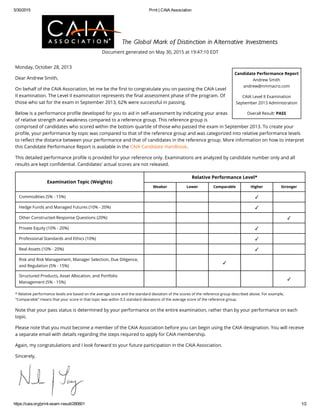

Andrew Smith passed the CAIA Level II examination in September 2013. Of those who took the exam, 62% passed. The letter provided Andrew with a performance profile comparing his results on each exam topic to other candidates who scored in the bottom quartile of passers. His performance ranged from weaker to stronger compared to this group across the various topics. He was informed that he must now become a member of CAIA to use the designation after passing.