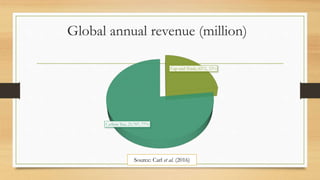

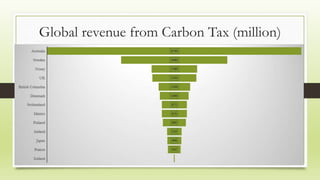

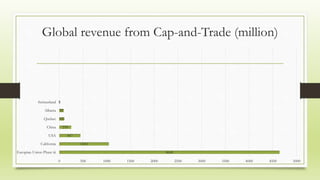

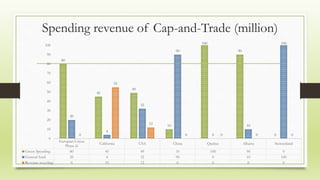

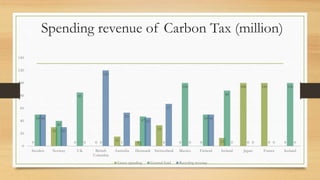

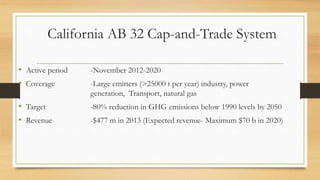

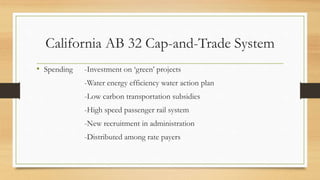

The document compares carbon tax and cap-and-trade systems, highlighting their similarities, such as correcting market failures and generating revenue, and differences, including cost certainty and compliance flexibility. It provides data on global revenues, with carbon tax generating a significantly higher share at 77%. The conclusion suggests that while most countries use carbon tax, a mix of both policies could be beneficial.