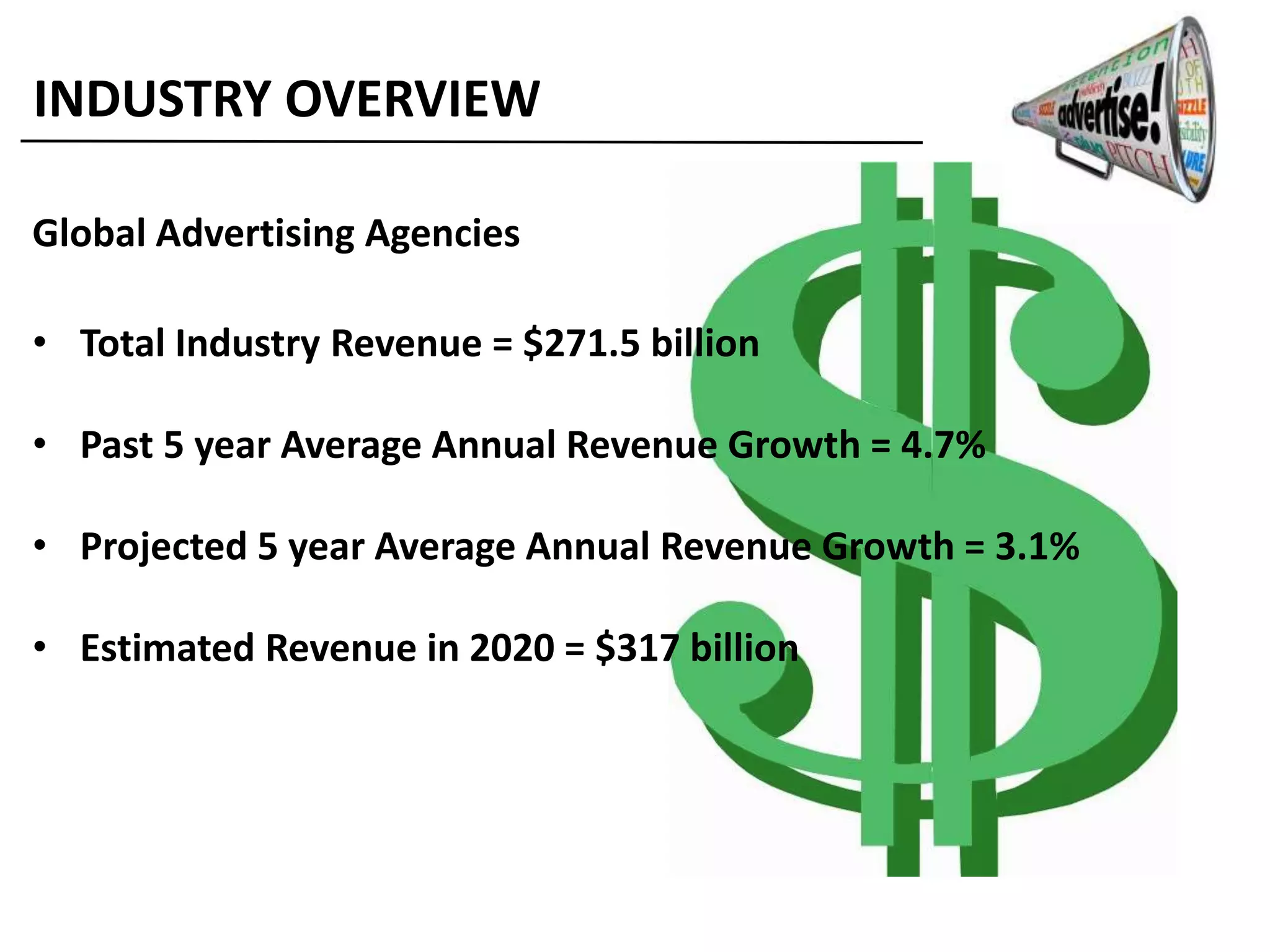

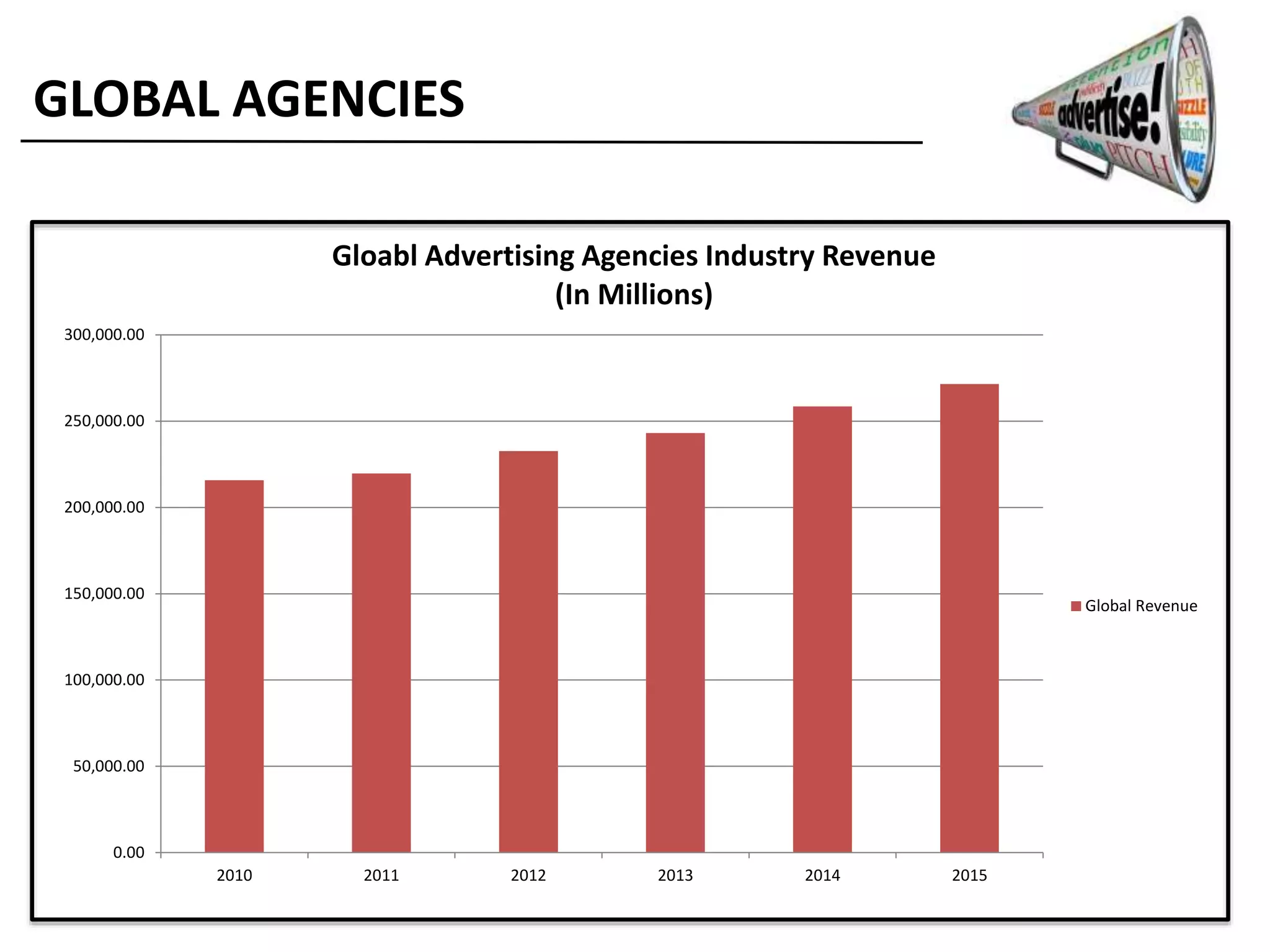

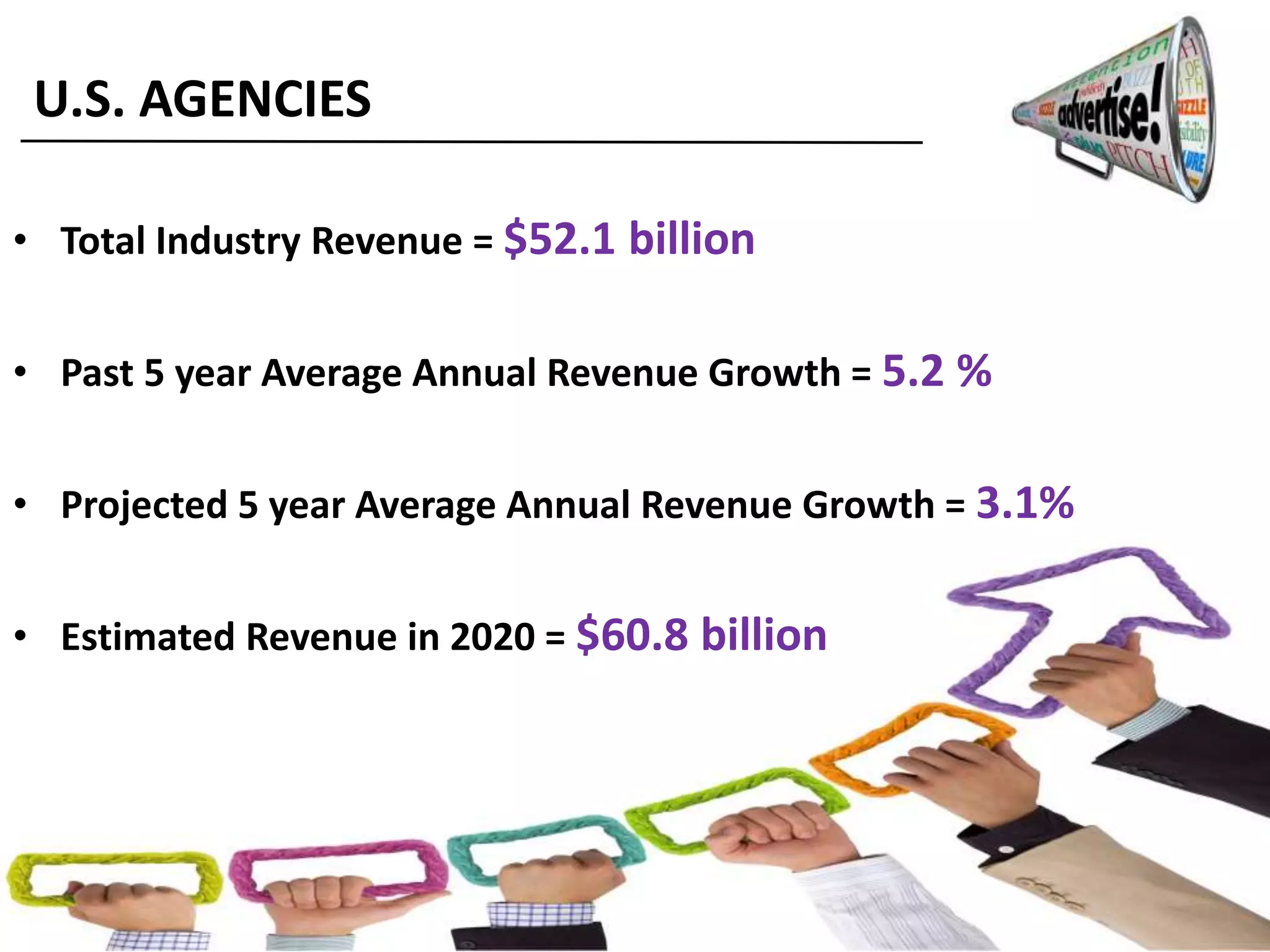

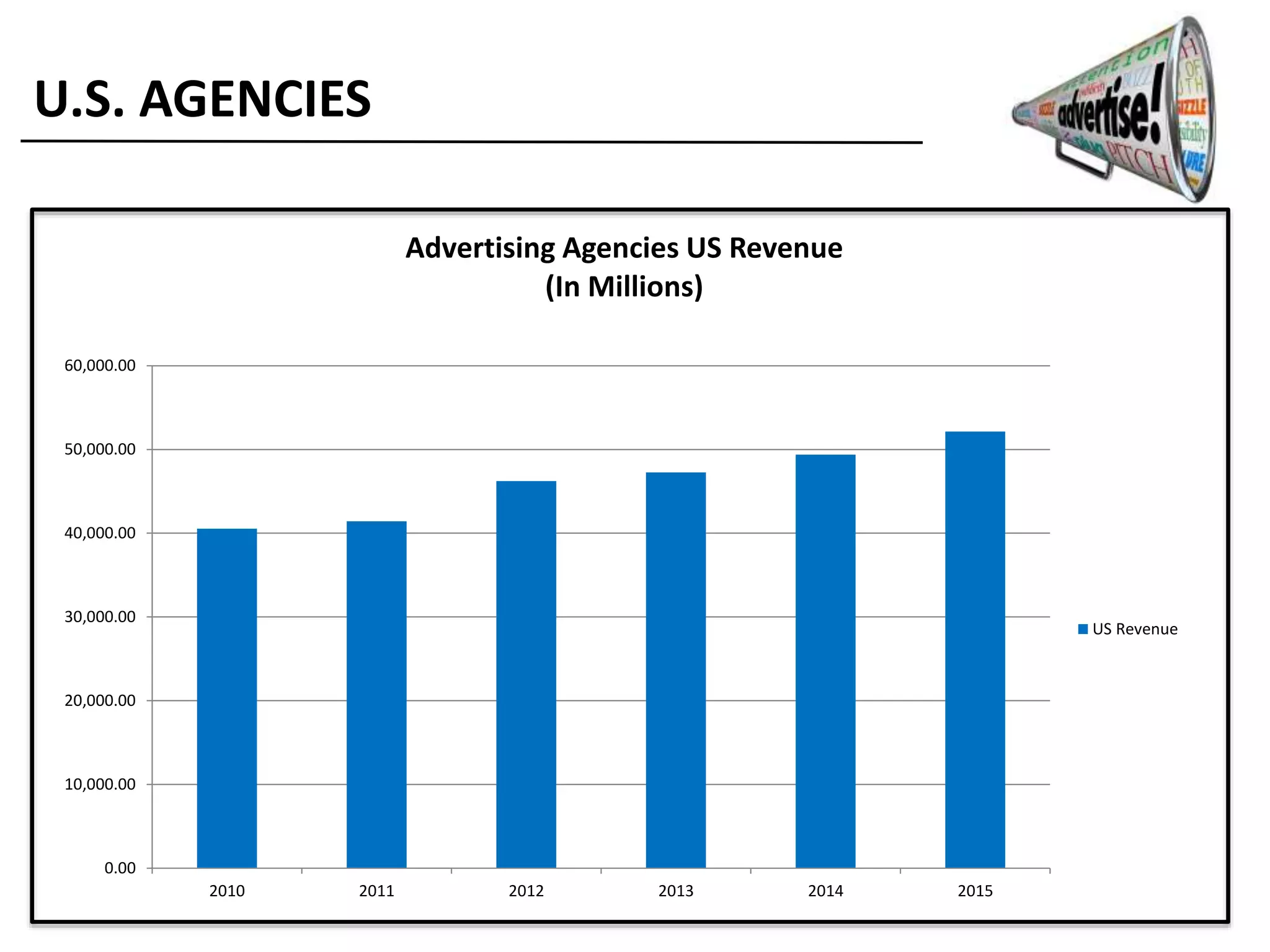

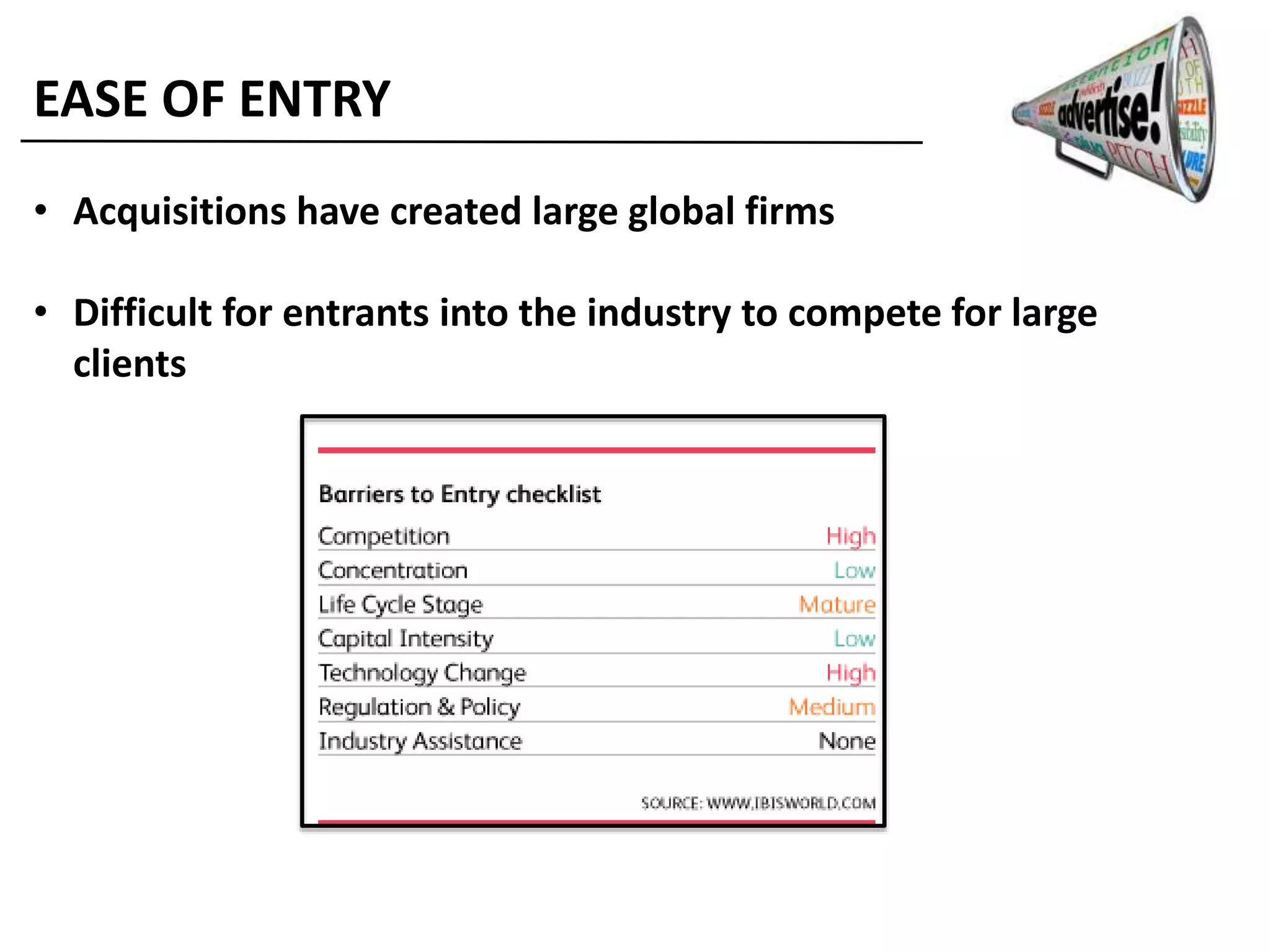

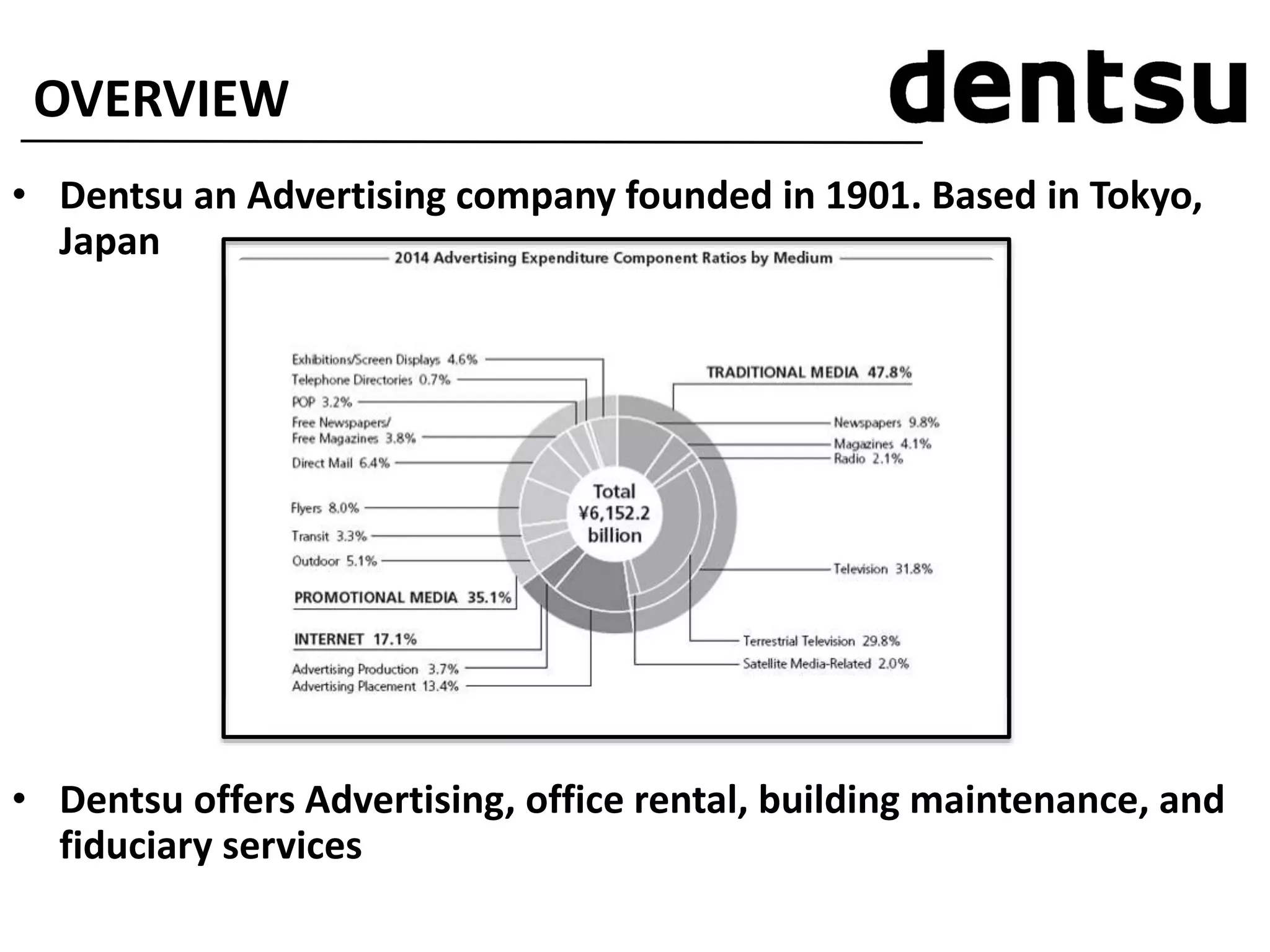

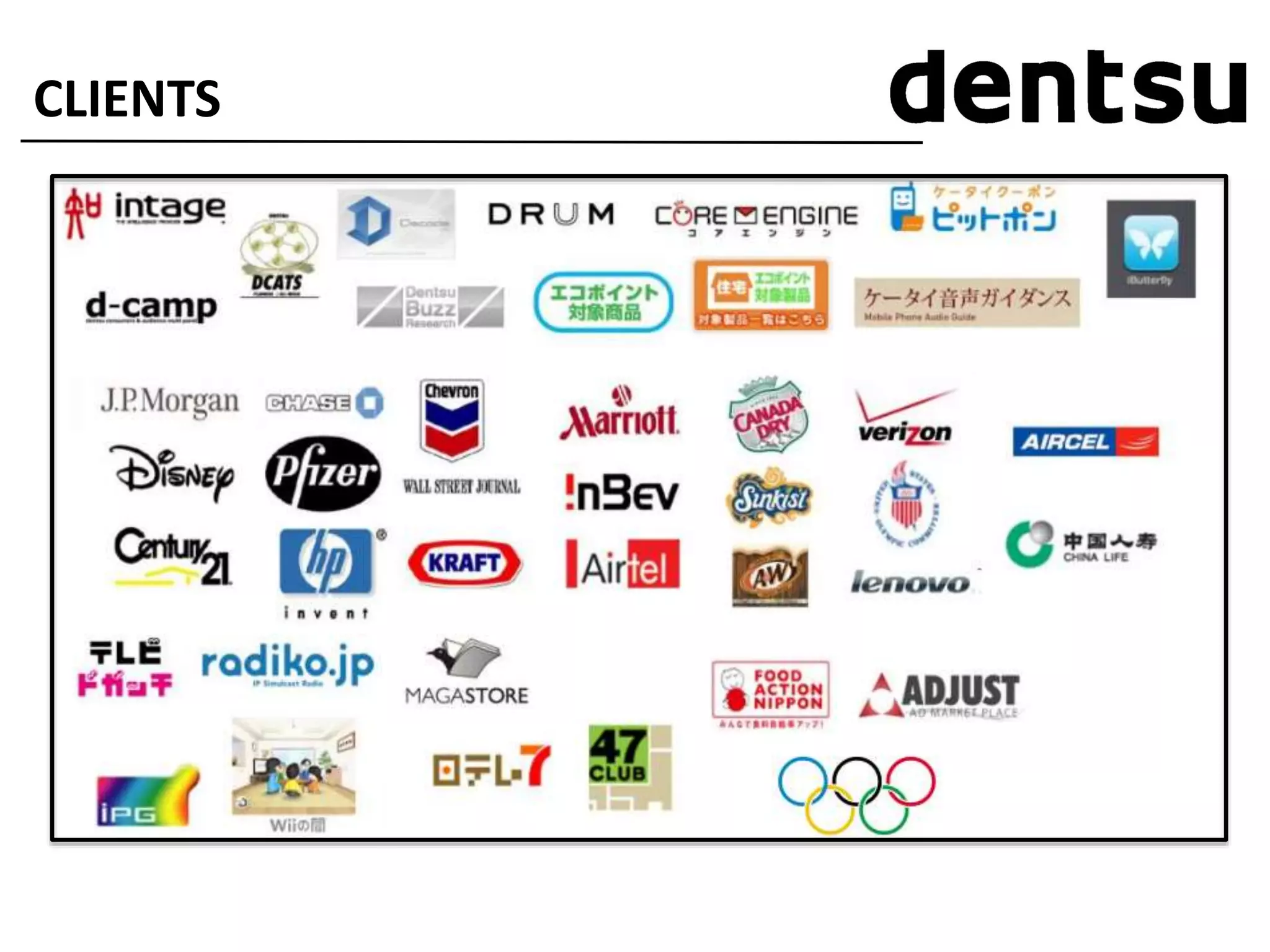

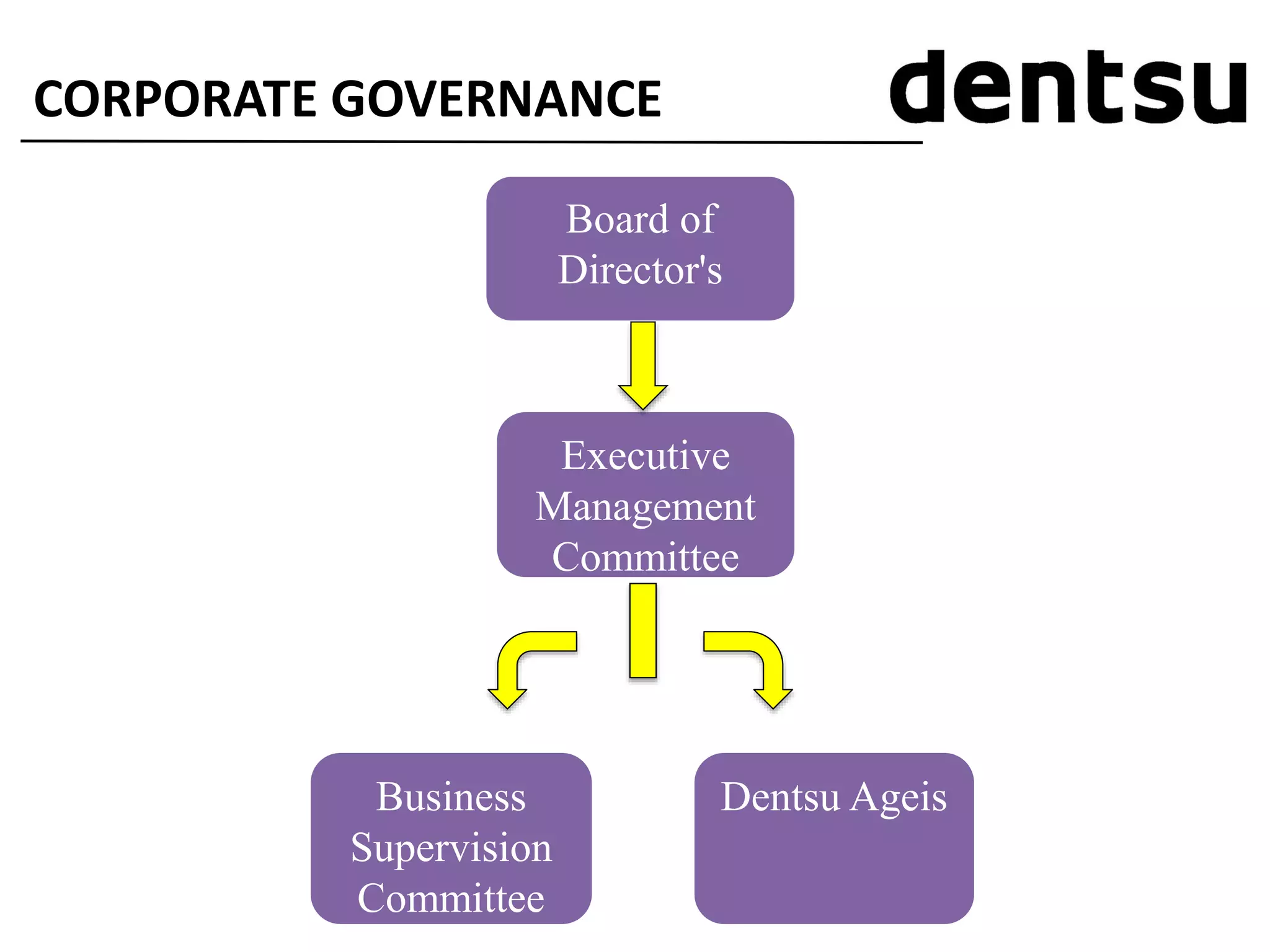

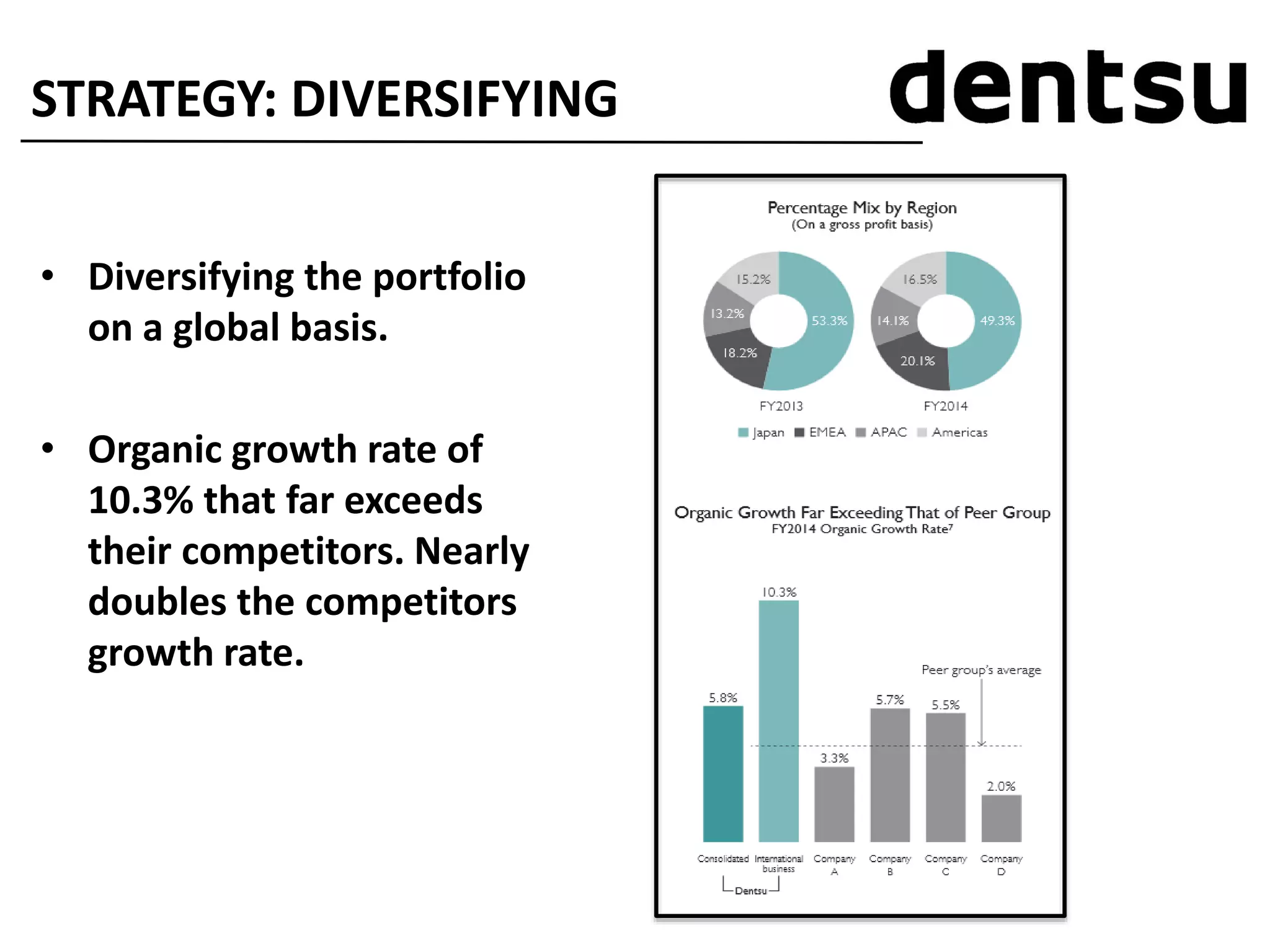

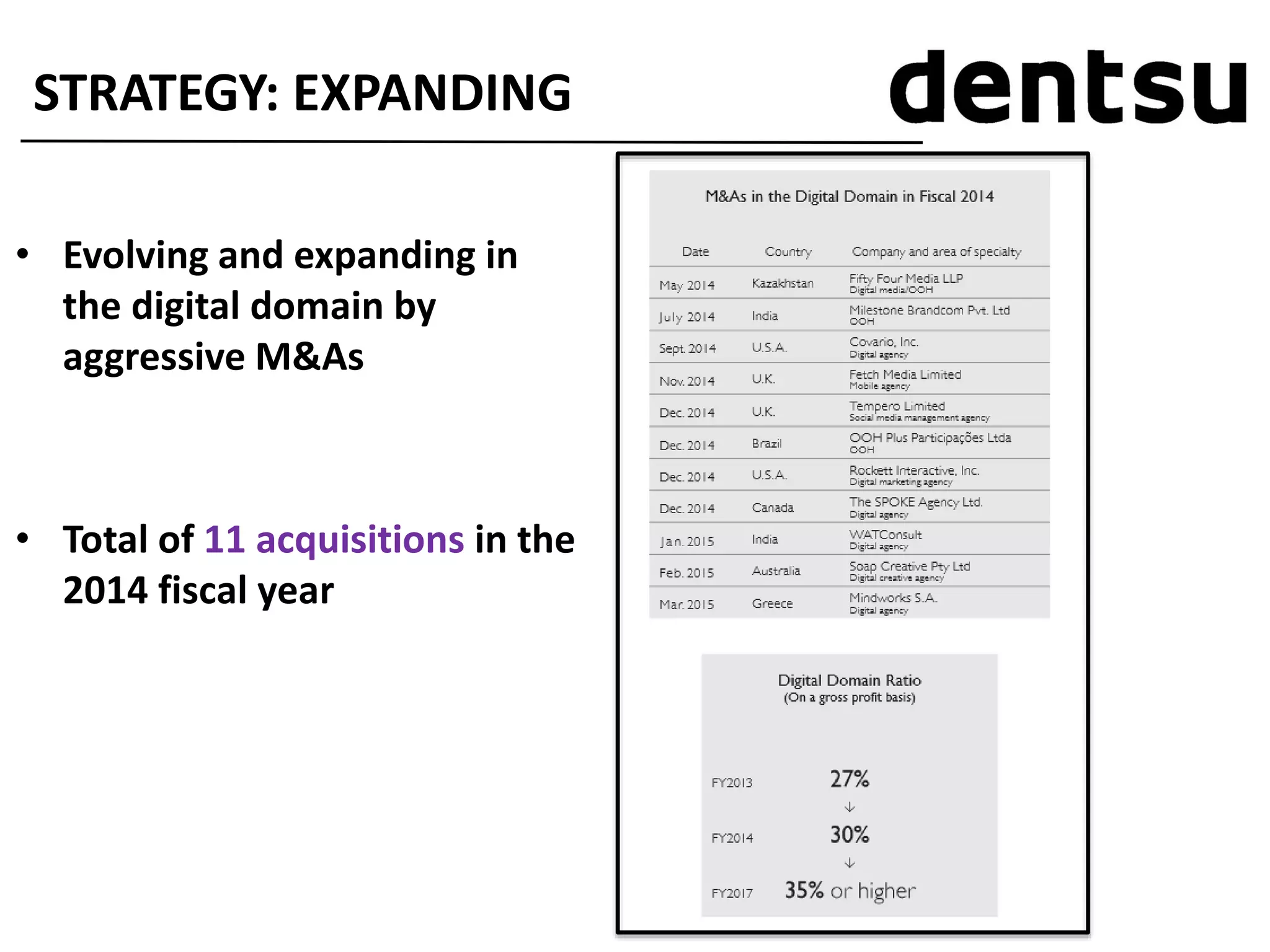

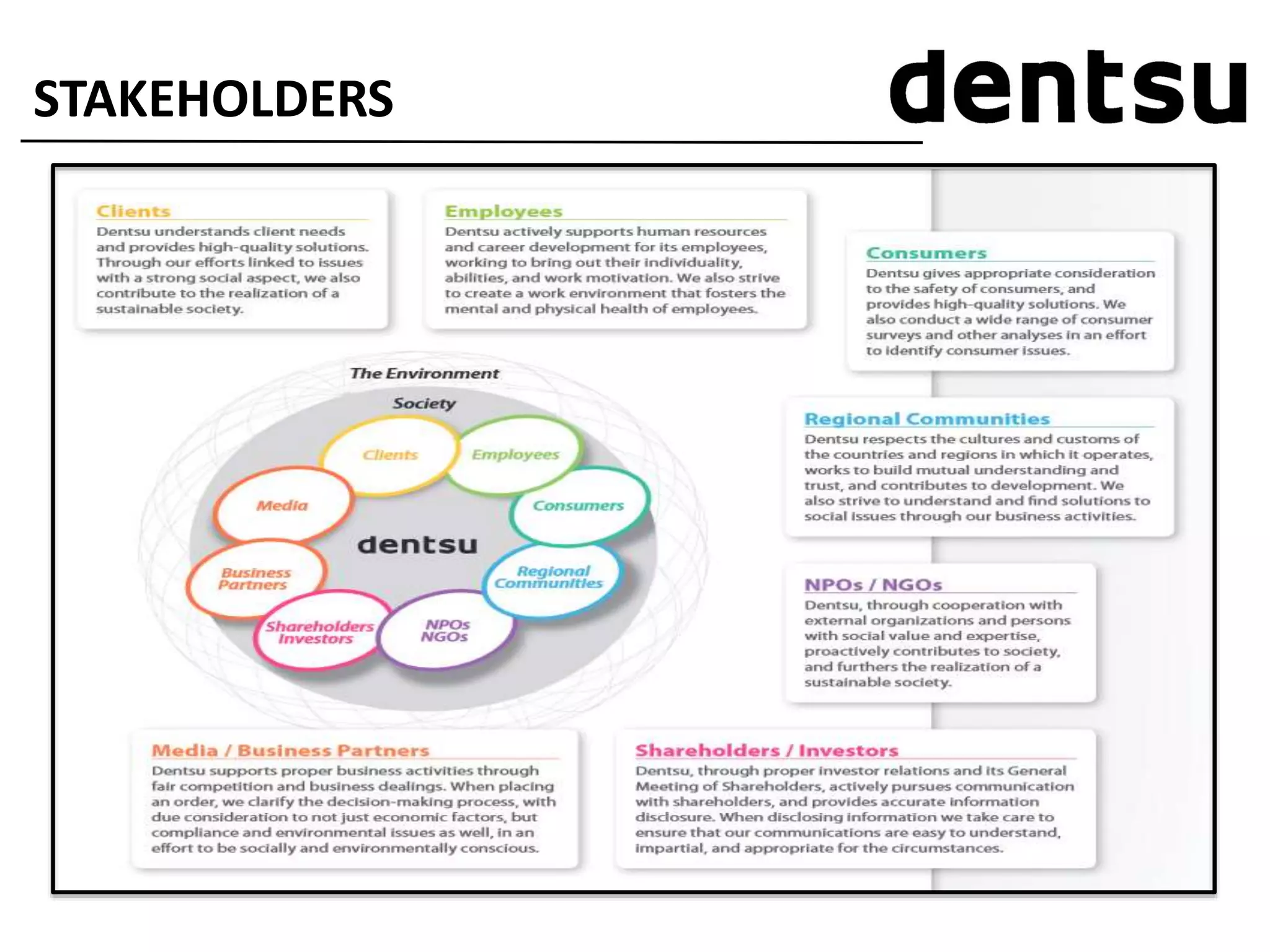

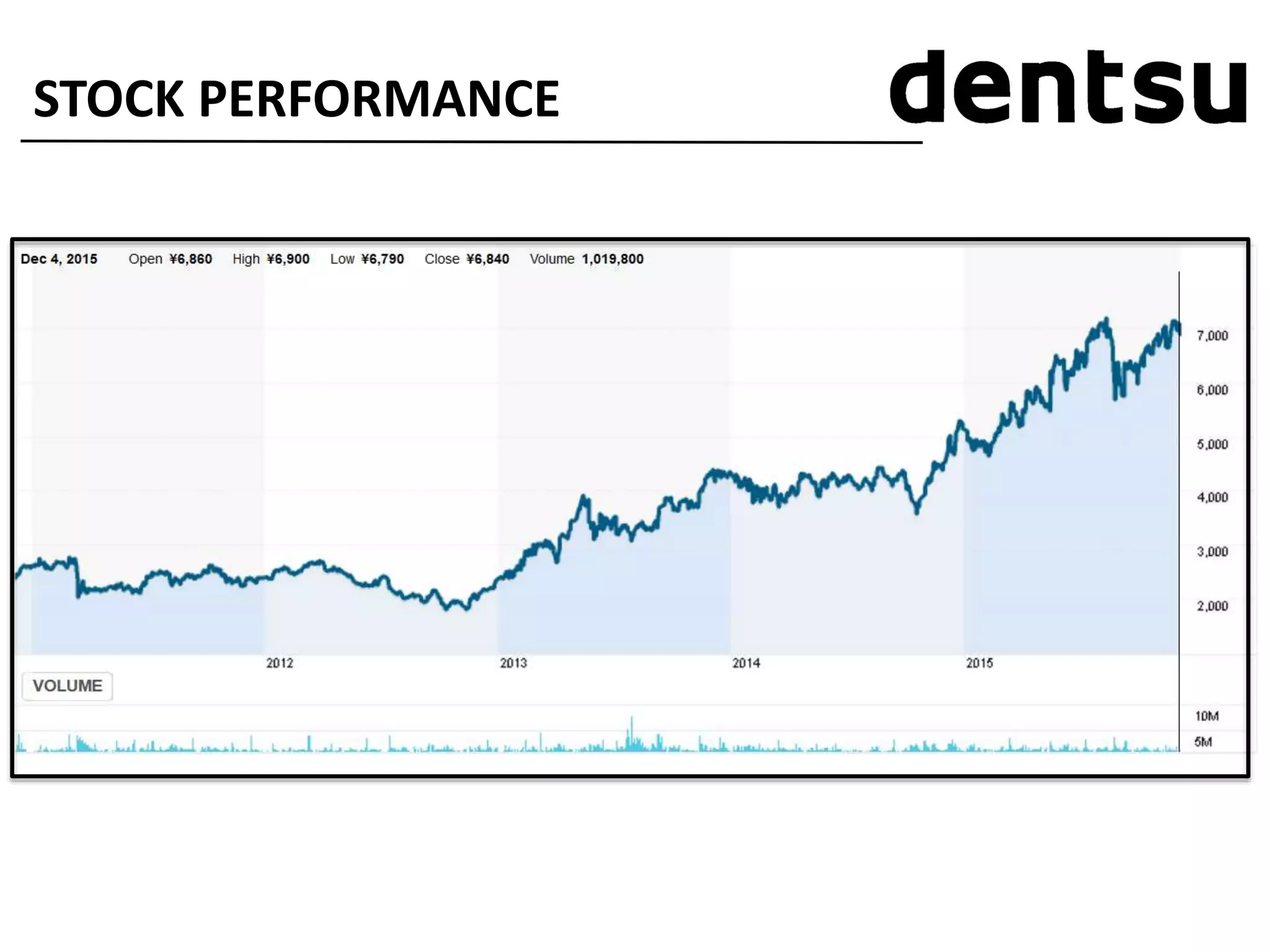

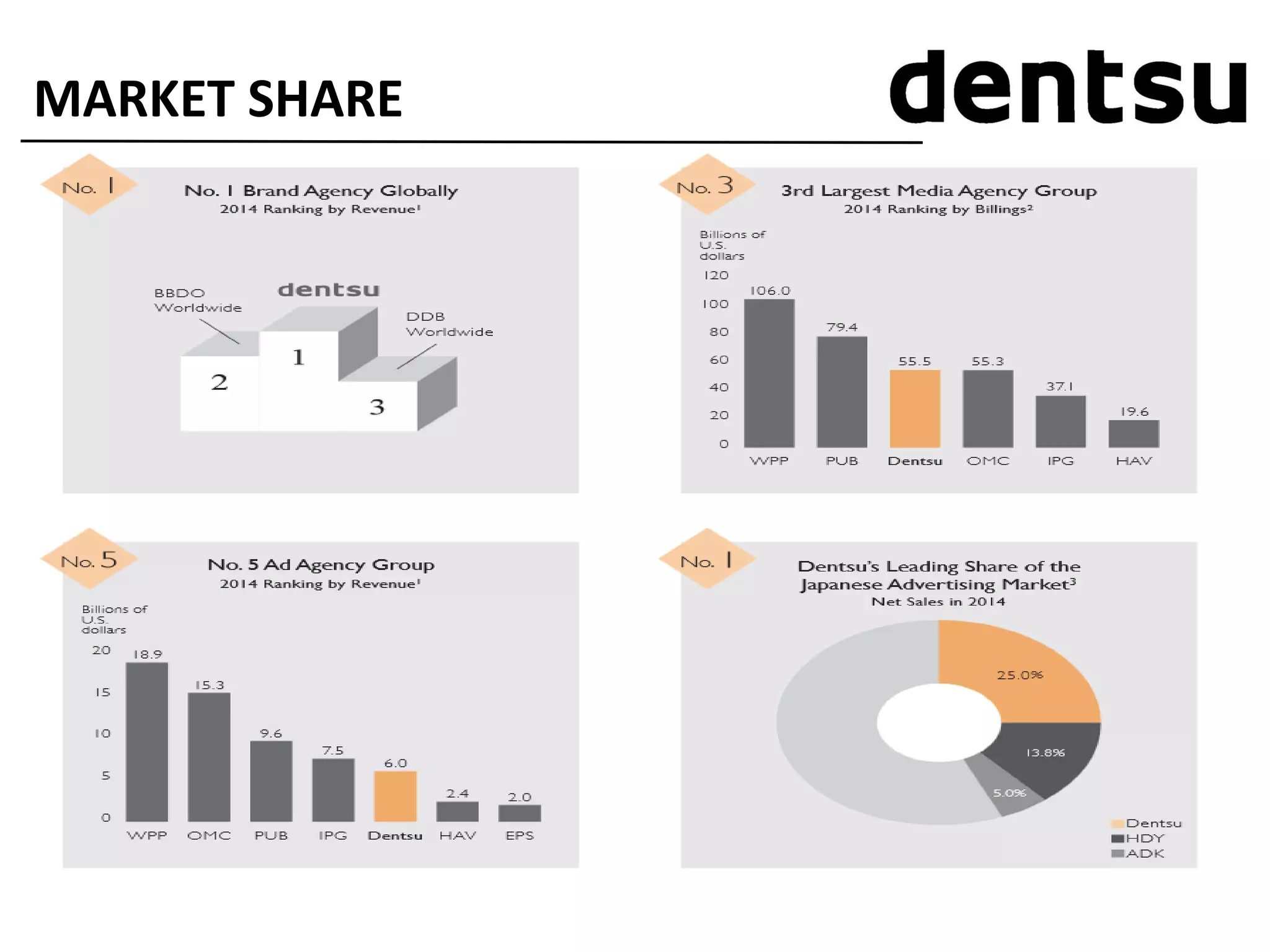

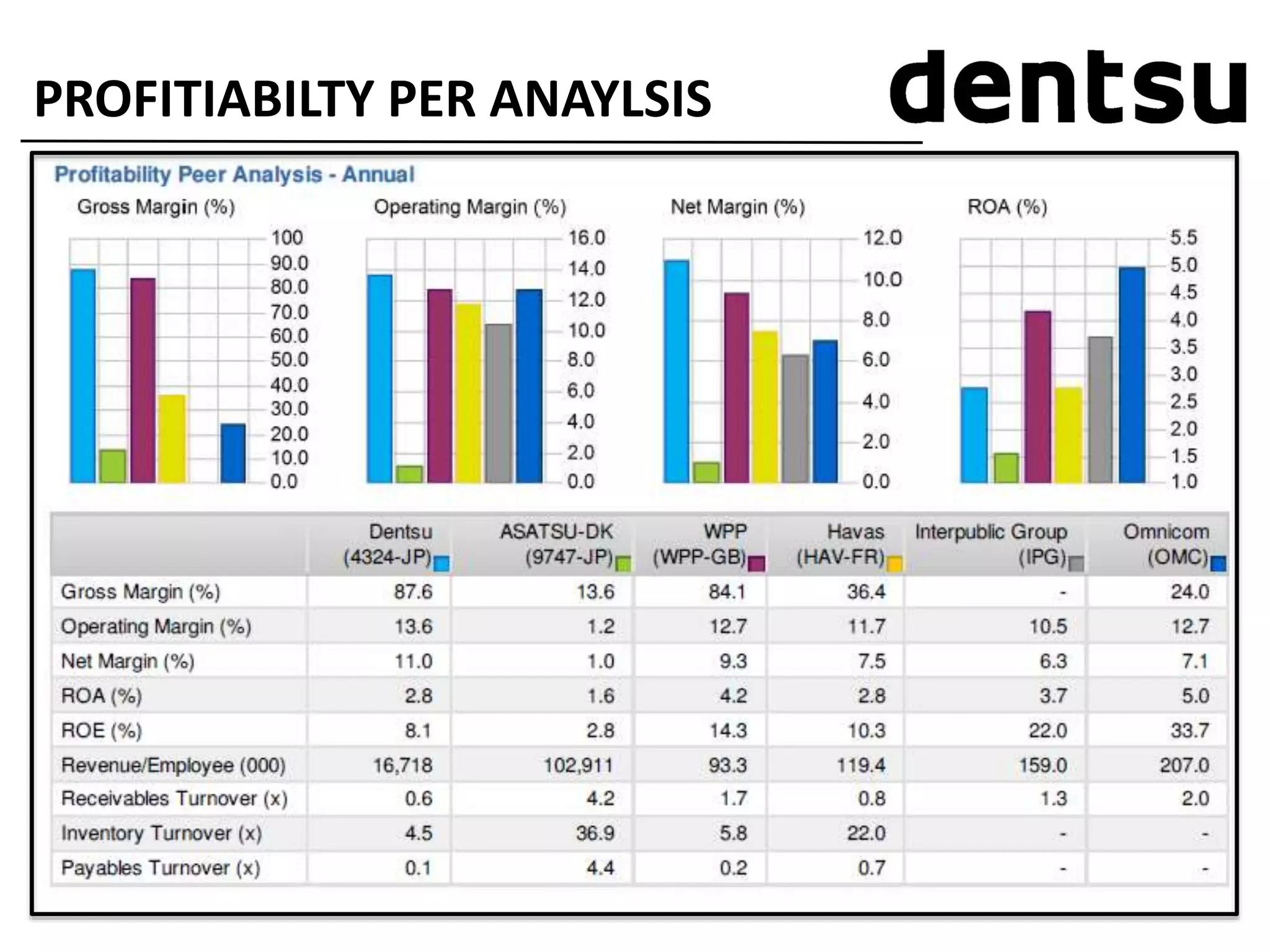

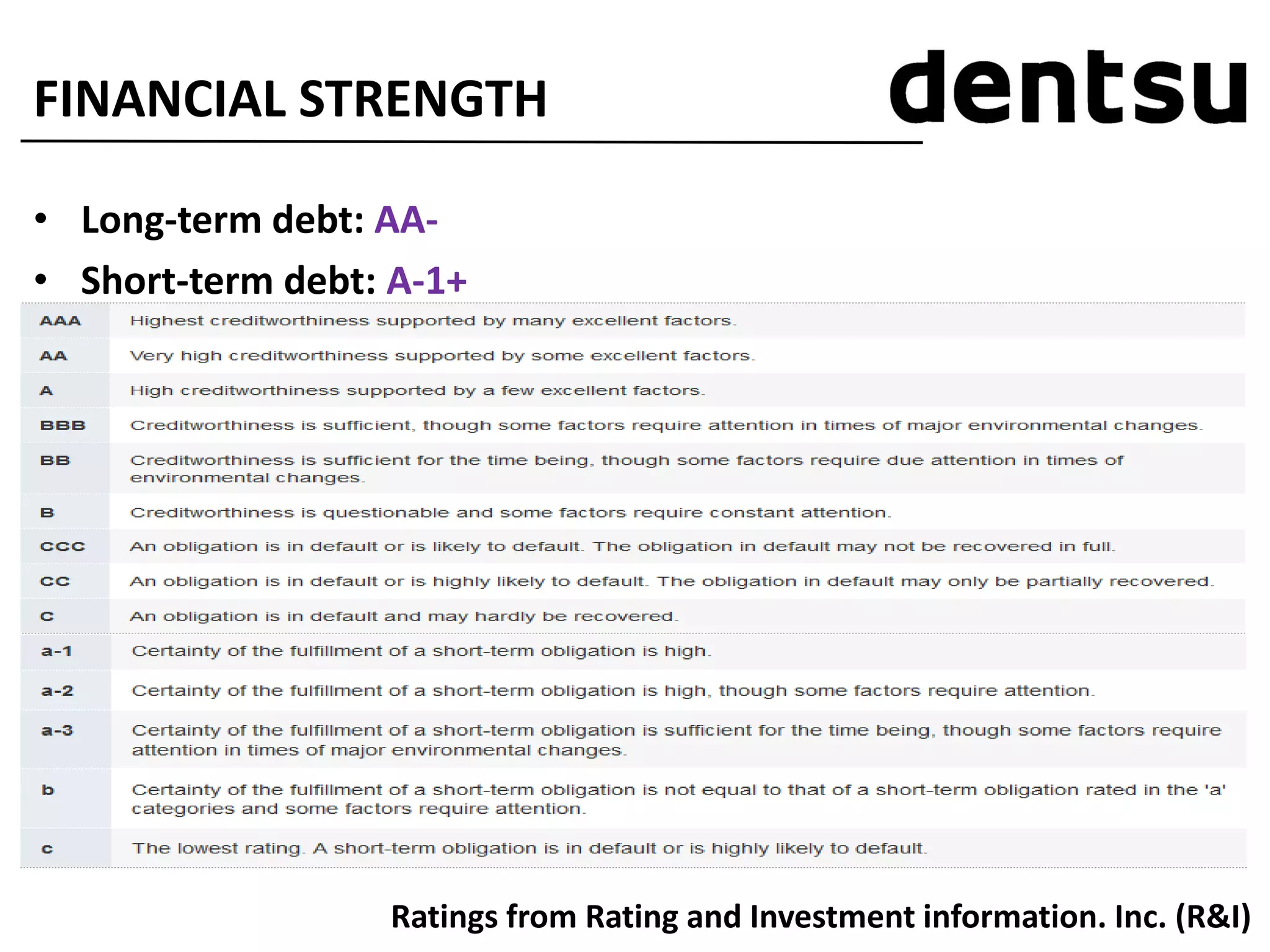

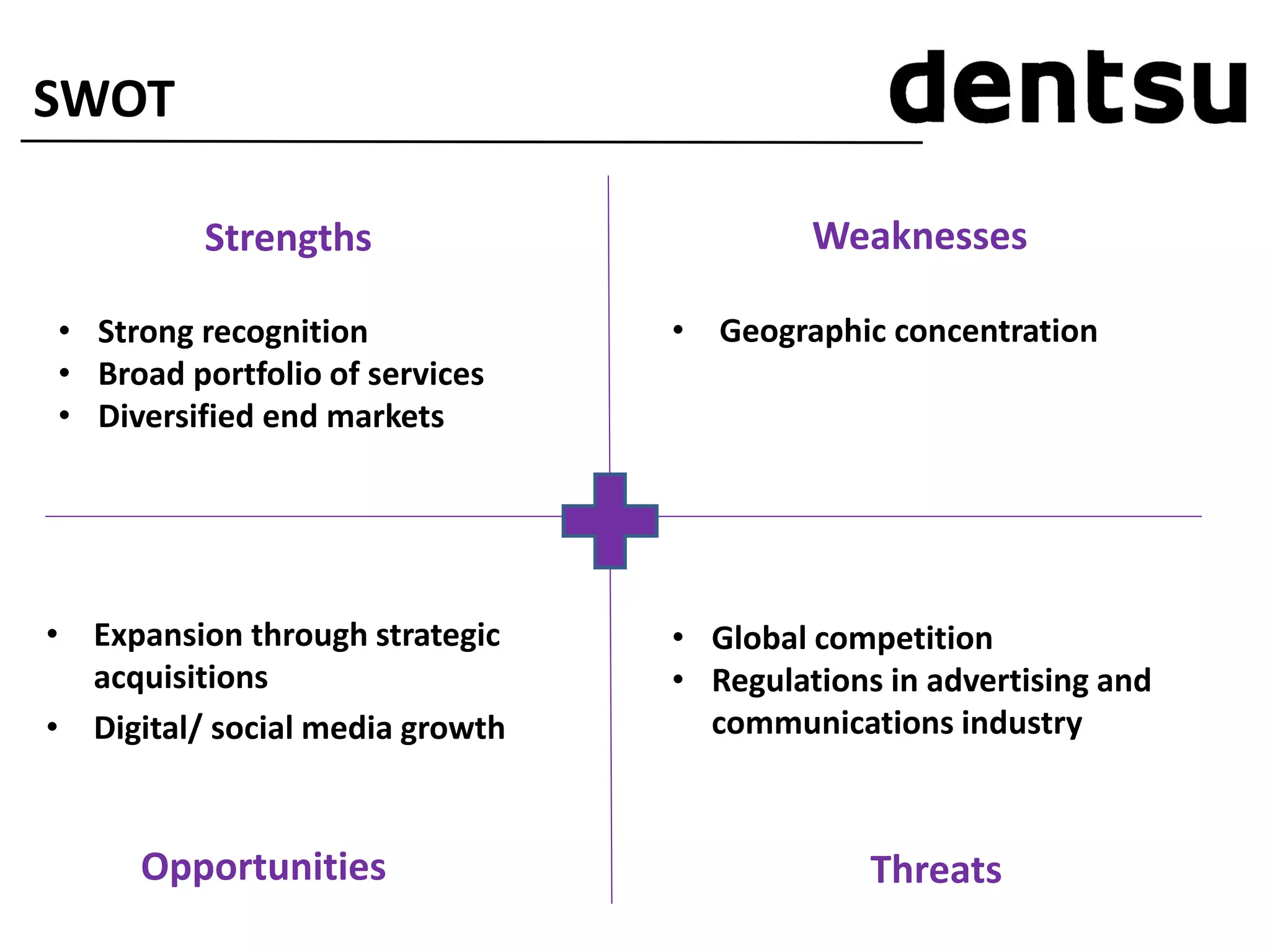

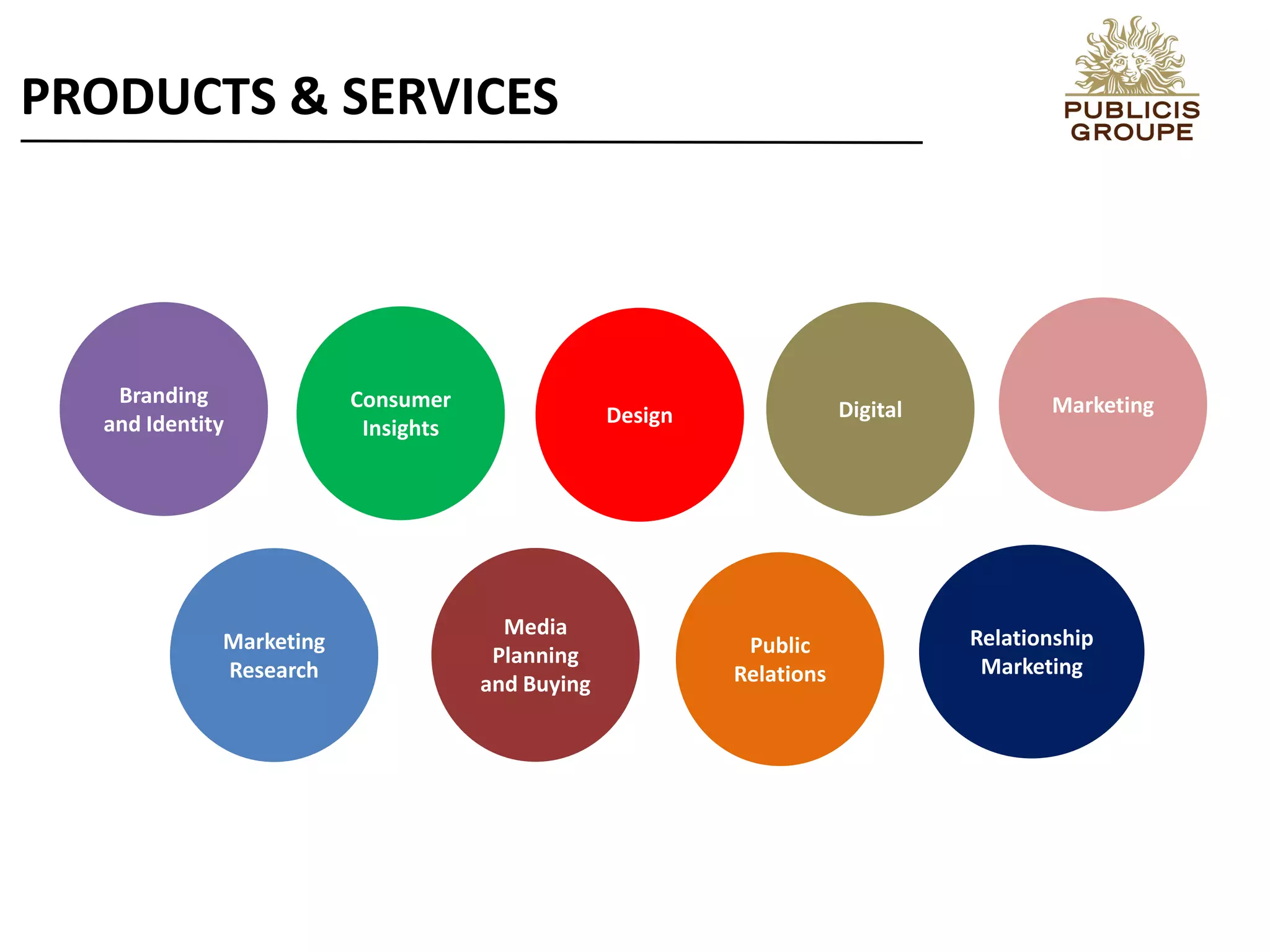

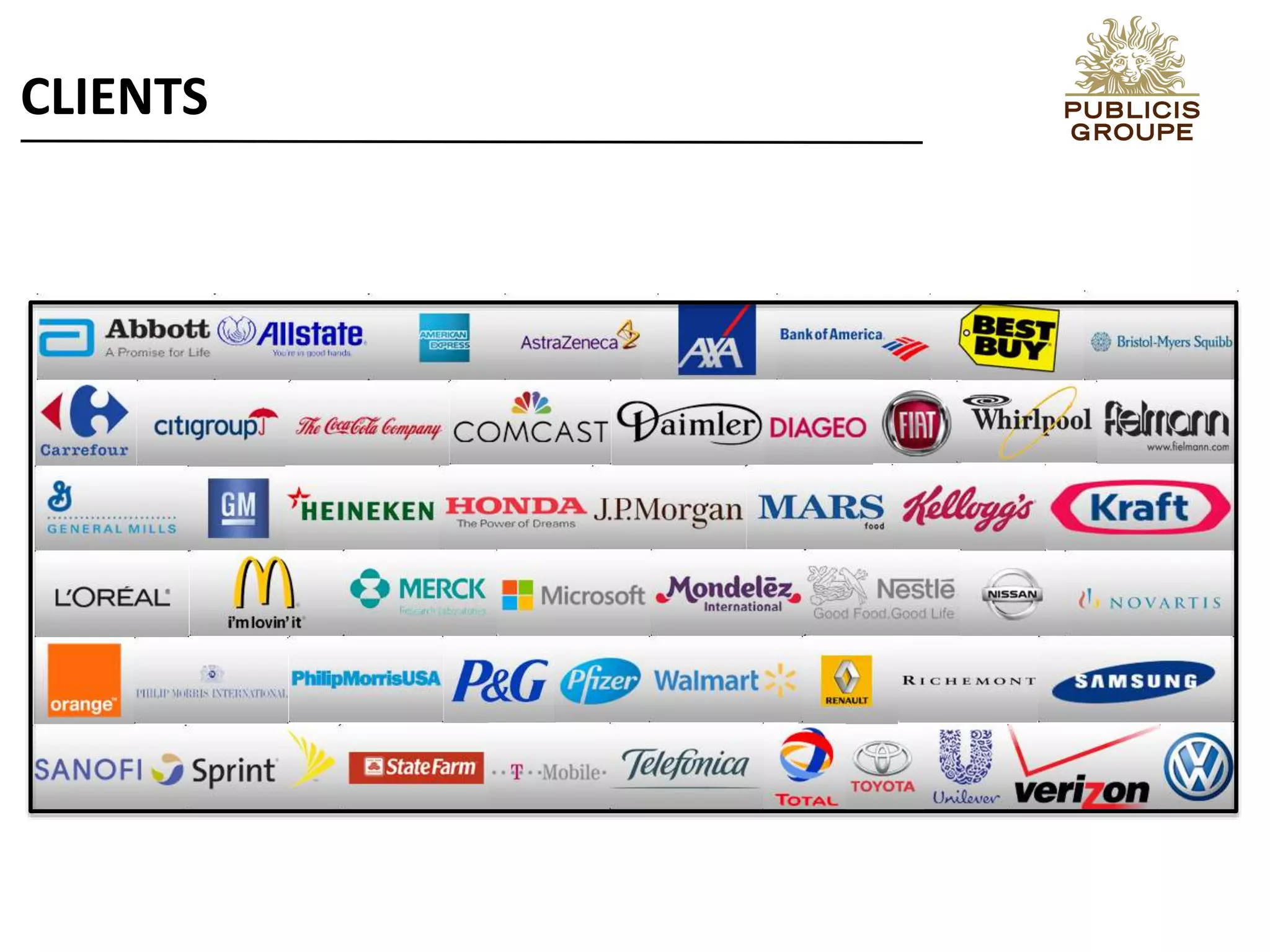

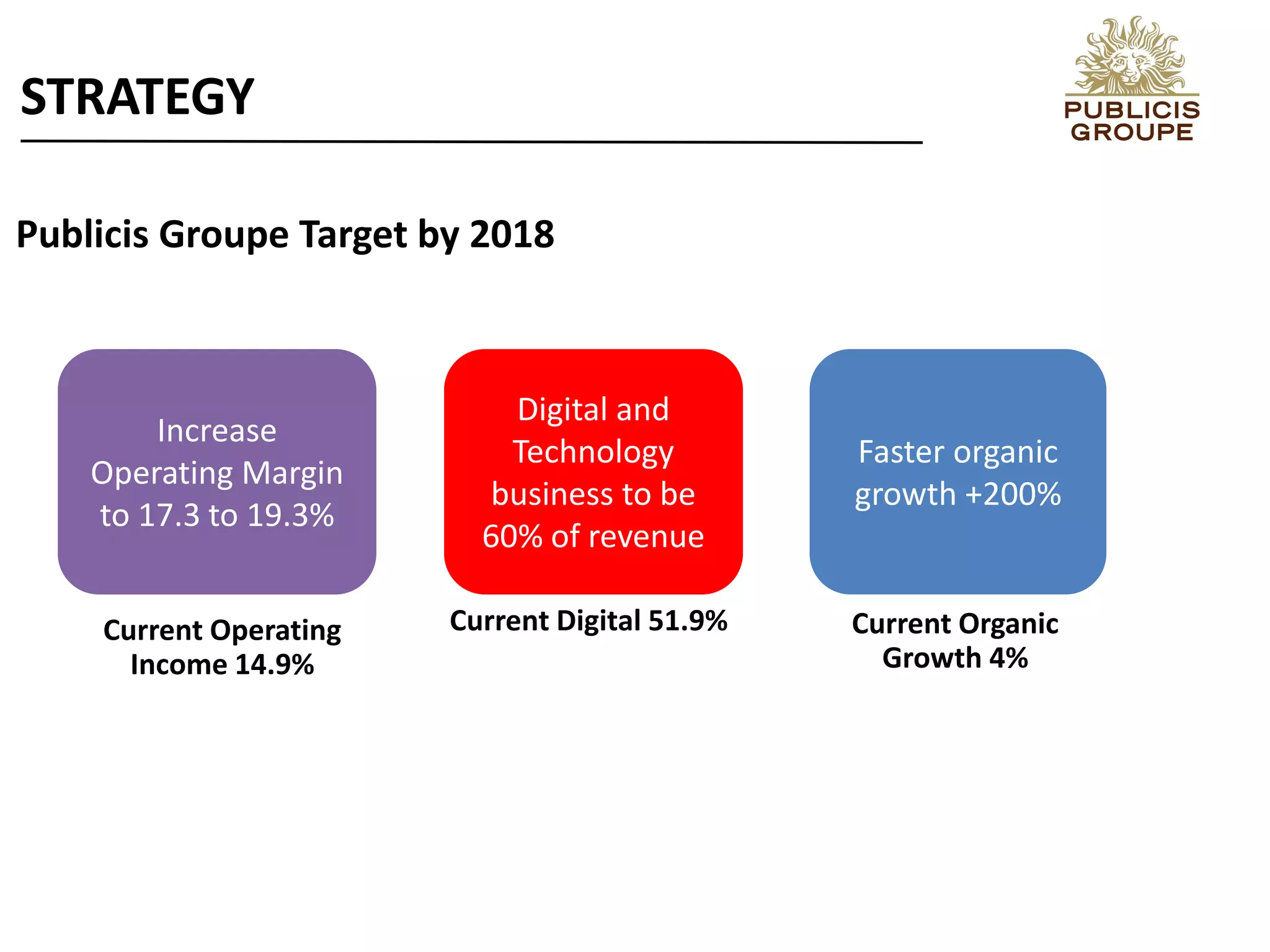

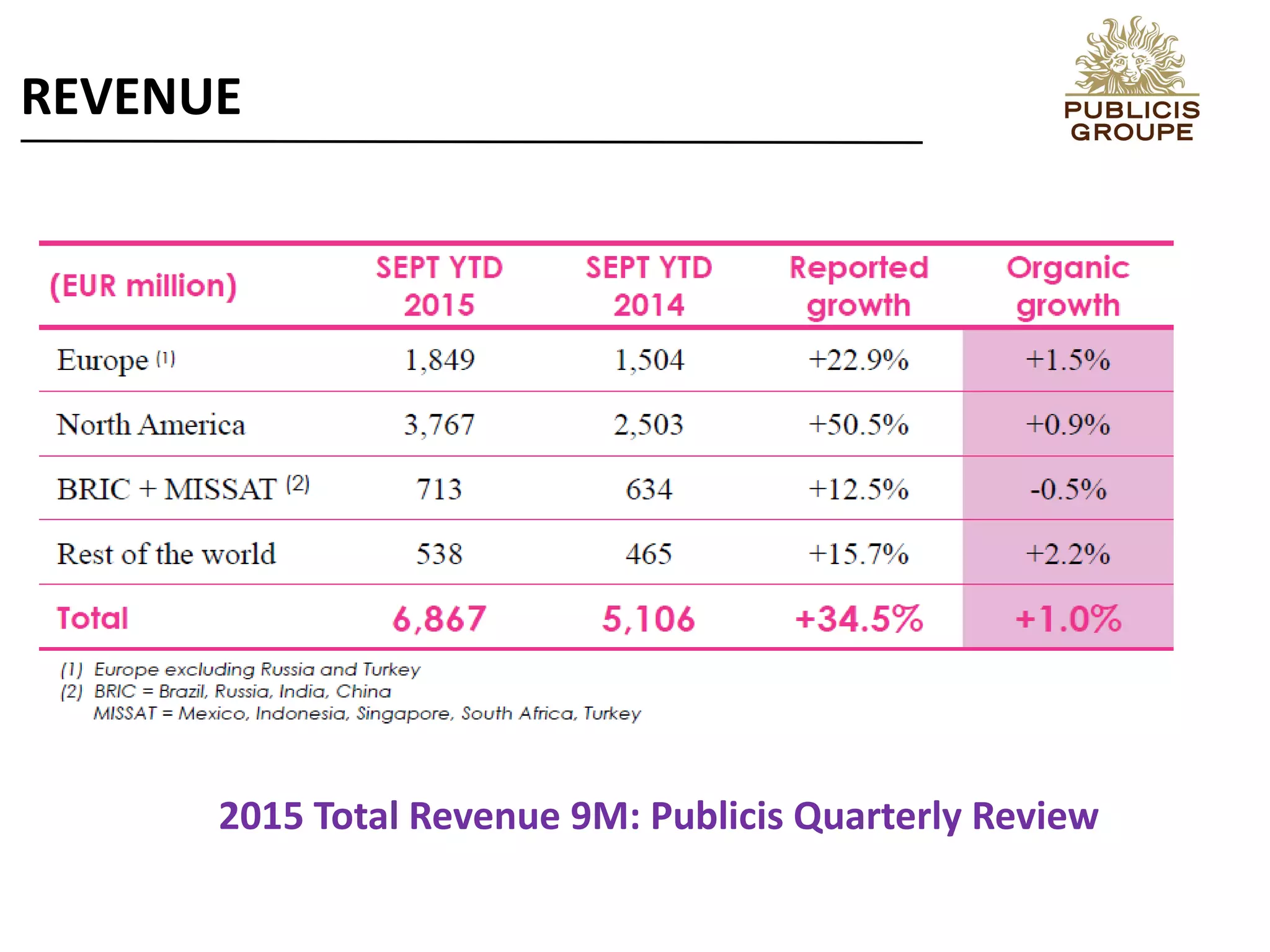

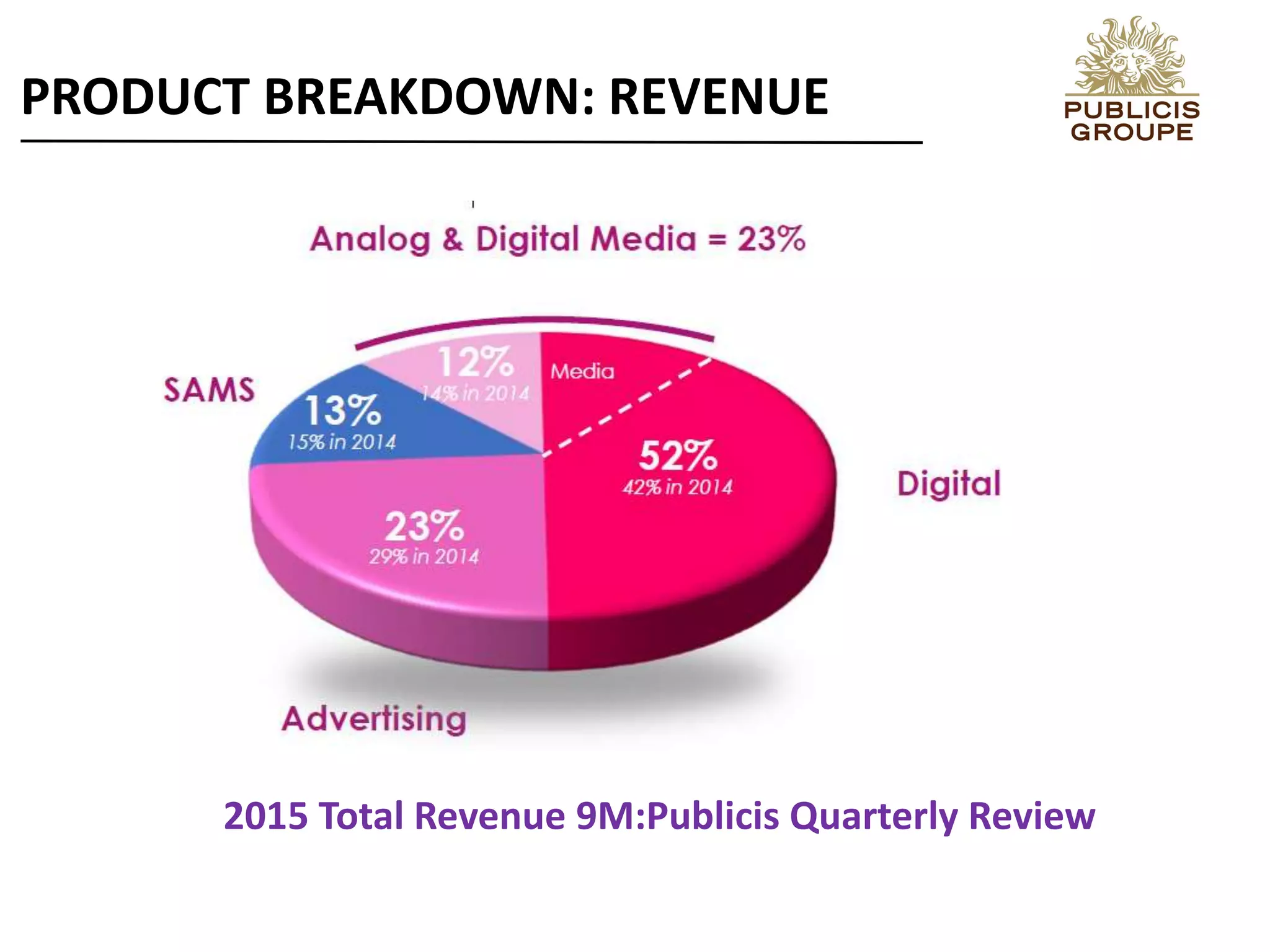

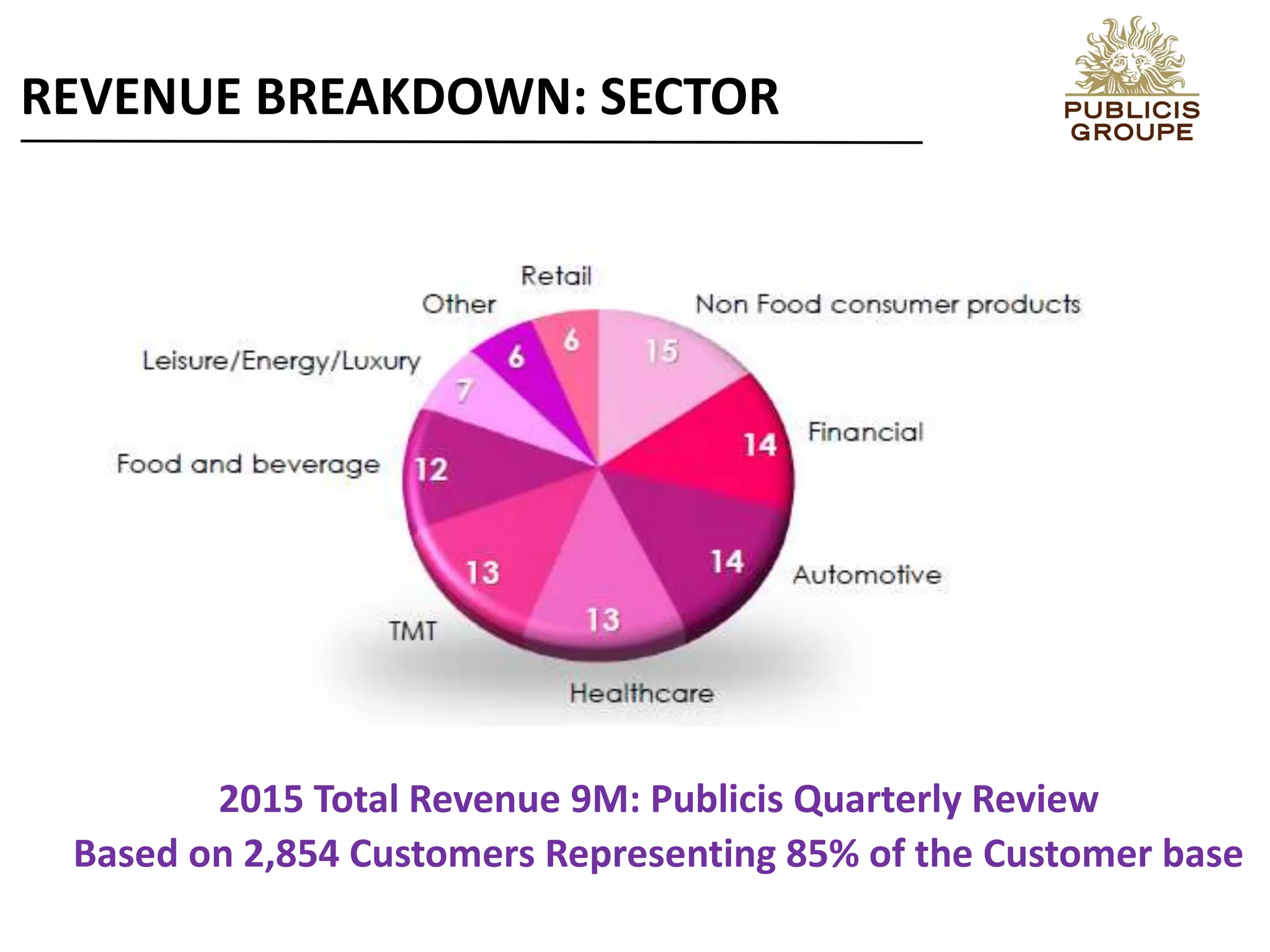

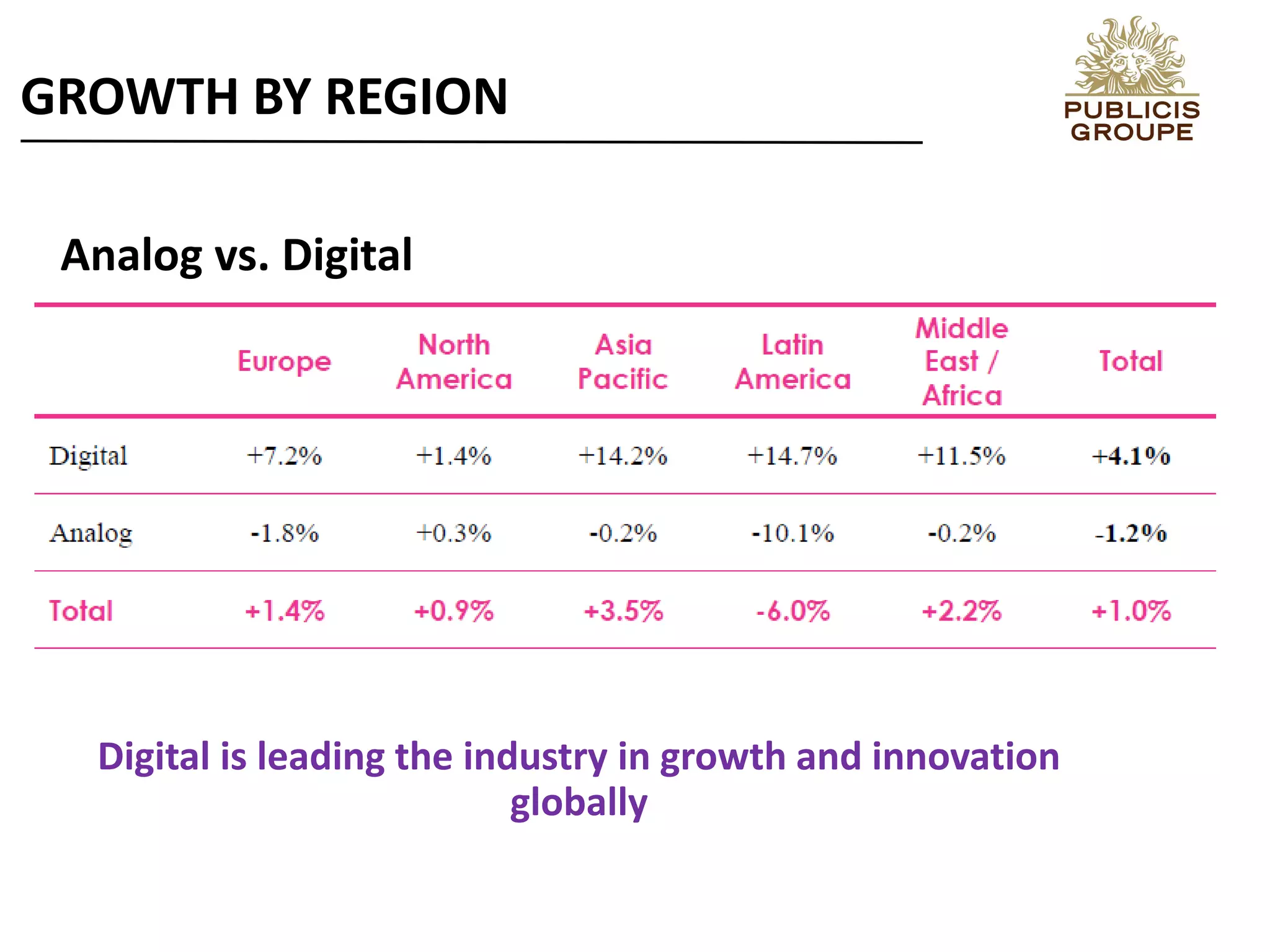

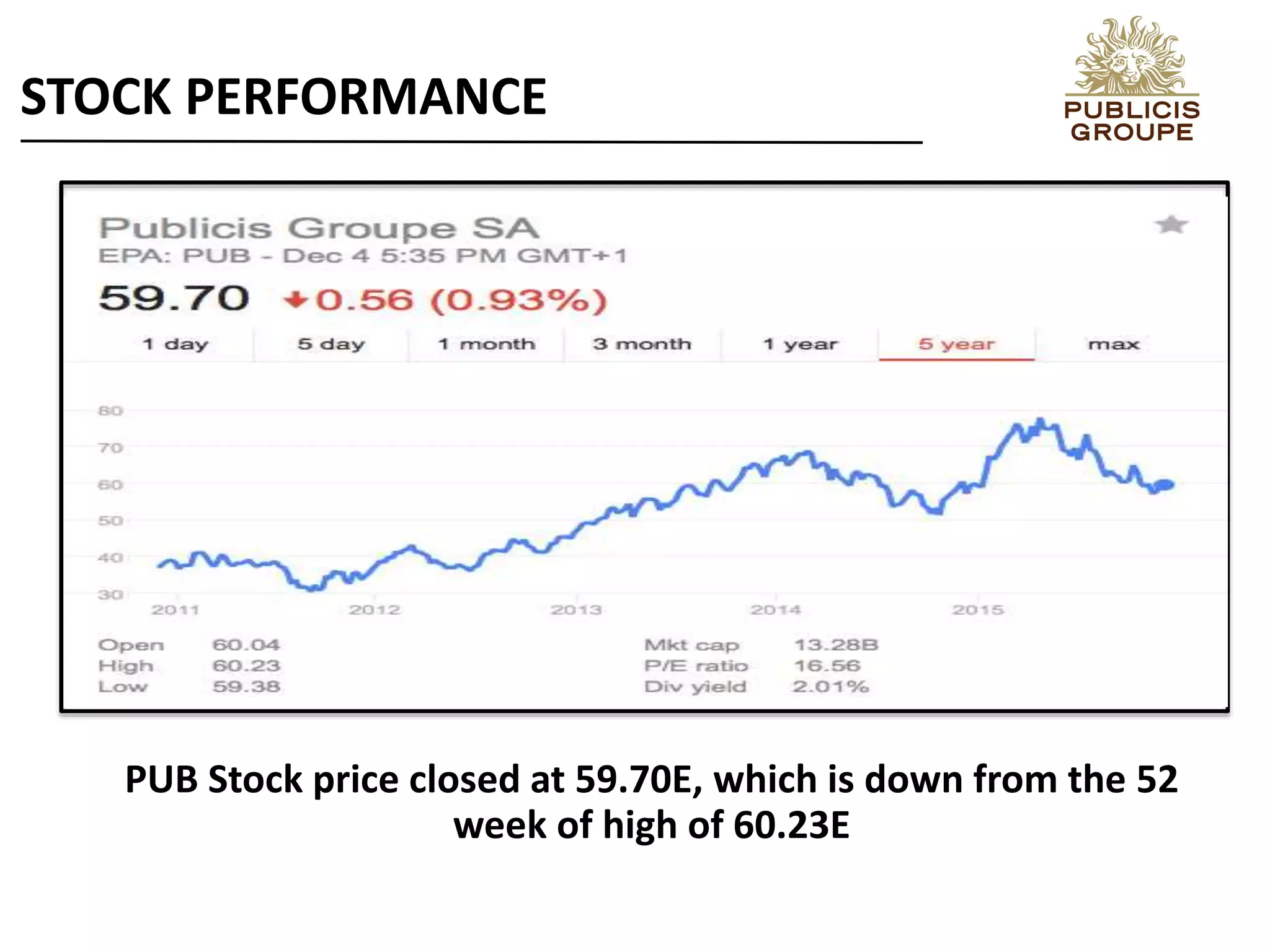

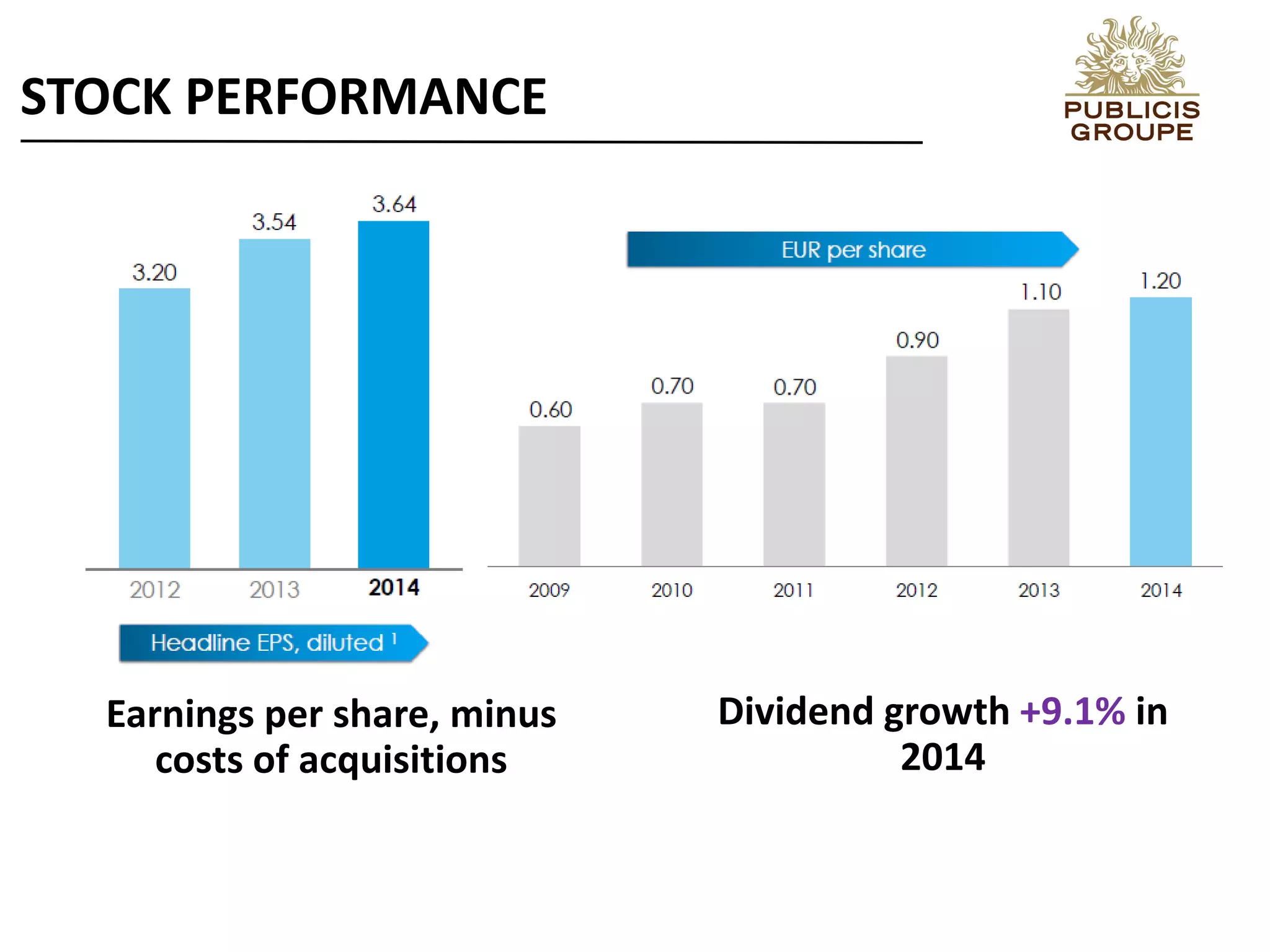

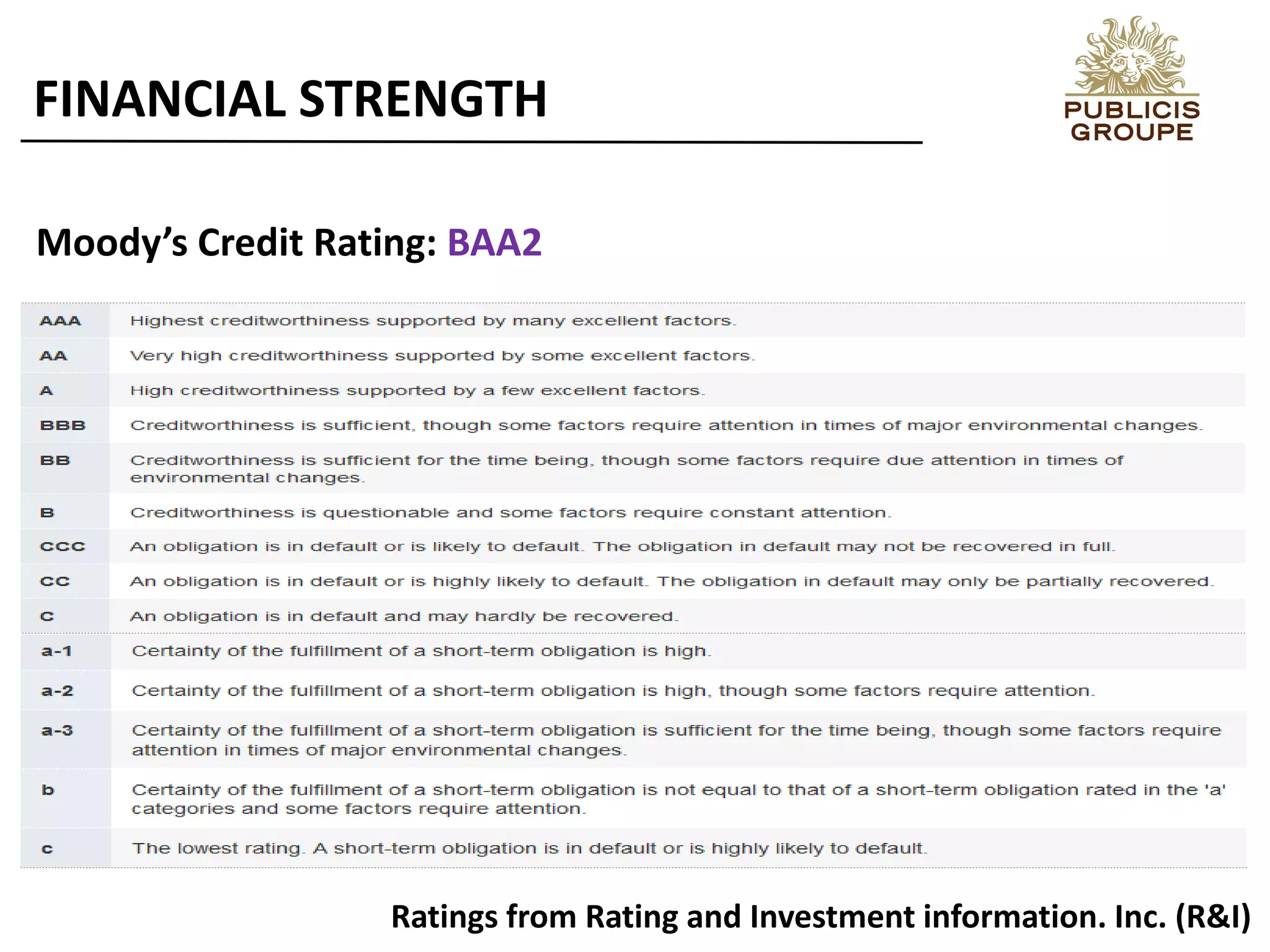

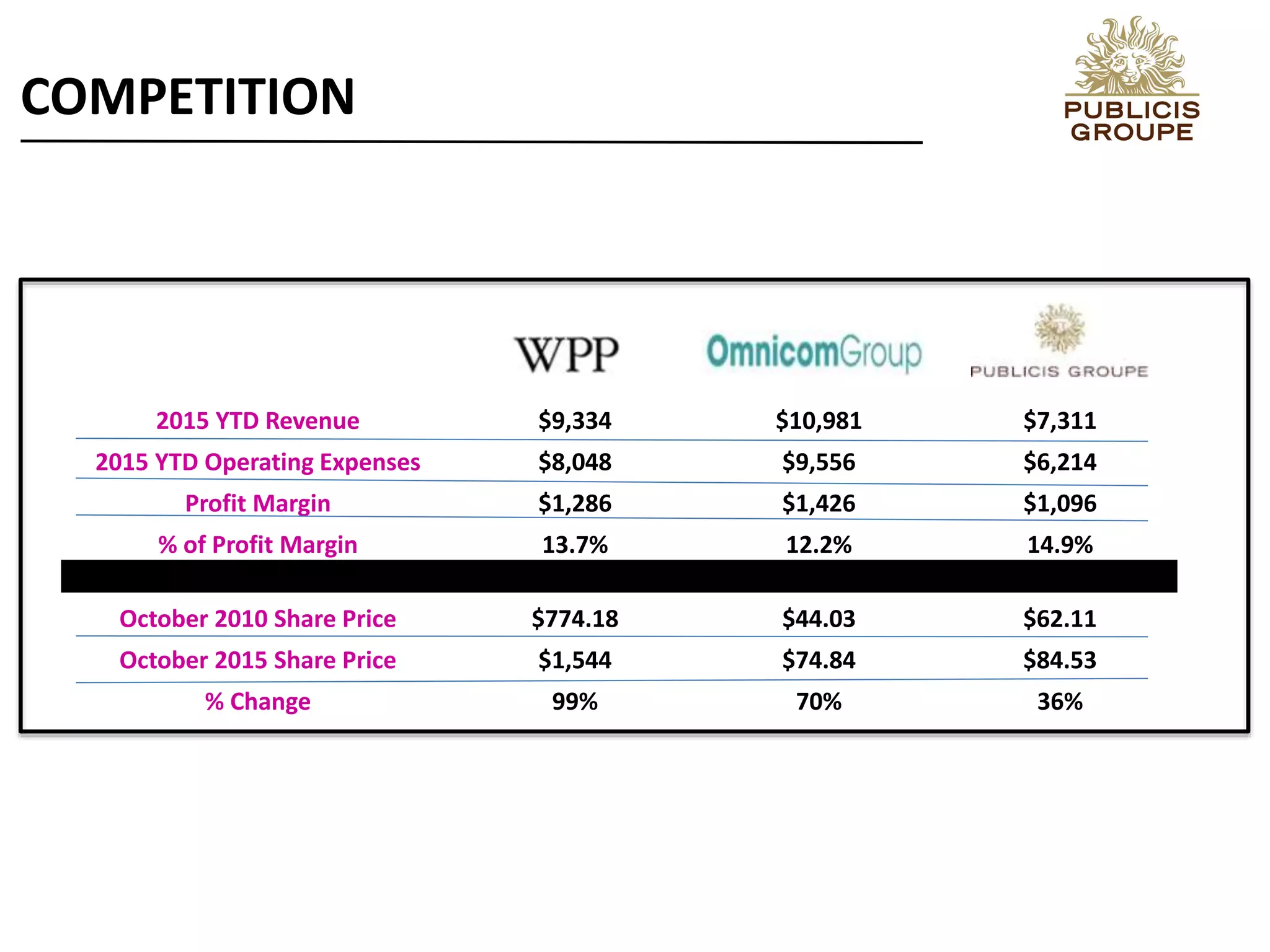

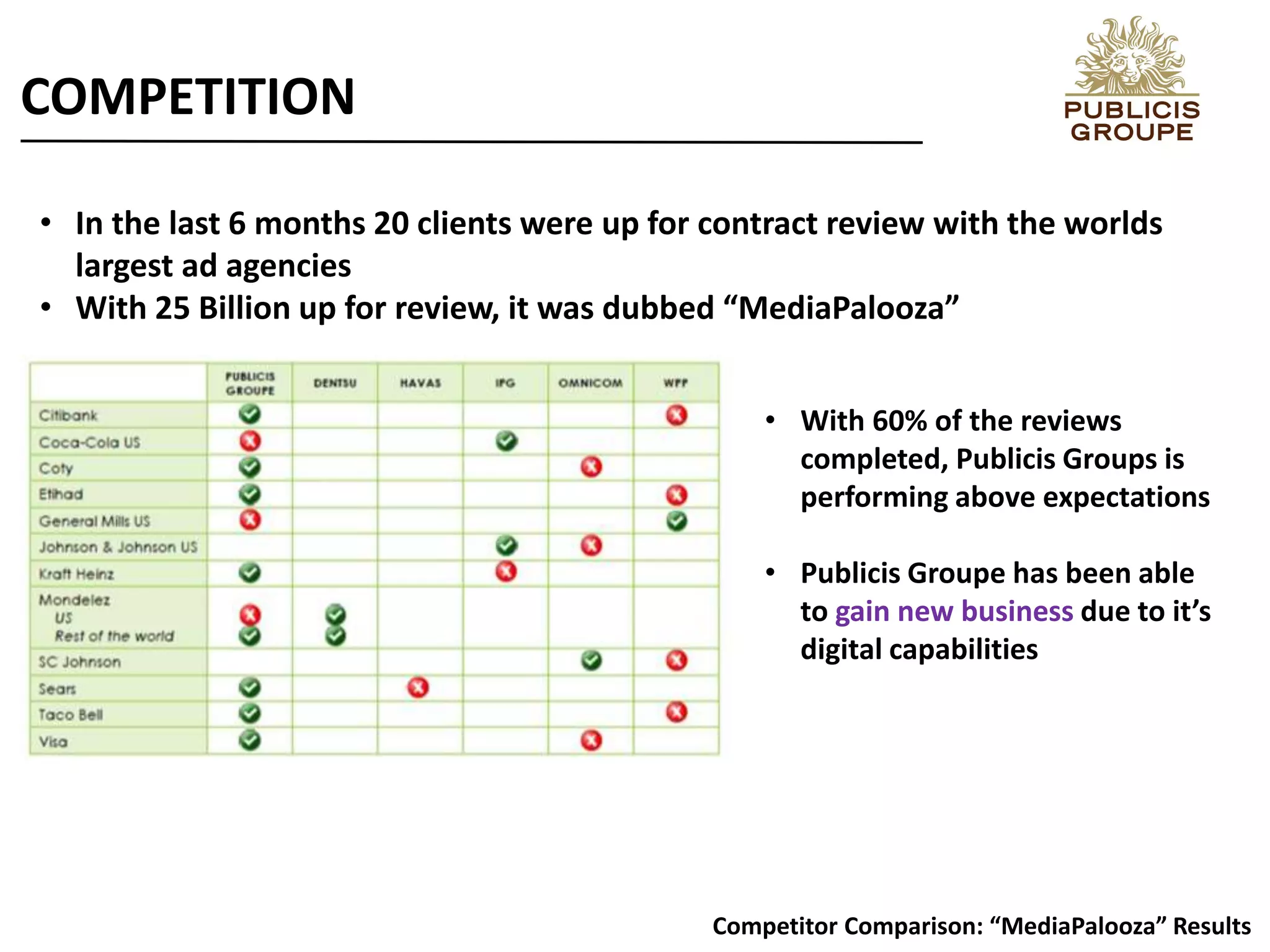

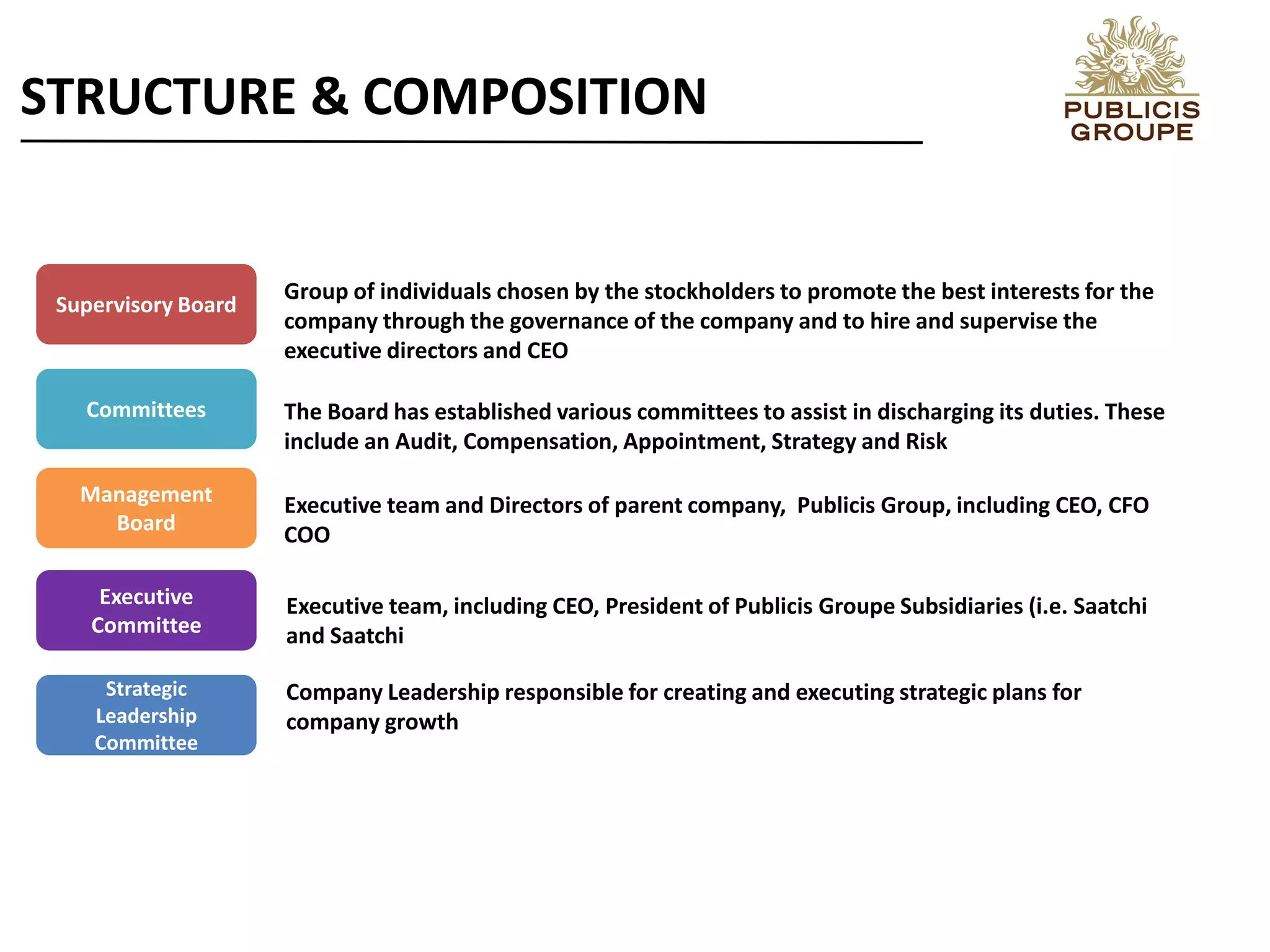

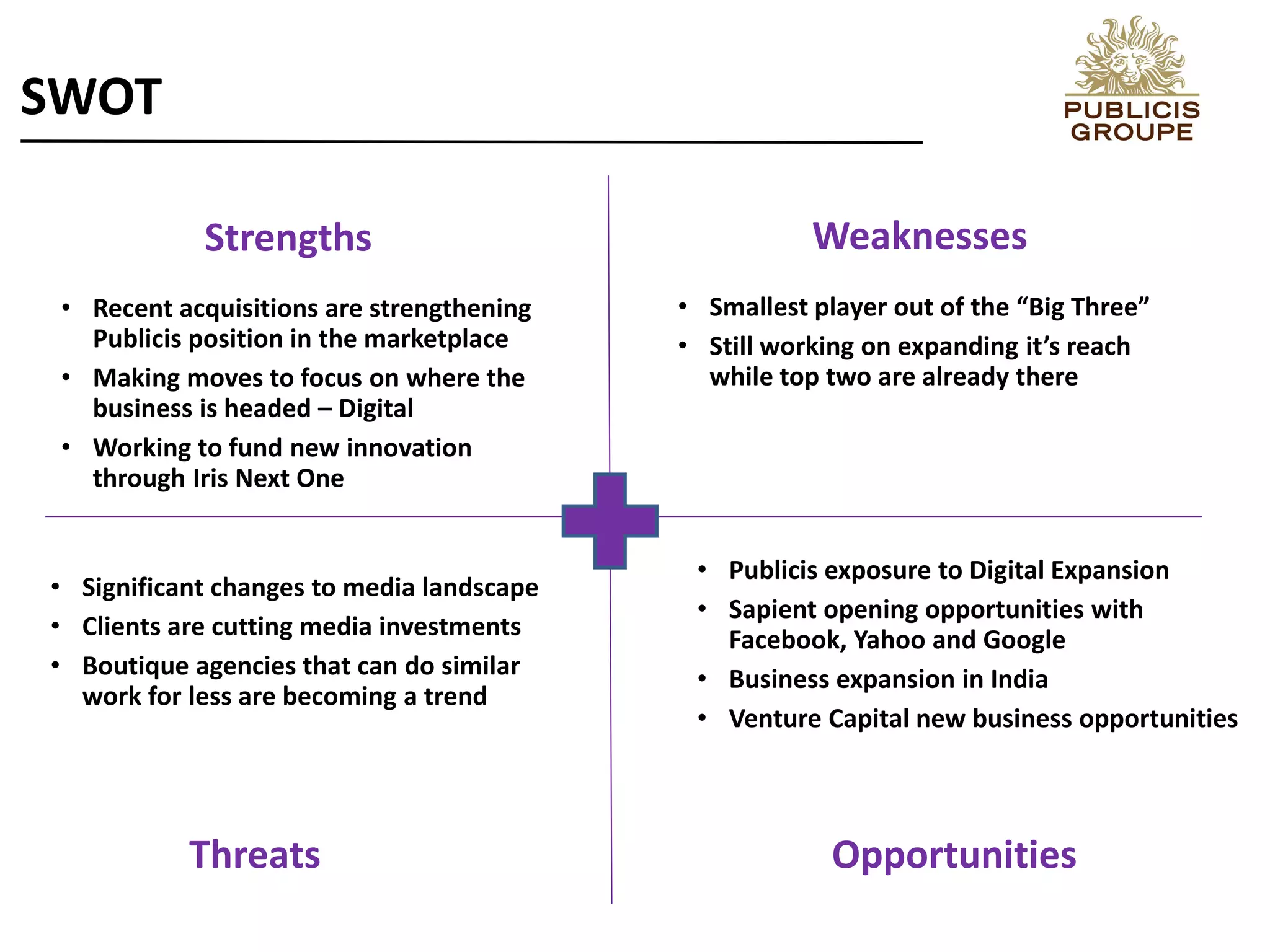

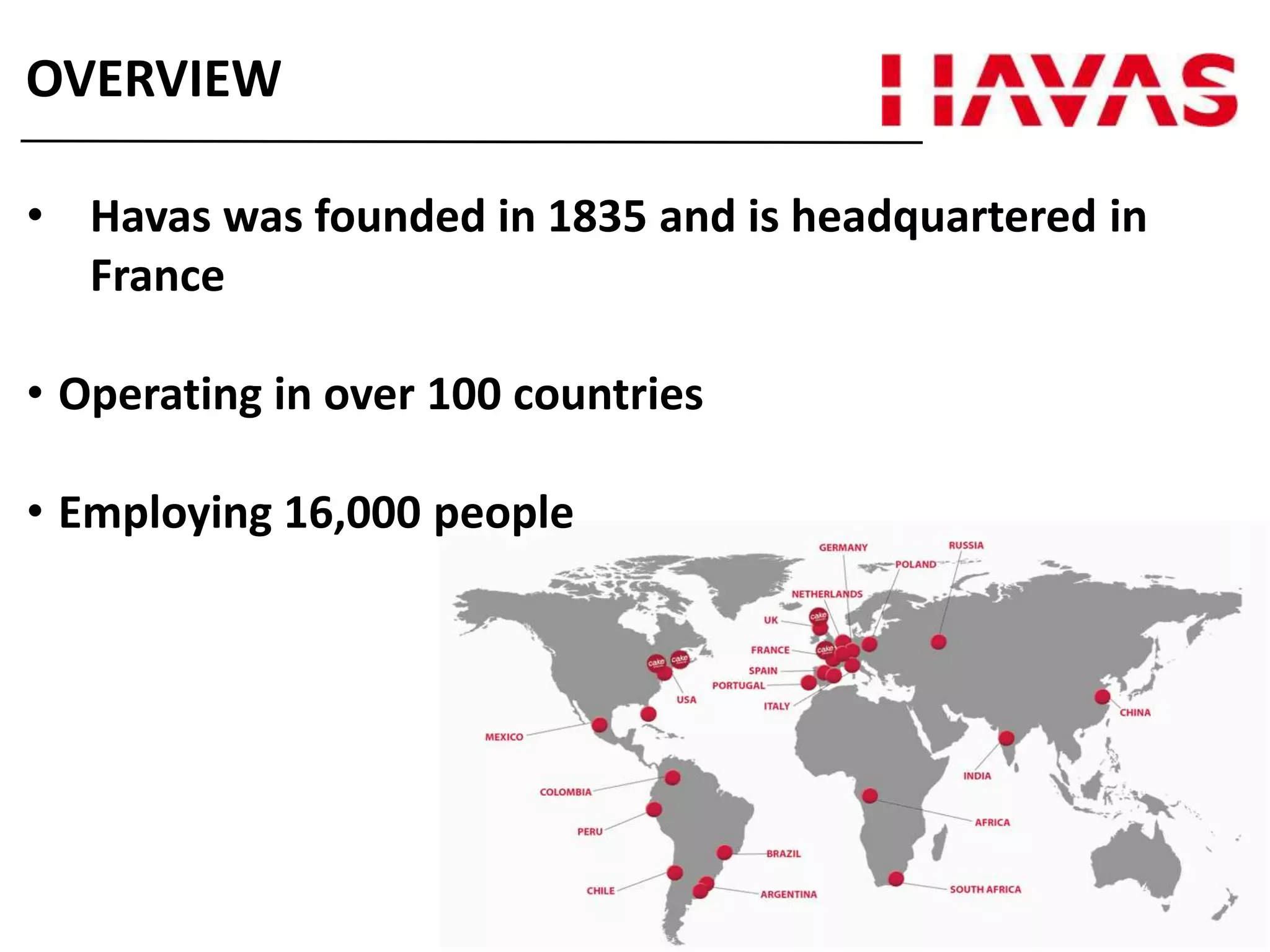

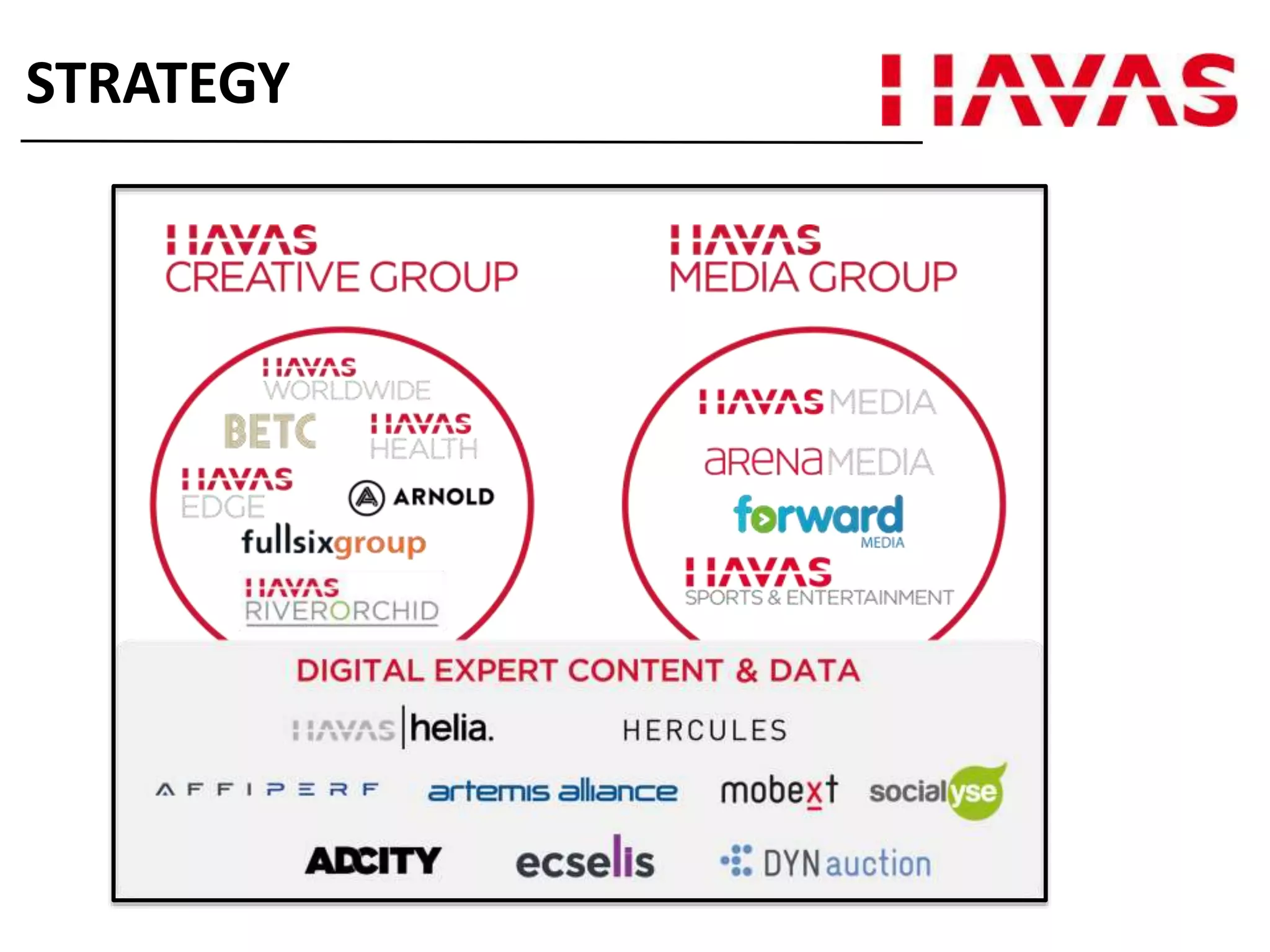

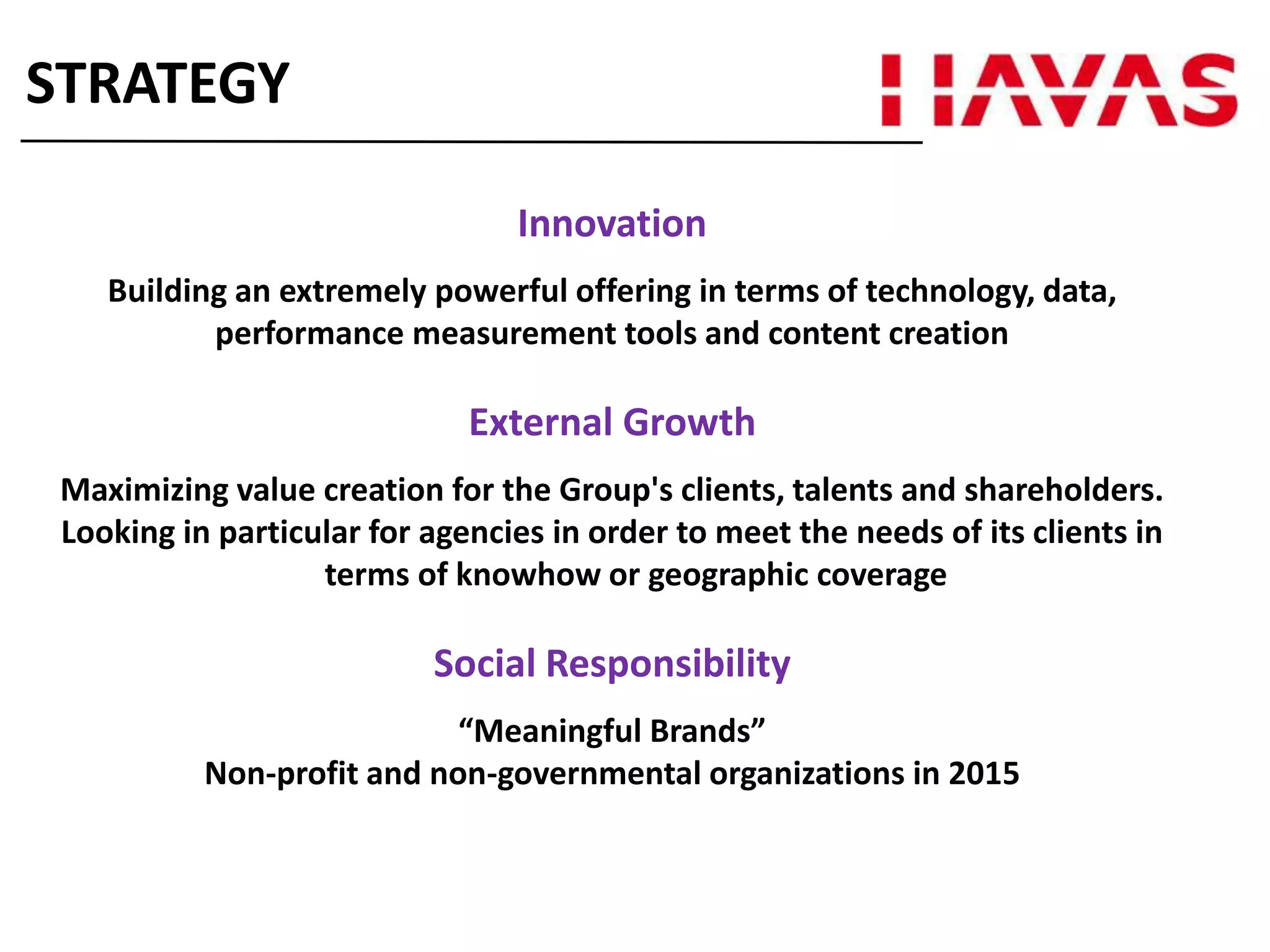

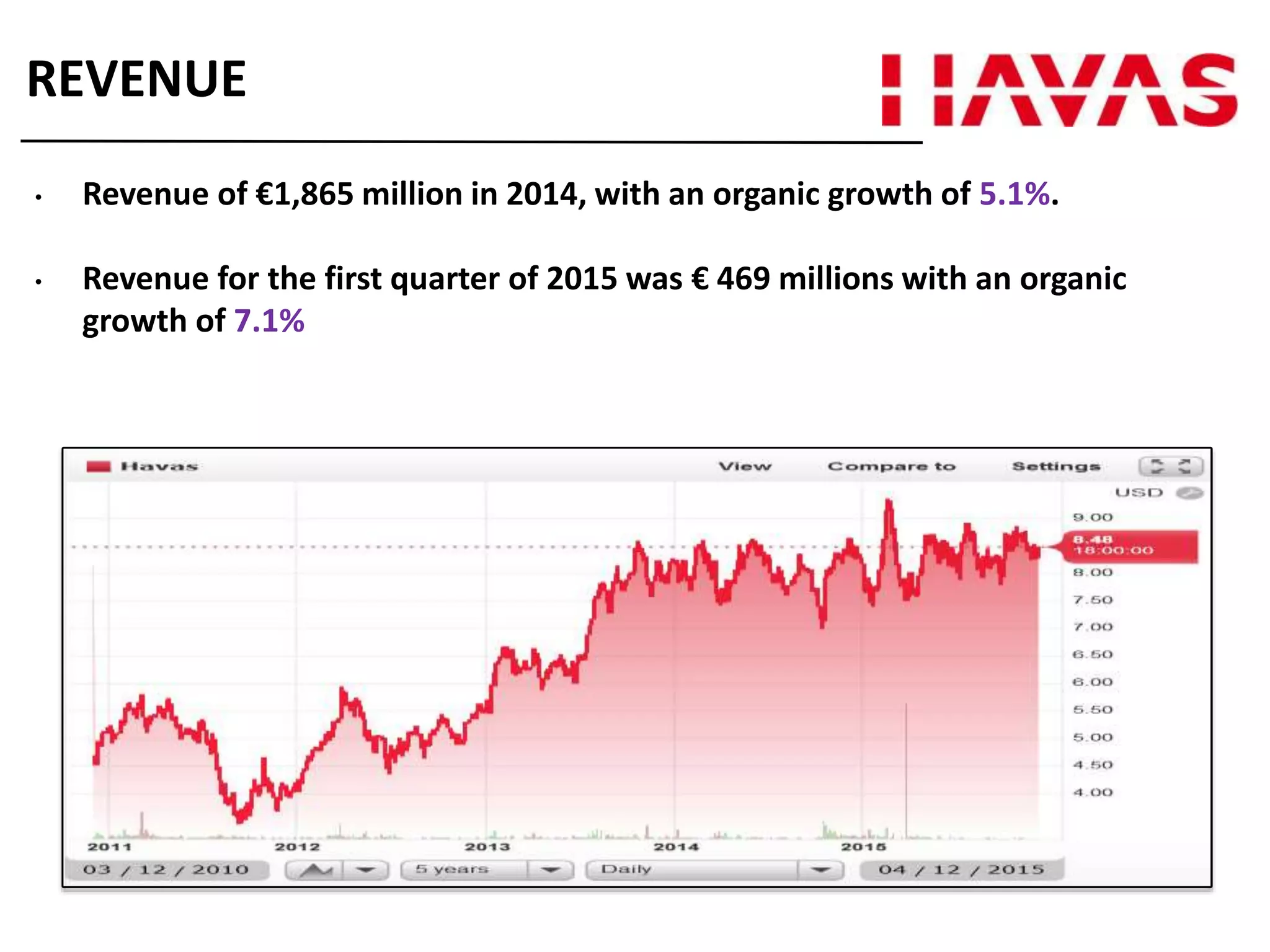

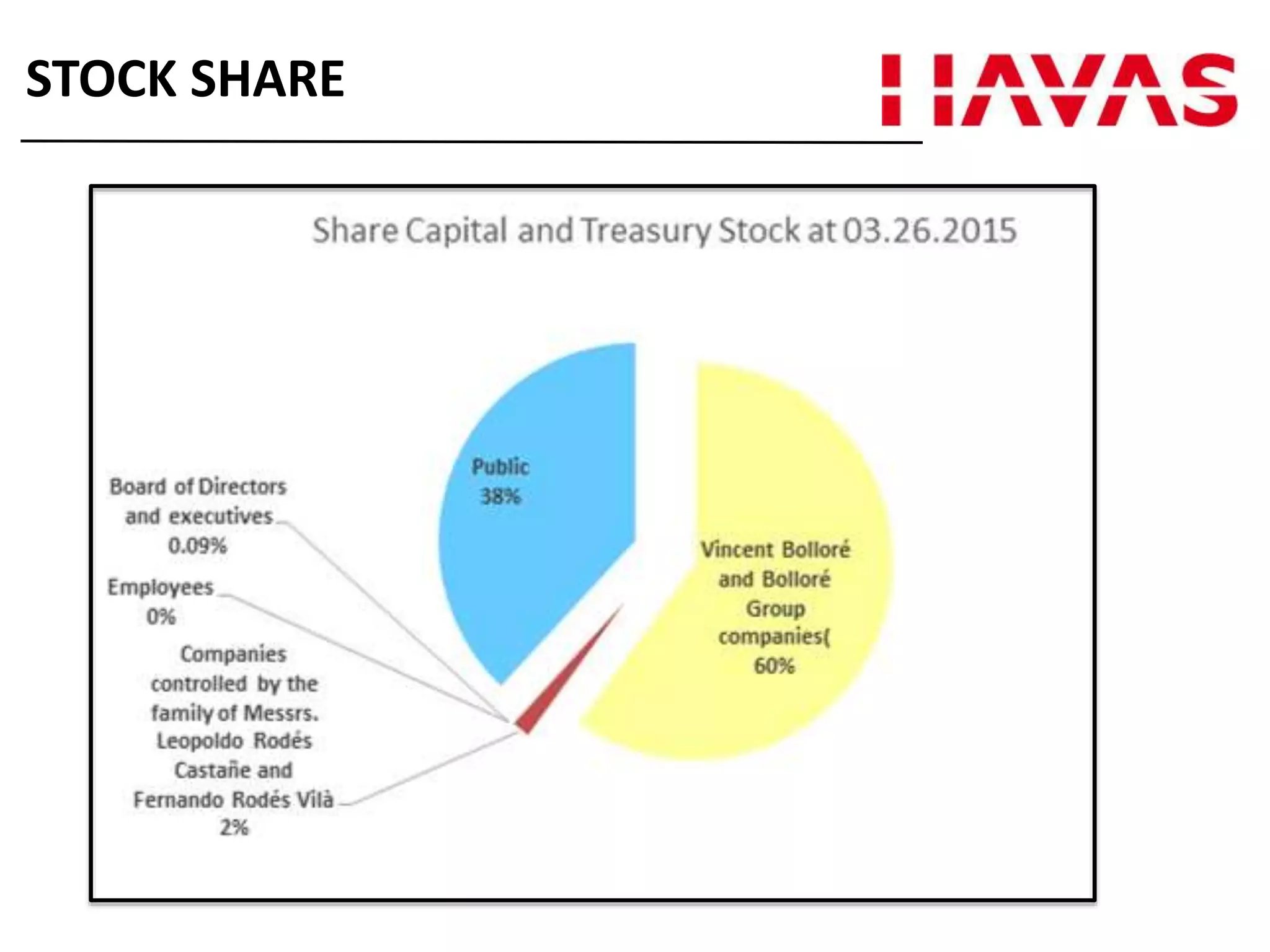

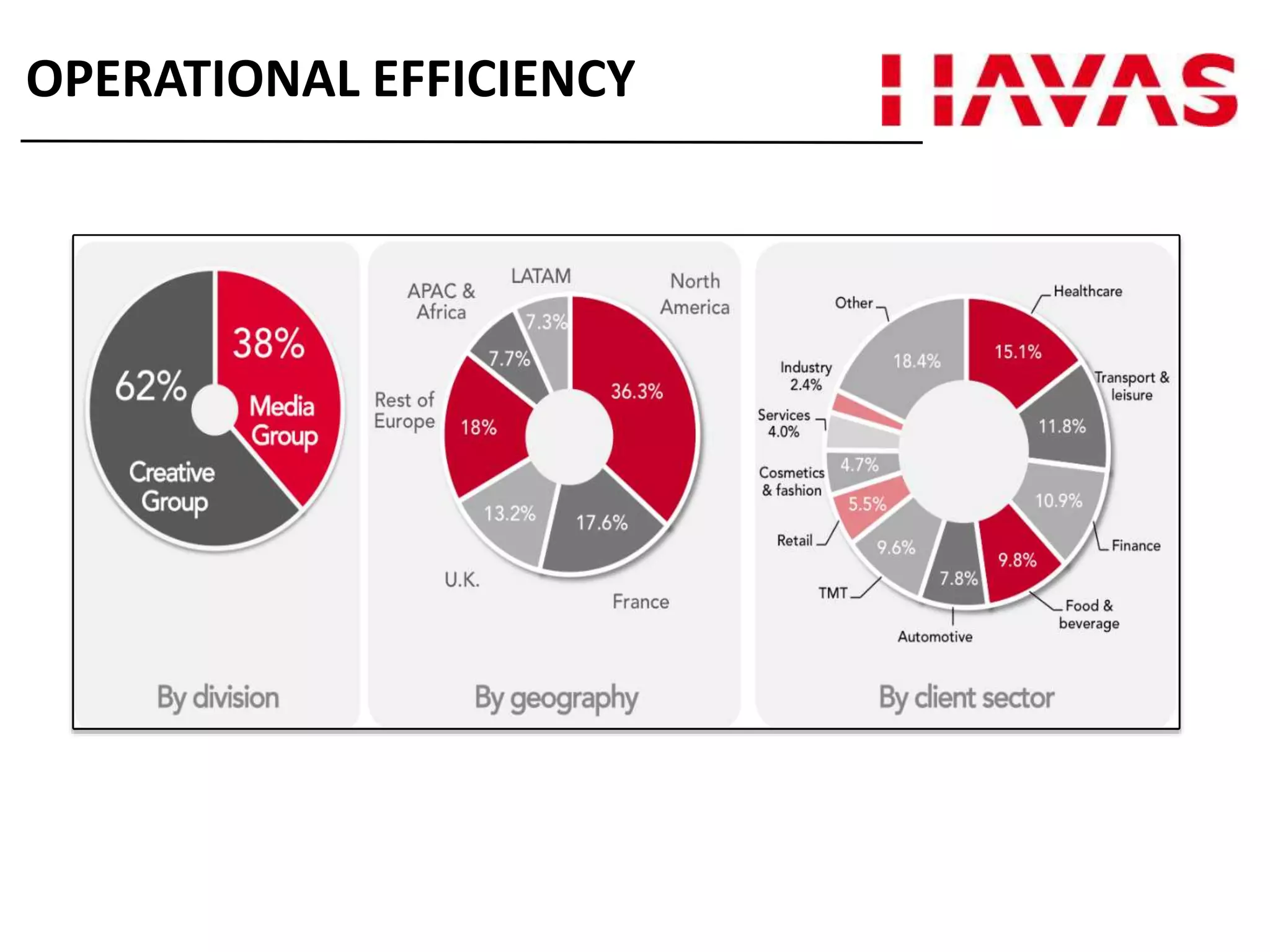

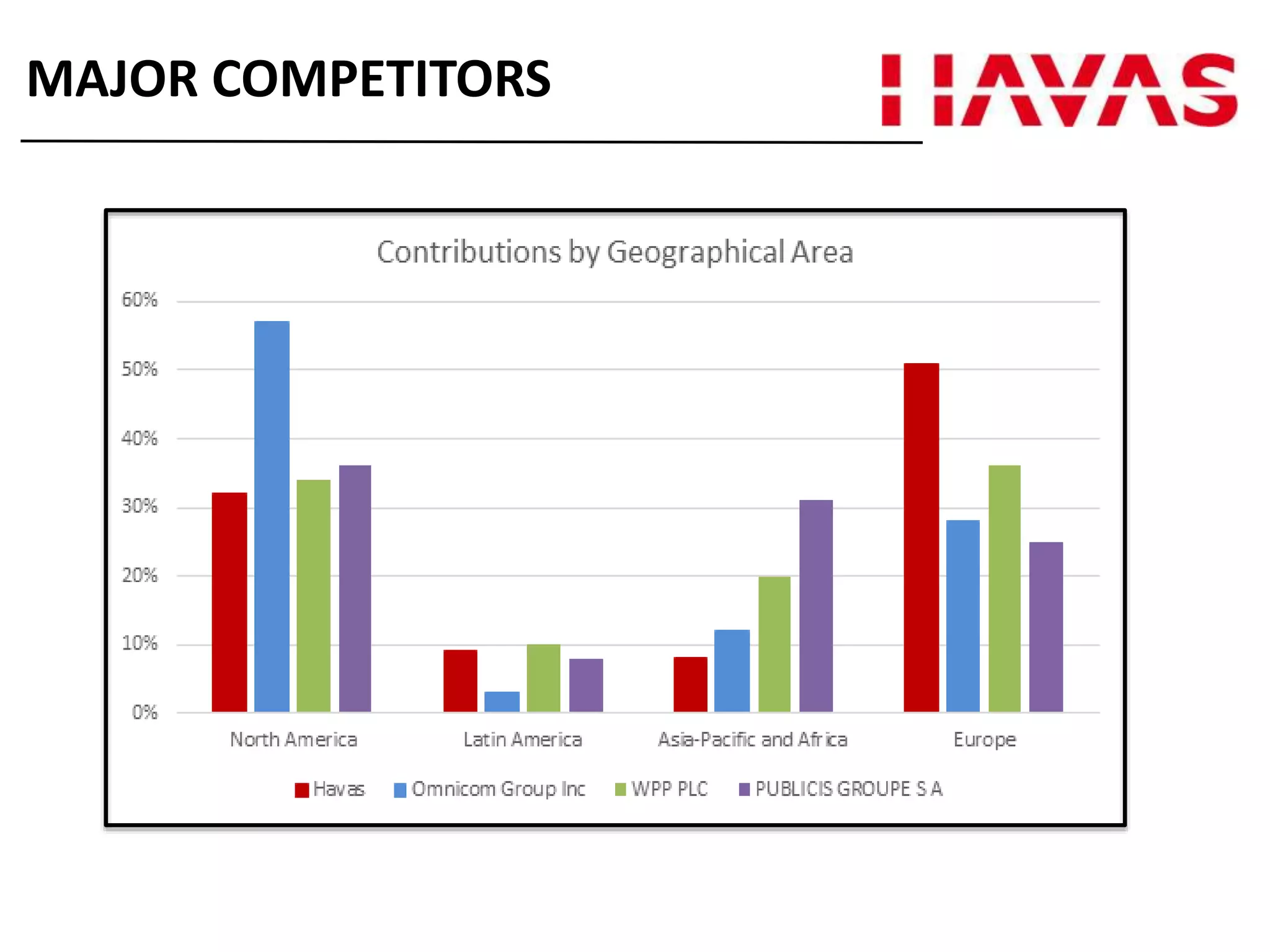

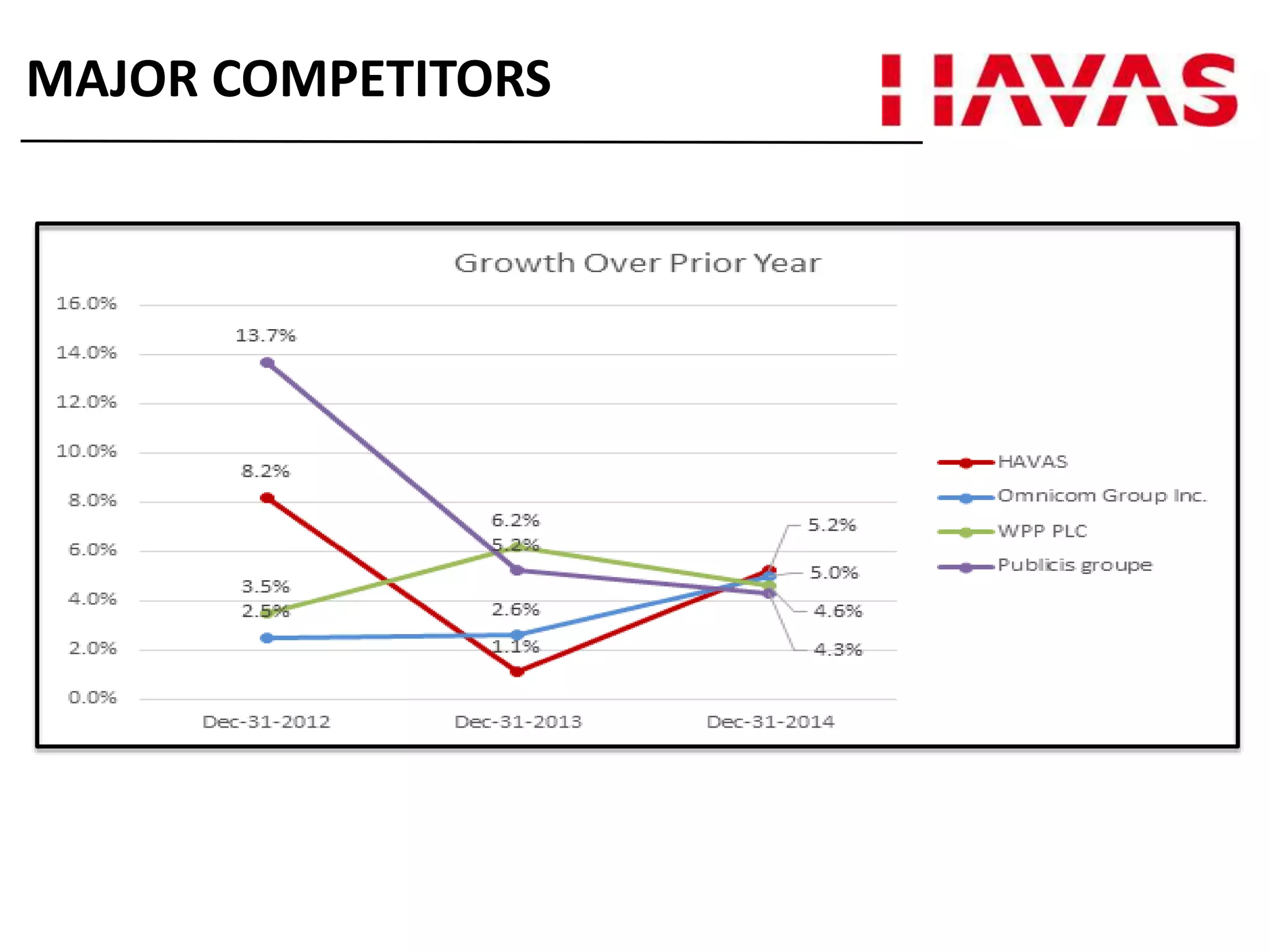

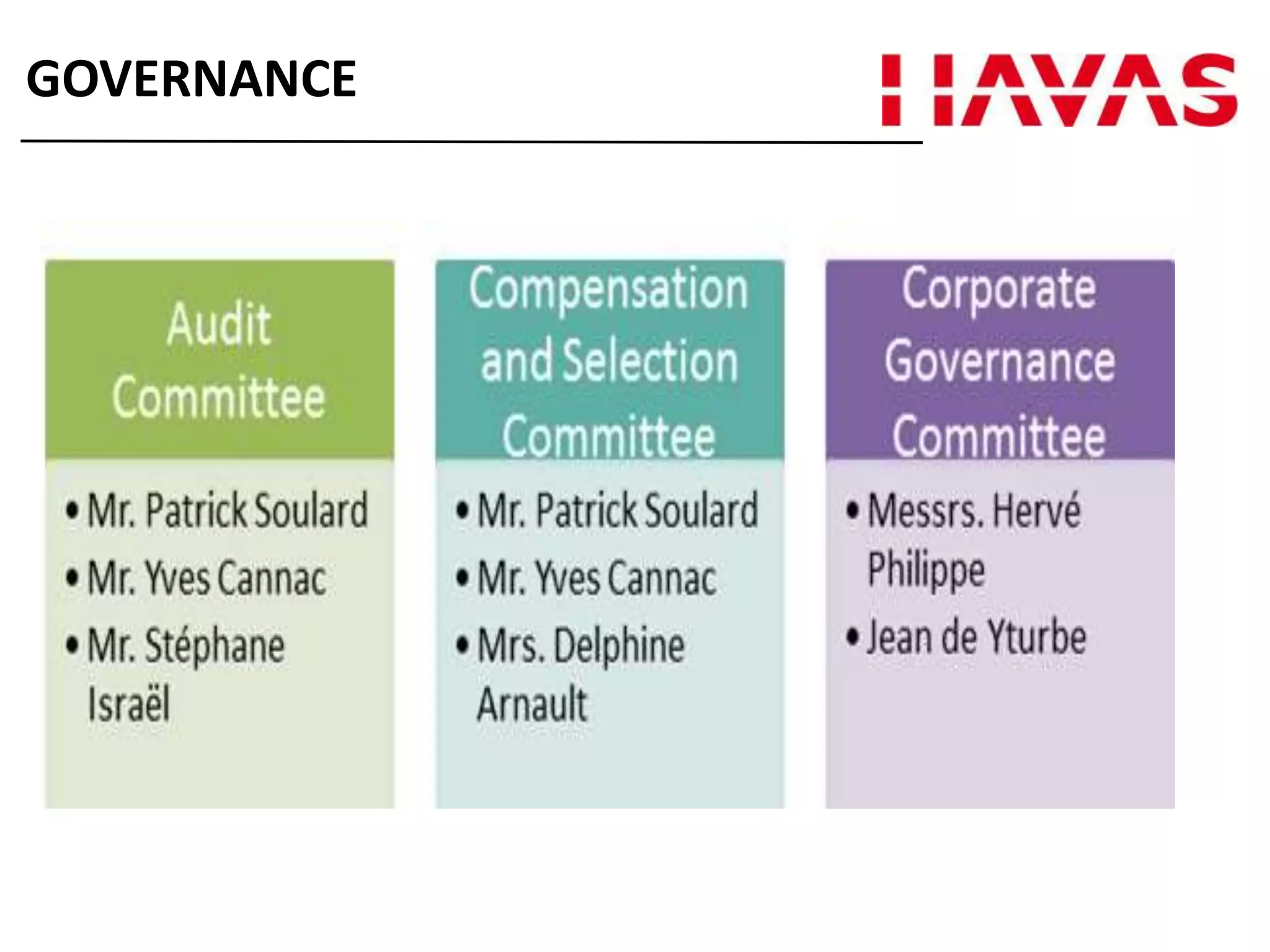

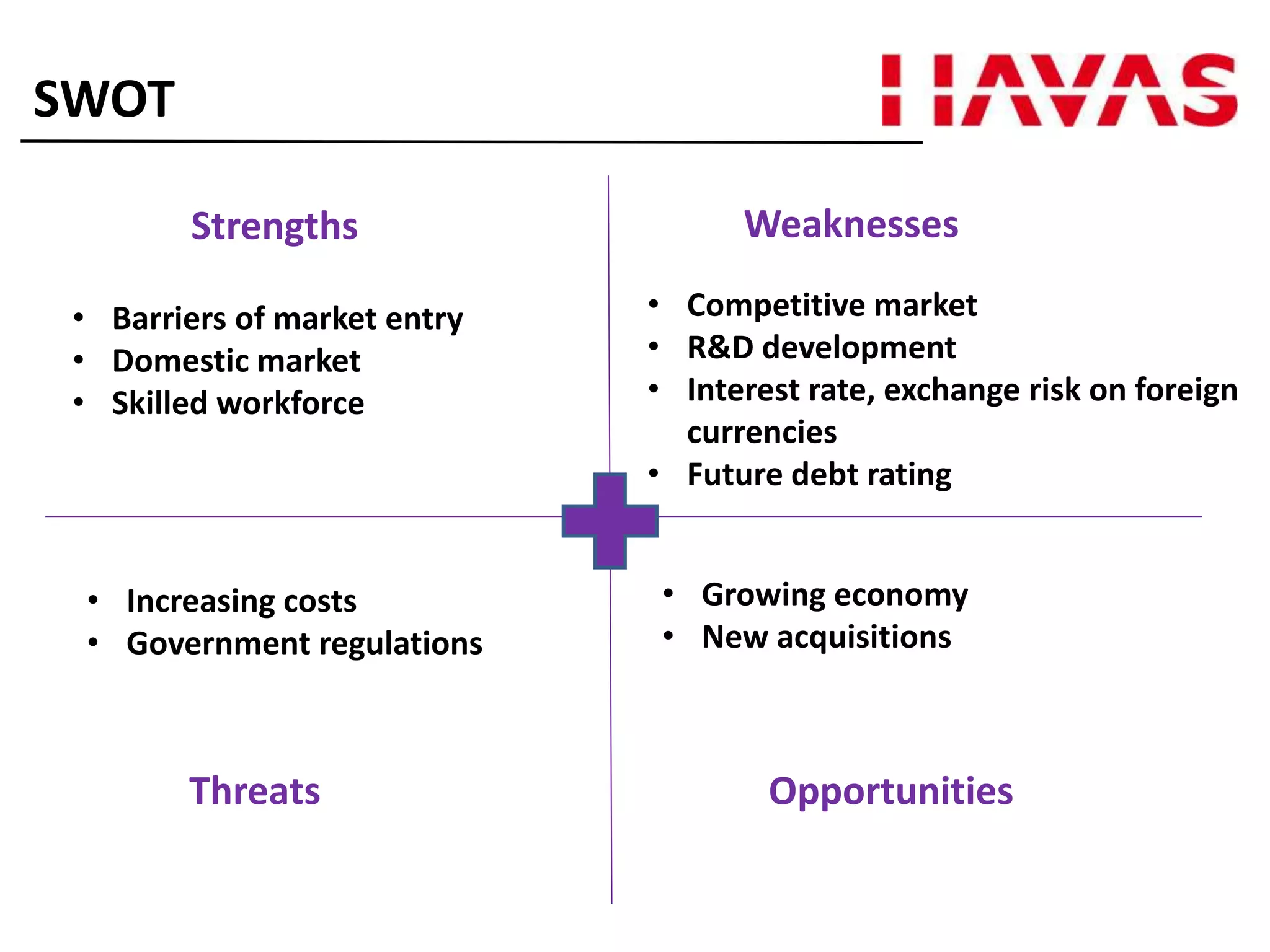

The document discusses the global advertising industry and provides an overview of several large advertising agencies. It begins with an overview of the advertising industry and key metrics such as total revenue, growth rates, and projected revenue. It then discusses four major global advertising agencies (Dentsu, Publicis, Havas, WPP) and provides details on each company's overview, products/services, clients, corporate strategy and goals, financial performance, and competitive position. The document contains information on industry trends, segmentation, external drivers, maturity levels in different regions, and analysis of threats and opportunities.