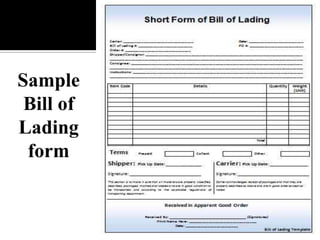

The document defines a bill of lading as a receipt signed by a carrier acknowledging receipt of goods and promising to deliver them safely to the designated port, excepting damages from the sea. It serves as a title of goods, a receipt of goods, and a contract of transportation between the shipper and carrier.