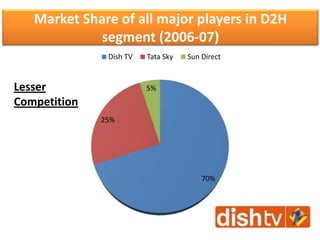

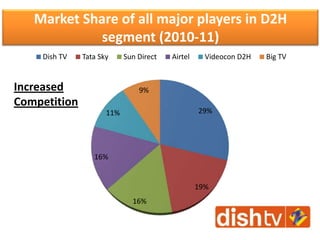

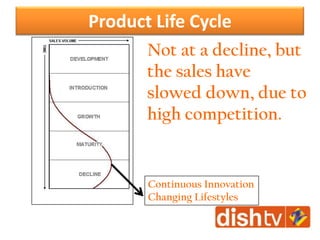

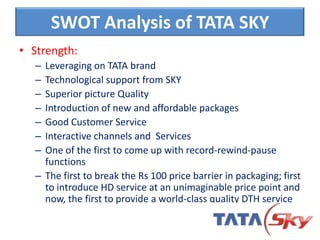

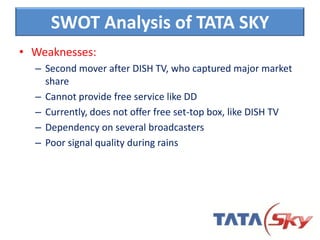

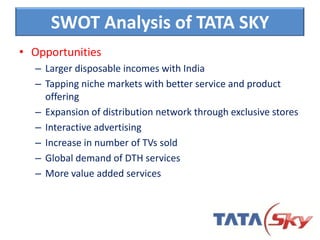

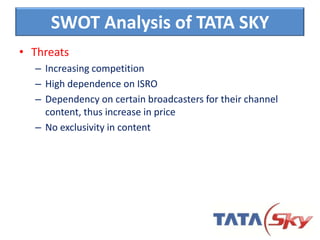

The document discusses the DTH (direct-to-home) sector in India, focusing on Dish TV and Tata Sky as the two major players. It provides background on when DTH services were allowed in India, examines the market share of different providers over time, and analyzes the strengths, weaknesses, opportunities and threats for Dish TV and Tata Sky through SWOT analyses. Financial data for 2011-2012 shows Dish TV was profitable while Tata Sky recorded a loss, though the loss amount decreased from previous years. The document also discusses the target market and consumer wants for DTH services.