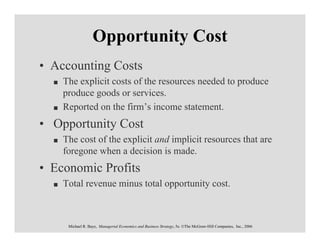

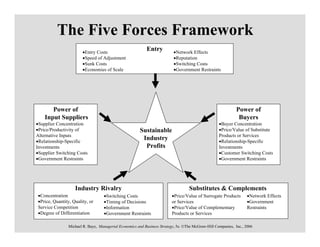

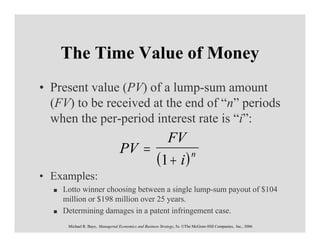

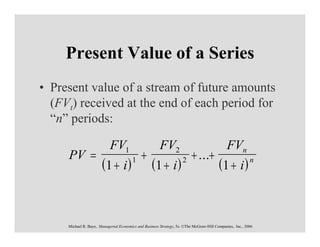

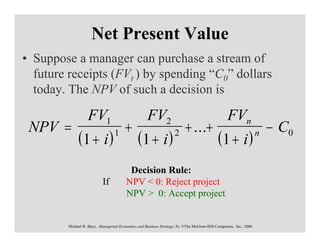

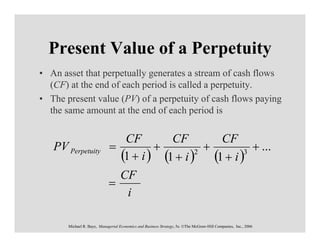

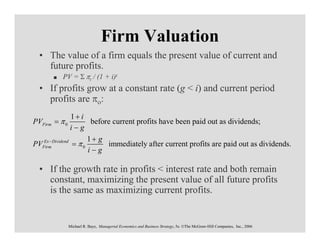

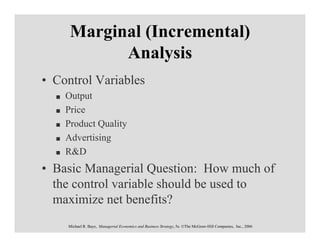

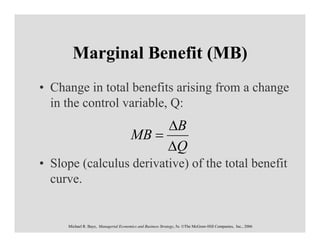

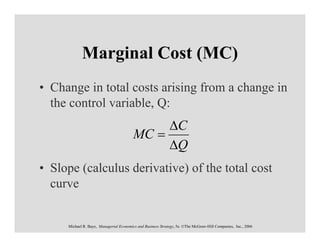

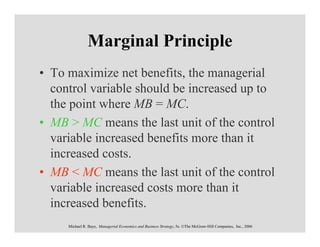

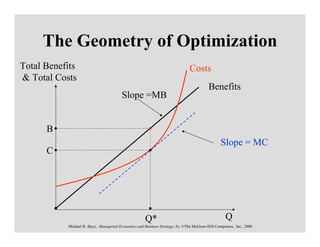

The document is an overview of key concepts from Chapter 1 of the textbook "Managerial Economics and Business Strategy" by Michael R. Baye. It defines managerial economics as using economics to direct scarce resources to efficiently achieve goals. It also discusses opportunity costs, economic versus accounting profits, the five forces framework for industry analysis, market interactions, the time value of money, net present value analysis, and marginal analysis. The overview provides high-level definitions and explanations of these fundamental concepts in managerial economics.