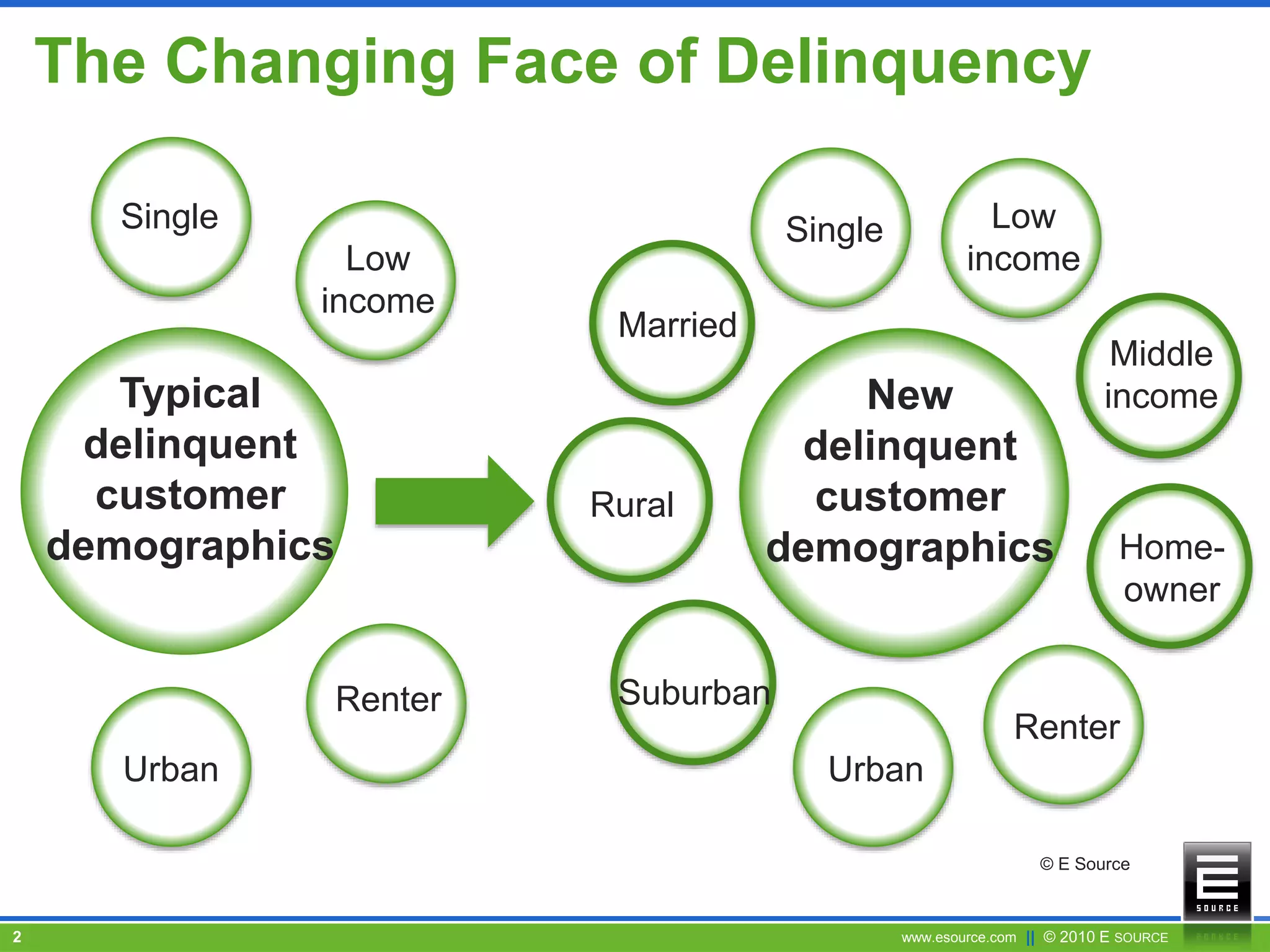

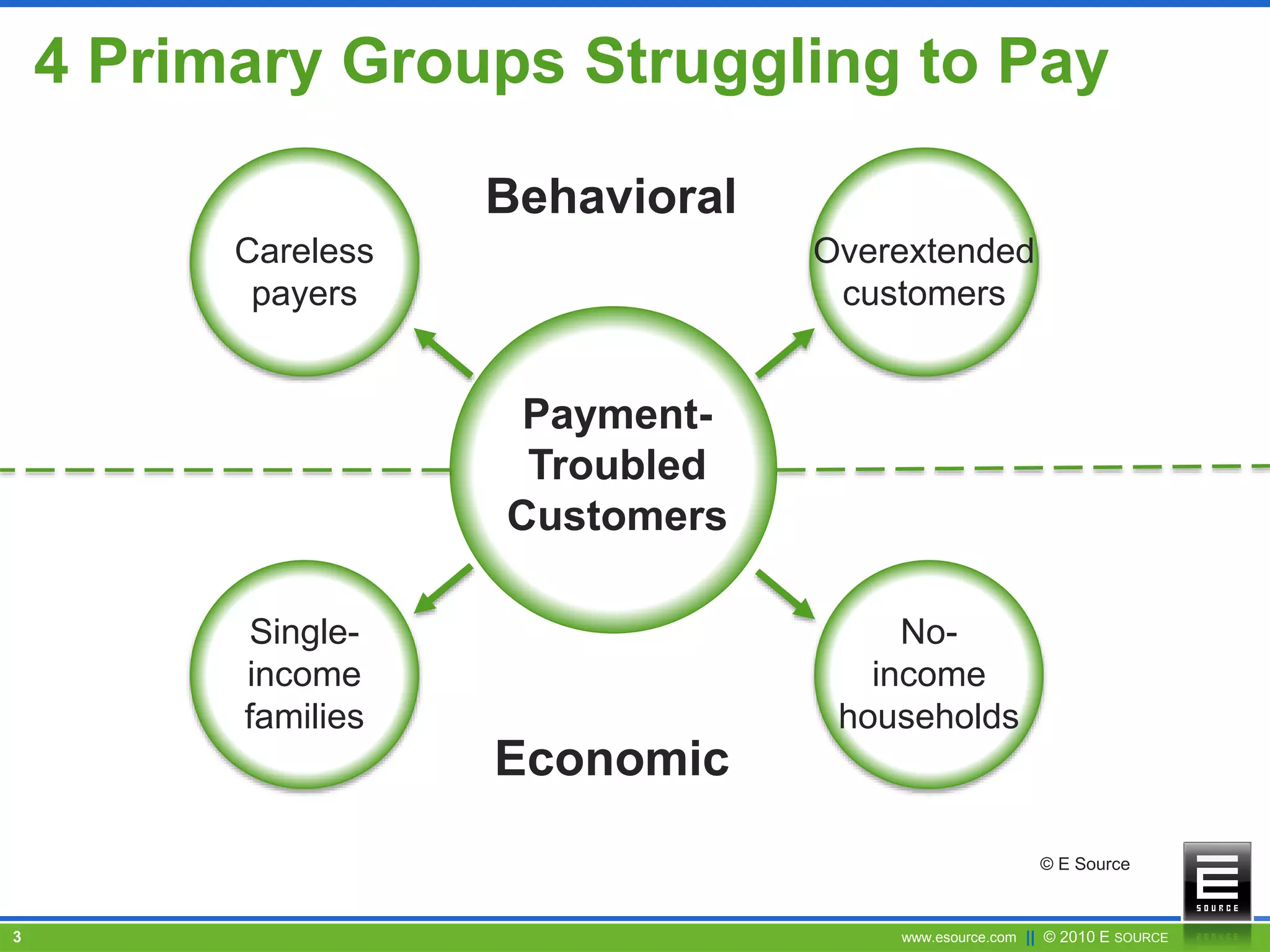

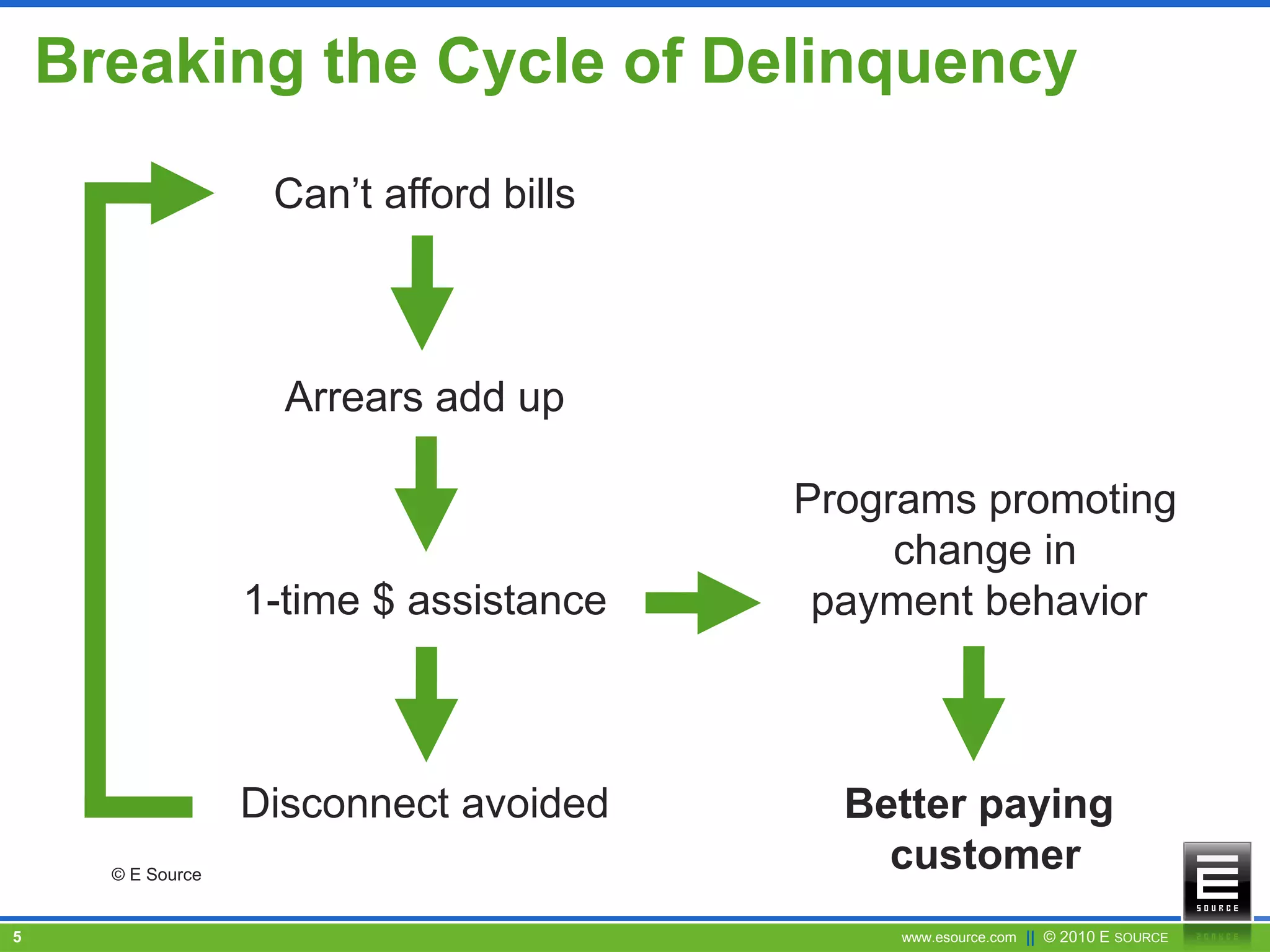

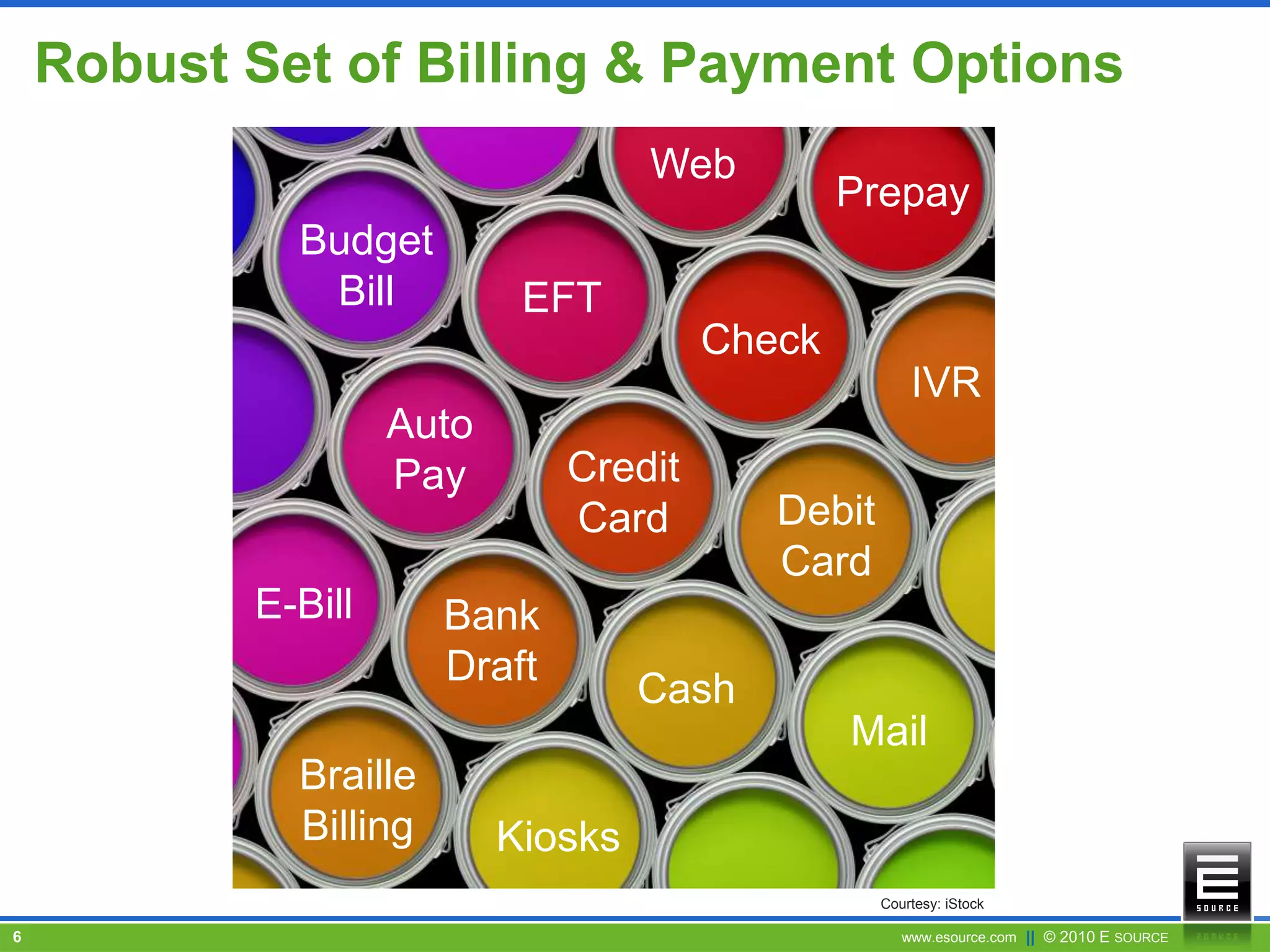

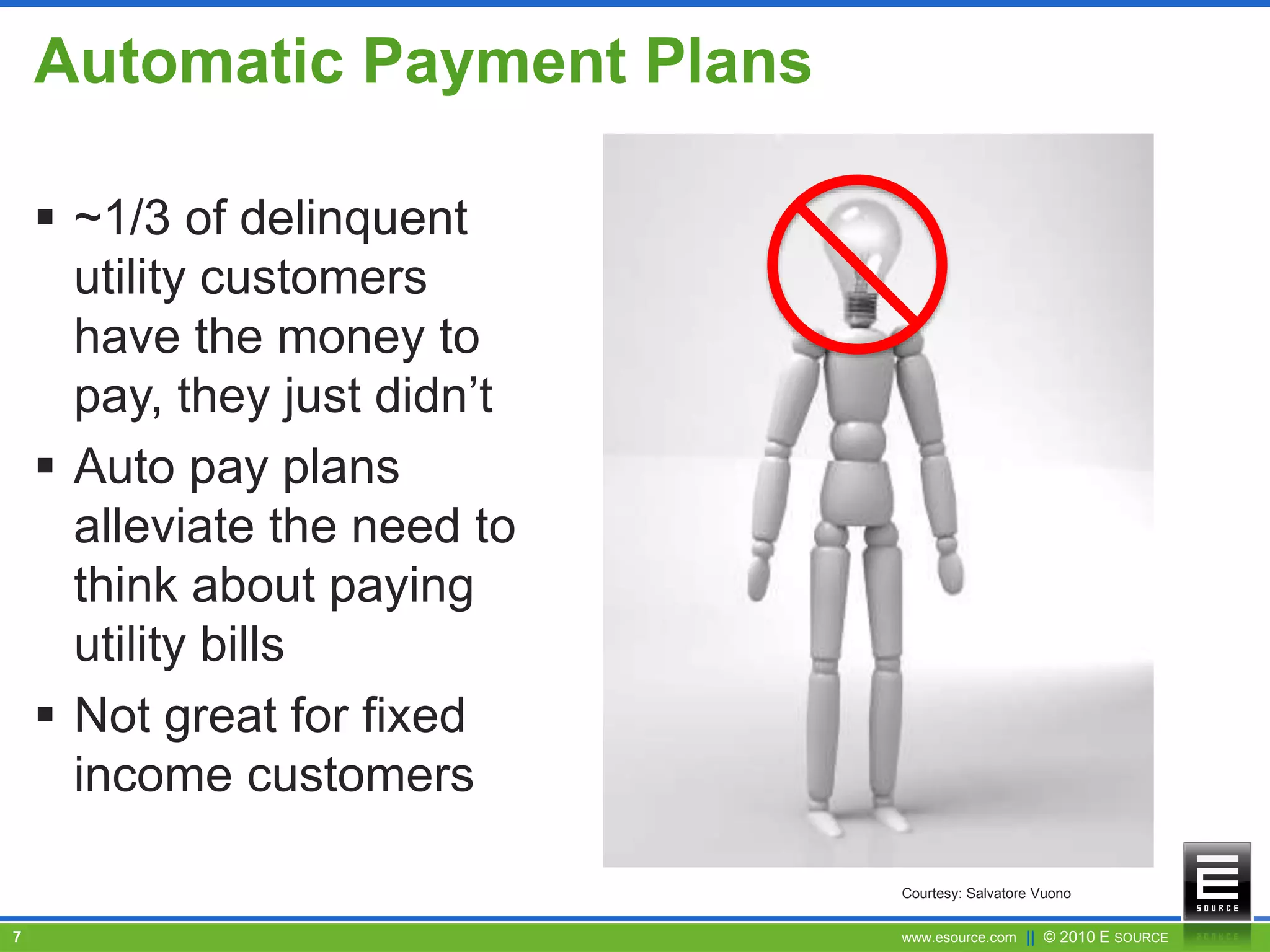

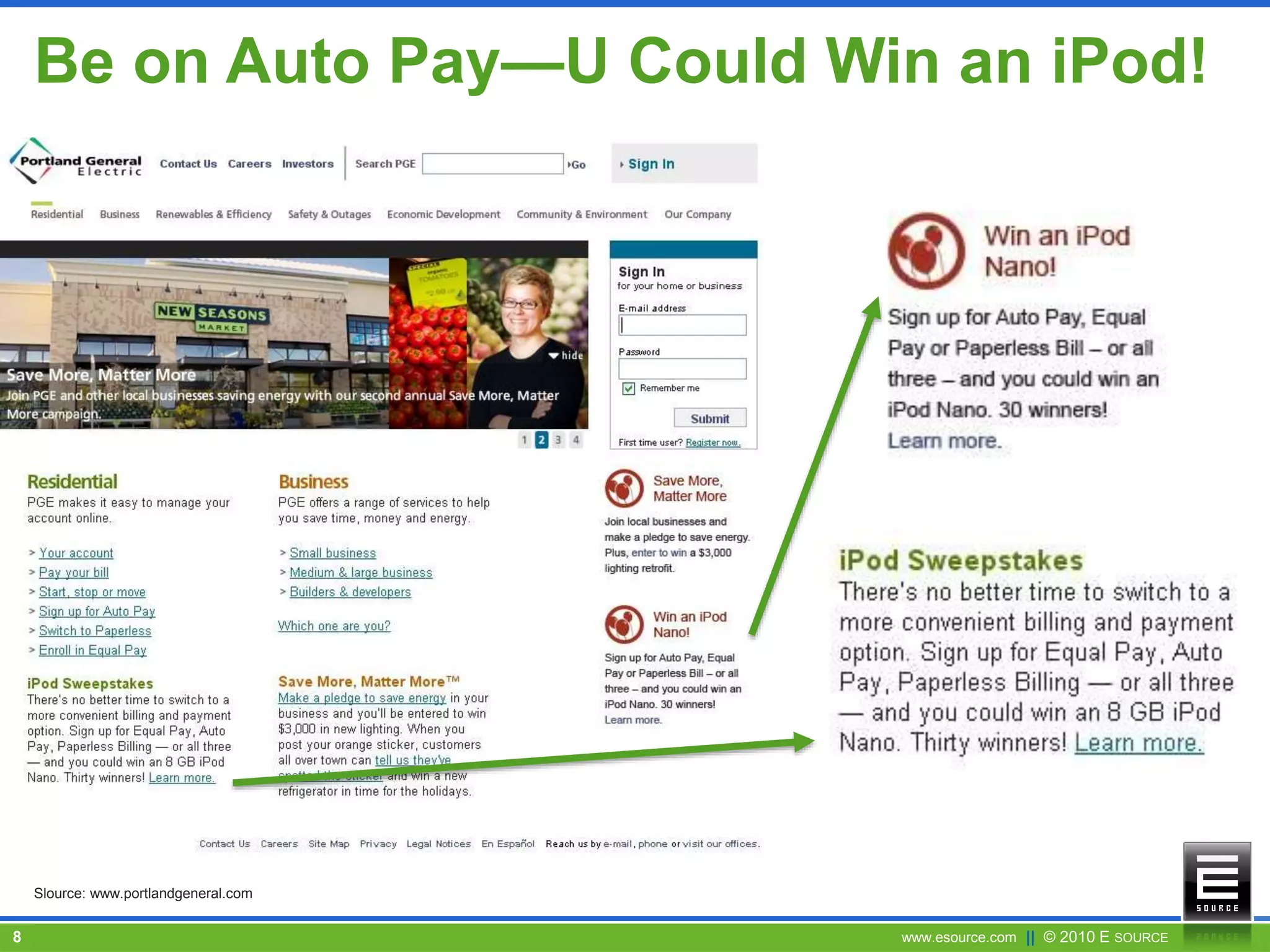

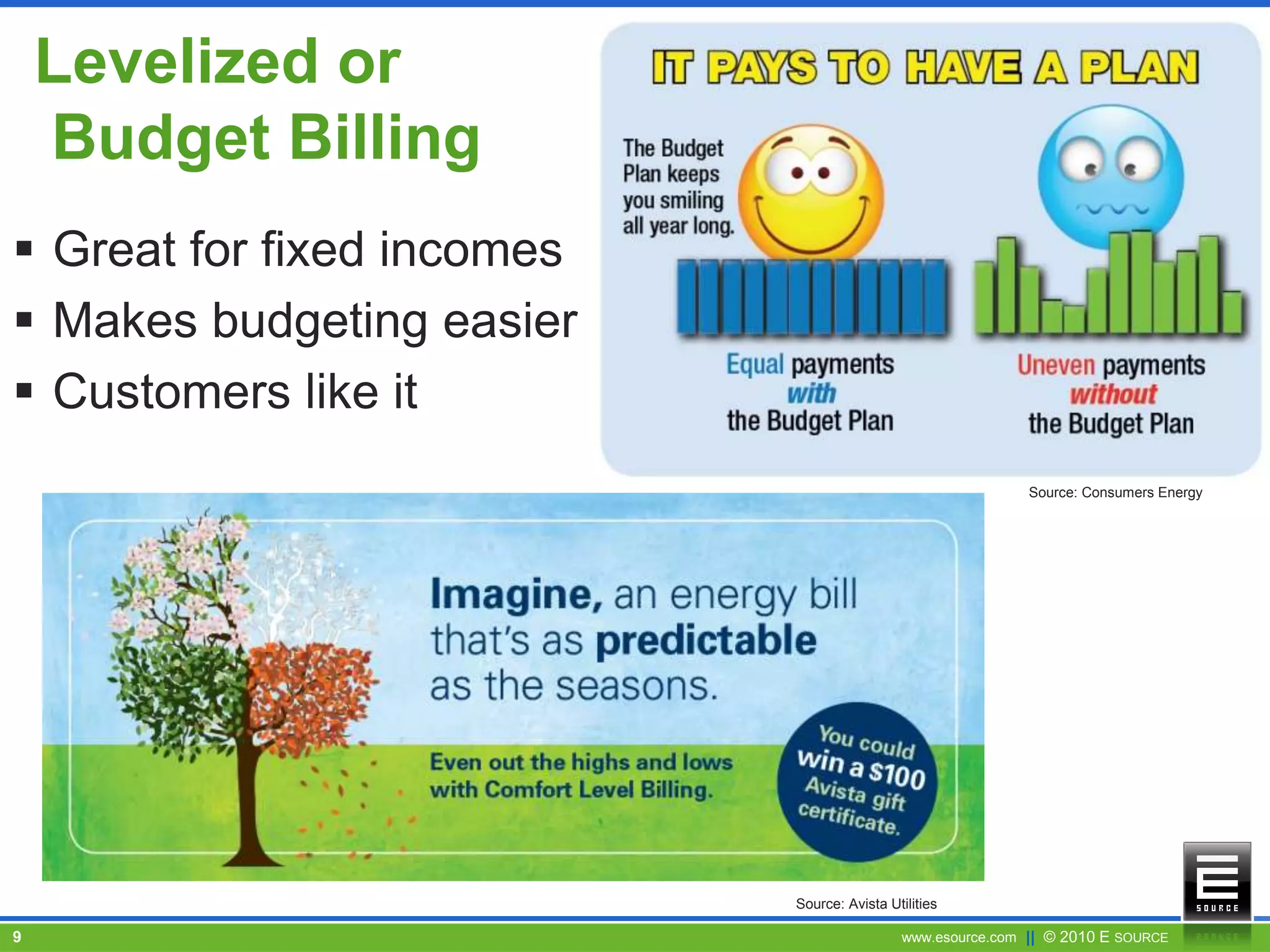

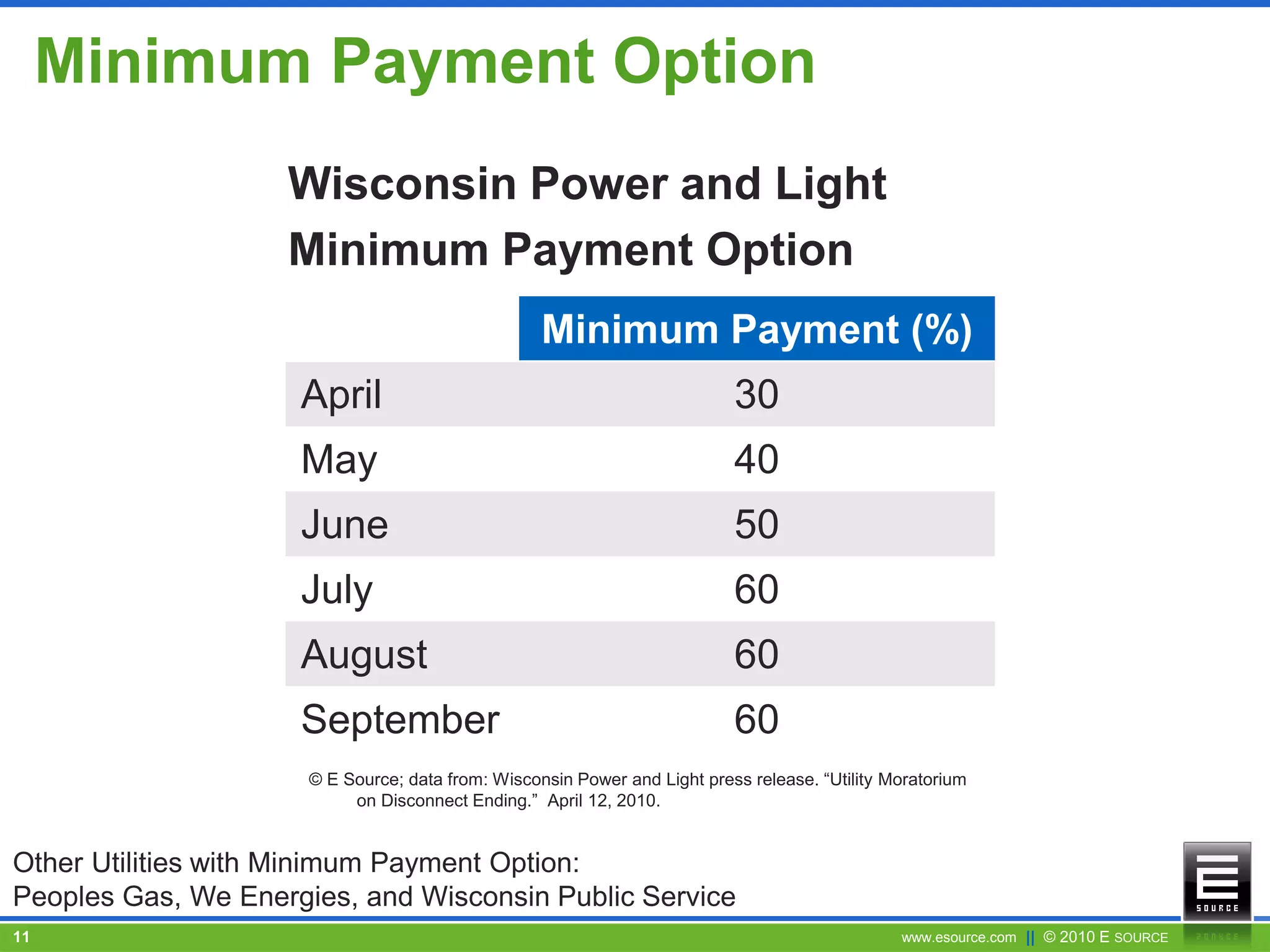

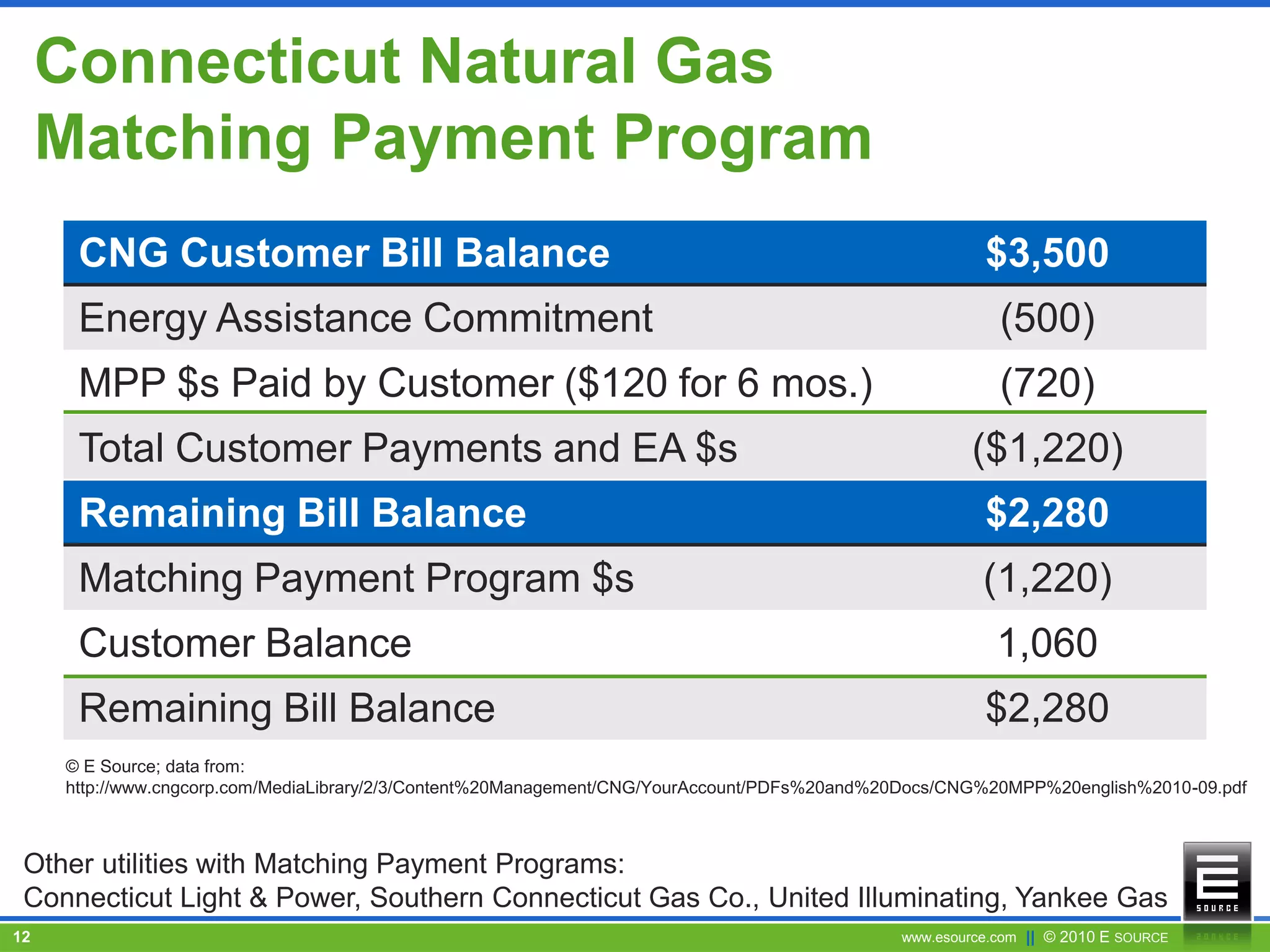

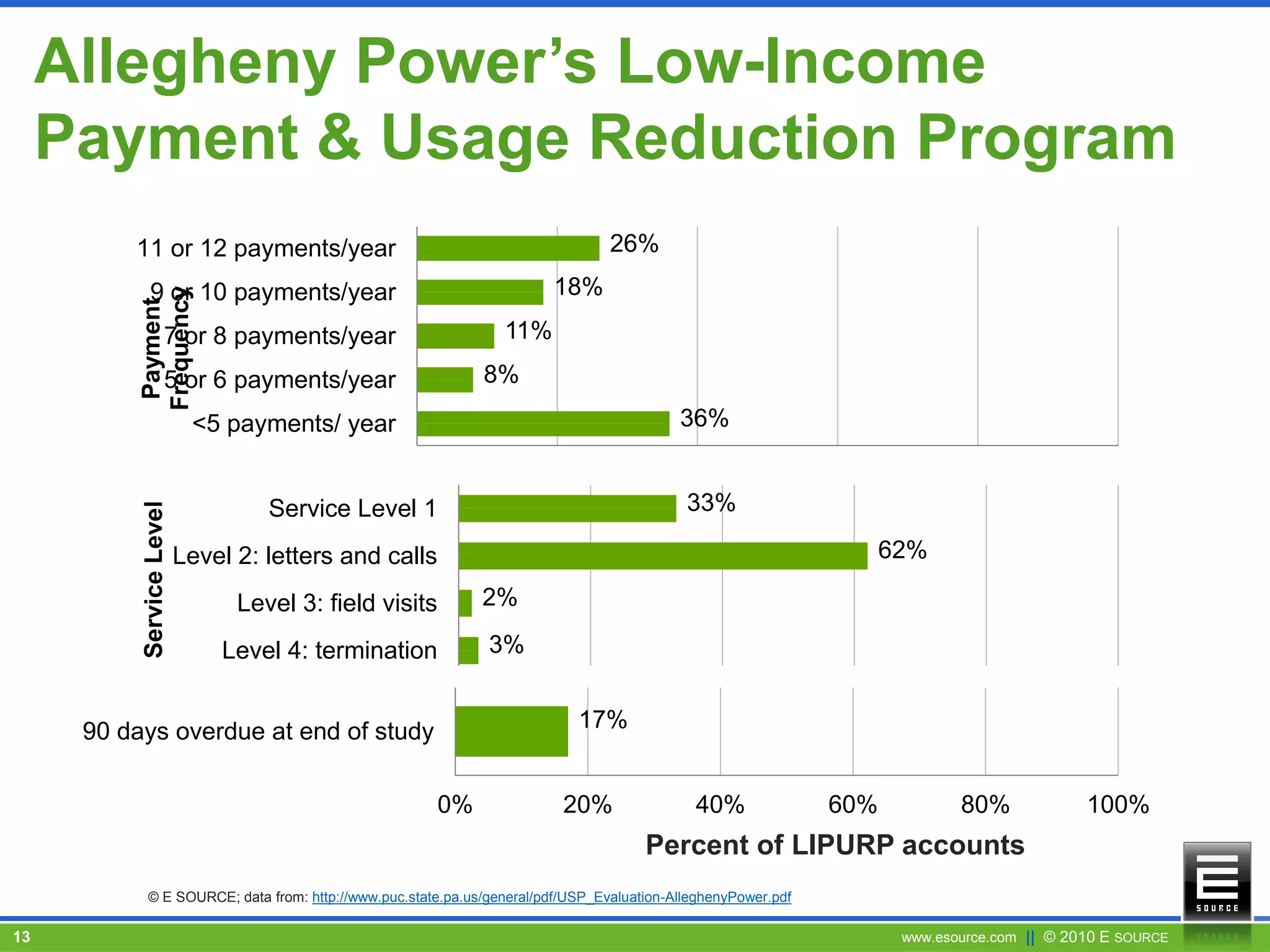

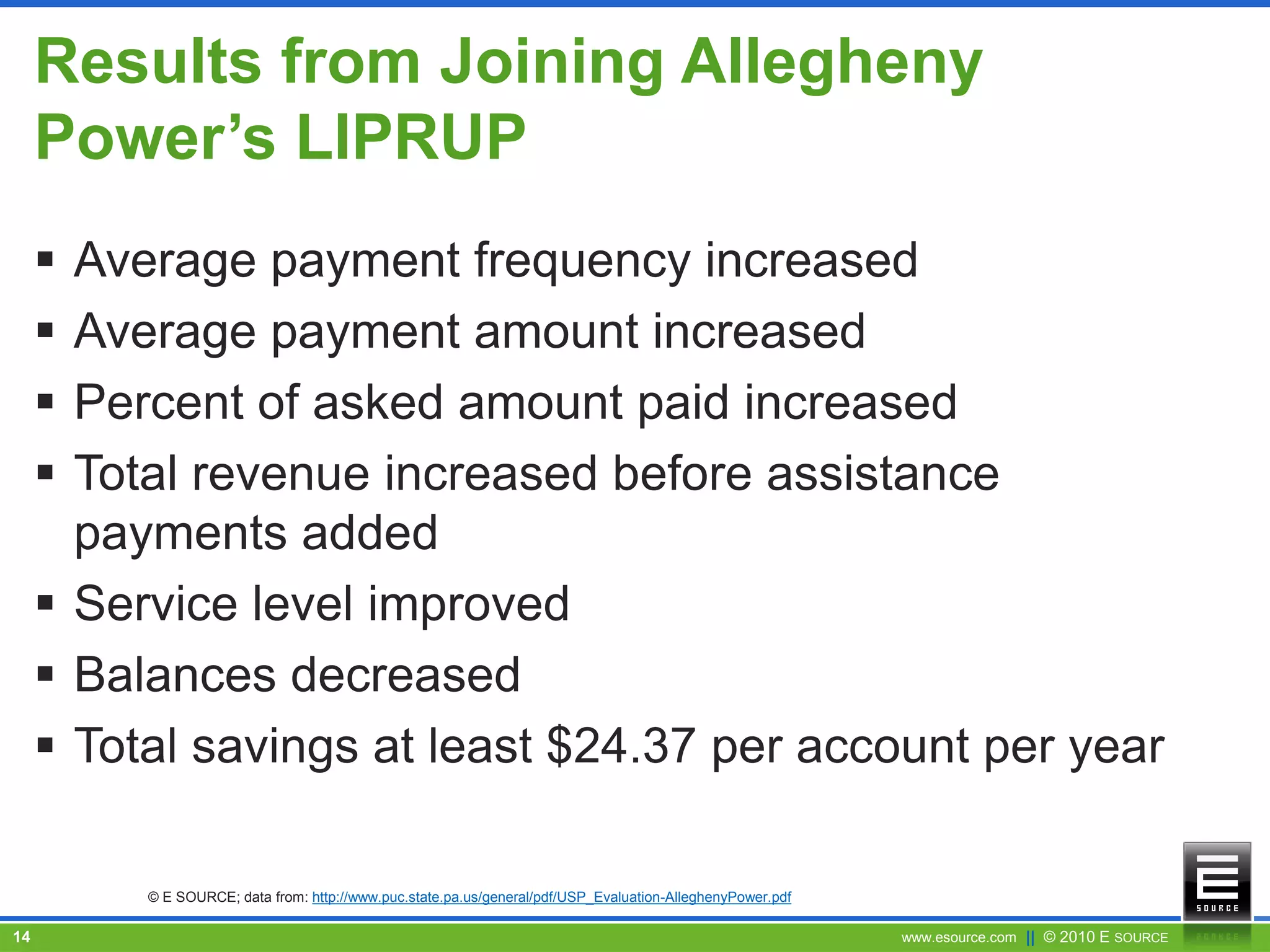

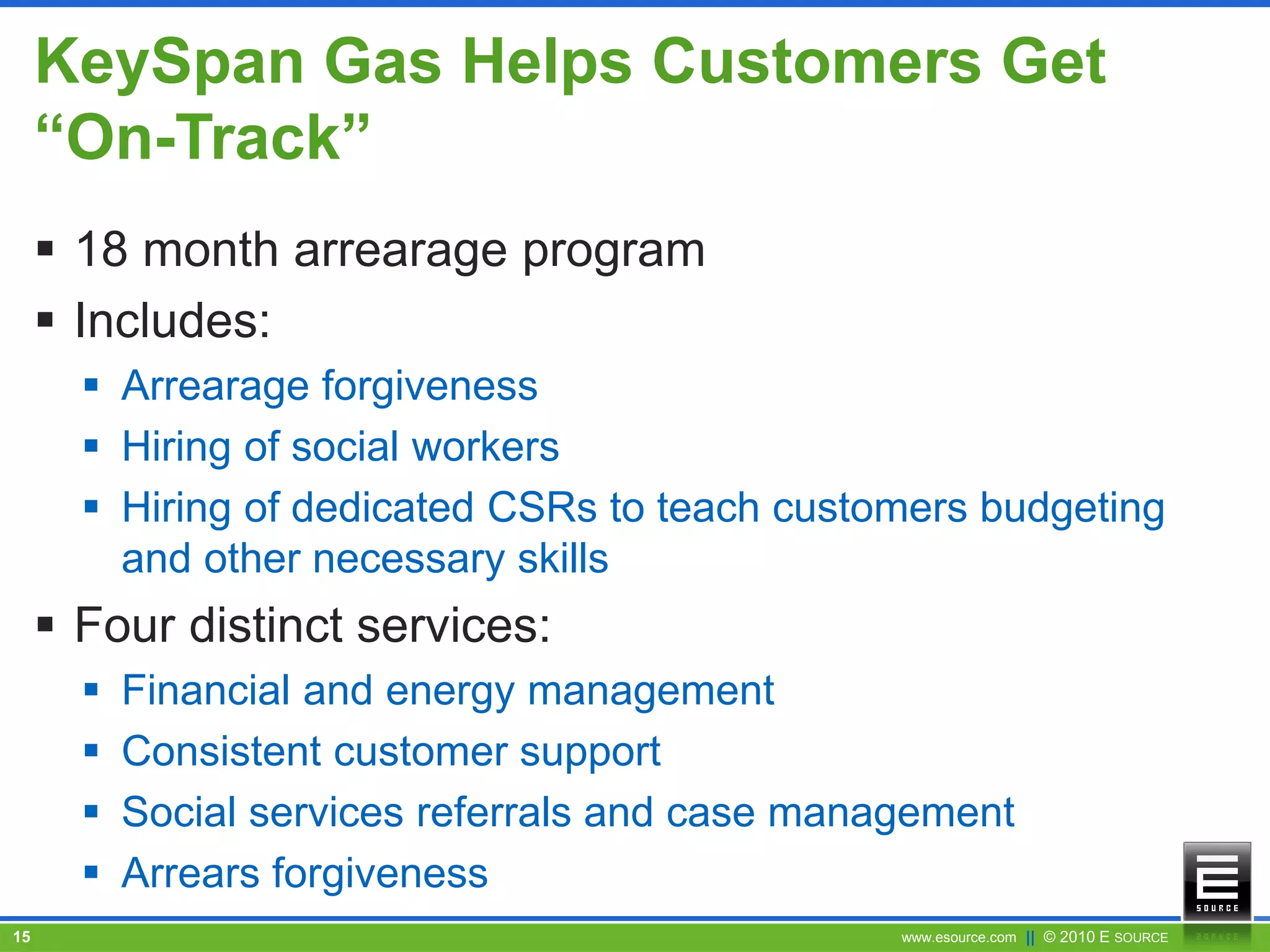

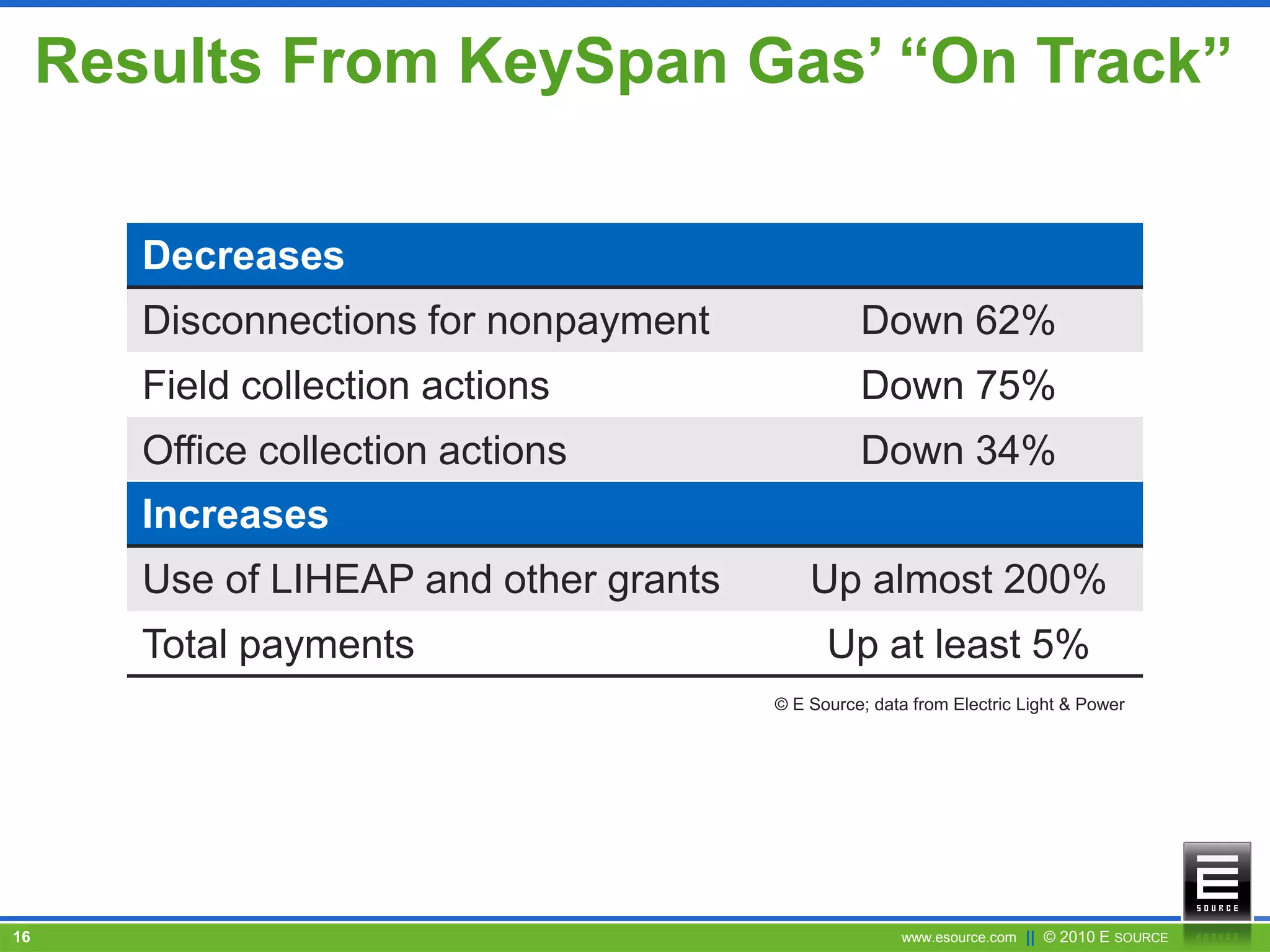

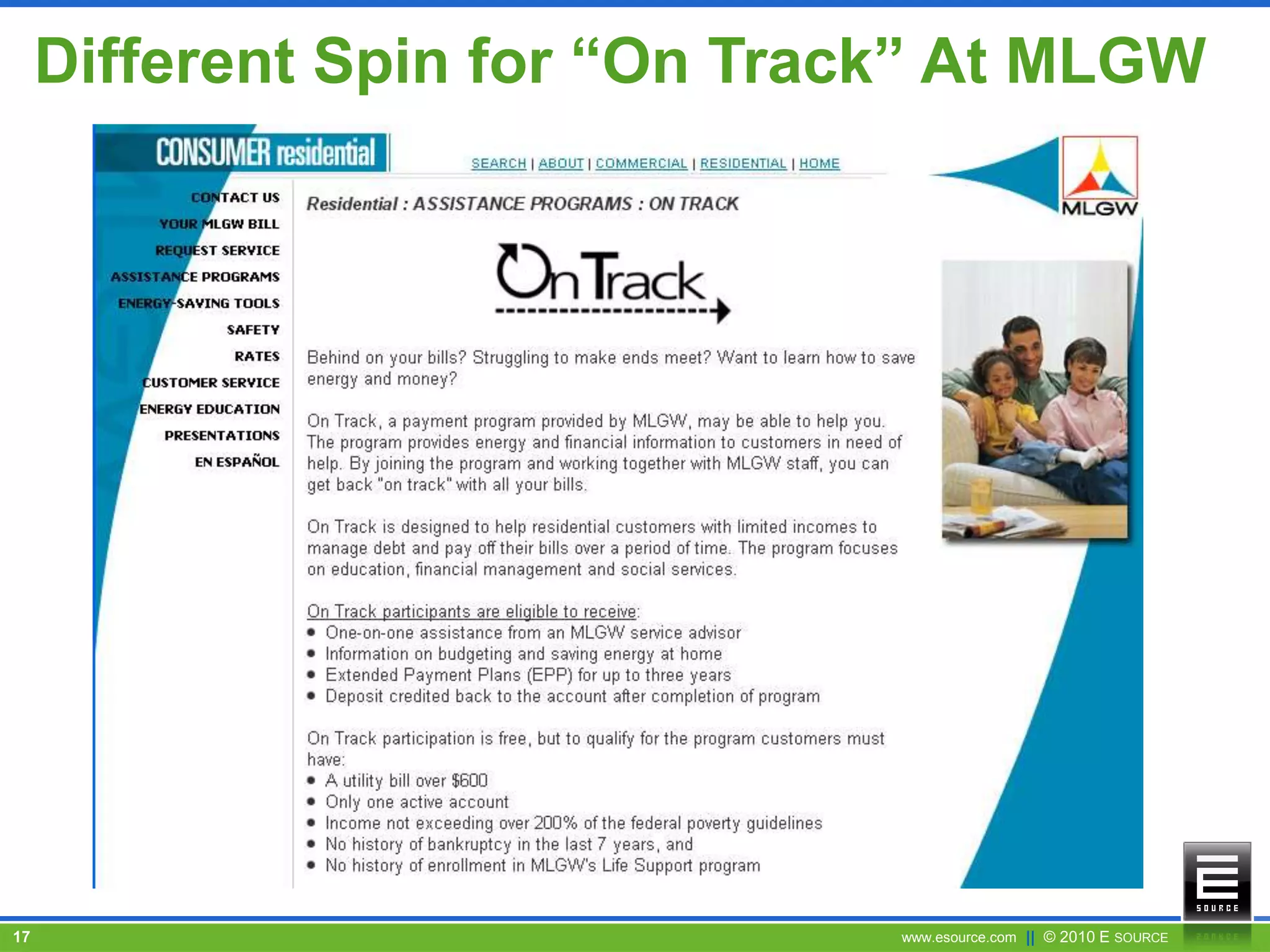

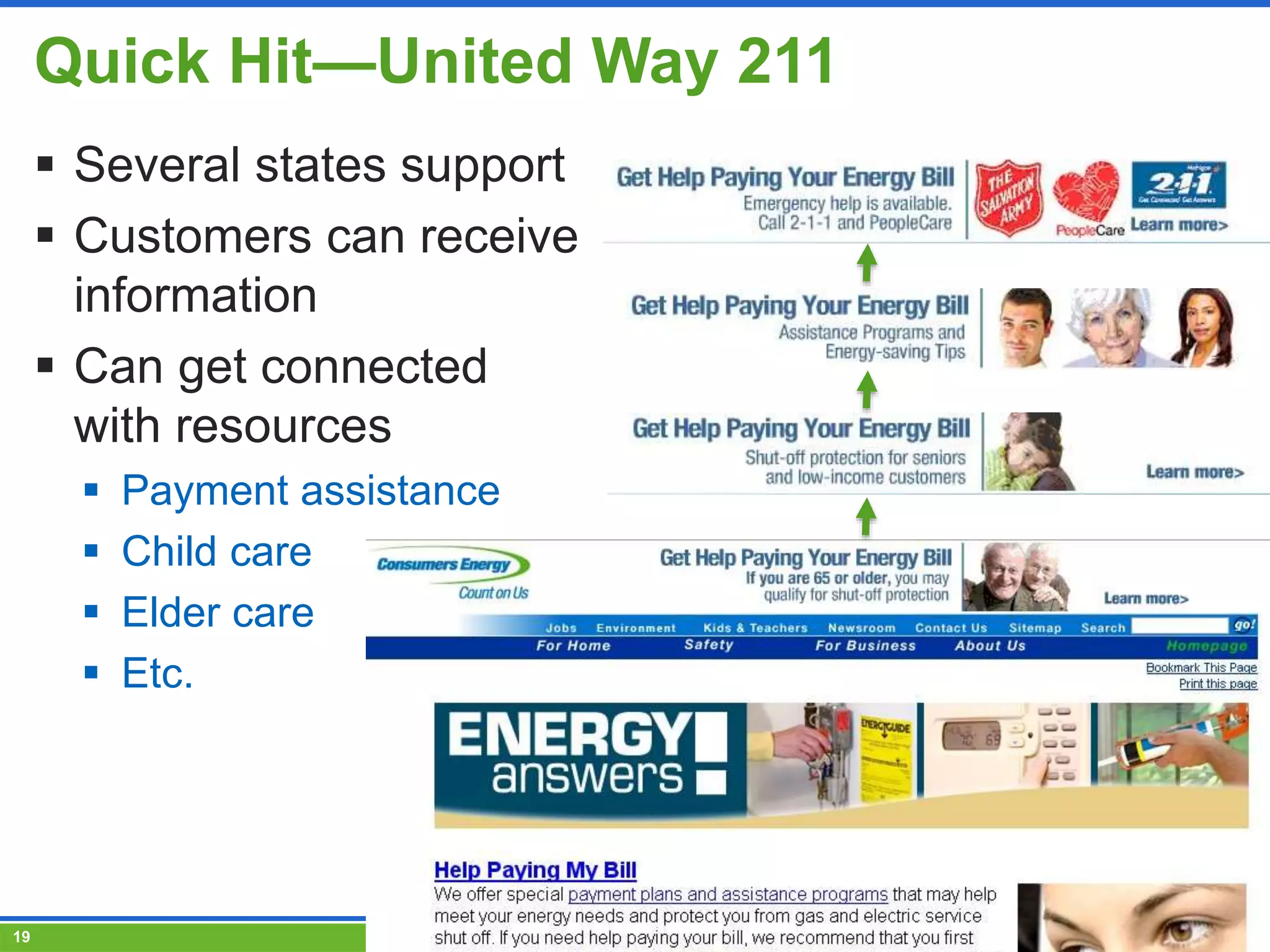

This document discusses programs that utilities can offer to help customers pay their bills regularly and on time. It summarizes several programs implemented by utilities, including automatic payment plans, budget billing, minimum payment options, matching payment programs, and programs that provide financial counseling and assistance. The key recommendations are to understand the demographics and needs of struggling customers, offer a variety of billing and payment options tailored to different customer needs, and provide combined assistance programs that address multiple financial and behavioral issues.