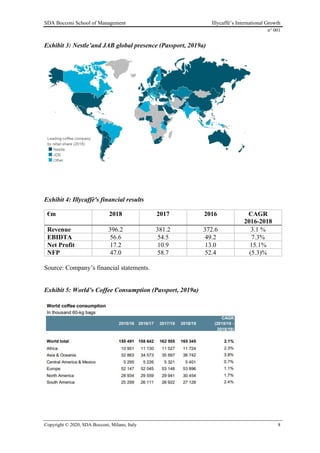

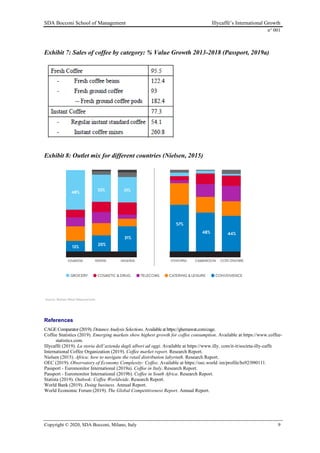

This document provides an overview of Illycaffè's international growth and evaluates foreign demand for Italian super-premium coffee. It discusses Illycaffè's history and international expansion, the global coffee industry trends of consolidation and premiumization, and Illycaffè's market positioning and distribution strategies in foreign markets. Key highlights include Illycaffè's focus on high-quality specialty coffee, expansion through subsidiaries and distributors in over 140 countries, and evaluating opportunities for further growth in emerging markets like Asia and Africa.