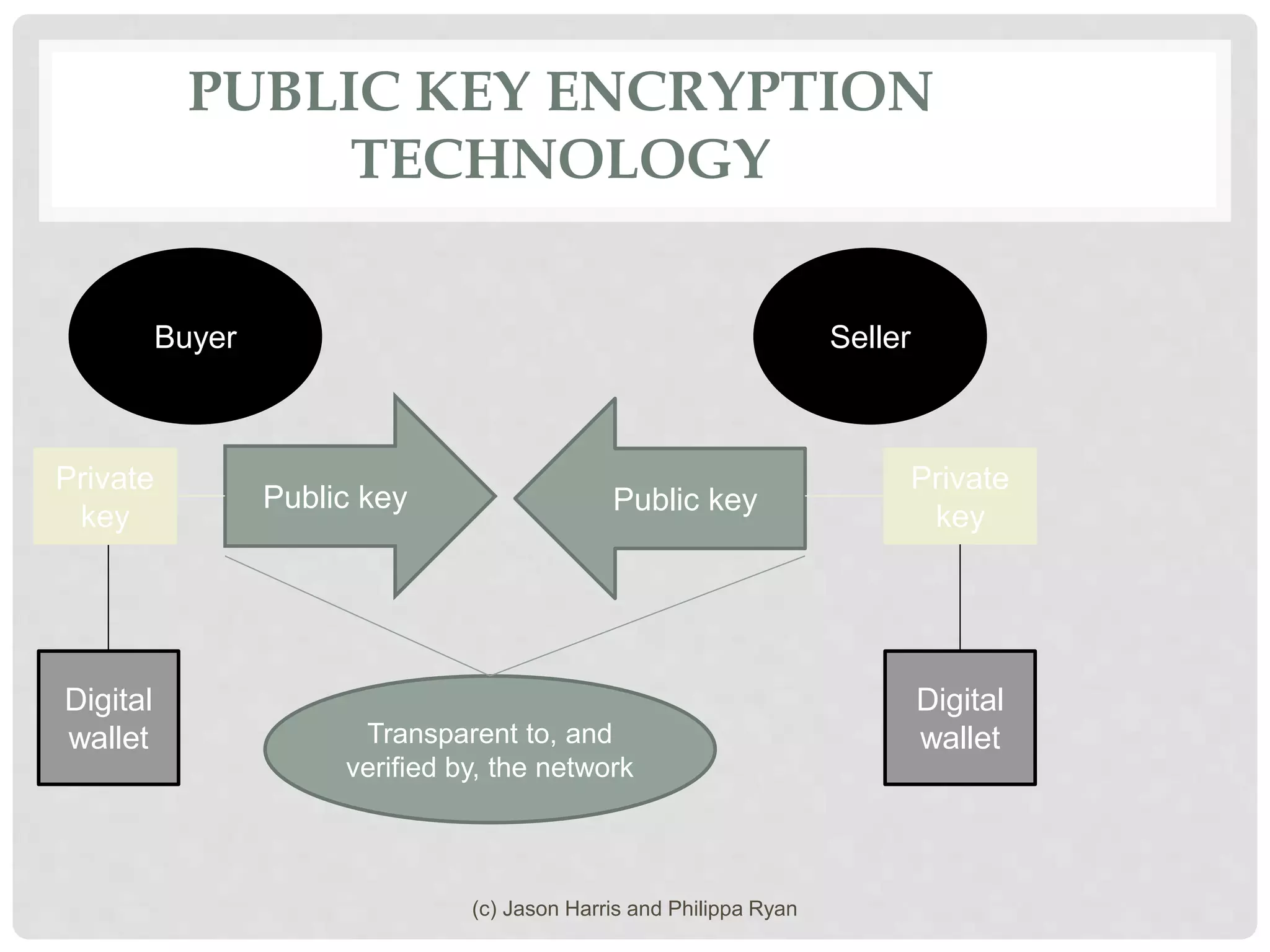

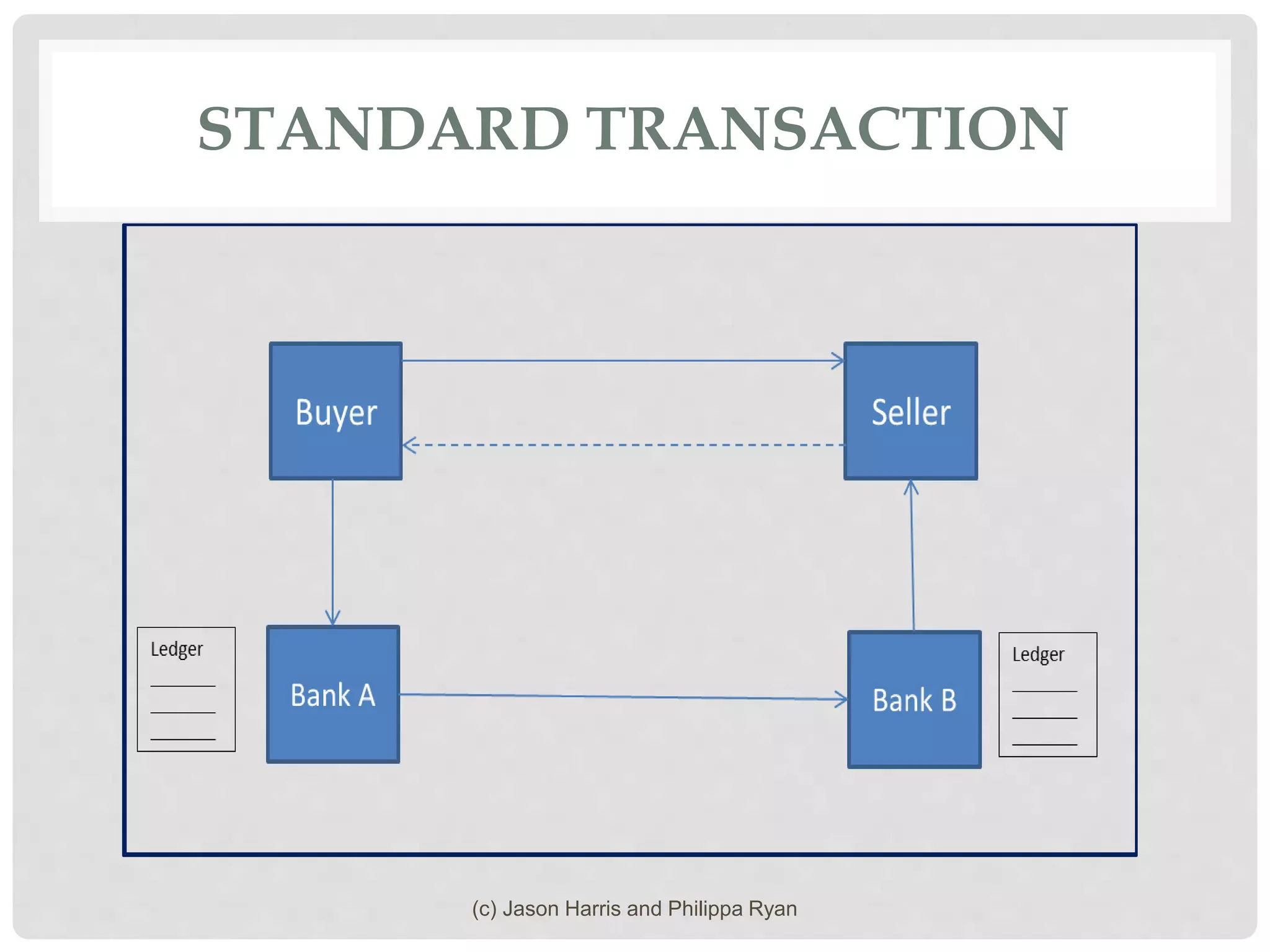

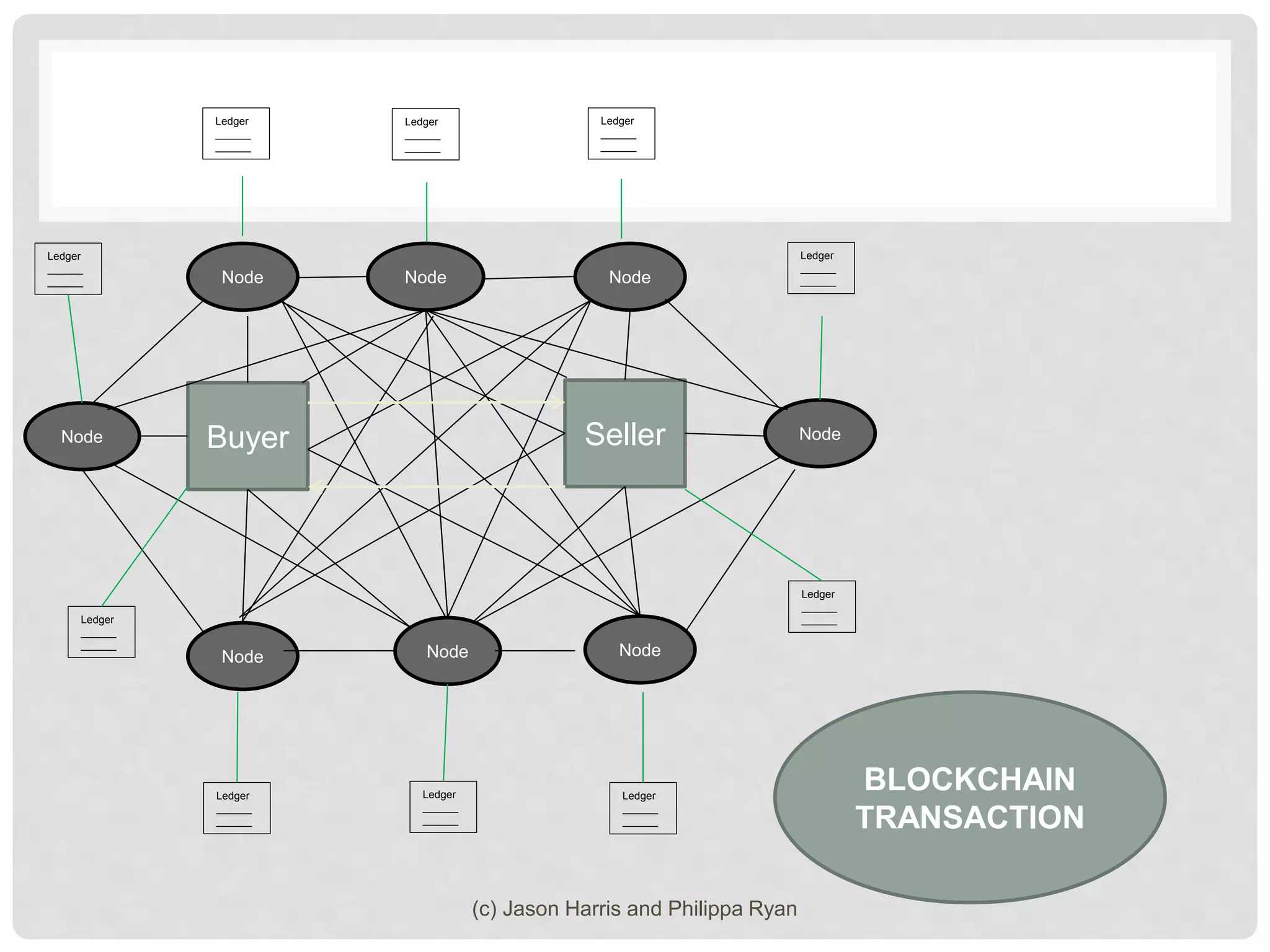

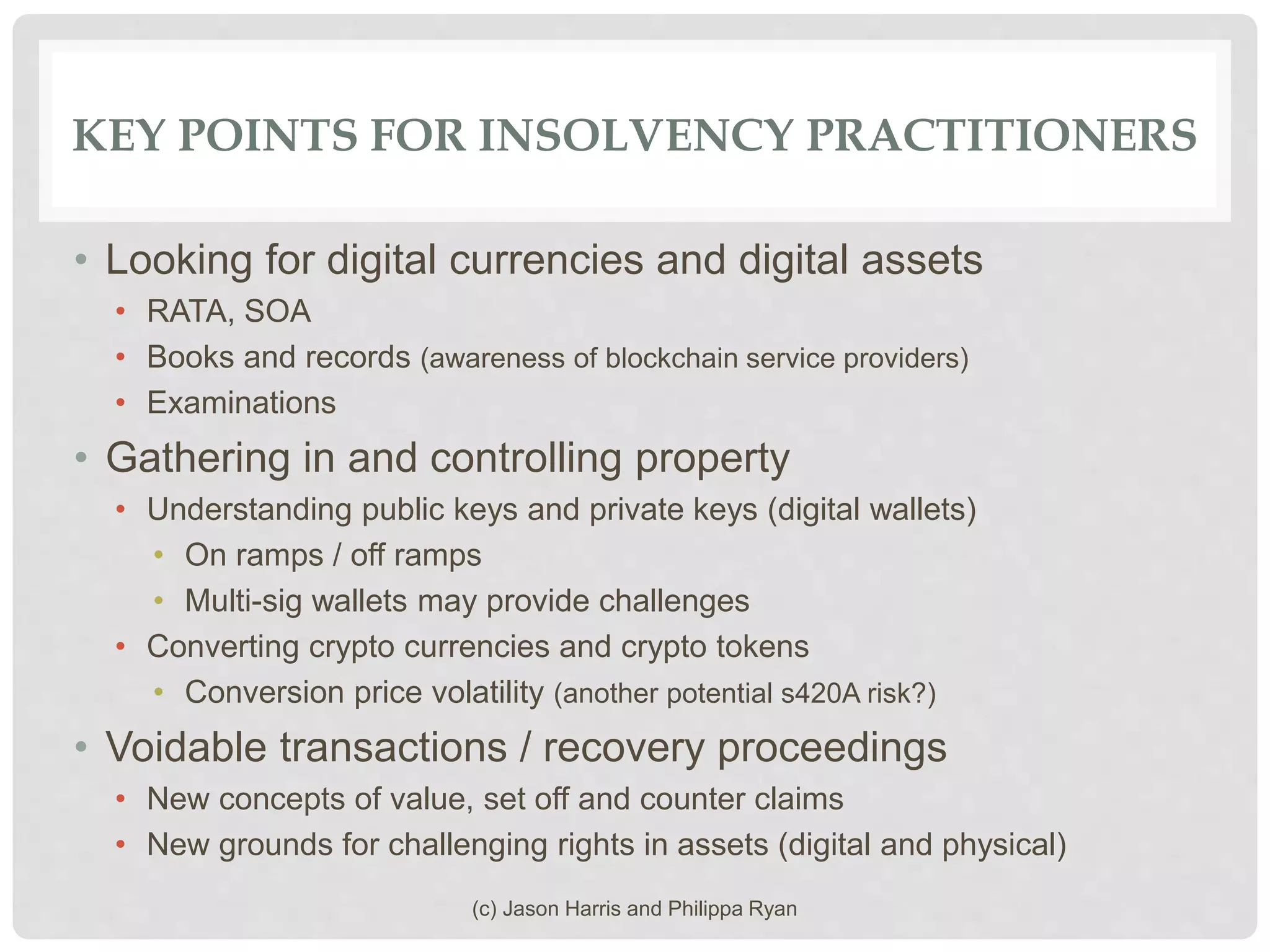

The document provides an overview of blockchain technology and digital assets, detailing their significance in modern transactions, particularly for insolvency practitioners. It outlines key concepts such as blockchain applications, digital currencies, smart contracts, and the role of various cryptocurrencies and exchanges. Additionally, it emphasizes the importance of understanding these technologies for managing and recovering digital assets in insolvency scenarios.