocator to the bank. Channel : Earned media Tools : Media publicity, Review sites, Word-of-mouth, Social media engagement (shares, like, positive comment) Participation : Exposure : Channel : Own media Tools : Company website, Content marketing, Social media pages, Mobile site, Blog Participation : Exposure : Networks : Paid media Tools : Display ads (Pop-ups/ Wallpaper-ads/ Video-ads), Social media advertising, SEM/SEO, Traditional advertising - TV, radio and print Engagement : Exposure : Super Fans Consumers General Consumers Not a BOC consumer and searching information for financial solutions Customer who had experienced BOC products and services. Not a high engage with the brand, only for his requirement Not directly engage with the brand, but he will engage if he sees any interesting info.

- 57. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 55 References Ali, I., Alvi, A. K. & Ali, R. R., 2012. CORPORATE REPUTATION, CONSUMER SATISFACTION AND LOYALTY. Romanian Review of Social Sciences, Volume 3, pp. 13-23. Al-Jammal, H. R., Khasawneh, A. L. & Hasan, M., 2015. The impact of the delegation of authority on employees' performance at great Irbid municipality: case study. nternational Journal of Human Resource Studies, pp. Vol. 5, No. 3 . Anderson, E. & Sullivan, M., 1993. The antecedents and consequences of customer satisfaction for firms. Marketing Science, 12:, Volume 12, pp. 125-143. Ansoff, I. 1965. Corporate strategy. New York: McGraw Hill. Diasz, L., 2017. Marketing & Business Strategy. 1st ed. Colombo: s.n. Erdem, T. and Swait, J. (2004). Brand Credibility, Brand Consideration, and Choice. Journal of Consumer Research, 31 (1), pp. 191–198. Fombrun, C.J. (1996) Reputation: Realizing value from the corporate image. Harvard Business School Press. Fombrun, C.J. & Van Riel, C.B.M. 2004. Fame and fortune: How successful companies build winning reputation. New Jersey: Pearson Education. Freeman, R. E. (1984). Strategic Management : A Stakeholder Approach. Boston: Pitman. Gorondutse, A. H., Hilman, H. & Nasidi, M., 2014. Relationship between Corporate Reputation and Customer Loyalty on Nigerian Food and Beverages Industry: PLS Approach. International Jouranal Management Business Res., 4(2), pp. 125-136. Gronroos, C. (2000). On defining marketing: finding a new roadmap for marketing.Marketing Theory, 6(4), 395-417. Jeng, S. P. (2011). The Effect of Corporate Reputations on Customer Perceptions and Cross-Buying Intentions. The Service Industries Journal, 31 (6), pp. 851–862. Johnson, G., Scholes, K. and Whittington, R. (2005) Exploring Corporate Strategy (7th edn), London: Prentice Hall. Kim, Y., & Lee, J. (2000). Relationship between corporate image and customer loyalty in mobile communications service markets, Africa Journal of Business Management, 4(18), 4035-4041. Kitchen, P. J. & Watson, T., 2008. Corporate Communication: Reputation in Action. In: T. Melewar, ed. Facets of Corporate Identity, Communication and Reputation. s.l.:RoutledgeEditors, p. Chapter 07 Kotler, P., & Armstrong, K. (2010). Principles of marketing: Global edition. New Jersey, Upper Saddle River: Pearson Prentice Hall. Krentler, K. A., Ramasashan, B. & Caruana, A., 2015. Corporate Reputation, Customer Satisfaction, & Customer Loyalty: What is the Relationship?. In: Assessing the Different Roles of Marketing Theory and Practice in the Jaws of Economic Uncertainty. s.l.:Springer Link .

- 58. Corporate Digital Communications– July ’20 CIM Membership No: 40023523 56 Loureiro, S. M. C., & Kastenholz, E. (2011). Corporate reputation, satisfaction, delight, and loyalty towards rural lodging units in Portugal. International Journal of Hospitality Management, 30, 575–583. doi:10.1016/j.ijhm.2010.10.007 Payne, A. & Frow, P., 2013. Strategic Customer Management: Integrating Relationship Marketing and CRM. s.l.:Cambridge University Roper, S. & Fill, C., 2012. Corporate Reputation: Brand and Communication. 1st ed. s.l.:Pearson Education Limited. Rowley, J., & Dawes, J. (1999). Customer loyalty-a recent concept for libraries? Library Management, 20(6), 345-351. Sandra Maria Correia Loureiro,Eduardo Moraes Sarmento &Goulwen Le Bellego |Len Tiu Wright (Reviewing Editor) Article: 1360031 | Received 11 Jun 2017, Accepted 09 Jul 2017, Accepted author version posted online: 30 Jul 2017, Published online:03 Aug 2017 Saxena, M., Manav, A., Lata, B. & Singh, L. B., 2015. CUSTOMER LOYALTY THROUGH EMPLOYEE ENGAGEMENT: A CONCEPTUAL MODEL. IRACST- International Journal of Research in Management & Technology, pp. 289-297 Schoenbachler, D. D., Gordon, G. L. & Aurand, T. W., 2004. Building brand loyalty through individual stock ownership. Journal of Product & Brand Management, pp. 488-497. Subramanian, K. R., 2018. THE CONNECTION BETWEEN YOUR EMPLOYEES AND CUSTOMERS. Journal of Advance Research in Business Management and Accounting. van Riel, C.B.M. and Fombrun, C.J. (2007) Essentials of Corporate Communication: Implementing Practices for Effective Reputation Management, Routledge, London and New York. Bibliography Web Sites BOC Annual Report : https://web.boc.lk/assets/reports/annual/BOC_AR_2018.pdf Napoleoncat web : https://napoleoncat.com LMRB web : www.kantarlmrb.lk