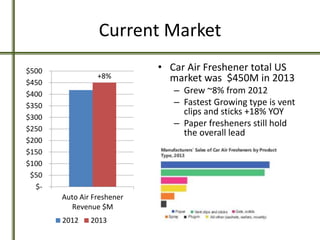

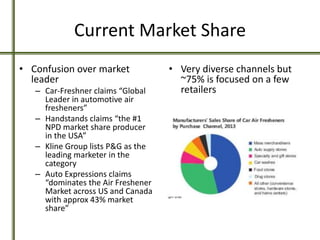

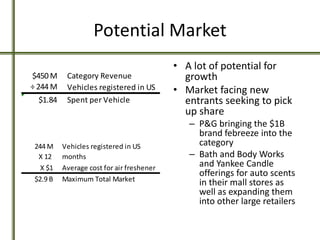

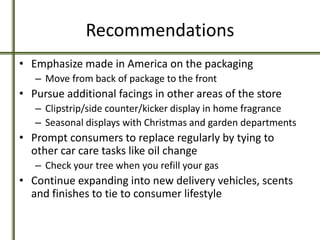

The US auto air freshener market was $450 million in 2013 and grew 8% from 2012. Vent clips and sticks grew the fastest at 18% year-over-year, while paper fresheners still have the overall lead. There is confusion over the market leader as several companies claim to dominate different segments. The market has potential for growth as new entrants like P&G and Bath & Body Works expand offerings. Recommendations include emphasizing American manufacturing, pursuing additional store placements, and tying freshener replacement to other car tasks.