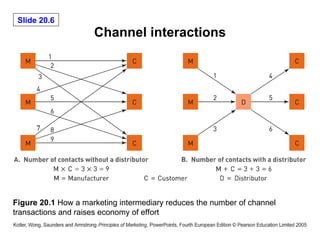

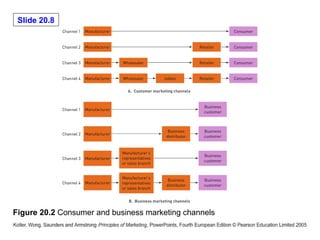

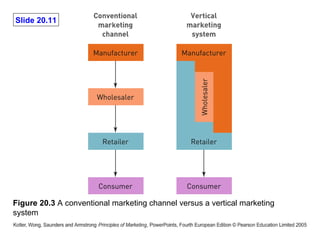

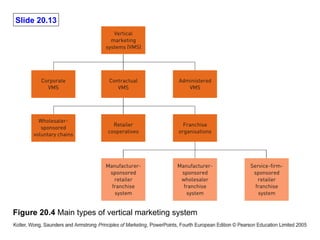

The document discusses managing marketing channels and the value delivery network. It describes how upstream and downstream partners work together to deliver products and services to customers. It also discusses how channel members add value through transactional, logistical, and facilitating functions. Key value-adding channel functions include information, promotion, contact with buyers, matching offers to needs, negotiation, distribution, and financing. The document outlines different channel structures like conventional channels, vertical marketing systems, and trends in channel retailing and wholesaling.