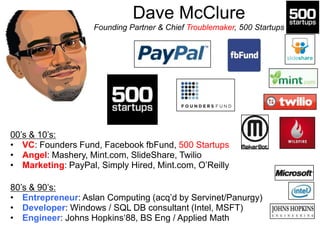

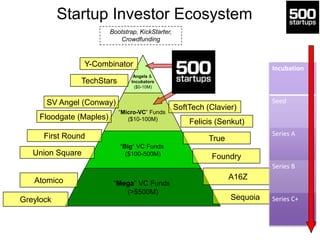

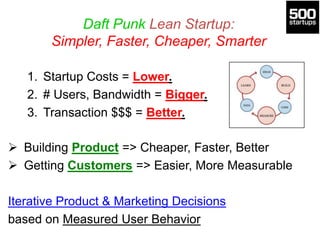

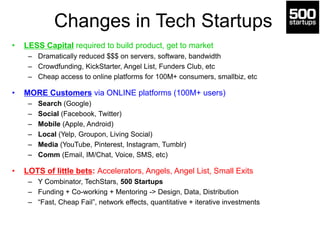

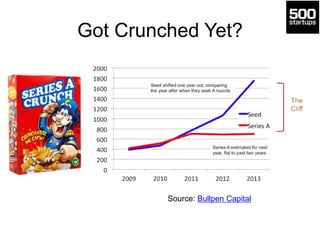

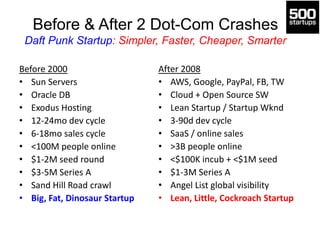

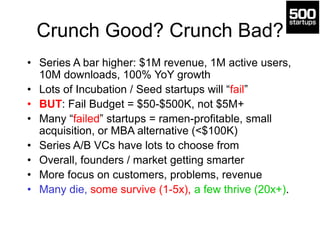

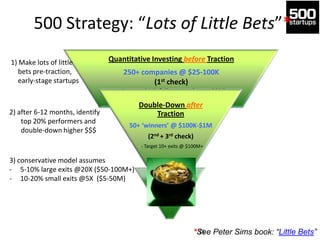

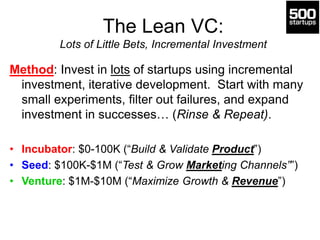

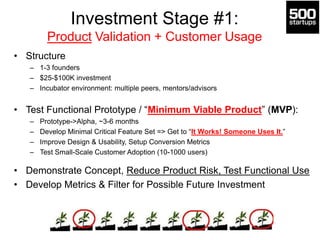

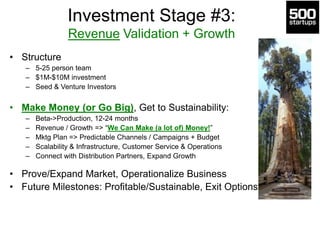

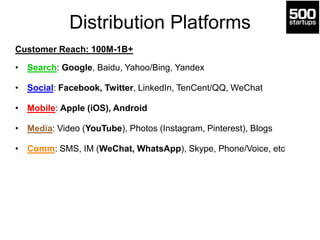

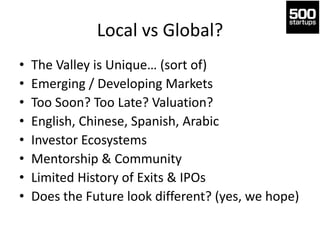

Dave McClure's talk at the H2 Summit discusses significant changes in the venture capital landscape, highlighting a shift towards smaller investments and a focus on startup metrics. He emphasizes lower startup costs and higher efficiency in reaching customers due to advancements in technology and online platforms. The presentation outlines a strategy of making numerous small investments in early-stage startups, with a focus on iterative development and customer feedback leading to eventual growth and sustainability.