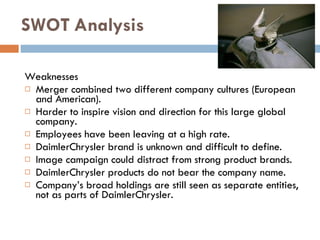

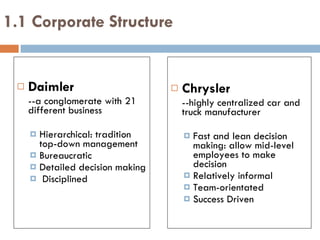

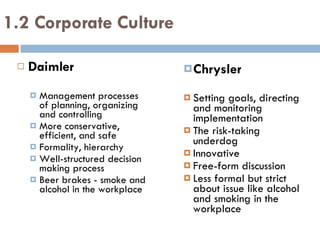

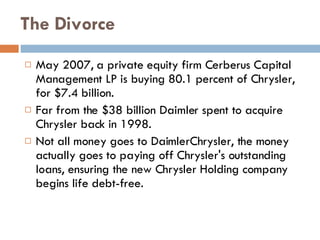

The document discusses the merger between Daimler and Chrysler. It provides background on both companies and analyzes their strengths, weaknesses, opportunities, and threats. It then details the merger process and outcomes. However, cultural clashes between the German and American companies, as well as poor strategic decisions, led the merger to ultimately fail to achieve its goals.