The document discusses key points to consider when creating a business plan, including:

1) A business plan is a communication tool that should be tailored to the intended audience, such as investors.

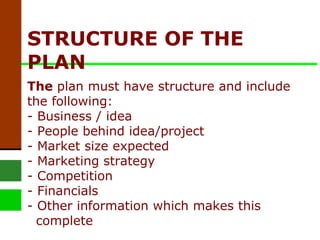

2) The business plan structure should include details on the business idea, team, market size, marketing strategy, competition, finances, and other relevant information.

3) Financial projections are difficult for new markets but can incorporate scenario and sensitivity analysis.

4) Valuation of the business depends on intangible and tangible factors and should consider the stake being negotiated.

![Business Planning: 12 points ‘ to trigger thinking’ Anjana Vivek [email_address] www.bizkul.com](https://image.slidesharecdn.com/businessplanning-12points1-090918121747-phpapp01/75/Business-Planning-12-Points-1-1-2048.jpg)