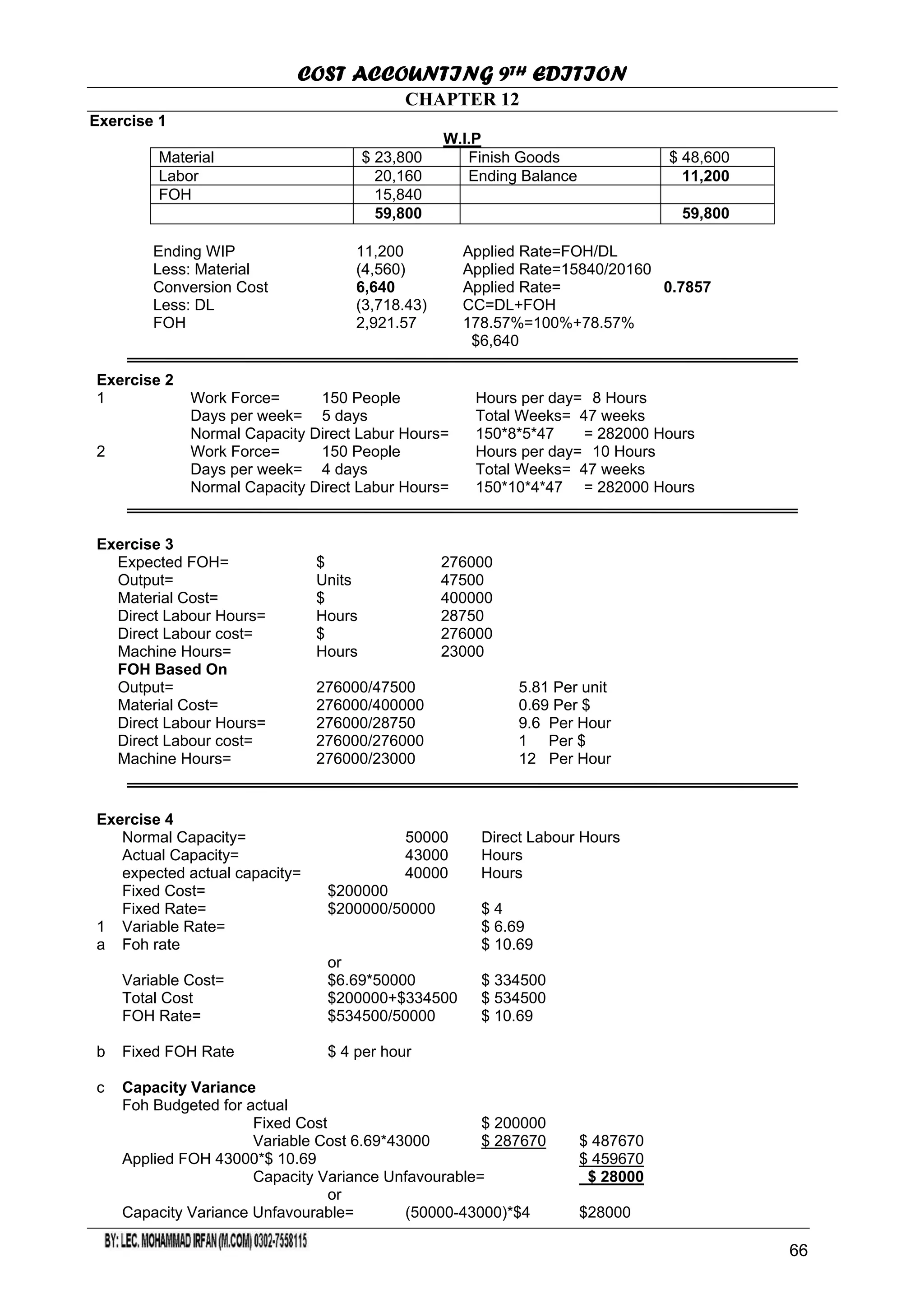

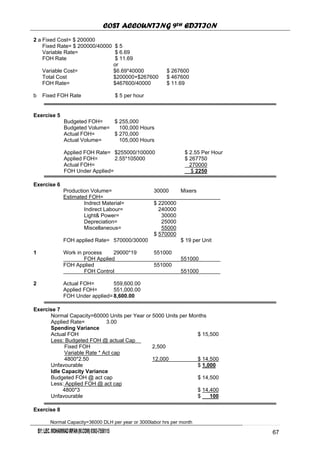

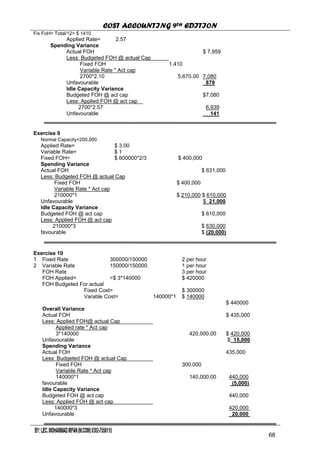

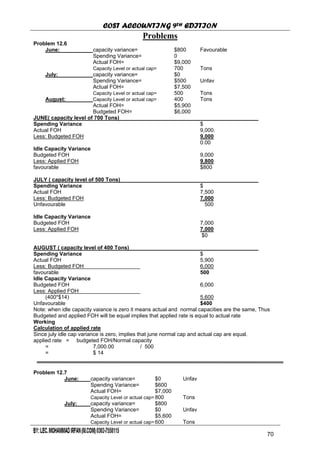

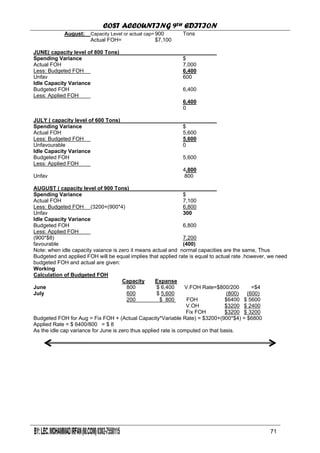

This document summarizes exercises from Chapter 12 of Cost Accounting, 9th Edition. It includes 11 exercises covering topics like work-in-process, overhead application rates, fixed and variable overhead rates, normal and actual capacity, budgeted and actual overhead, and overhead variances including spending and idle capacity variances. Calculations are shown for overhead application, budgeting, and analyzing variances at different production capacity levels.