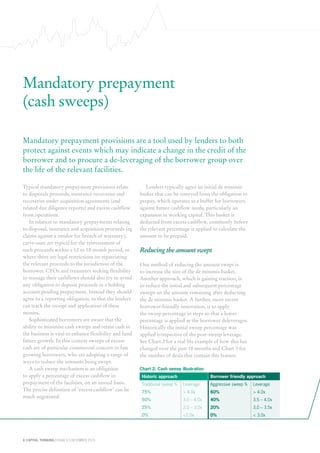

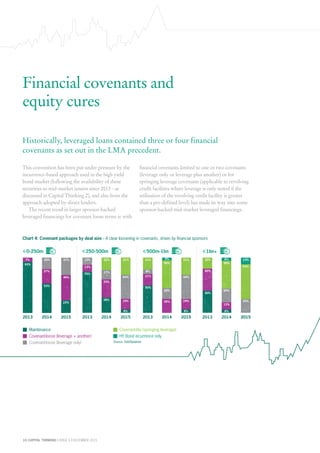

This document provides a summary of key changes in loan documentation that are creating opportunities for mid-market borrowers. Specifically, it discusses how historically rigid loan terms are giving way to more flexible "permitted baskets" and "grower baskets" that expand over time. It also explores how features like accordion facilities and reductions to mandatory cash sweeps are allowing borrowers greater flexibility to engage in strategic activities like acquisitions while maintaining debt levels. The document analyzes these shifts through several examples and suggests borrowers should capitalize on the increasingly borrower-friendly loan market conditions.