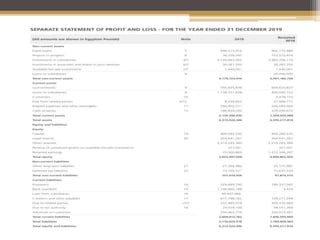

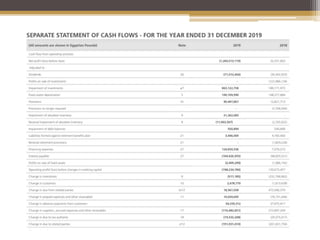

This document provides an overview and analysis of balance sheet and cash flow statements for Suez Cement Company. It defines a balance sheet as a financial statement showing a company's assets, liabilities, and equity at a given date. Balance sheets are useful for computing return rates, evaluating capital structure, and assessing risk and future cash flows, though they have limitations like reporting historical costs and using estimates. The document also defines a cash flow statement as recording cash inflows and outflows during a period, including operating, investing, and financing activities. Operating activities reflect cash from providing products/services, while investing activities reflect long-term asset acquisitions and disposals. Financing activities reflect cash from investors, issuing/buying back shares