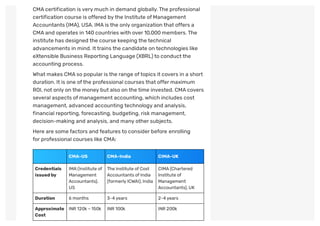

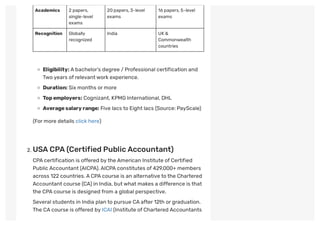

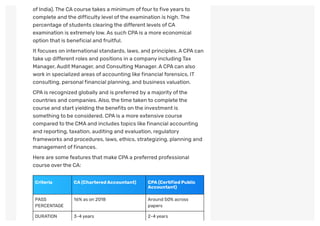

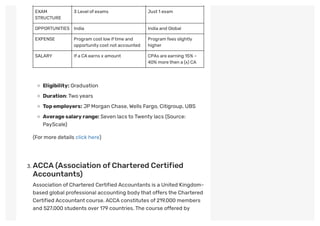

This document discusses top professional courses in accounting and finance that can boost one's career. It outlines certification courses like CMA, CPA, ACCA, as well as courses in areas like financial modeling, digital marketing, and FRM. These courses provide in-depth skills training focused on practical application in industries. They take less time than traditional degrees but offer high return on investment and salary benefits. Employers increasingly demand these specialized designations.