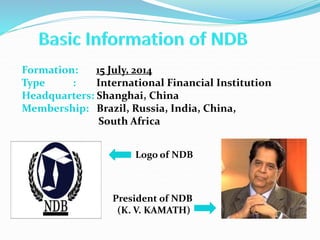

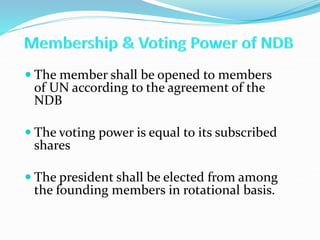

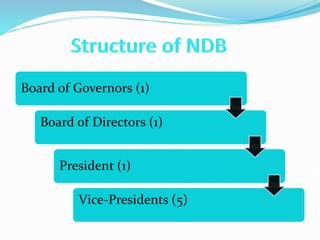

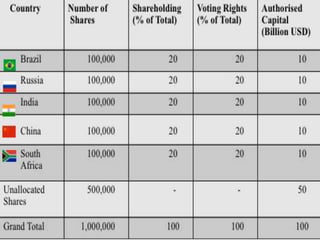

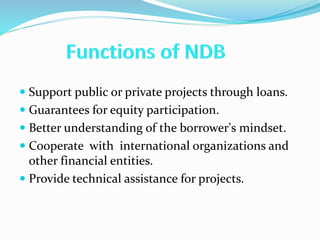

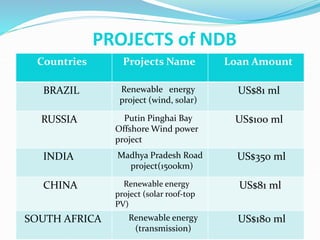

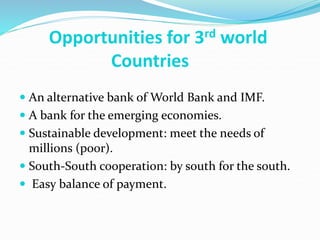

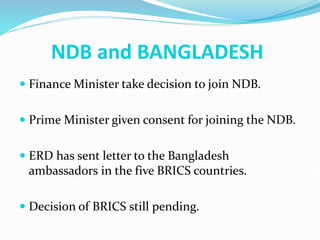

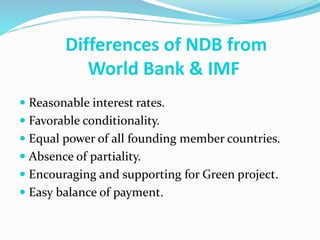

The document discusses the New Development Bank (NDB), established on July 15, 2014, as an international financial institution aimed at providing an alternative to the World Bank and IMF, primarily serving emerging economies like BRICS nations. It highlights NDB's objectives of enhancing global financial cooperation, addressing infrastructure development, and promoting sustainable projects, while also outlining its governance structure and funding contributions from member countries. Additionally, challenges such as political conflicts among member states and the existing dominance of the World Bank and IMF are noted.