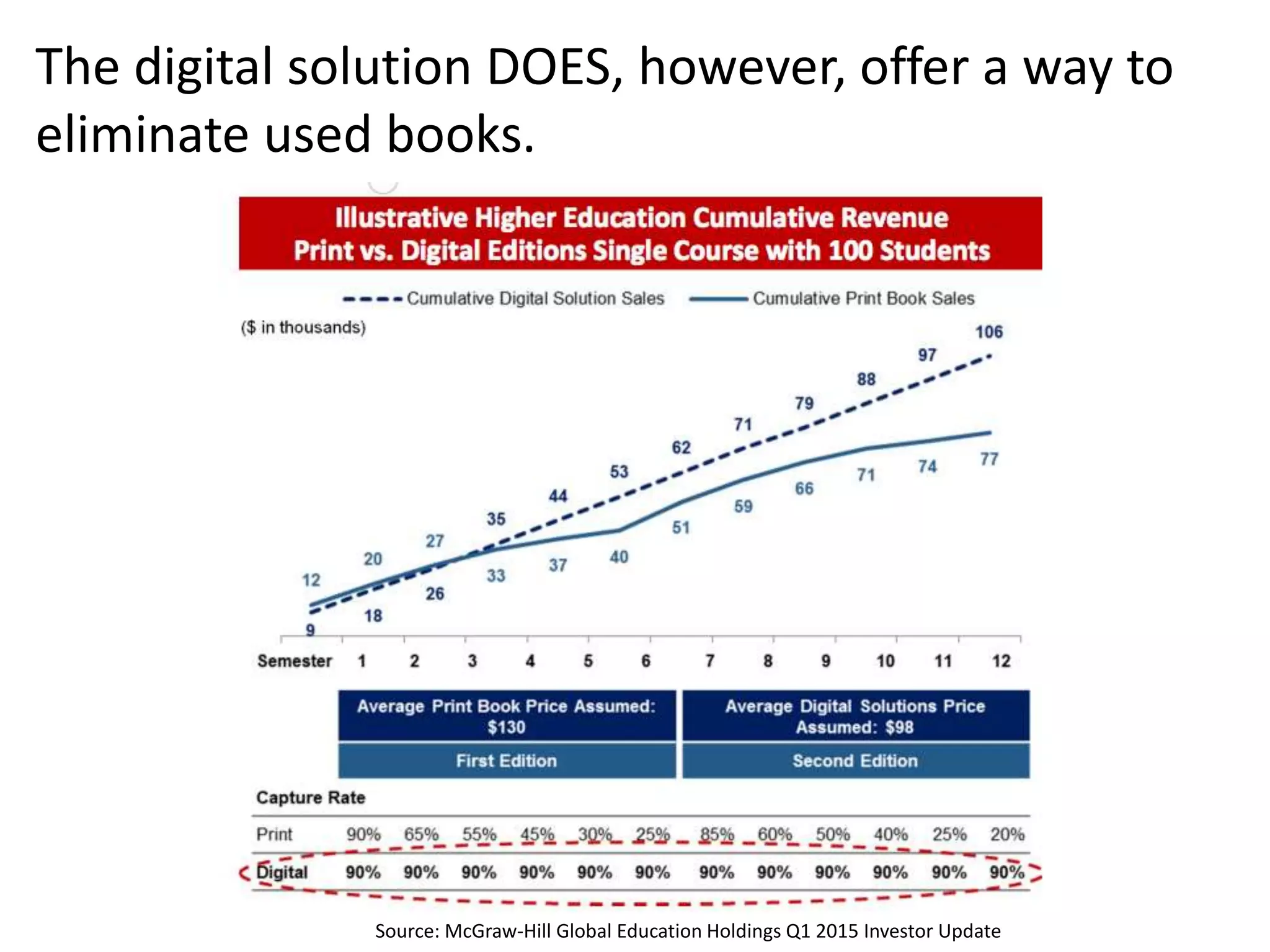

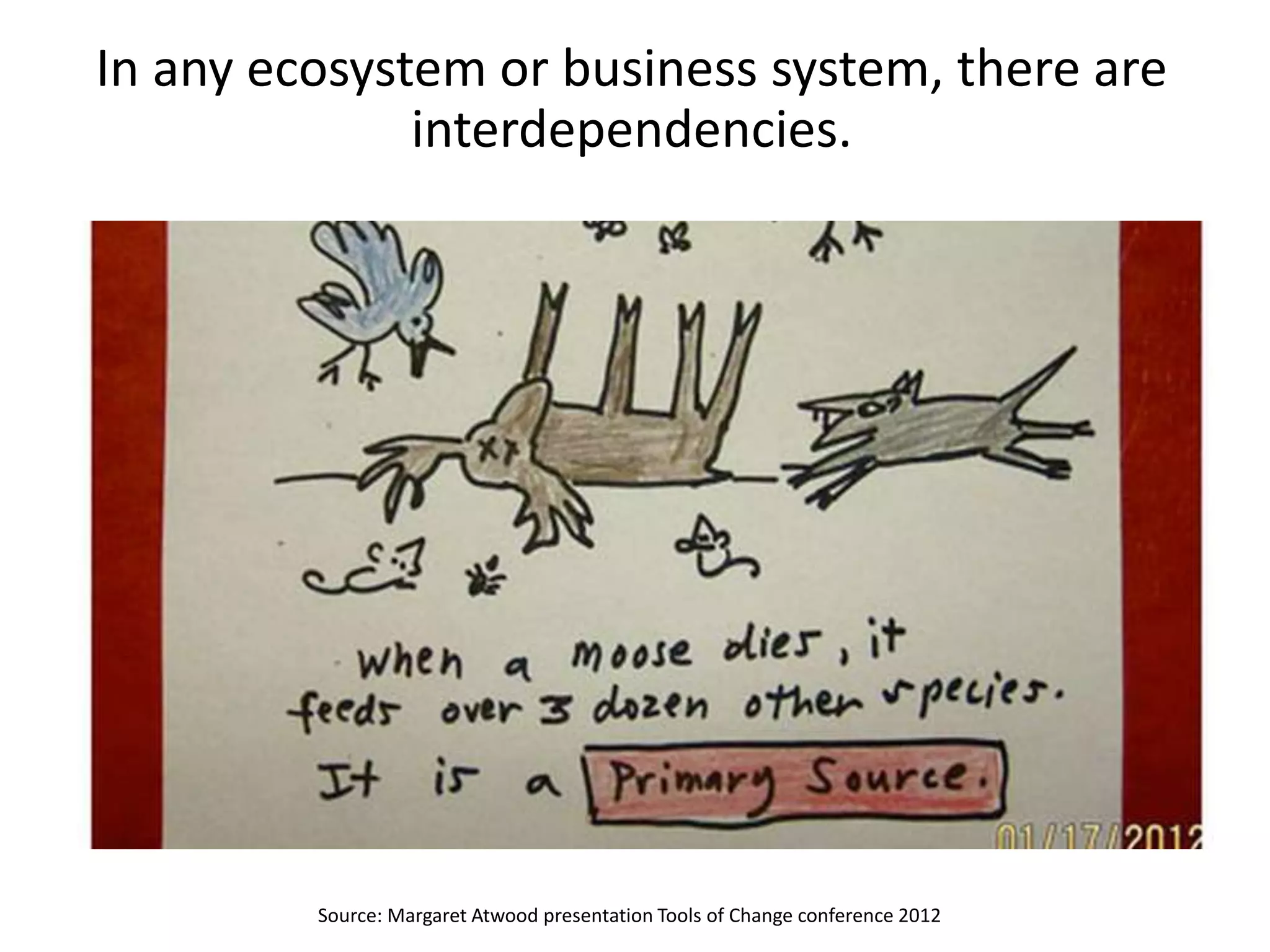

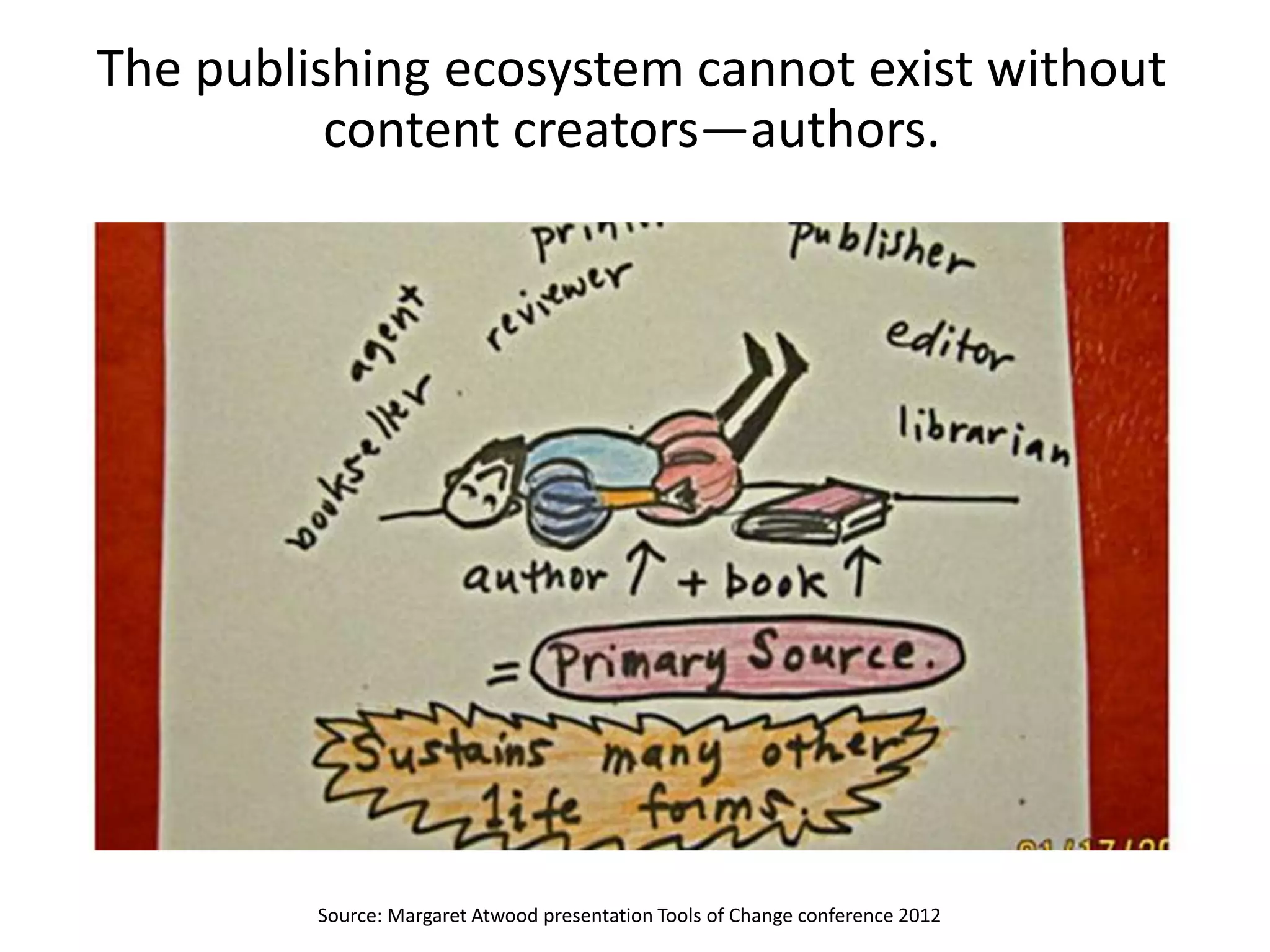

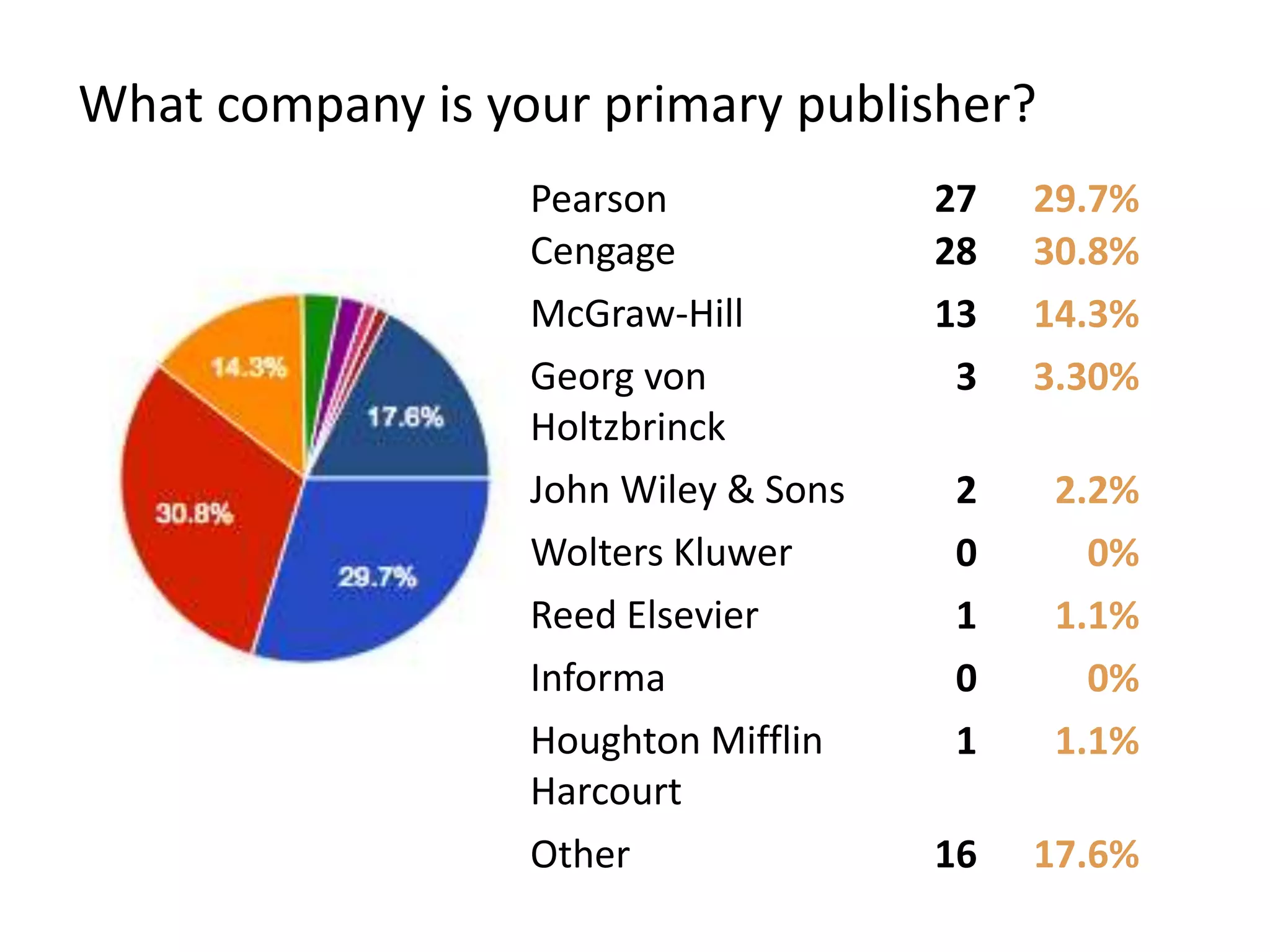

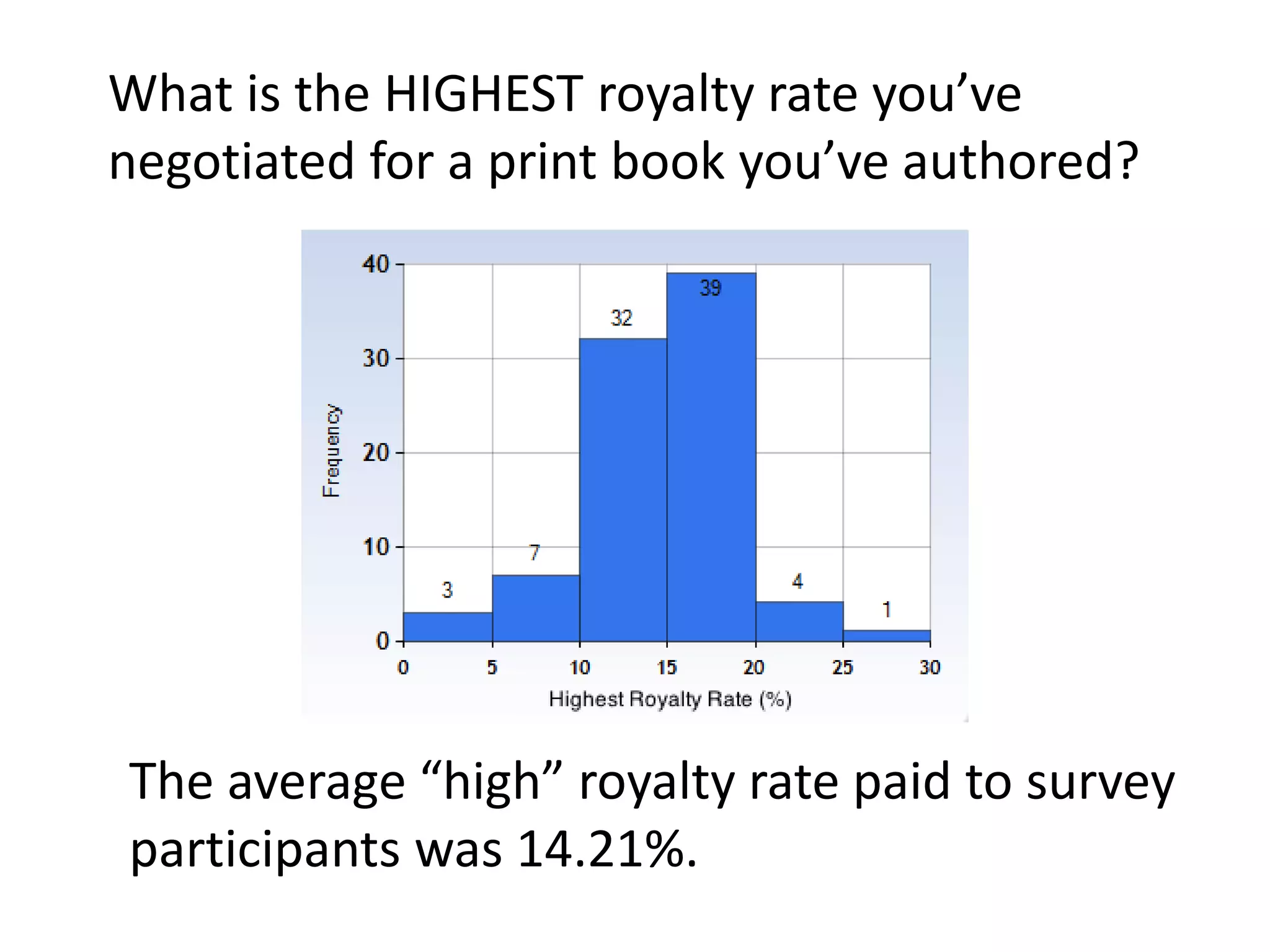

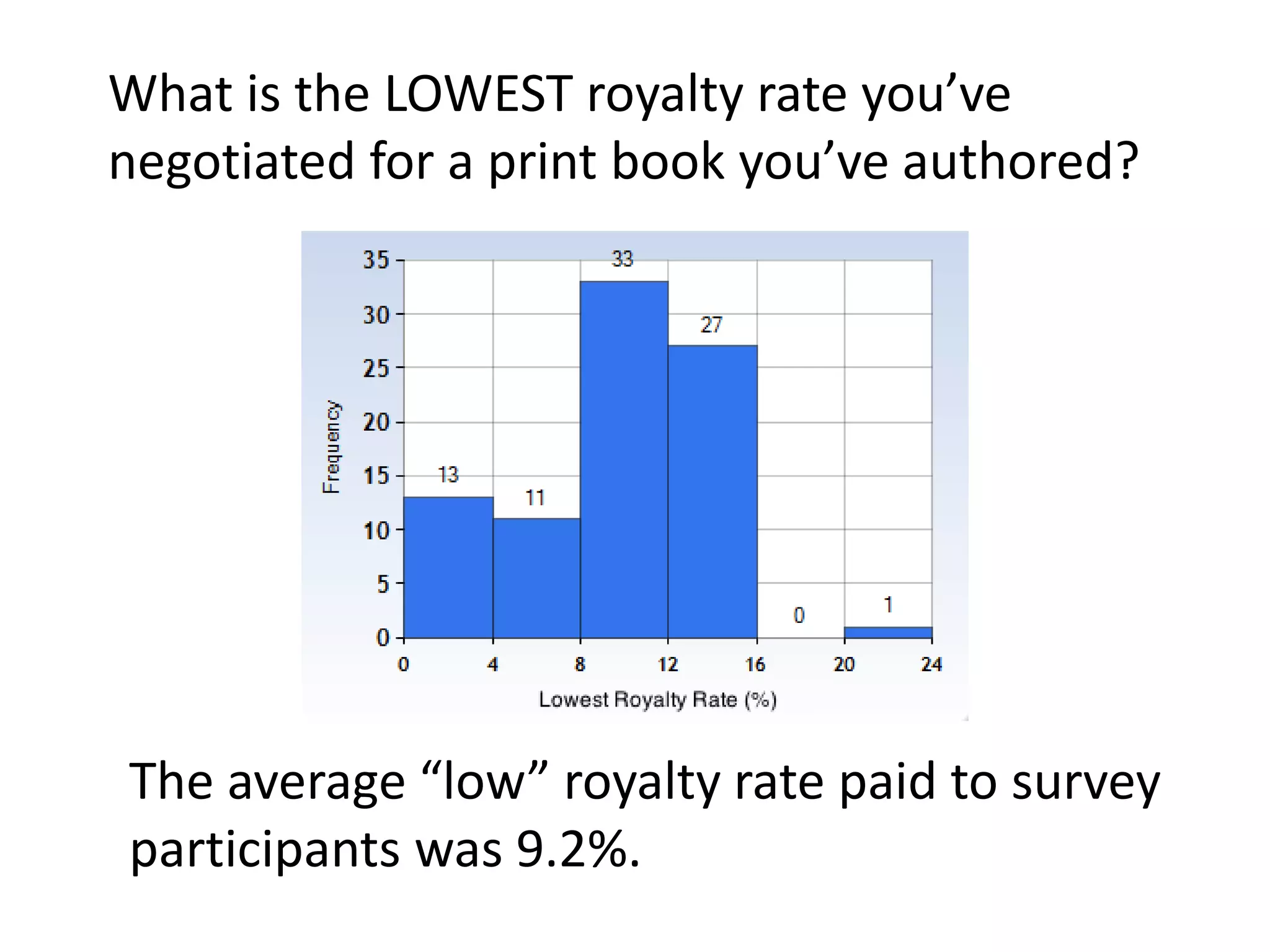

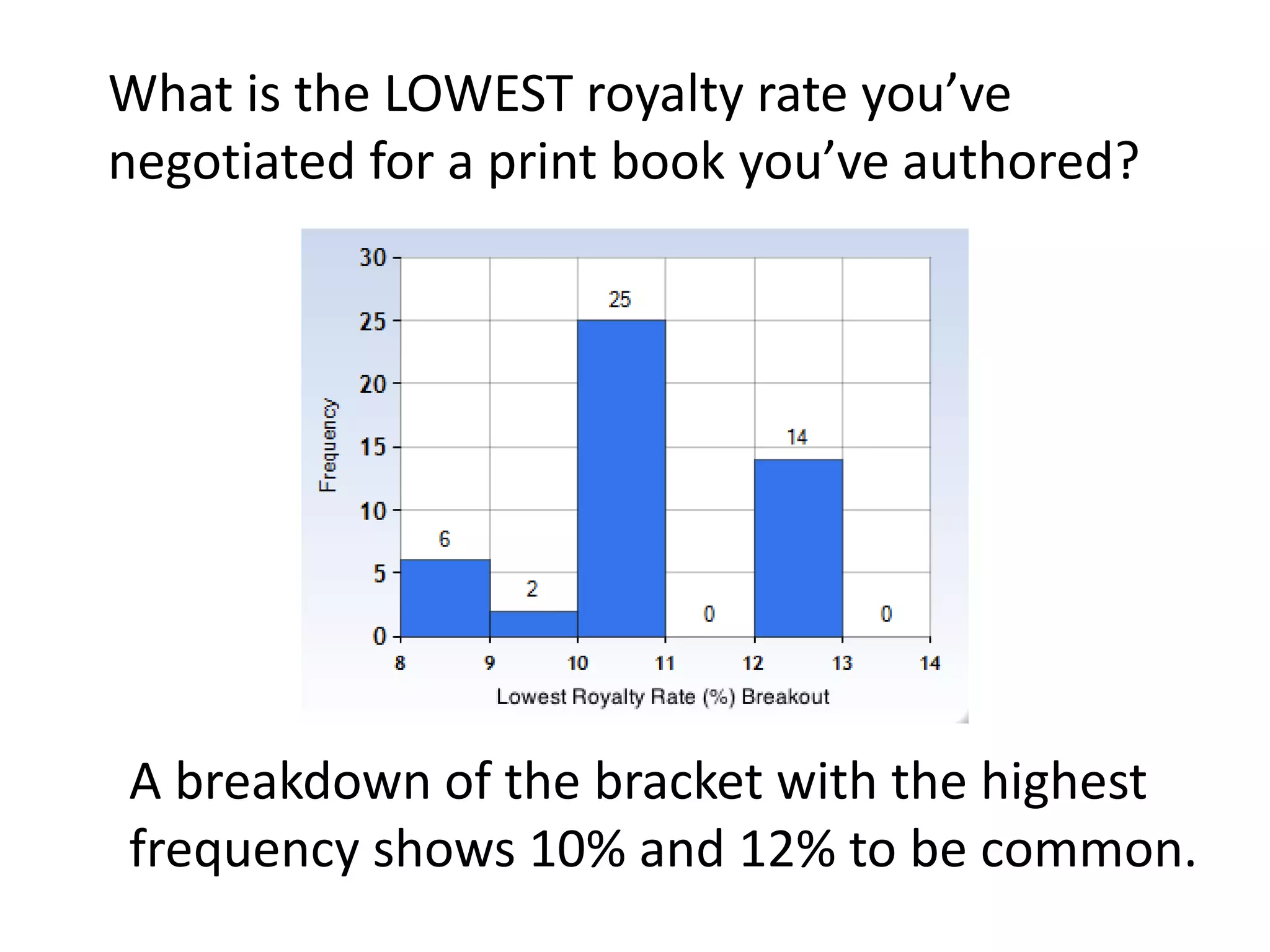

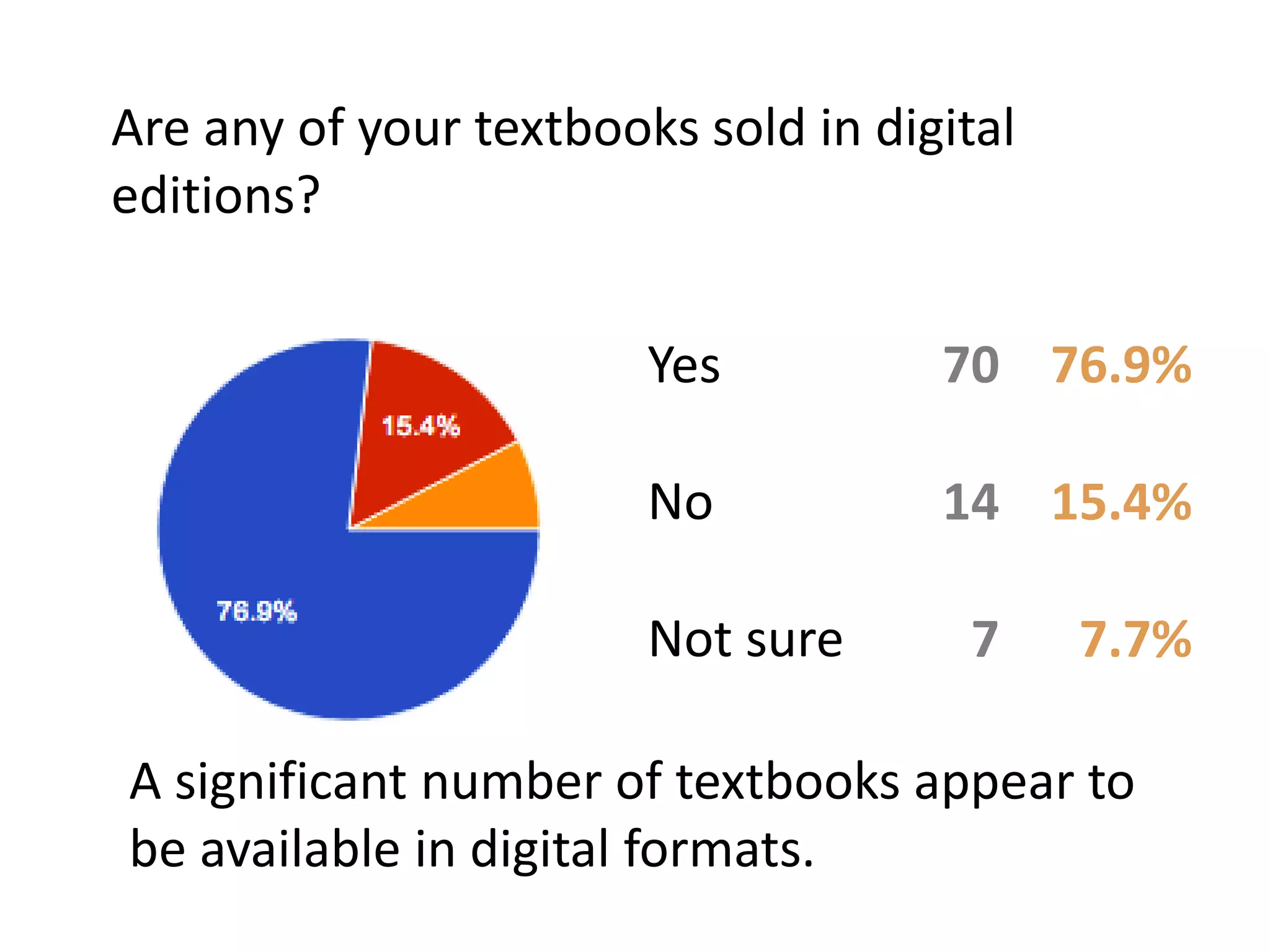

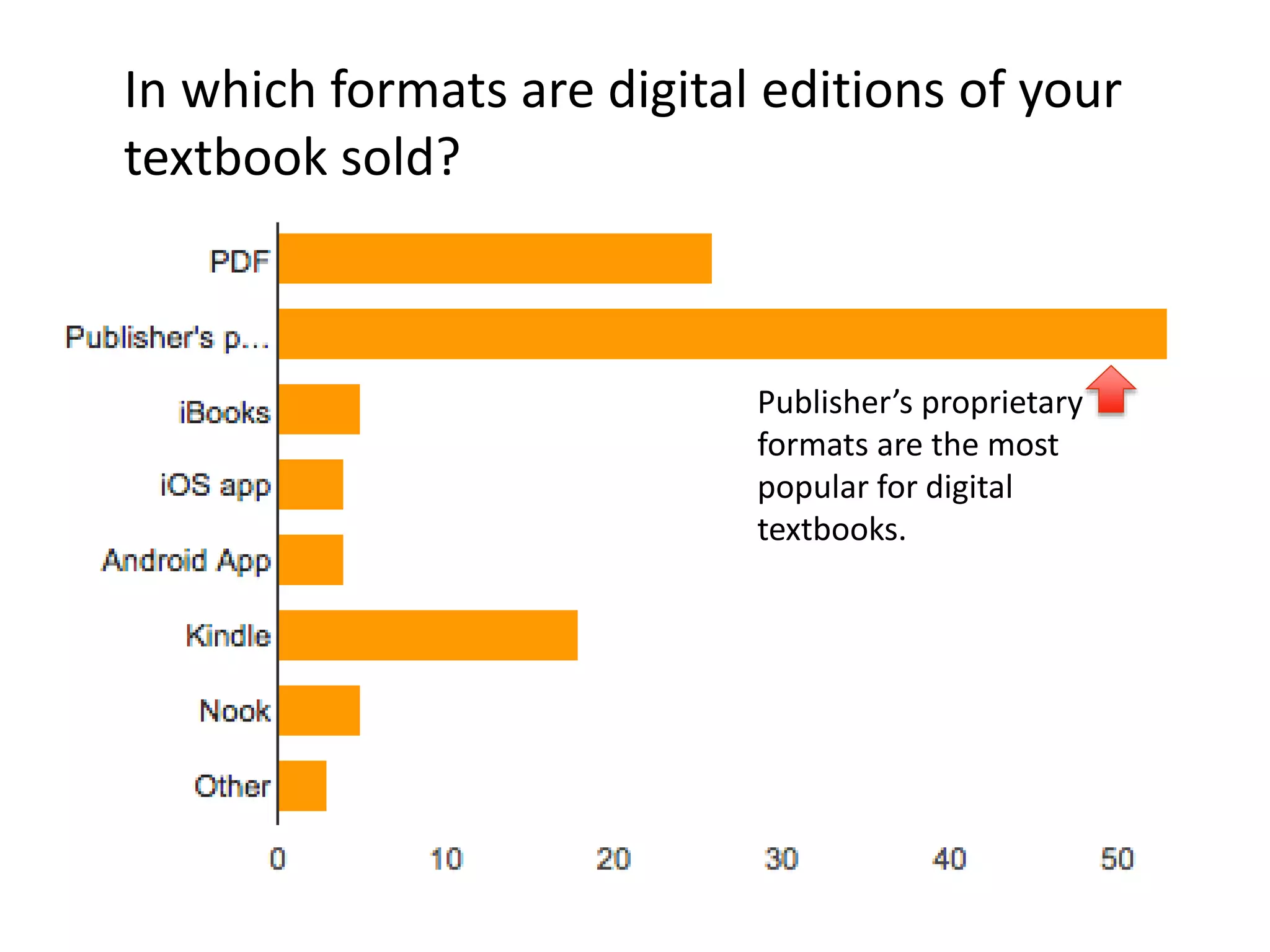

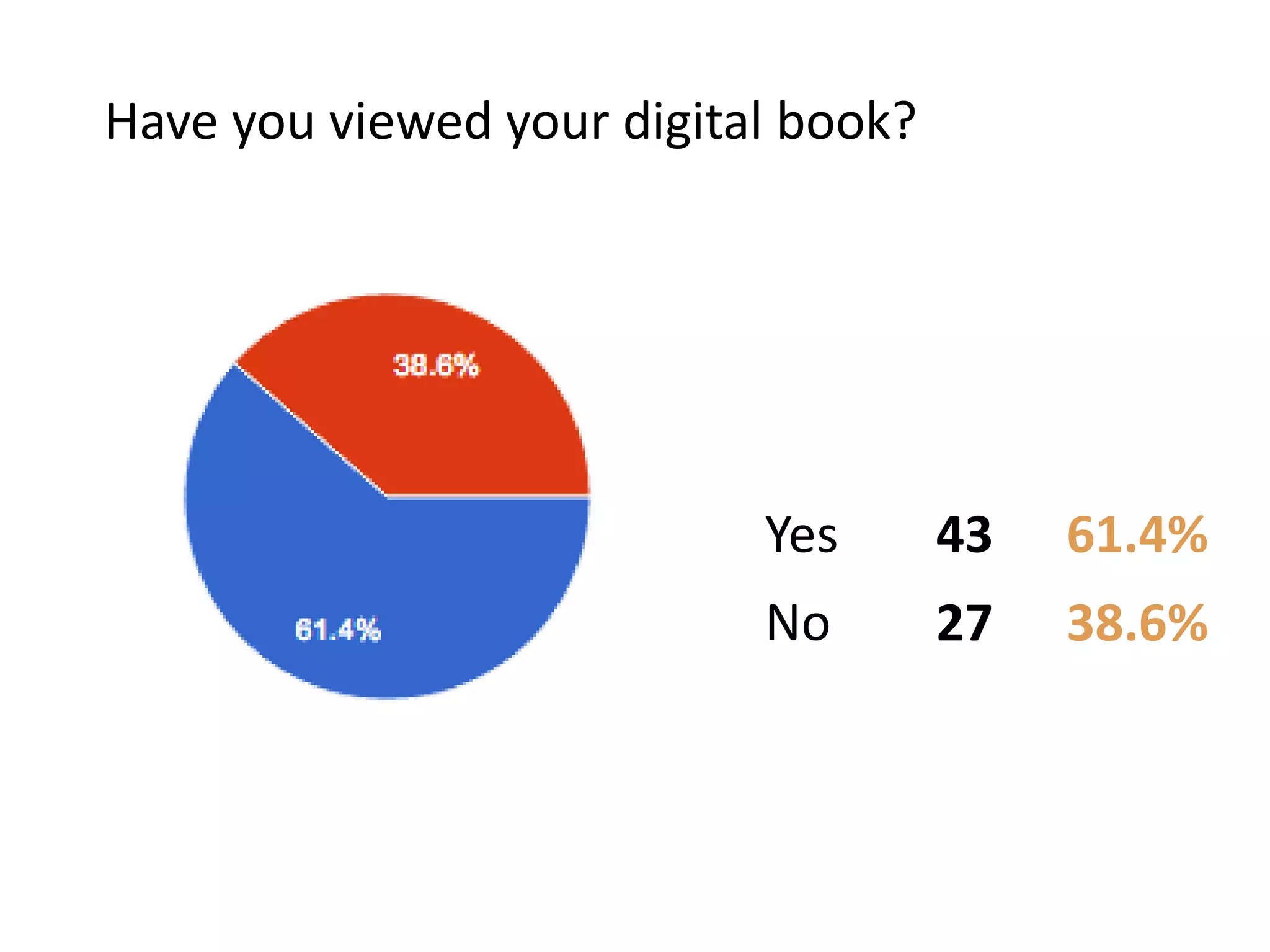

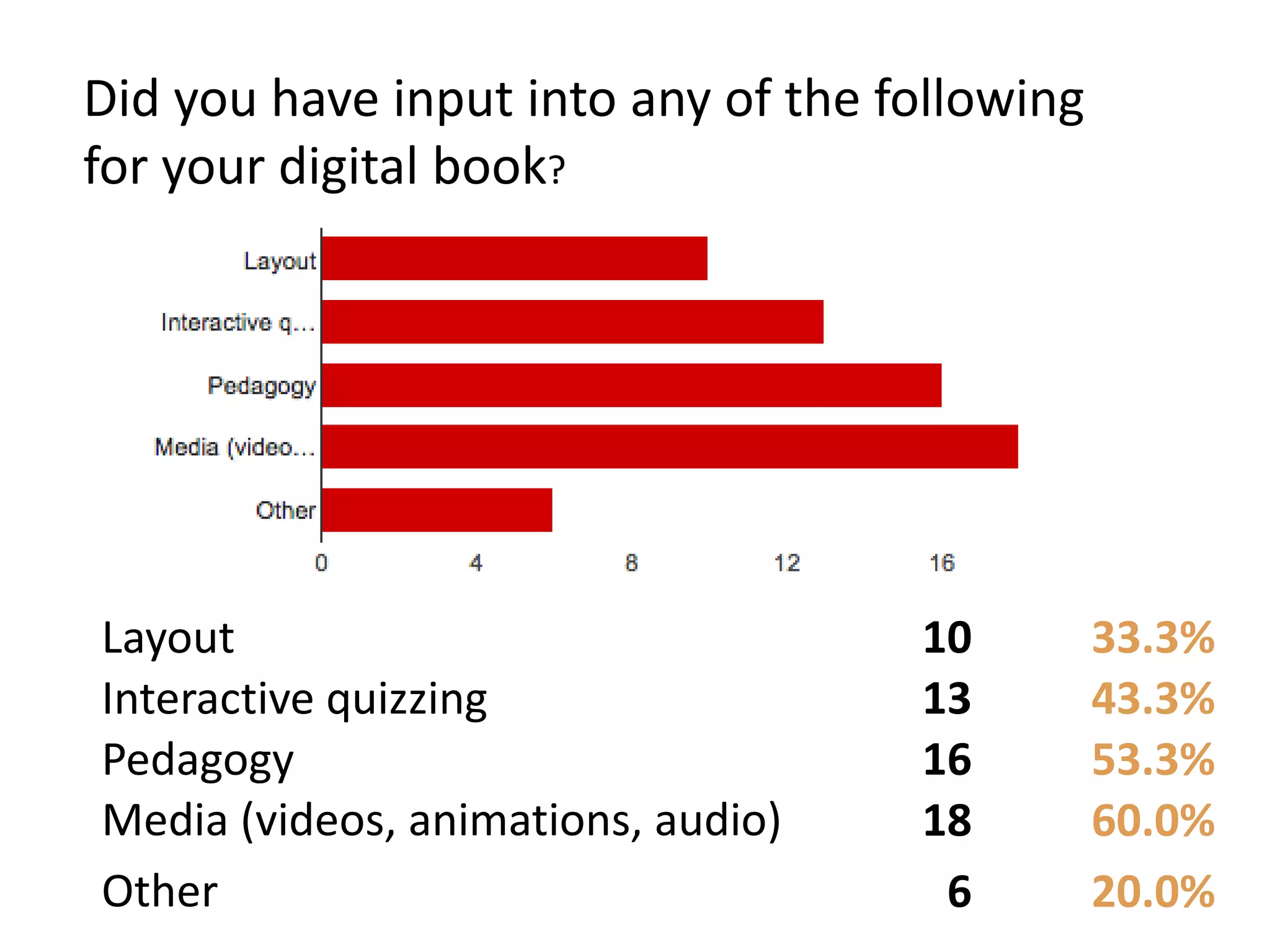

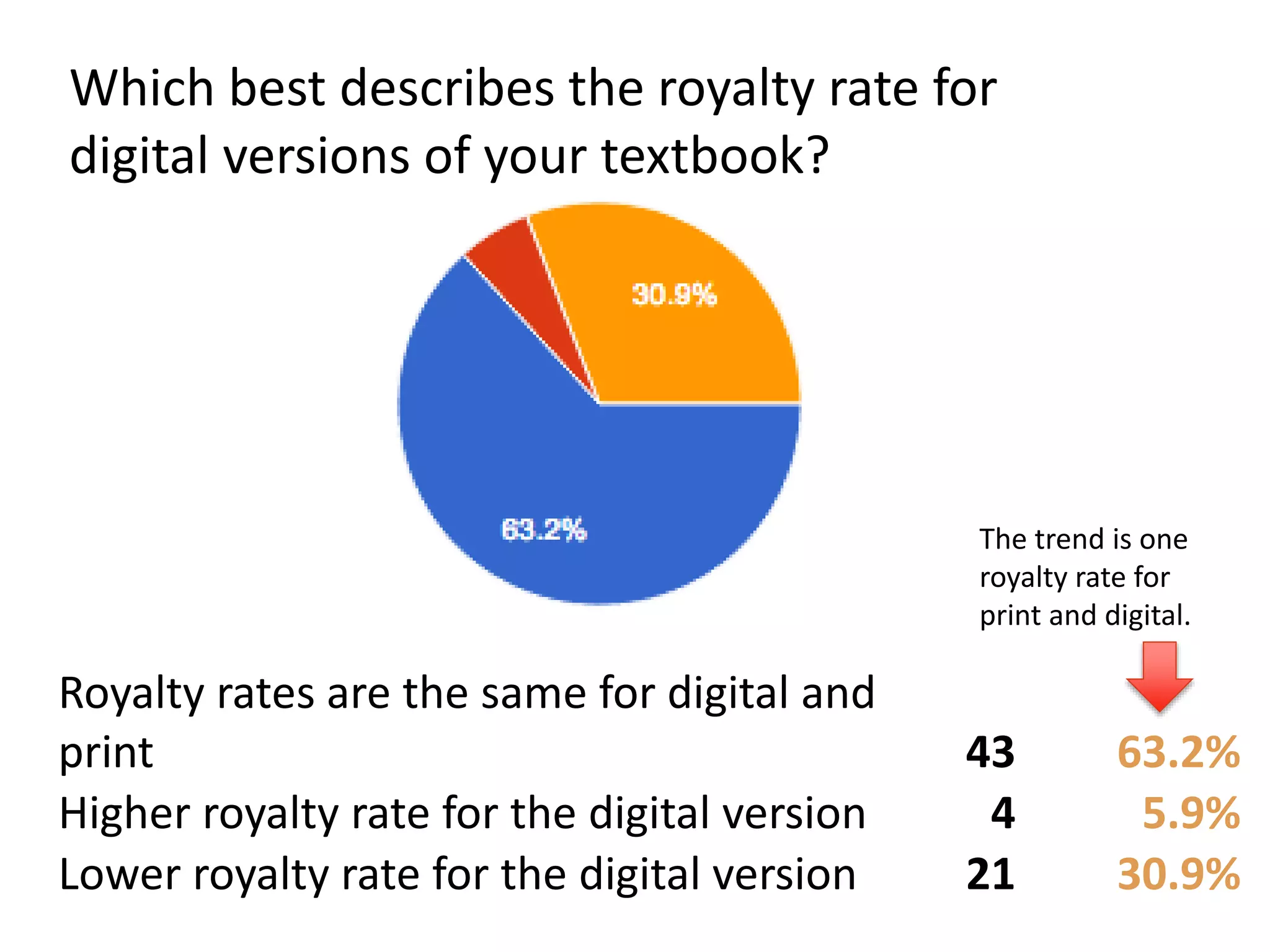

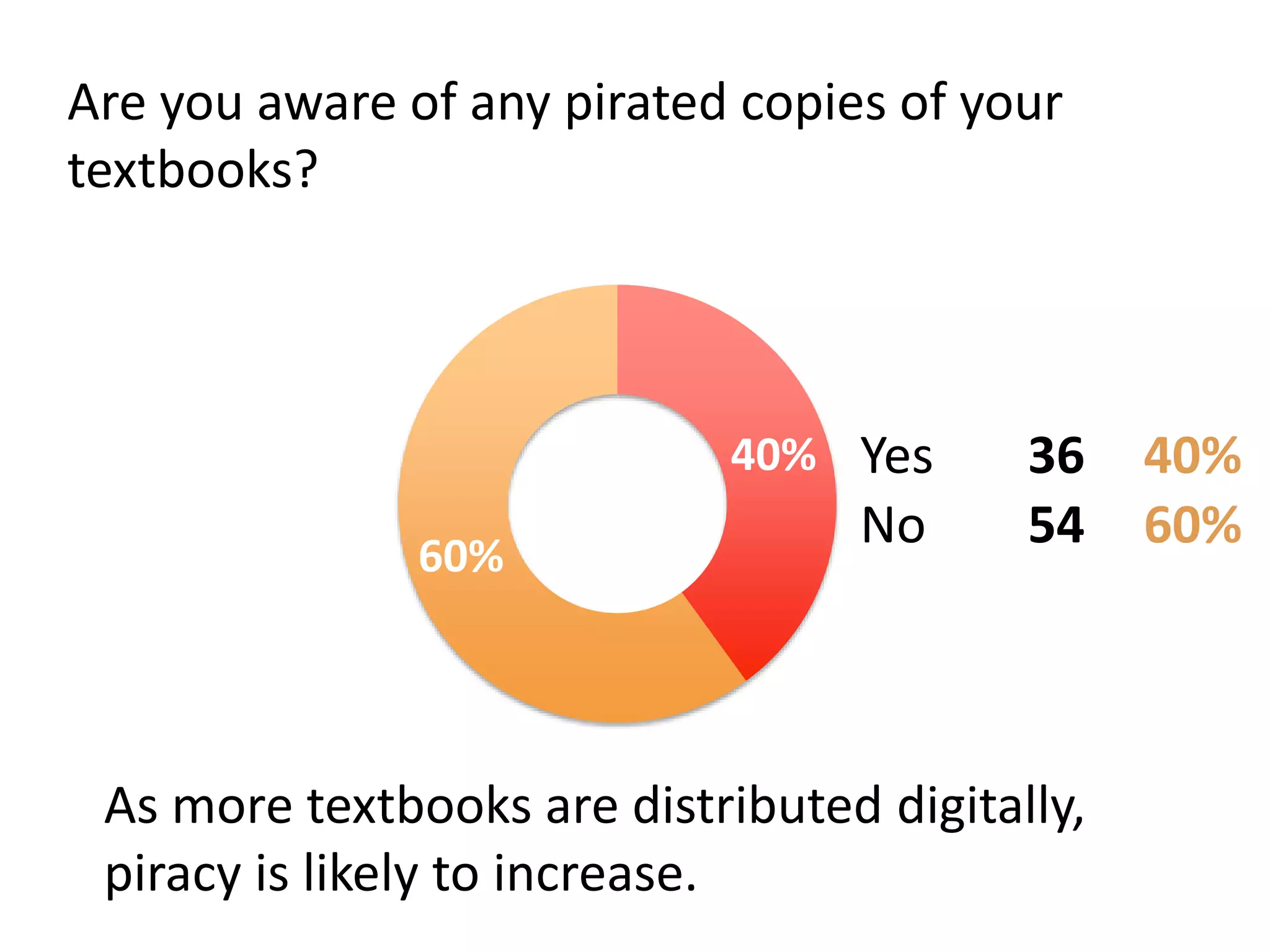

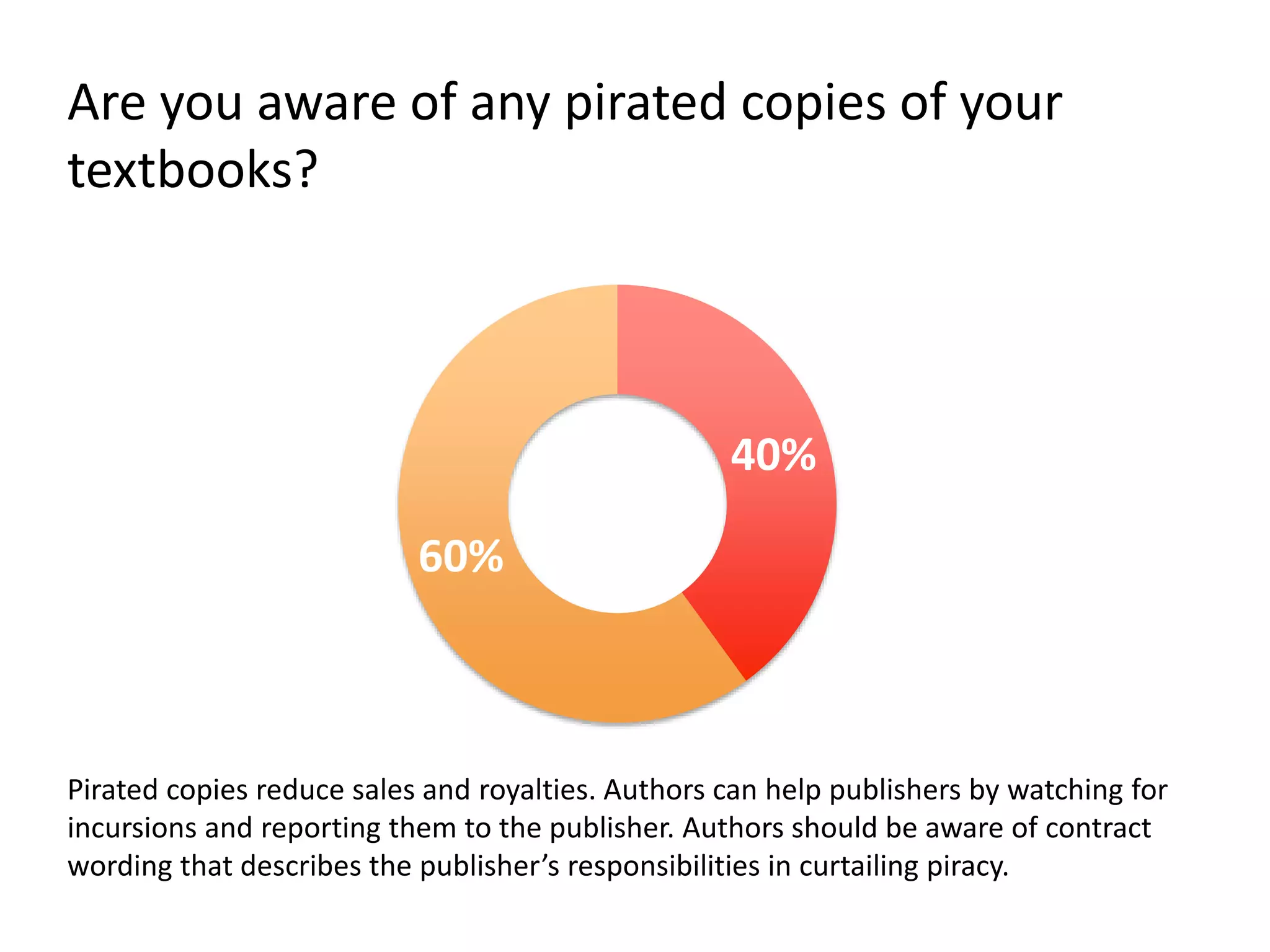

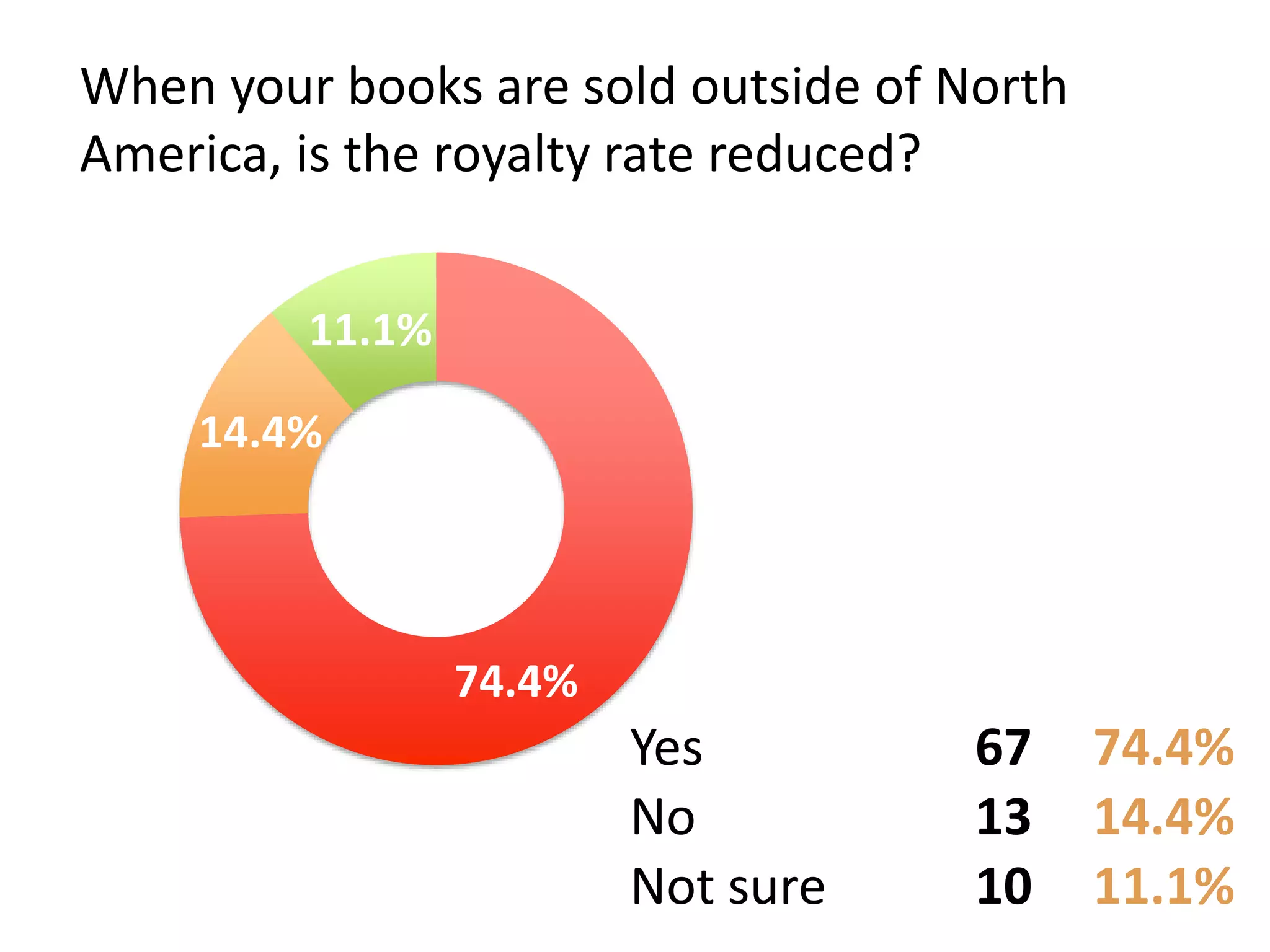

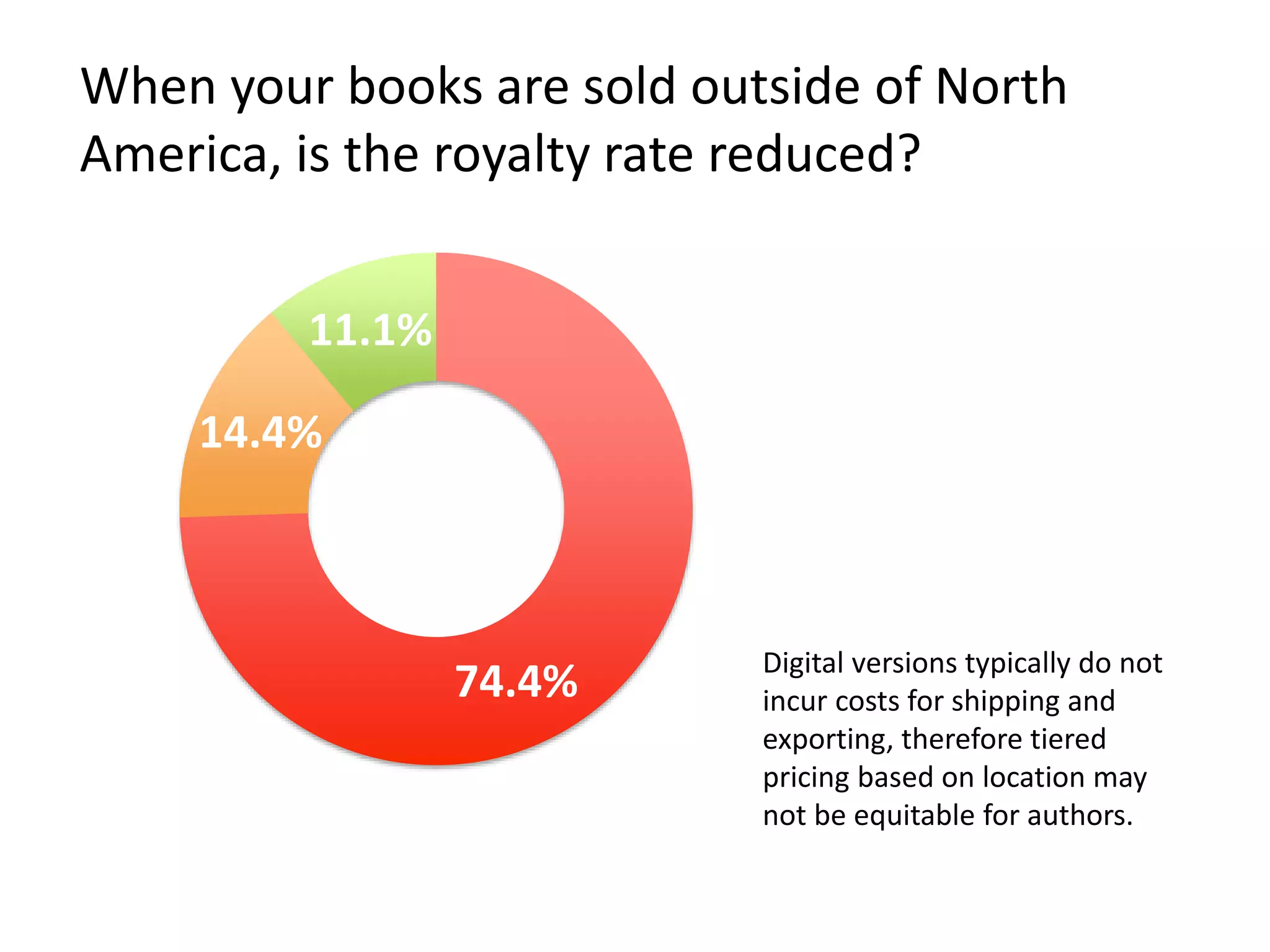

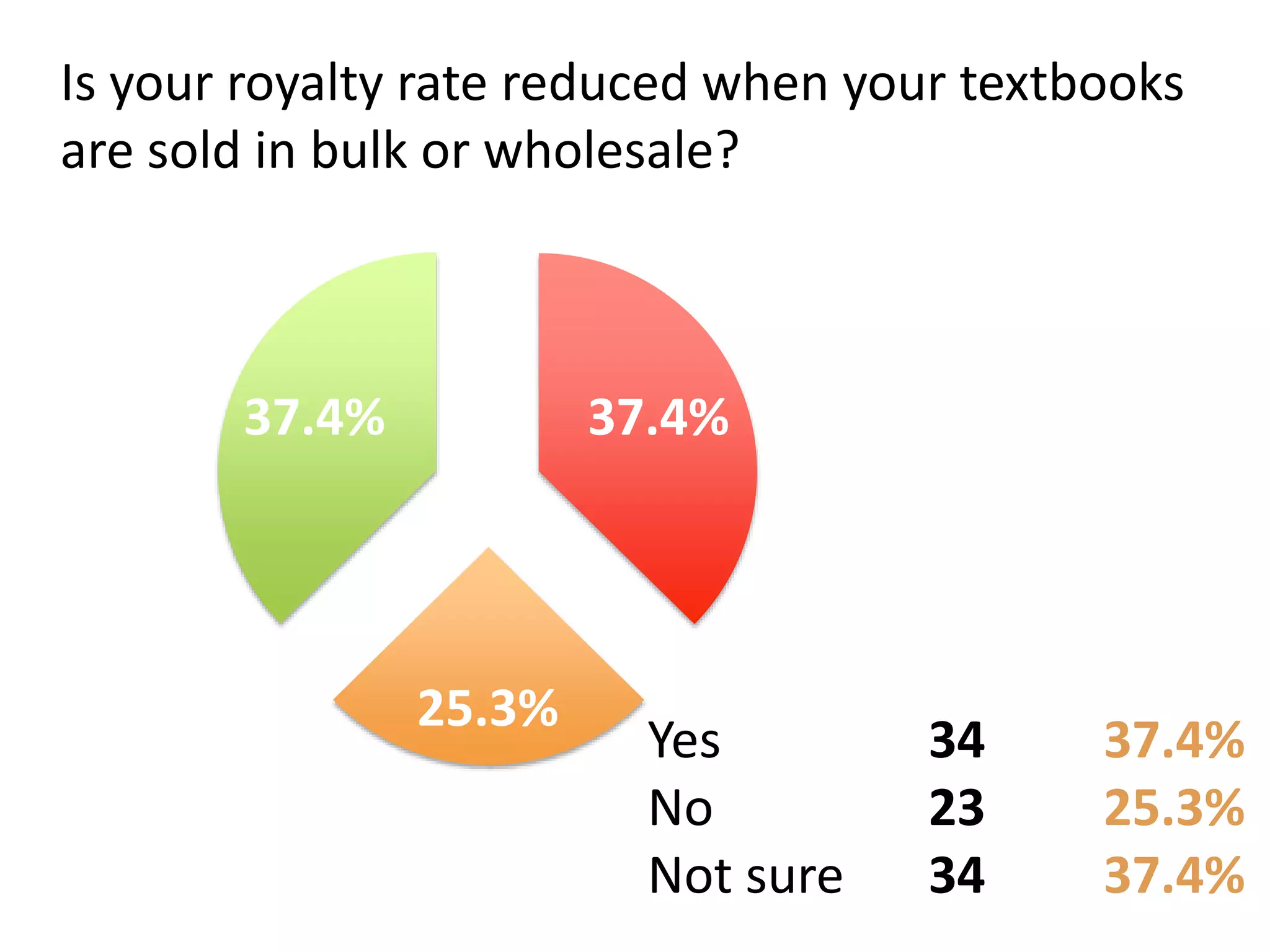

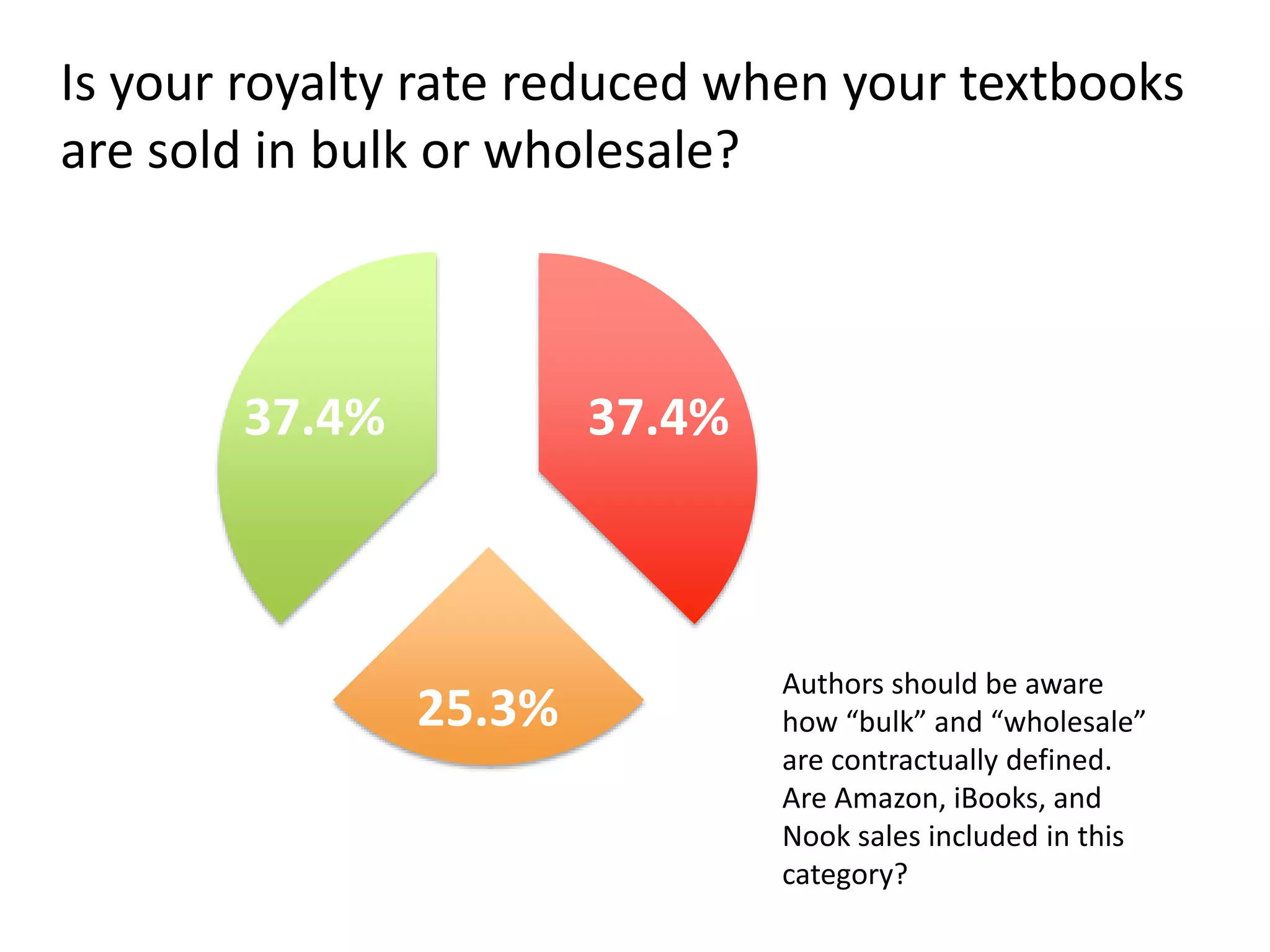

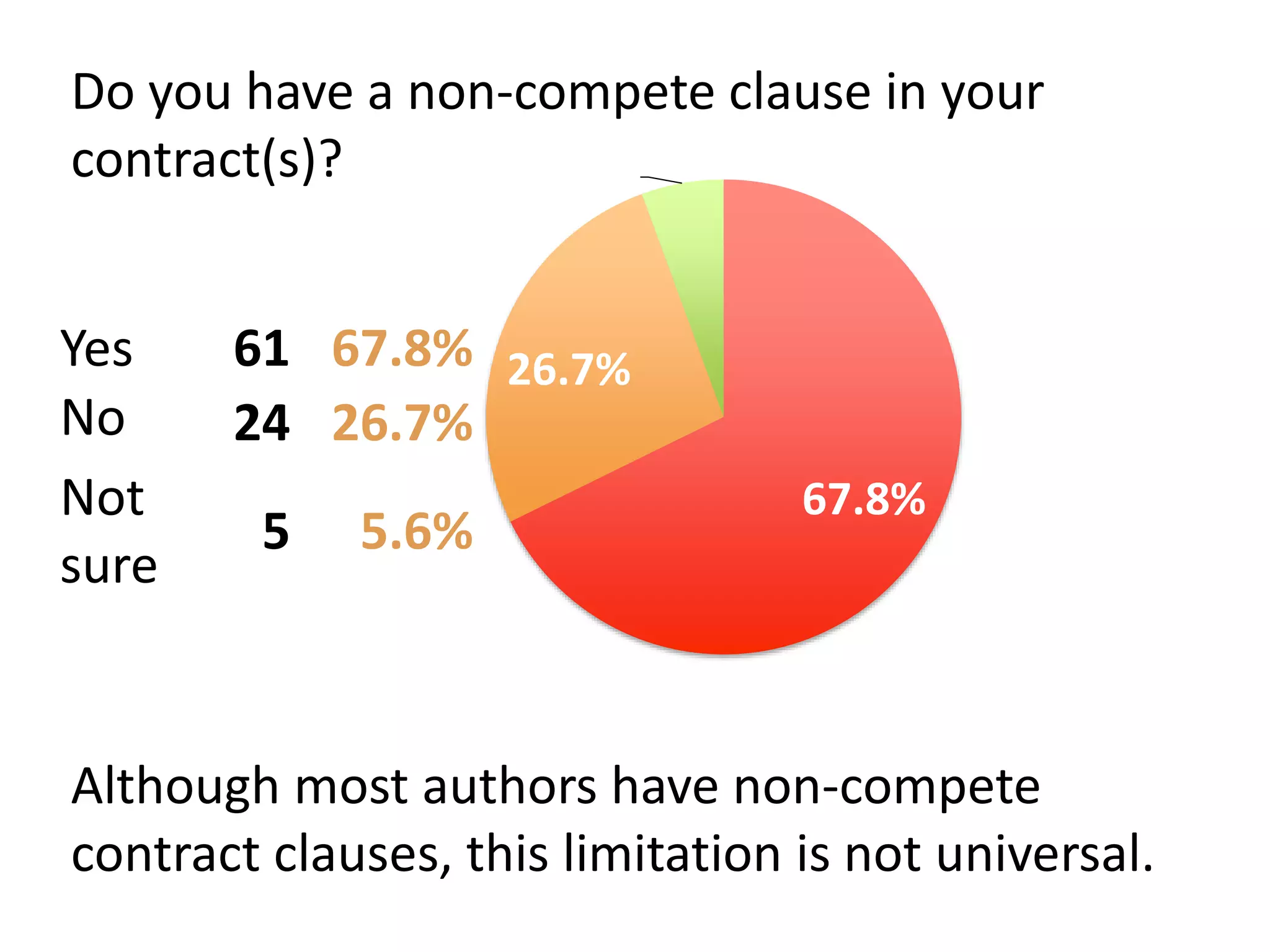

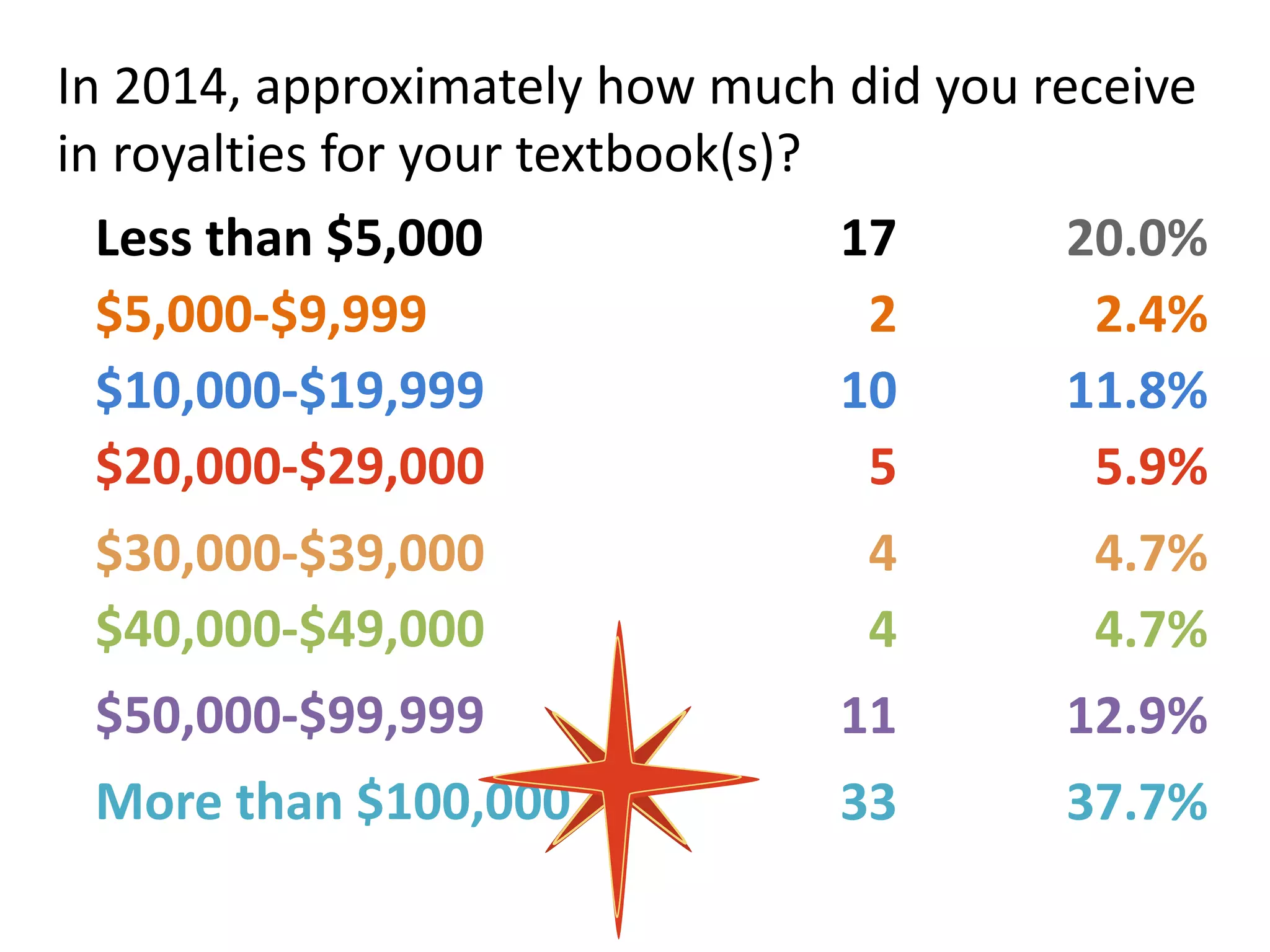

The 2015 digital textbook report analyzes the textbook industry's dynamics using Porter's five forces model, highlighting the dominance of major publishers like Pearson and Cengage, while noting the ongoing threat of alternative distribution models and digital platforms. It reveals that while many authors have transitioned to digital formats, concerns regarding piracy and unsustainable royalty structures persist. The report emphasizes the need for authors to adapt to changing industry trends and re-evaluate contract clauses as the market evolves.