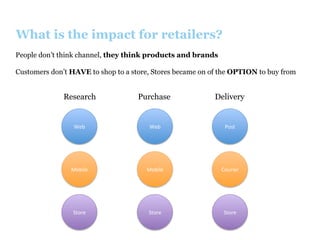

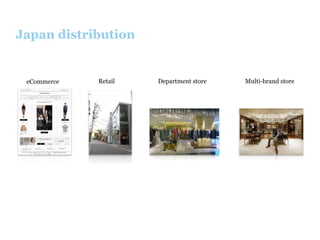

This document discusses the strategy and execution of establishing an omnichannel distribution model for the brand Carven in Japan. Key points include:

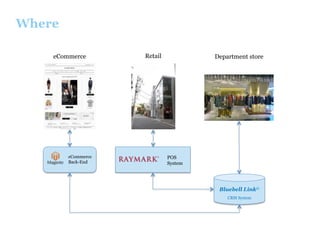

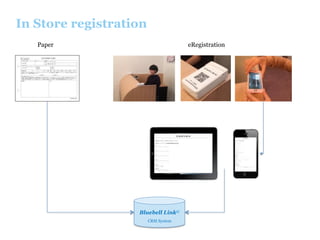

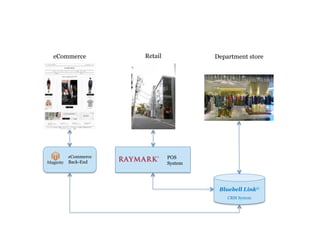

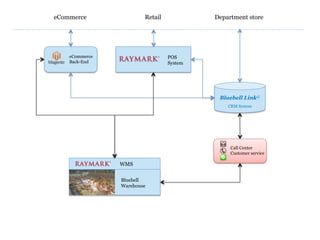

- Collecting customer data from all touchpoints including ecommerce, retail stores, and department stores and merging the data for analysis.

- Developing a best-in-class multi-channel customer service by integrating call centers, ecommerce, retail, and warehouses.

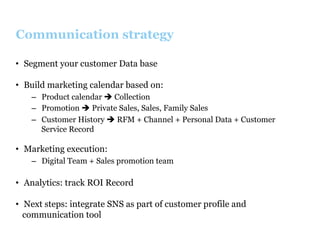

- Adapting communication and promotion strategies based on customer data segmentation and purchase history across channels.

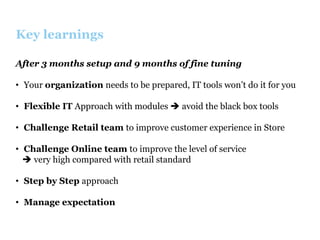

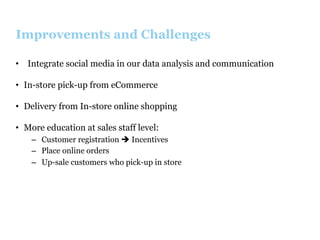

- Establishing KPIs and being responsive to optimize the omnichannel model through improvements and addressing challenges over time.