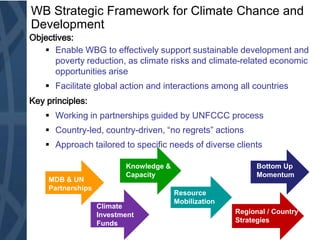

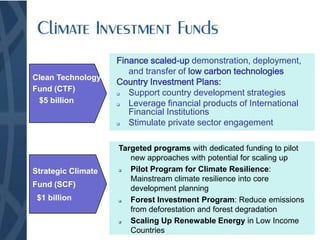

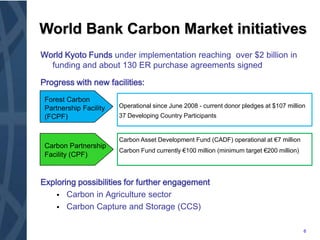

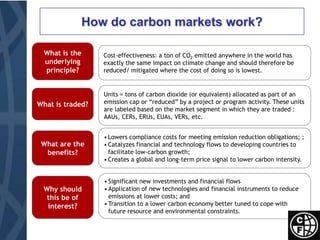

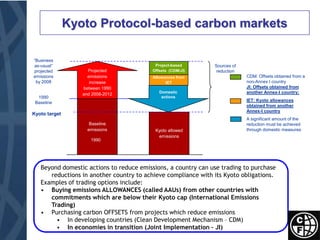

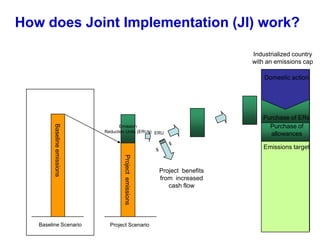

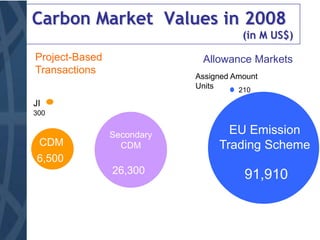

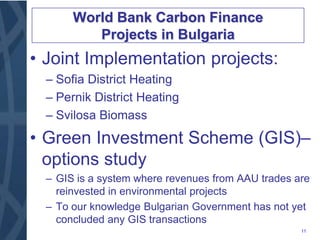

The document discusses the World Bank's strategic framework for addressing climate change and development. It aims to enable the WBG to support sustainable development and poverty reduction as climate risks and opportunities arise. Key principles include working in partnerships guided by the UNFCCC process and taking country-led, tailored approaches. The WBG will provide knowledge, mobilize resources, and support regional and country climate strategies and plans through financing climate change mitigation and adaptation. Carbon markets can play a central role in mobilizing private sector finance for low carbon investments in developing countries.