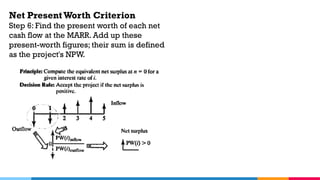

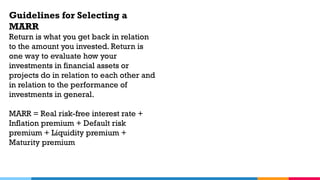

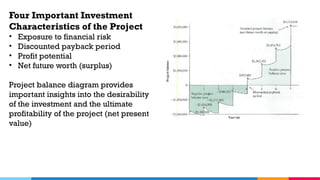

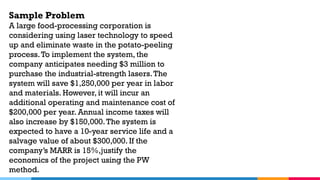

The document discusses the evaluation of investment projects using present worth (PW) analysis, comparing cash inflows and outflows to determine net present worth (NPW) and investment viability. It outlines steps for calculating NPW and the criteria for accepting or rejecting projects based on cash flow and required rates of return (MARR). Additionally, it provides guidelines for selecting the best alternatives among projects, including those with unequal service lives.