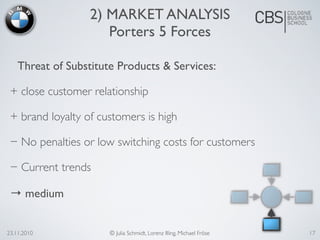

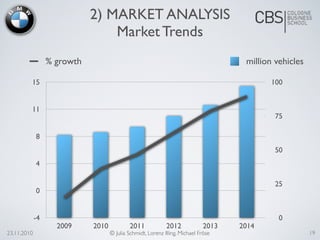

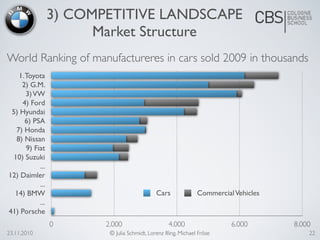

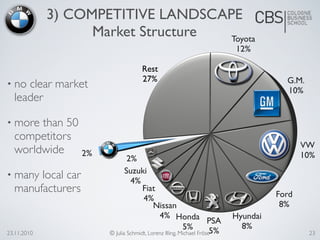

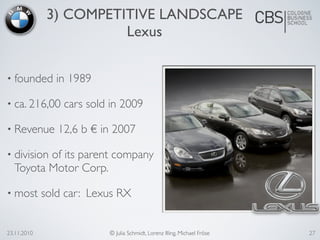

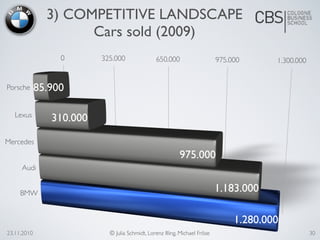

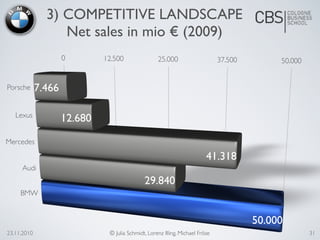

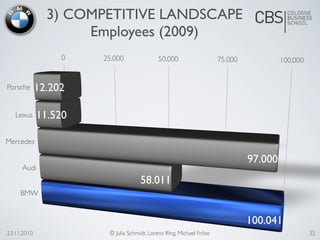

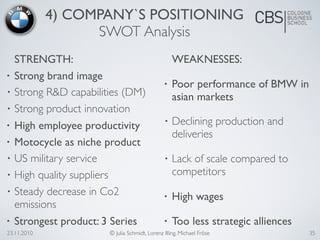

The document provides an analysis of BMW's market position. It discusses BMW's history, current operations with over 1 million cars sold annually across various brands and regions. A PEST analysis finds rivalry among competitors to be high, threat of new entrants low, bargaining power of suppliers and buyers to be medium and high, and threat of substitutes to be medium. Key competitors like Mercedes, Audi, Porsche, and Lexus are analyzed. BMW's strategy is to be the leading provider of premium products and services. A SWOT analysis finds strengths in branding and innovation and weaknesses in Asian market performance. Opportunities exist in hybrid vehicles and growth markets while threats include competition and regulations. Recommendations include expanding in growth markets