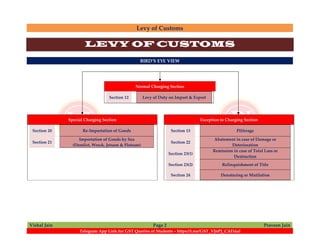

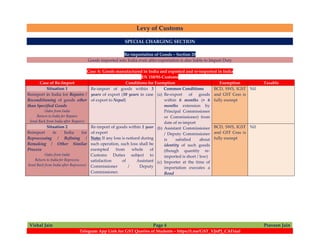

The document elaborates on customs duty regulations in India, outlining normal and special charging sections for the import and export of goods. It details processes for re-importation, pilferage, damages, and exemptions, including specific criteria under which customs duties apply or are remitted. Moreover, it provides clarifications on recent amendments related to the export and re-import of goods for exhibitions without payment of integrated tax.

![Levy of Customs

Vishal Jain Page 3 Praveen Jain

Telegram App Link for GST Queries of Students – https://t.me/GST_VJnPJ_CAFinal

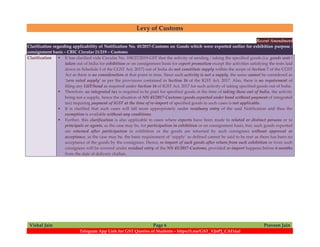

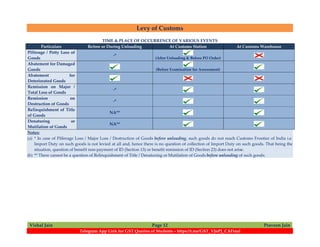

NORMAL CHARGING SECTION

Levy

Assessment

Collection

Stage where declaration of liability is made.

Person or Properties in respect of which tax

or duty is to be levied is identified and

charged

Procedure of quantifying the amount of

liability.

Liability to tax or duty does not depend

upon Assessment

Final stage where tax or duty is actually

collected.

Collection of tax or duty may be postponed

to later time for administrative convenience.

Import or Export of Goods – Section 12

Goods + Imported into OR Exported from + India

Customs Duty

Assessable Value Rate of Duty

Section 14(1)

Transaction Value

Section 14(2)

Tariff Value [CBIC]

(Valuation Rules & Exchange

Rate is ALWAYS Required)

(Valuation Rules & Exchange

Rate is NOT Required)

Import Duty

Ist Sch. to CTA, 1975

Export Duty

IInd Sch. to CTA, 1975

Standard

Rate

Preferential

Rate

(Export Duty is on very Few

Goods)

Notes:

(a) Preferential Rate is always lesser than or equal to Standard Rate for Import Duty.

For Imports from Most Favored Nations (MFN) (i.e. Import from Member Nations of WTO + Import from Nations having Separate

Bilateral Agreement), Preferential Rate is applied for Import Duty.

For Imports from Other Nations , Standard Rate is applied for Import Duty.

(b) Even Government is liable to pay Import Duty if it imports any goods. However, imports of goods by Indian Navy, specific equipment

required by Police, Ministry of Defense, Costal Guard, etc. are fully exempt by virtue of specific Exemption Notification subject to

fulfilment of conditions and procedure.](https://image.slidesharecdn.com/canotesonlevyofcustoms-210510200548/85/CA-NOTES-ON-LEVY-OF-CUSTOMS-3-320.jpg)

![Levy of Customs

Vishal Jain Page 5 Praveen Jain

Telegram App Link for GST Queries of Students – https://t.me/GST_VJnPJ_CAFinal

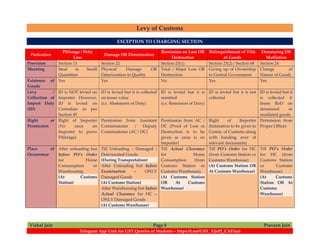

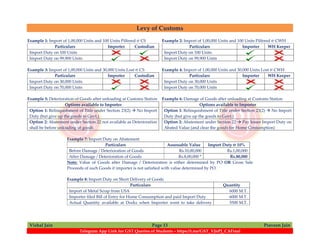

Case B: Goods re-imported without being subjected to re-manufacturing or re-processing through melting, recycling or recasting abroad

EN 45/2017-Customs

Case of Re-Import Conditions for Exemption Exemption Taxable

Situation 1

Re-import in India where the

earlier Export was under

Export Benefits

(Sales from India

Sales Return to India)

Export Benefits claimed are as

follows:

(a) Export and claiming

Drawback OR Refund of

Customs / Central Excise /

State Excise / IGST

(b) Export under Bond / LUT

without payment of IGST at

the time of Export

(c) Export under Duty

Exemption Scheme (Advance

Authorization / Duty Free Import

Authorization or Export

Promotion Capital Goods Scheme)

Common Conditions

(a) Re-import should be in 3

Years (+ 2 Years

extension) from Export.

(b) Identity of goods shall

remain the same (i.e. Re-

imported goods shall

NOT be subjected to re-

manufacturing, re-

processing through

melting, recycling or

recasting abroad)

However, exemption is

NOT applicable in below

cases:

(a) Re-imported goods had

been exported by EOU

or Free Trade Zone

(b) Re-imported goods had

been exported from

Public Warehouse or

Private Warehouse

(c) Re-imported goods falls

under Fourth Schedule

to Central Excise Act,

1944 (Tobacco &

Petroleum Products)

Import Duty on

Re-Importation

–

Taxable Portion

LOWER of

Import Duty on Re-

Importation

OR

[Amount of Drawback

/ Refund OR

Amount of IGST not

paid at the time of

export OR

Amount of IGST and

GST Com. Cess

leviable at time &

place of Original

Import]

Situation 2

Re-import in India is after

Repairs outside India and

where the earlier Export was

NOT under Export Benefits

(Purchase into India

Return outside India for Repairs

Send Back to India after Repairs)

(a) Export was for repairs. Also,

no Export Benefits was given

on their Export.

(b) Ownership of goods shall

remain the same

Not Applicable Value = Fair Cost of

Repairs including

Cost of Materials used

for repairs (whether

such costs are actually

incurred or not) +

Insurance and Freight

Charges (both ways)

Situation 3

Re-import in India in Residuary

Cases

(Taken out of India for Exhibition

Send Back to India after Exhibition)

- BCD, SWS, IGST

and GST Cess is

fully exempt

Nil](https://image.slidesharecdn.com/canotesonlevyofcustoms-210510200548/85/CA-NOTES-ON-LEVY-OF-CUSTOMS-5-320.jpg)