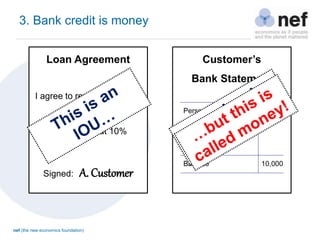

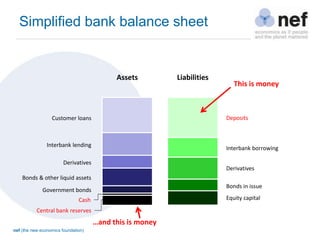

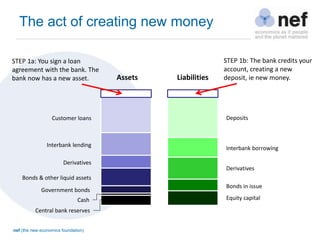

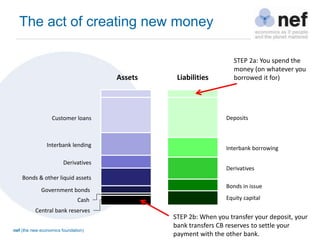

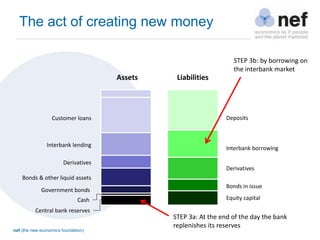

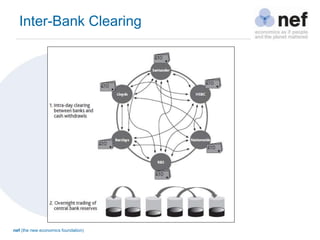

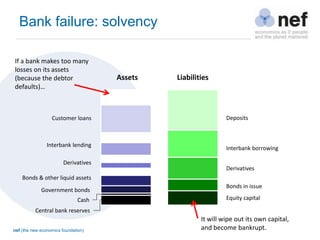

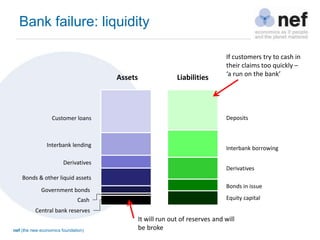

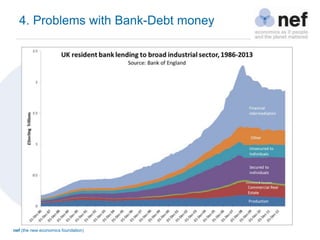

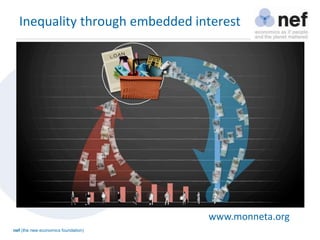

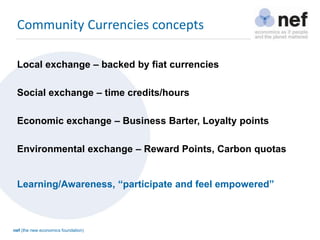

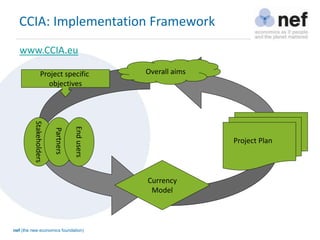

The document discusses the New Economics Foundation's perspective on the shift from traditional bank debt-based money to community currencies as a social technology. It highlights the Community Currencies in Action project aimed at empowering communities across Northwest Europe through knowledge sharing and implementing community currencies to achieve better social, economic, and environmental outcomes. Additionally, it explores the role of banks in money creation, the challenges of bank-debt money, and various forms of community currencies to address these issues.