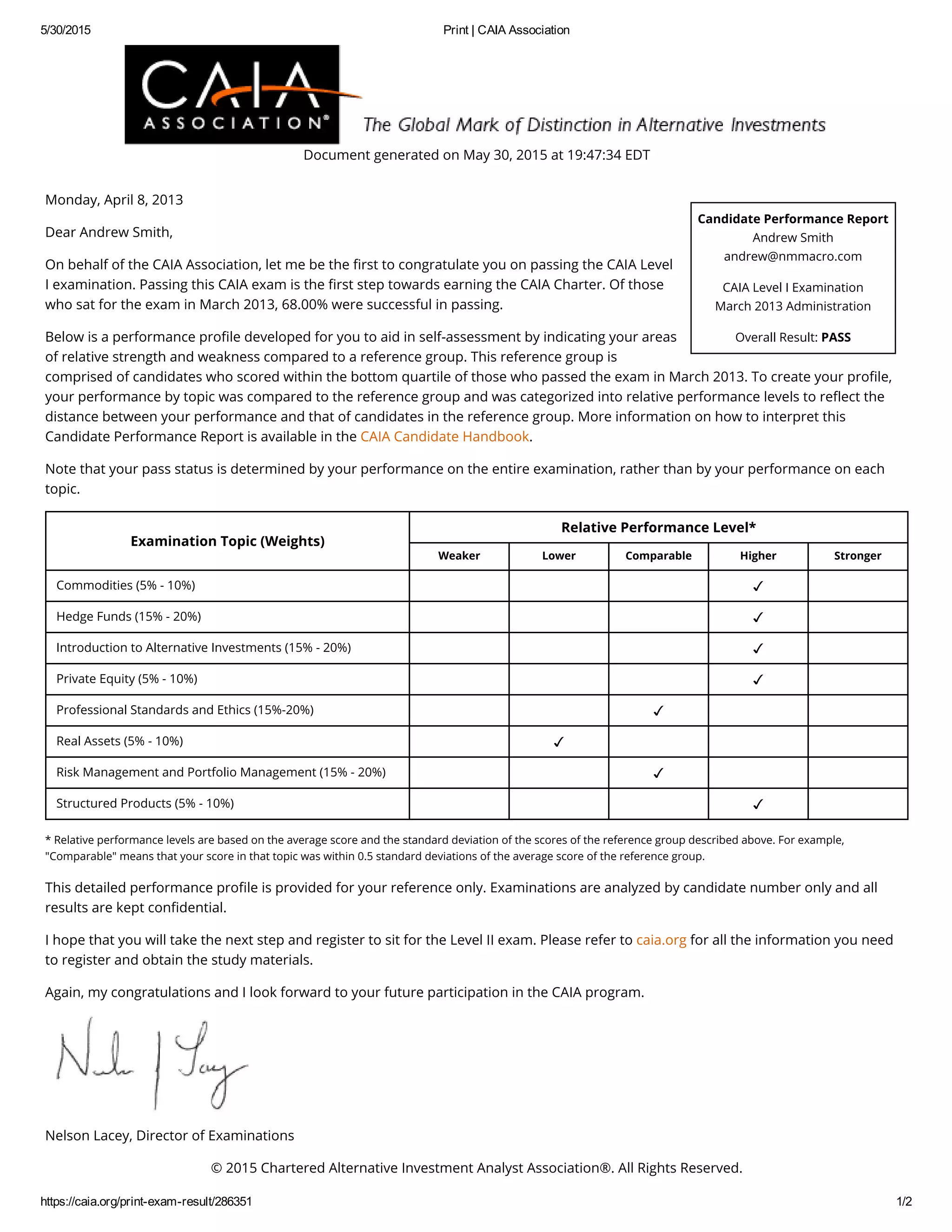

Andrew Smith passed the CAIA Level I examination in March 2013. Of the candidates who took the exam, 68% passed. His performance profile shows how he scored in each topic area compared to those who scored in the bottom quartile of passers. He scored comparably or higher in all topic areas. The letter congratulates him on passing and encourages him to register for the Level II exam.