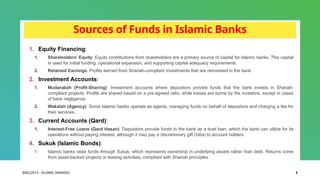

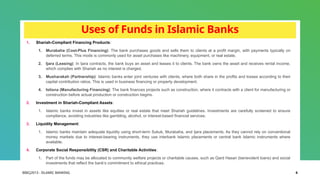

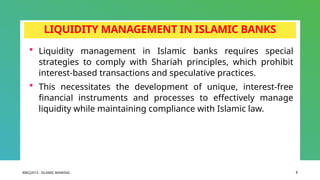

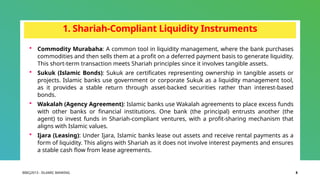

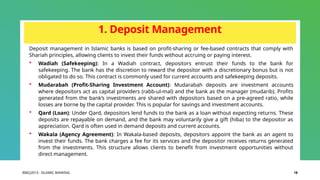

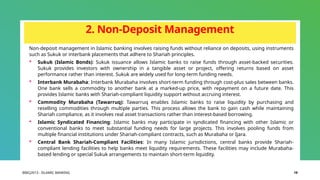

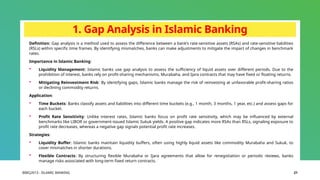

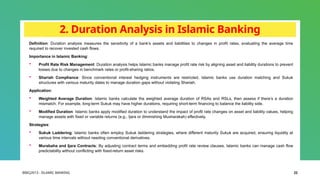

The document discusses asset-liability management (ALM) in Islamic banking, highlighting the need for Shariah-compliant practices that avoid interest and speculative transactions. It covers sources and uses of funds, liquidity management, and the structure of financial instruments such as mudarabah and sukuk. The importance of aligned asset and liability maturities for financial stability and growth in the Islamic banking sector is emphasized.