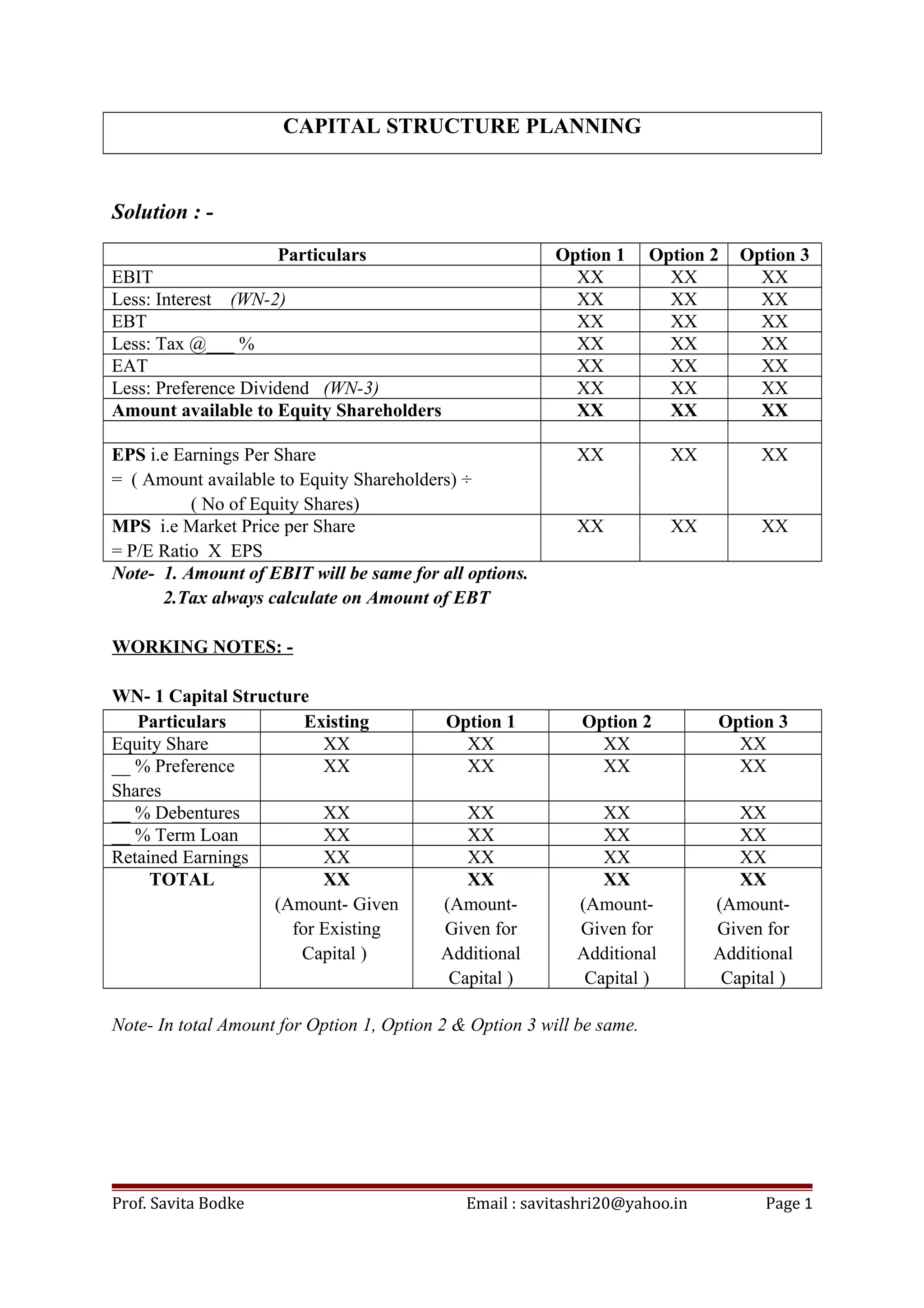

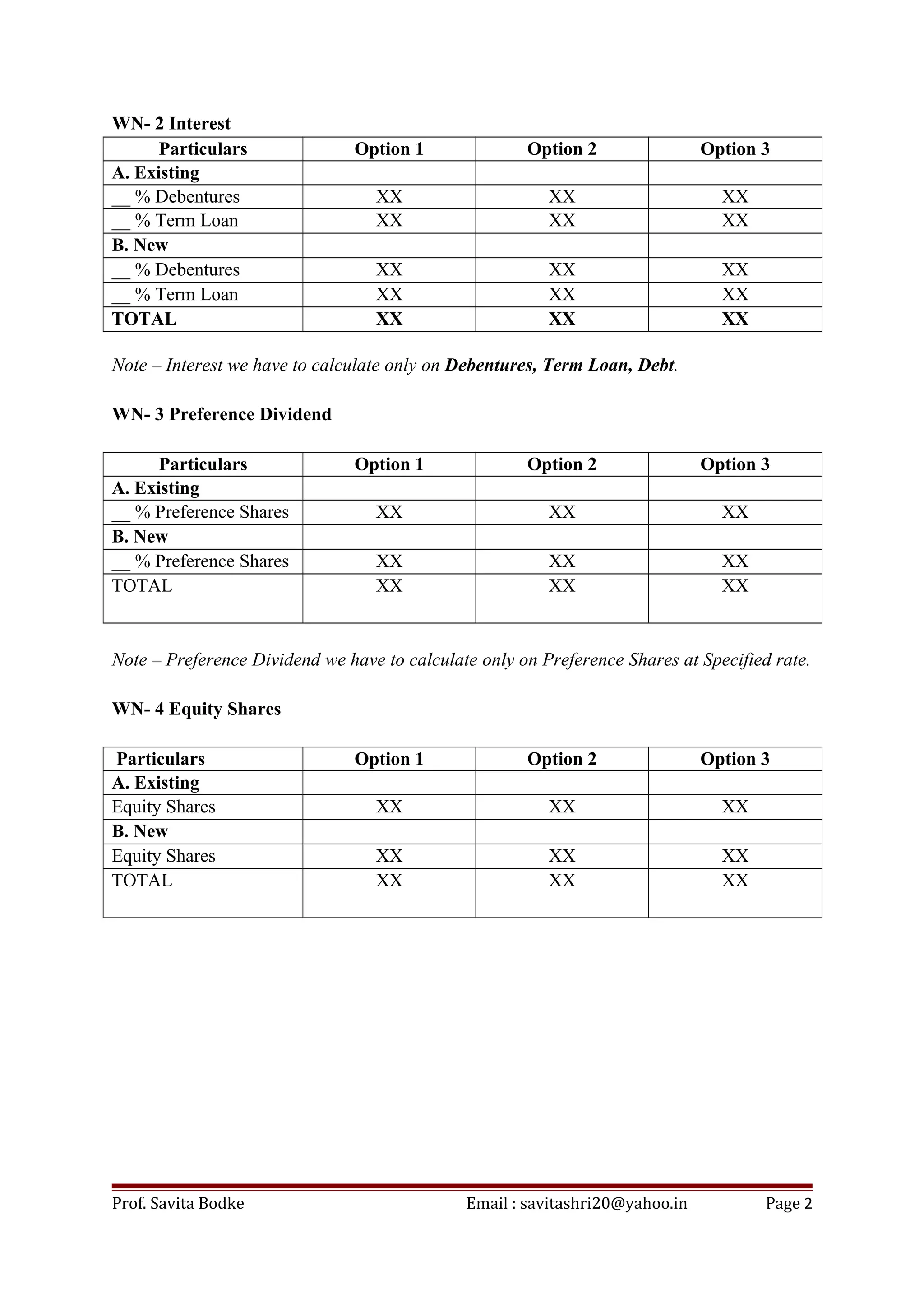

The document outlines three capital structure options for a company and calculates key financial metrics for each. It shows the earnings before interest and taxes (EBIT), interest costs, earnings before tax (EBT), taxes, earnings after tax (EAT), preference dividends, and amounts available to equity shareholders. It then calculates earnings per share (EPS) and market price per share (MPS) for each option. Working notes provide details on the capital structures for each option, including amounts of debt instruments, preference shares, and equity shares. Interest costs and preference dividends are also specified for each capital structure plan.