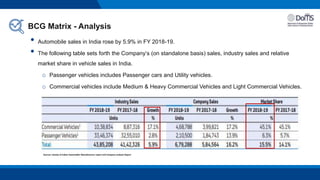

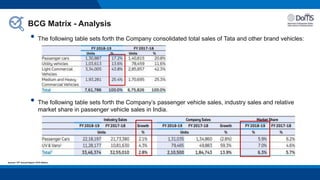

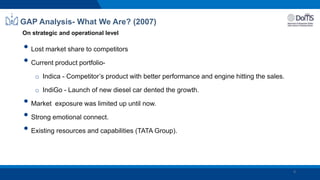

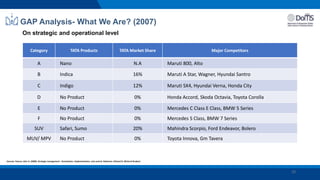

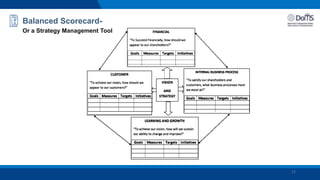

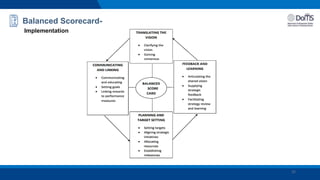

The document provides details about Tata Motors' implementation of the Balanced Scorecard as a performance management tool to drive its turnaround strategy in the early 2000s. It discusses how Tata Motors created a cross-functional committee and core scorecard team to build strategy maps and cascaded scorecards from the corporate to business unit levels. This achieved better vertical alignment of objectives across the organization. As a result, Tata Motors was able to significantly improve its financial performance and sales growth within two years of implementing the Balanced Scorecard.