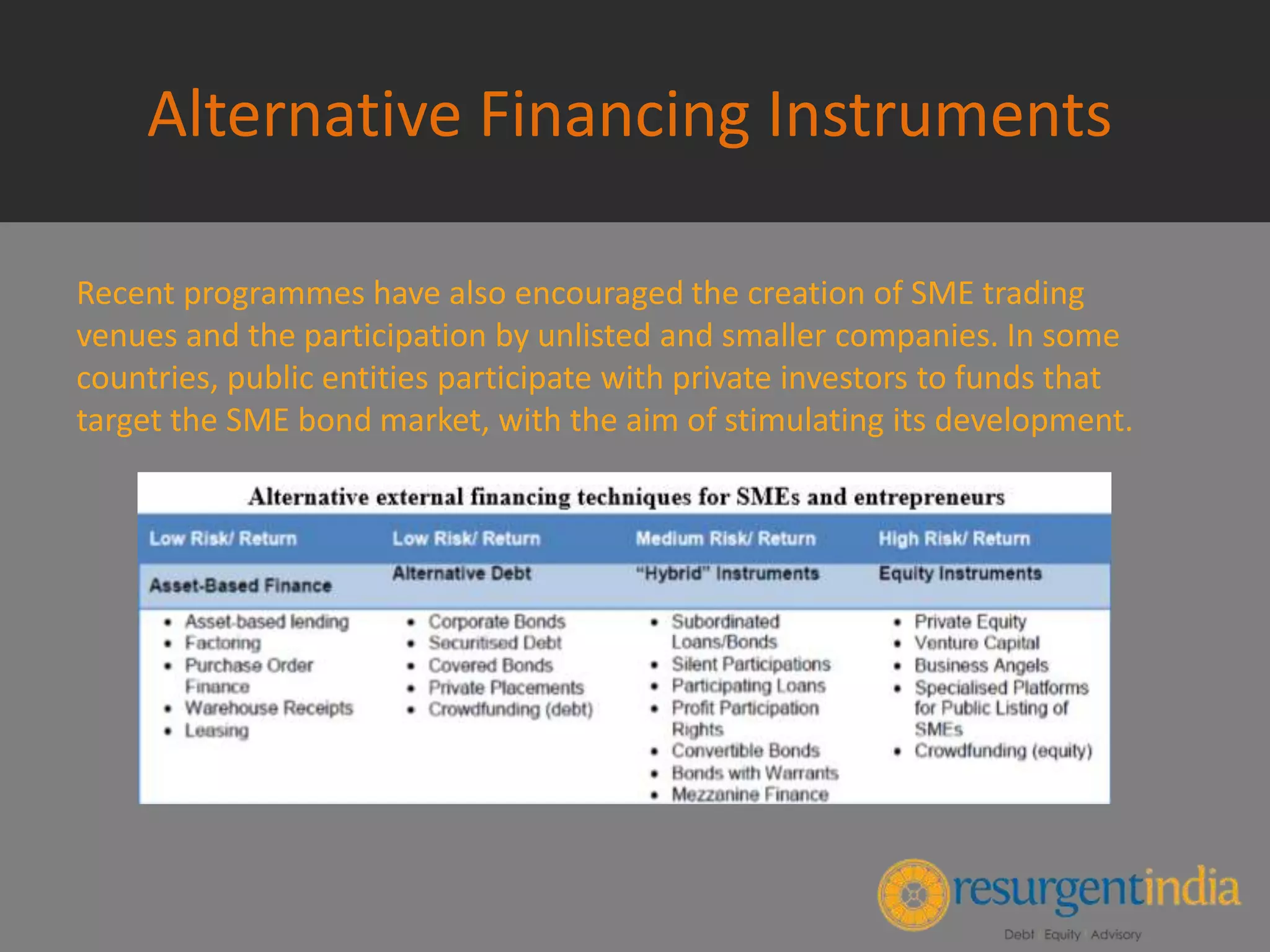

Asset-based finance is an alternative form of financing where firms obtain funding based on the value of specific assets like accounts receivable, inventory, and equipment, rather than on their own creditworthiness. It provides faster access to cash under more flexible terms than traditional bank loans. While asset-based finance is widely used, alternative debt instruments have seen limited usage among SMEs. Policymakers are targeting transparency and investor protection rules to develop corporate bond markets for SMEs. Trade credit is also an important source of short-term financing for SMEs through loans and guarantees to support import/export activities.