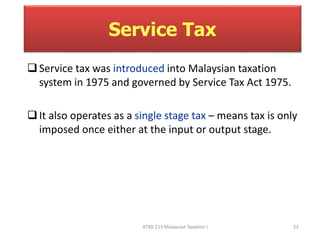

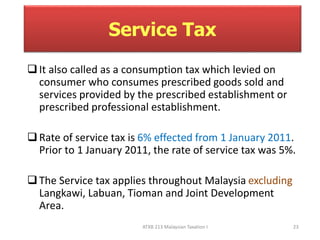

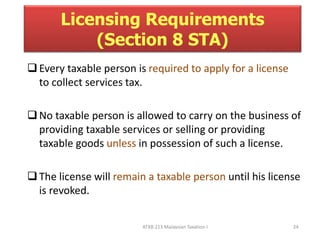

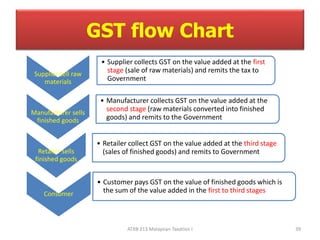

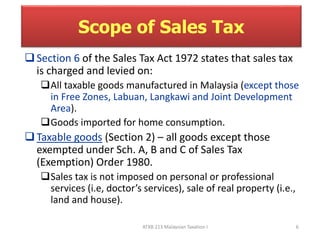

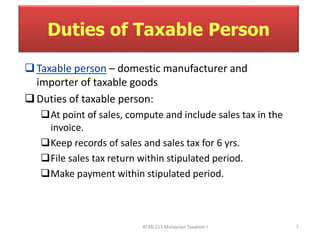

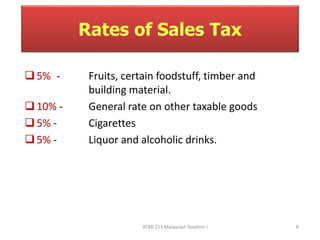

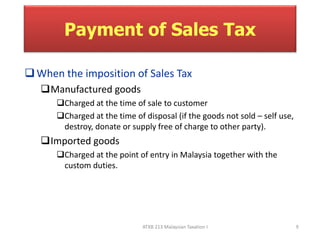

This document provides an overview of indirect taxes in Malaysia, including sales tax, service tax, and the proposed goods and services tax (GST). It discusses the key concepts, scope, exemptions, rates, and compliance requirements for each tax. The objectives of implementing GST are also summarized, such as improving tax collection, increasing the tax base, and encouraging investment.

![Exemption on Raw Material

Inputs

Ring System [section 9(1) and (2) Sales Tax Act]

– Provision of tax free materials from one manufacturer to

another

– Application has to be made to the Sales Tax Office

– The applicant has to be licensed

– The materials are used in the manufacture of finished

product

ATXB 213 Malaysian Taxation I 19](https://image.slidesharecdn.com/chapter9indirecttax-141101025119-conversion-gate01/85/Chapter-9-indirect-tax-19-320.jpg)

![Exemption on Raw Material

Inputs

Refund System [section 31 Sales Tax Act]

– Modified version of ring system

– A licensed manufacturer can purchase raw materials free

of sales tax from a vendor who has paid the sales tax

– The vendor can then apply to claim a refund

Credit System [section31A Sales tax Act]

– Intended for small manufacturers

– Ensures their inputs do not suffer any tax

– Based on a refund of tax paid by the manufacturer

– Licensed manufacturer able to obtain a credit of the tax

ATXB 213 Malaysian Taxation I 20](https://image.slidesharecdn.com/chapter9indirecttax-141101025119-conversion-gate01/85/Chapter-9-indirect-tax-20-320.jpg)