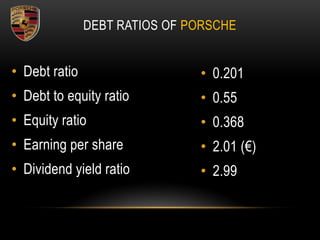

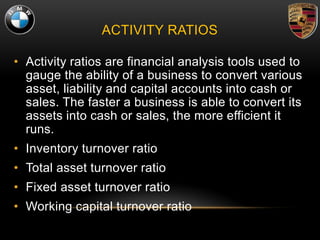

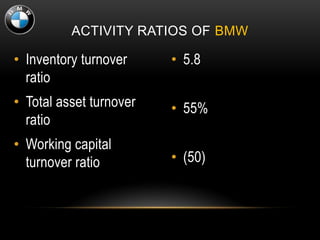

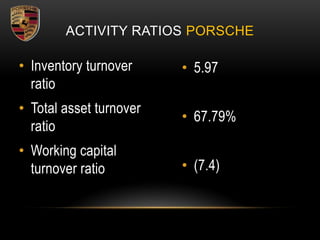

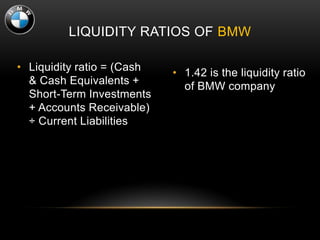

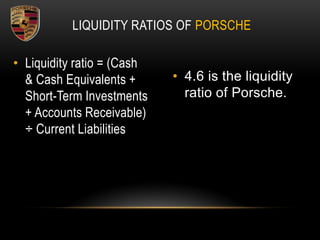

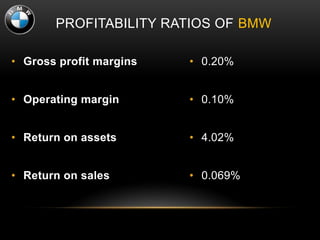

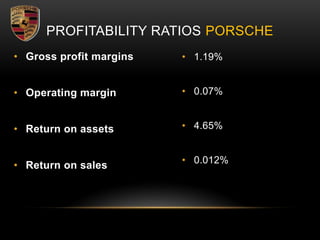

The document analyzes BMW and Porsche using various financial metrics including debt ratios, activity ratios, liquidity ratios, and profitability ratios. For debt ratios, BMW has a debt ratio of 0.27, debt to equity ratio of 1.13, and equity ratio of 0.24 while Porsche has lower debt with a debt ratio of 0.201, debt to equity ratio of 0.55, and equity ratio of 0.368. The document also compares the companies' activity, liquidity, and profitability ratios to evaluate operating efficiency and financial performance.