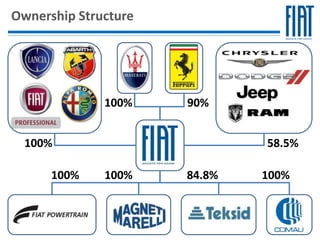

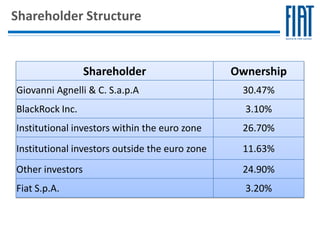

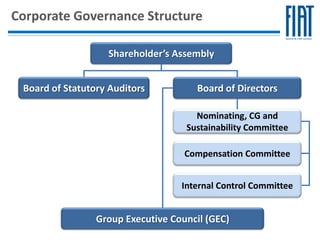

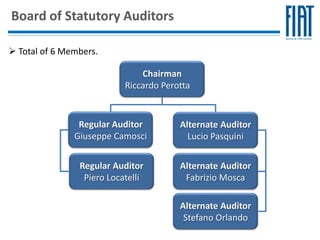

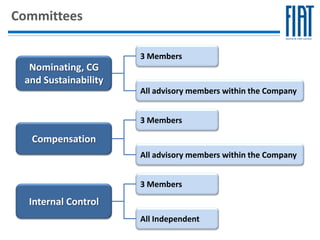

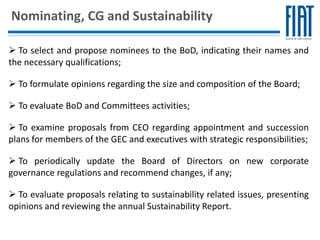

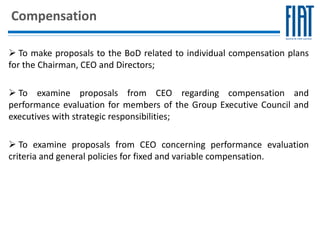

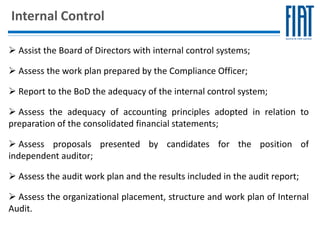

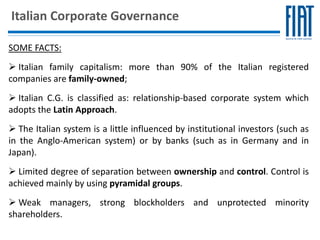

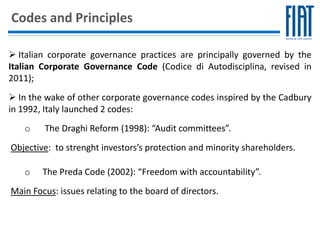

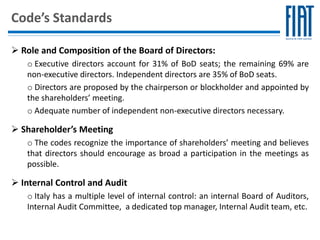

Fiat provides an overview of its board of directors, management structure, and corporate governance committees. The board has 16 members including 5 executive directors and 8 independent members. There are also 3 main committees: Nominating, CG and Sustainability; Compensation; and Internal Control. Fiat follows Italian corporate governance norms which are characterized by family ownership and a relationship-based system with less influence from institutional investors than Anglo-American systems.