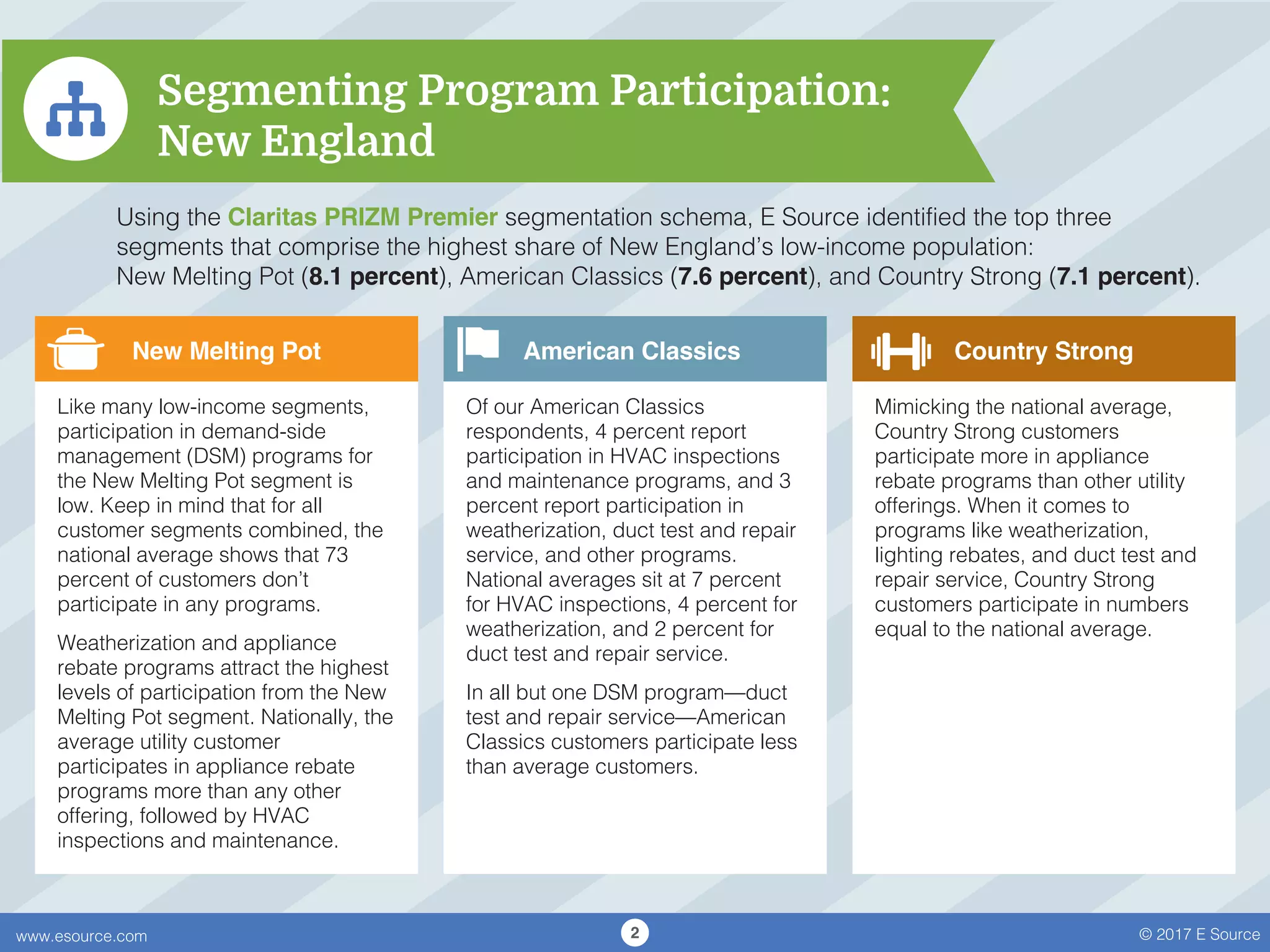

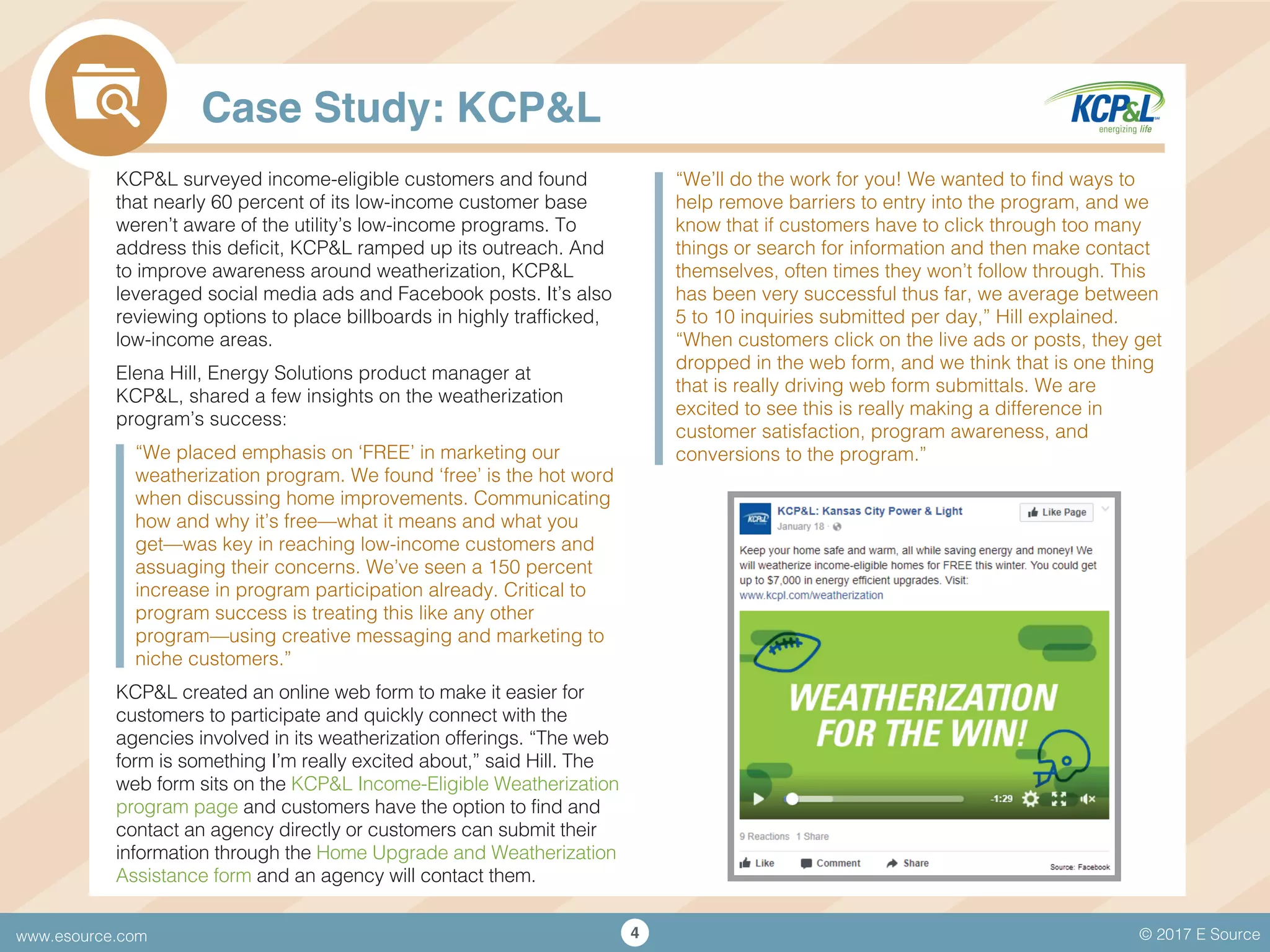

The document discusses the need for utilities to tailor outreach efforts for low-income programs, as these customers are not a uniform group with the same needs. It highlights findings from a segmentation analysis in New England, showing varying participation rates among different low-income segments in utility programs, and suggests broader eligibility criteria and personalized marketing strategies to improve participation. A case study on KCP&L illustrates the success of targeted outreach, including online forms and effective messaging, in increasing program awareness and participation significantly.