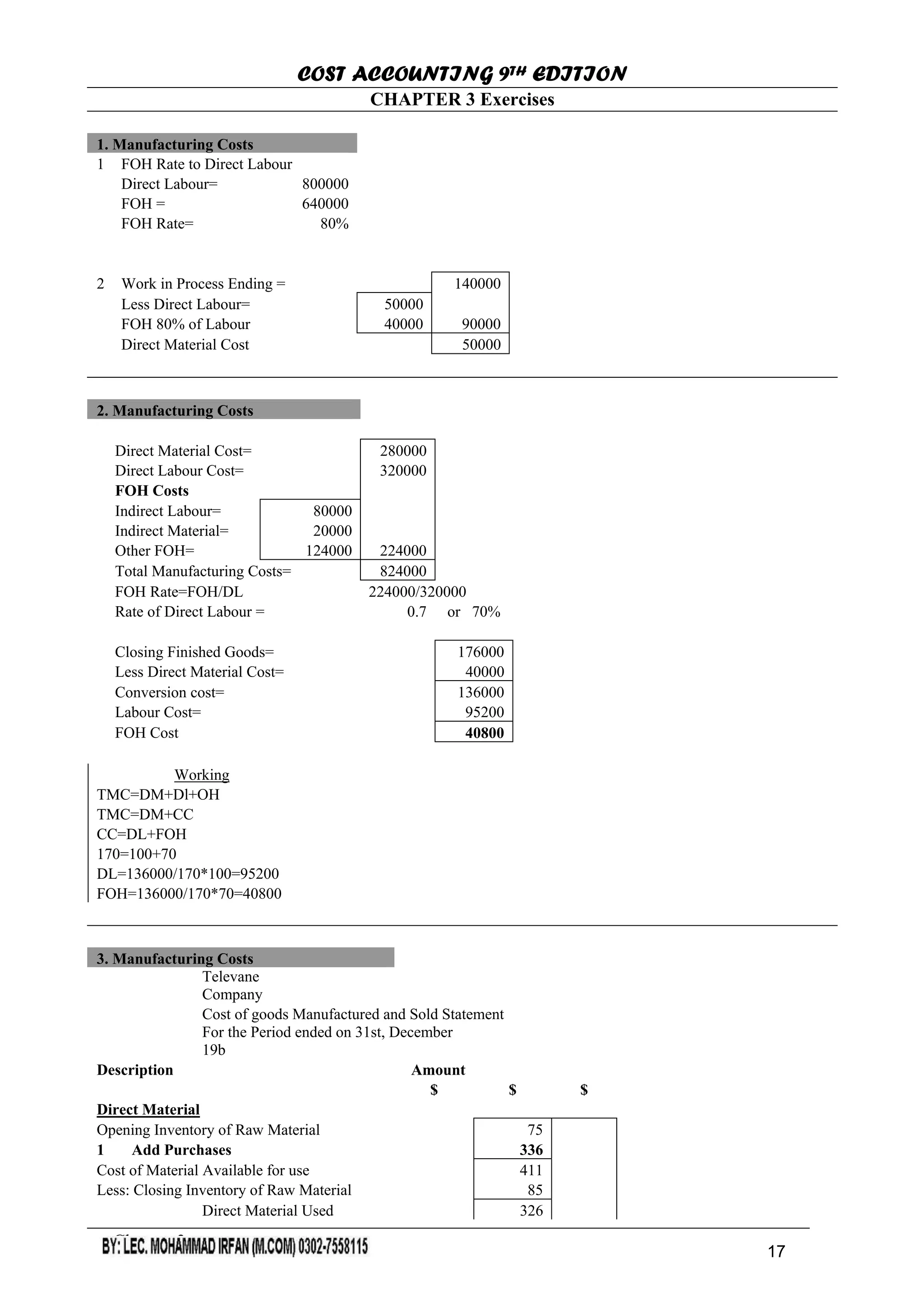

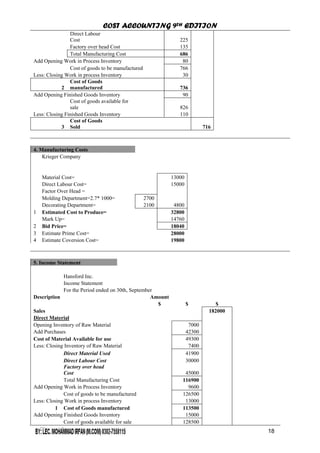

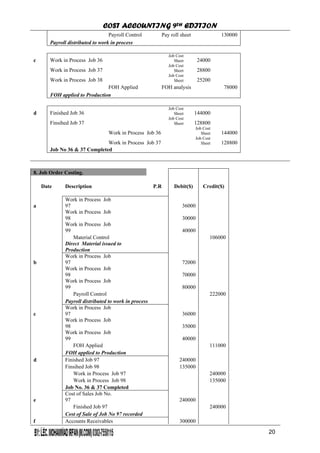

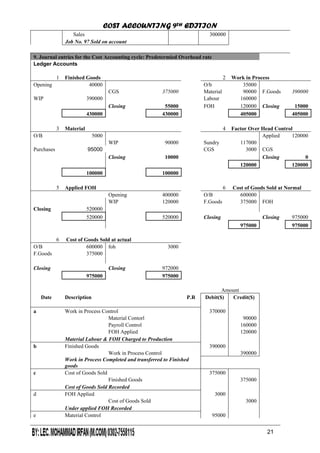

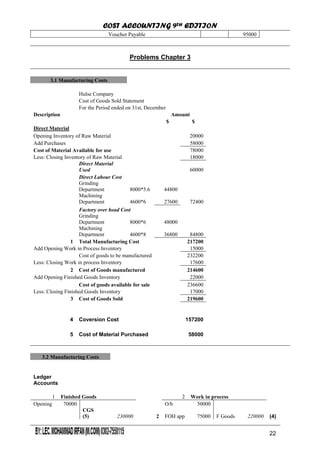

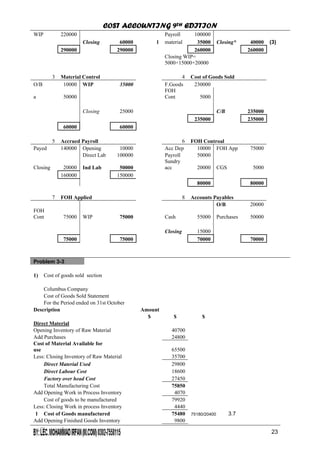

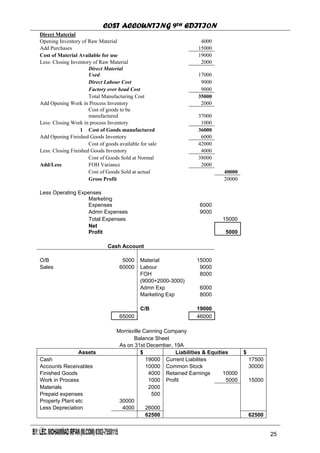

This document contains examples and problems related to manufacturing costs and cost of goods sold calculations. It includes journal entries, income statements, and calculations for direct material costs, direct labor costs, factory overhead costs, work in process, finished goods, and cost of goods sold. Manufacturing costs are calculated and allocated to inventory and cost of goods sold using absorption costing. Variances between applied and actual overhead are also accounted for.