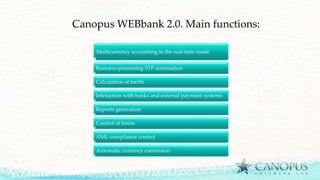

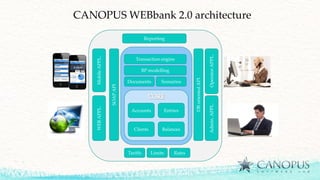

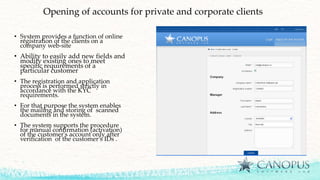

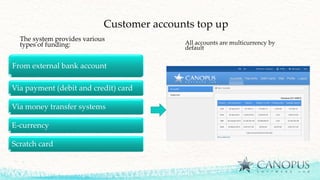

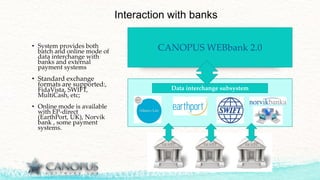

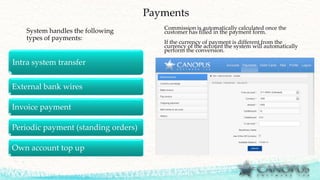

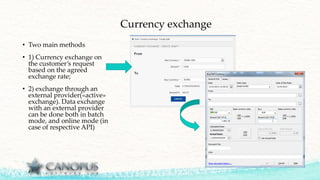

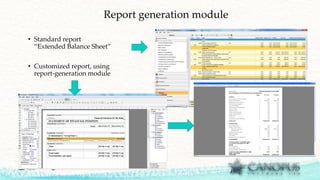

Canopus Software is a software development company that offers the CANOPUS WEBbank 2.0 platform, an innovative software solution for modern banking. The platform provides a universal system to fully automate business processes for banks, payment systems, and other financial institutions. Key features include multi-currency accounting, automated business workflows, payment processing, reporting, security controls, and mobile applications. The platform is highly customizable and scalable to meet client needs.