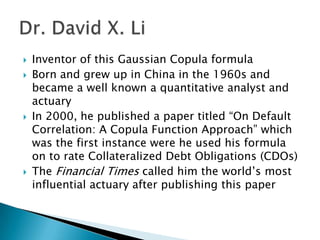

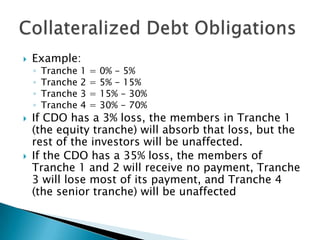

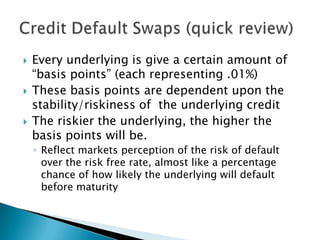

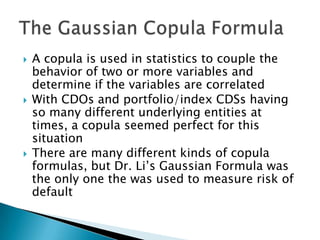

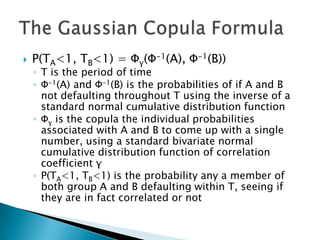

The document discusses David X. Li, the inventor of the Gaussian copula formula which was widely used to rate collateralized debt obligations (CDOs) containing mortgage-backed securities in the run-up to the 2008 financial crisis. While the formula helped fuel the rapid growth of the CDO market, it had significant flaws and limitations that were not properly understood. When the housing market collapsed, it revealed that CDOs given high credit ratings based on the formula were in fact highly risky and worthless. This contributed greatly to the financial crisis and global recession.