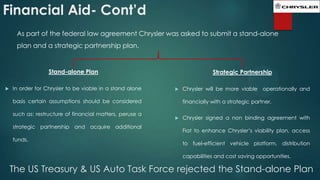

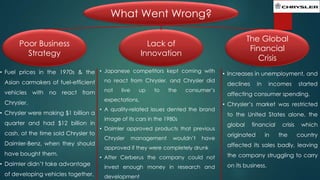

Chrysler has faced many financial difficulties throughout its history. Most recently, Chrysler was struggling due to the global financial crisis in 2008 and was low on cash. Chrysler received $4 billion in federal loans but requested an additional $9 billion. The stand-alone restructuring plan was rejected, but a strategic partnership with Fiat was approved. Chrysler filed for bankruptcy in April 2009 and emerged from bankruptcy in June 2009 as a partnership between Fiat and the U.S. government. The alliance with Fiat provided Chrysler with fuel-efficient technology and access to new markets to help ensure its long-term viability. However, challenges remained in making smaller, more fuel efficient cars profitable in the U.S. market