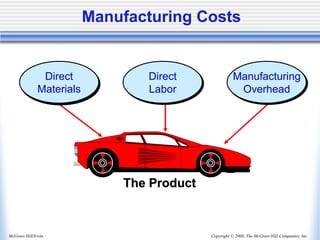

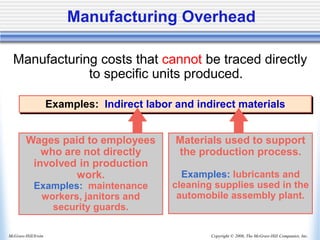

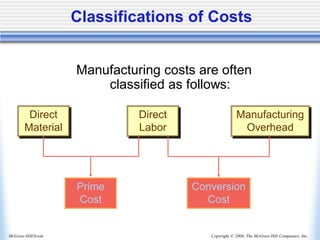

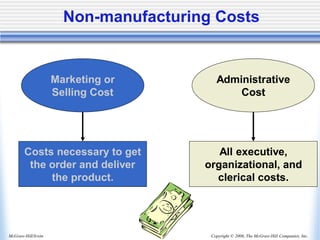

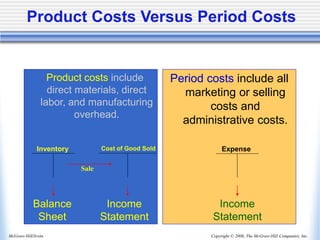

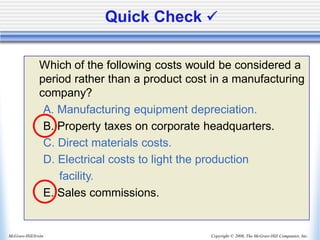

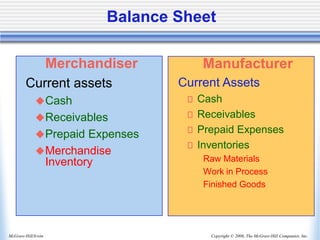

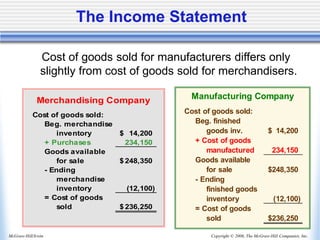

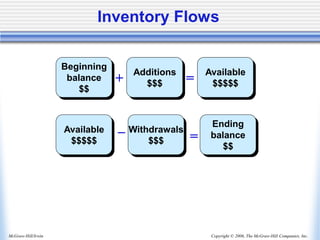

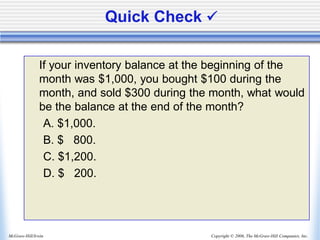

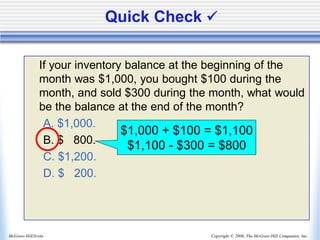

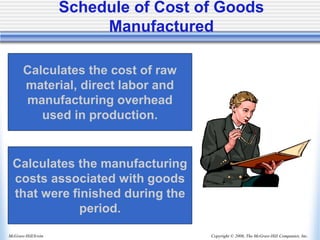

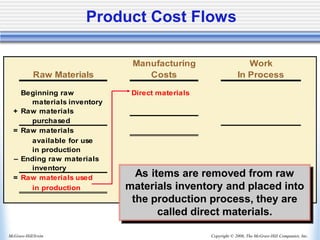

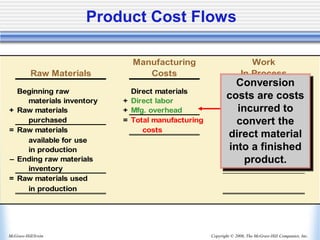

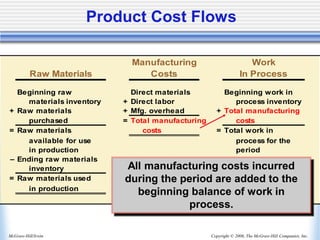

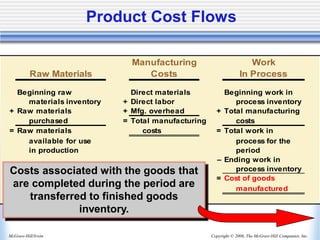

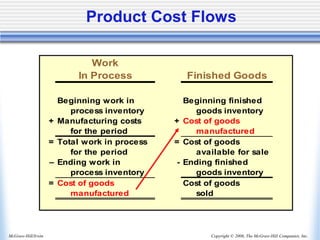

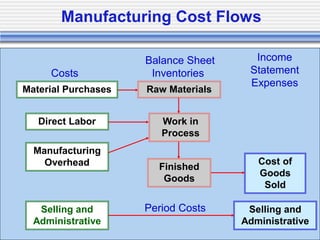

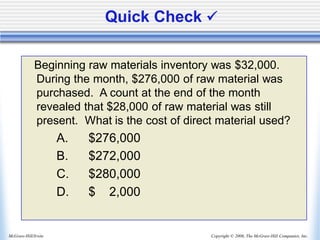

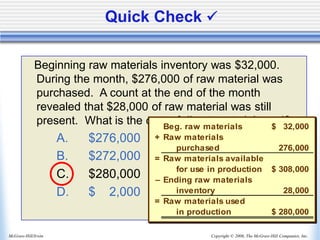

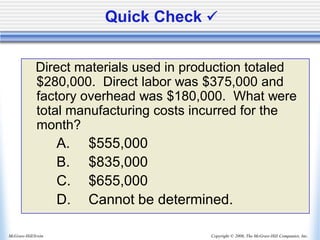

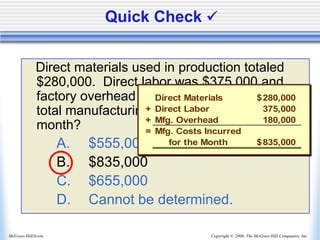

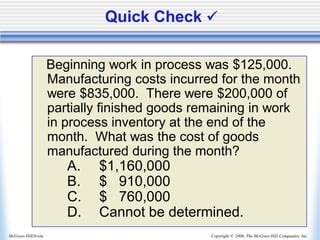

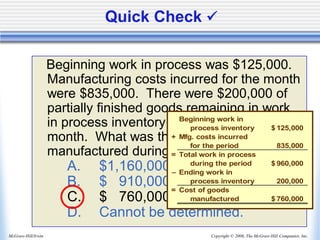

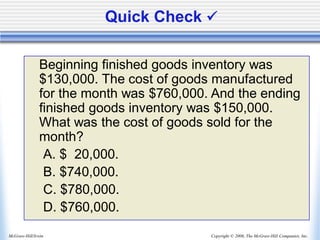

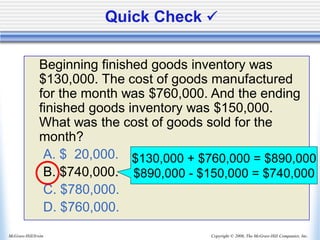

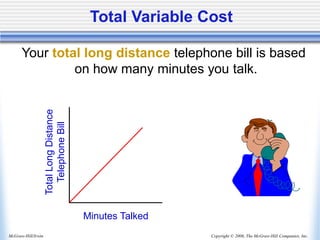

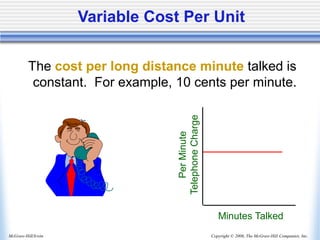

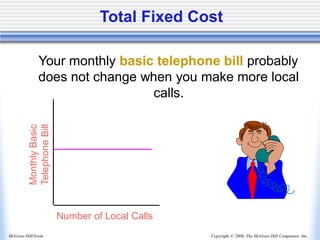

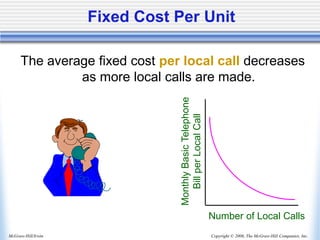

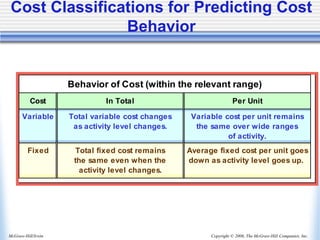

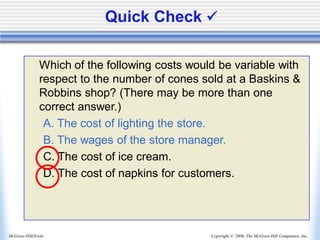

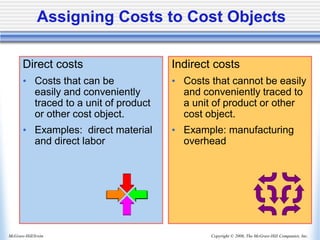

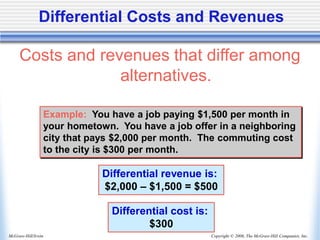

This document contains excerpts from a textbook chapter on cost accounting. It defines and provides examples of different types of costs including direct materials, direct labor, manufacturing overhead, prime costs, conversion costs, product costs and period costs. It also explains the classification of costs as variable or fixed and how they behave with changes in activity levels. Manufacturing cost flows and inventory valuations are demonstrated through examples of raw materials, work in process, finished goods and cost of goods sold calculations.