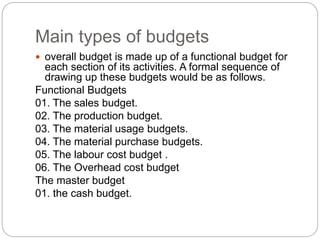

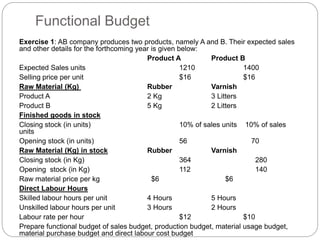

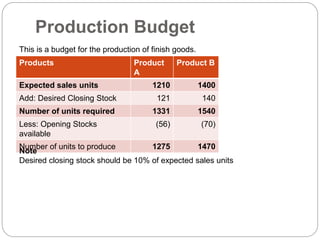

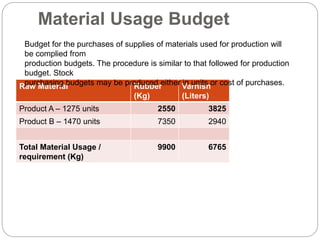

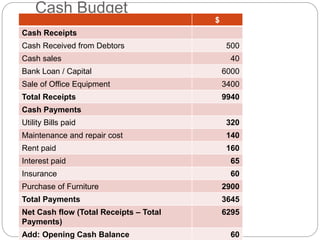

The document discusses budgeting and provides examples of functional budgets, including a sales budget, production budget, material usage budget, material purchase budget, direct labor cost budget, and cash budget. It defines what a budget is and the purposes of budgeting such as planning, coordination, control and performance evaluation, and participation. It also provides an example of how to prepare functional budgets for a company producing two products based on expected sales units, prices, material and labor details.