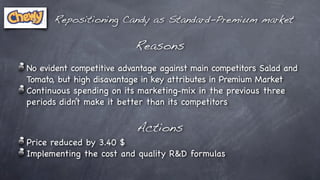

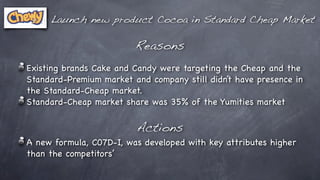

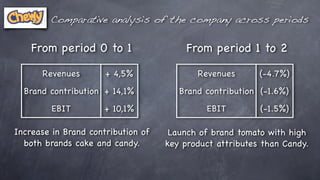

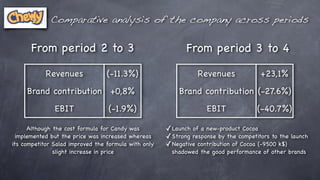

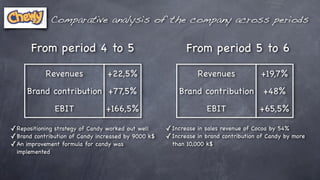

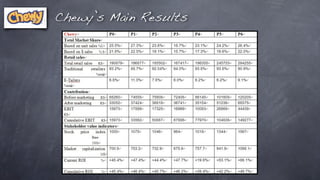

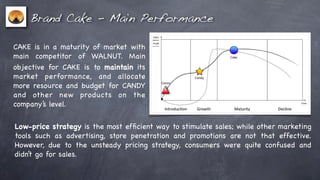

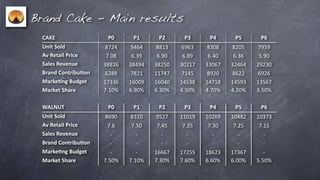

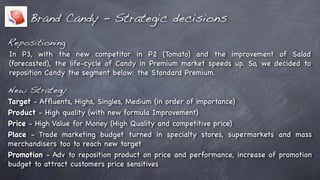

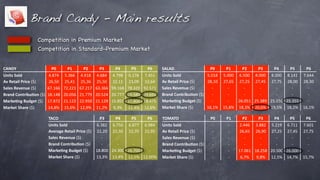

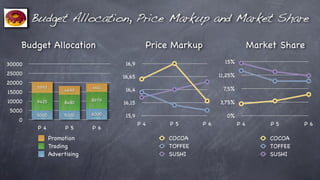

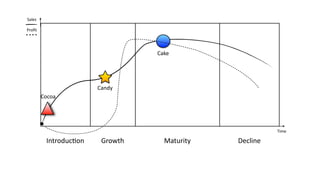

Chewy analyzed the performance of its Cake, Cocoa, and Candy brands across multiple periods in the Yumities market. It found that Candy was underperforming in the premium market against competitors like Salad and Tomato. So in period 3, Chewy repositioned Candy in the standard-premium market by lowering its price and increasing marketing investments. Chewy also launched a new brand, Cocoa, in the standard-cheap market in period 4 to gain market share. While Cocoa saw initial success, competitors responded strongly, causing Cocoa's contribution to become negative in period 4. Chewy continued adjusting its strategies for each brand period over period to improve sales, profits, and market position.