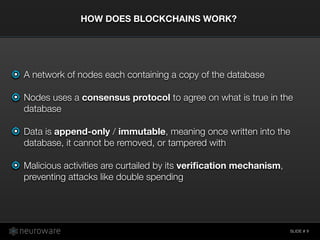

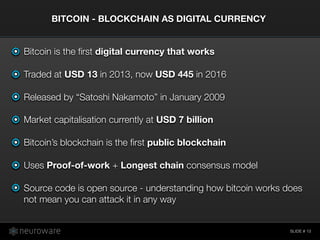

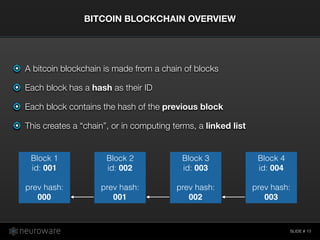

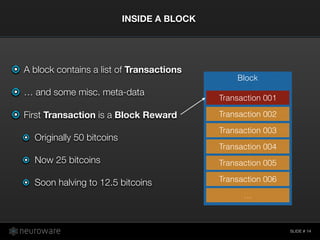

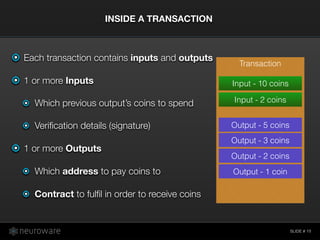

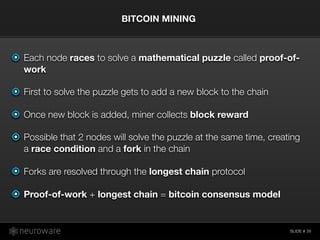

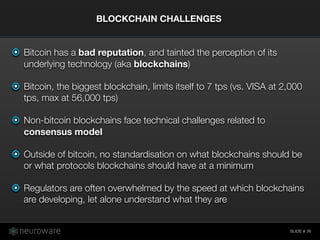

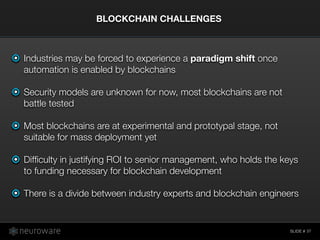

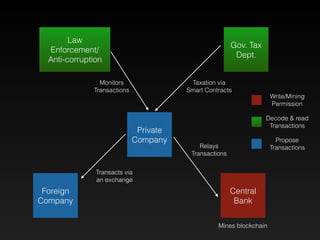

The document discusses the potential of blockchain technology, highlighting Neuroware's innovations as the first Malaysian company to graduate from Silicon Valley's 500 startups. It explains the mechanics of blockchains, particularly Bitcoin, and their implications for various sectors such as finance, with increased security and programmable contracts. The current challenges facing blockchain implementation and adoption in industries are also addressed, emphasizing the need for standards and regulatory understanding.