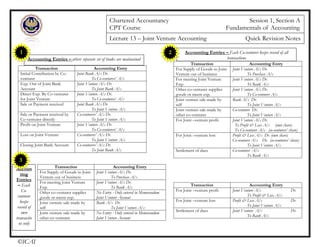

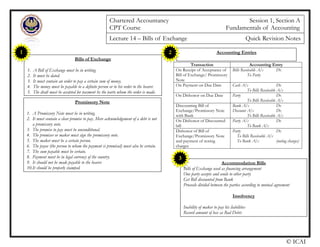

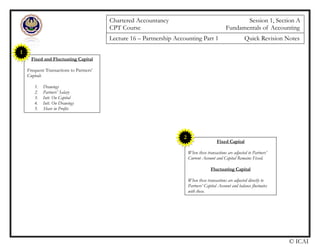

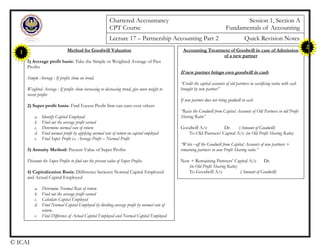

The document provides a comprehensive overview of various accounting principles and transaction entries relevant to chartered accountancy, including concepts like expenses accrual, income accrual, stock evaluation, and partnership accounting. It details specific accounting entries for consignment, joint ventures, bills of exchange, and goods sold on approval, while also highlighting adjustments related to partners’ capital and goodwill valuation. Key points emphasize the distinction between capital and revenue, the importance of separate personal transactions, and the treatment of unusual losses and profits.

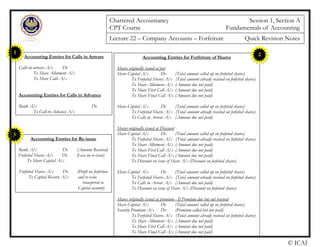

![Chartered Accountancy Session 1, Section A

CPT Course Fundamentals of Accounting

Lecture 15 – Sale of Goods on

Approval or Return Basis Quick Revision Notes

Accounting Treatment

Sale of Goods on Approval or Return Basis

Casually

Treat as Ordinary

Sale

Frequently

Prepare Sales or

Return Journal

Numerously

Sales or Return Day

Book

Sales or Return

Ledger

1

Goods Causally Sent On Sales or Return

1. At the time of Sending the goods:

Debtor’s A/c Dr. [Invoice price]

To Sales A/c

2. At year end if goods still lying with customer and

time limit not passed:

a) Reverse the original entry

b) Take the stock into account

Stock with Customers on Sale or Return A/c Dr.

To Trading A/c

[Cost or Market Value whichever is less]

2

© ICAI

Goods Frequently Sent On Sales or Return

Prepare ‘Sale or Return Journal/Day Book’

Goods sent on Approval Goods Returned Goods Approved Bal.

1 2 3 4 5 6 7 8 9 10 11 12 13

Date Particulars fl Amt. Date Particulars fl Amt. Date Particulars fl Amt. Amt.

3

Goods Numerously Sent On Sales or Return

Prepare Memorandum Books

Sale or Return Day Book Sale or Return Ledger

4

Journal Entries

1. Goods sent to customers on a sale or return basis

In Memorandum Books:

Customer’s A/c Dr.

To Sale or Return A/c

In General Ledger

----- No Entry -----

2. Goods returned by customers

In Memorandum Books:

Sale or Return A/c Dr.

To Customer’s A/c

In General Ledger

----- No Entry -----

3. Goods approved by customers

In Memorandum Books:

Sale or Return A/c Dr.

To Customer’s A/c

In General Ledger

Customer’s A/c Dr.

To Sale or Return A/c

4. At year end

In Memorandum Books:

----- No Entry -----

In General Ledger

Stock with Customers on Sale or Return A/c Dr.

To Trading A/c [Cost or Net Realizable Value, whichever is less]

5](https://image.slidesharecdn.com/combinepdf-181206172519/85/CA-fast-track-notes-for-Accountancy-5-320.jpg)

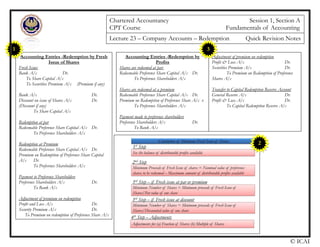

![Void Contract Voidable Contract

Definition A contract which ceases to be enforceable by law

becomes VOID when it ceases to be enforceable

Enforceable by law at the option of one or more

parties, but nor at the option of other

Nature Valid when it is made but subsequently

becomes unenforceable

Voidable at the option of the aggrieved party and

remains valid until rescinded by him

Rights Does not provide any legal remedy for the

parties to the contract

Aggrieved party gets a right to rescind the contract

Chartered Accountancy

CPT Course

Lecture

What is Contract ?

An Agreement enforceable by Law [Section 2(h)]

Agreement:

“Every promise and every set of promises, forming the consideration

for each other” [Section 2(e)]

“When the person to whom the proposal is made signifies his assent

thereto, the proposal is said to be accepted. Proposal when accepted,

becomes a promise” [Section 2(b)]

Enforceable by Law:

“All agreements are contracts if they are made by the free consent of

parties competent to contract, for a lawful consideration and with a

lawful object, and are not hereby expressly declared to be void”

[Section 10]

© ICAI

Voidable Contract

Enforceable by law at the option of one or more

parties, but nor at the option of other

Voidable at the option of the aggrieved party and

remains valid until rescinded by him

Aggrieved party gets a right to rescind the contract

Chartered Accountancy

CPT Course

Lecture 1 – Nature of Contract Quick Revision Notes

“When the person to whom the proposal is made signifies his assent

nt of

1

3

Visit us @ www.CAShiksha.com

Void Contract Illegal Contract

Scope It may not be illegal Its is always Void

Effect on

collateral

transaction

Collateral transactions to

the agreement may be

enforced for execution

Collateral transactions to the

agreement also become illegal

and cannot be enforced

Punishment No punishment for

entering

Punishment for entering

4

Session 1, Section B

Mercantile Law

Quick Revision Notes

2

www.CAShiksha.com

A GS Shiksha initiative

Illegal Contract

is always Void

Collateral transactions to the

agreement also become illegal

and cannot be enforced

Punishment for entering](https://image.slidesharecdn.com/combinepdf-181206172519/85/CA-fast-track-notes-for-Accountancy-11-320.jpg)