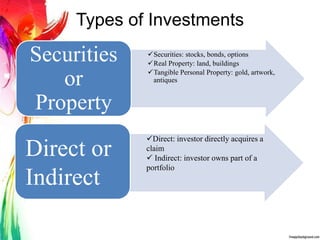

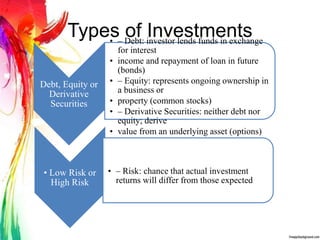

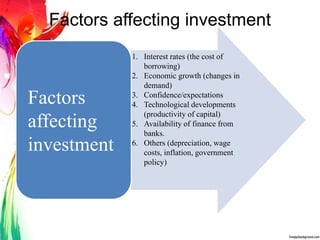

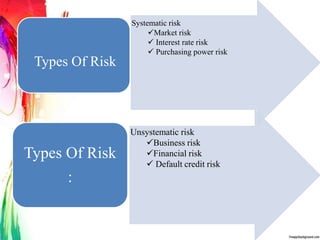

The document discusses various topics related to investment including the meaning of investment, characteristics of investment like return, risk and safety, types of investments like securities, real property and tangible assets. It also discusses the difference between investment, speculation and gambling. Other topics covered include factors affecting investment, investment avenues in India like equity shares, bonds, money market instruments, mutual funds and life insurance. It also discusses the meaning of tax planning, objectives and essentials of tax planning.