- Bitcoin is a digital currency based on cryptography. Transactions are recorded on a decentralized peer-to-peer network, without a central authority.

- The document discusses how the Bitcoin protocol works, including how the blockchain solves the double spending problem and incentivizes miners to verify transactions through cryptocurrency rewards.

- While Bitcoin has potential advantages like low fees and no central control, there are also concerns about its ability to replace national currencies, provide true anonymity, and be regulated by governments.

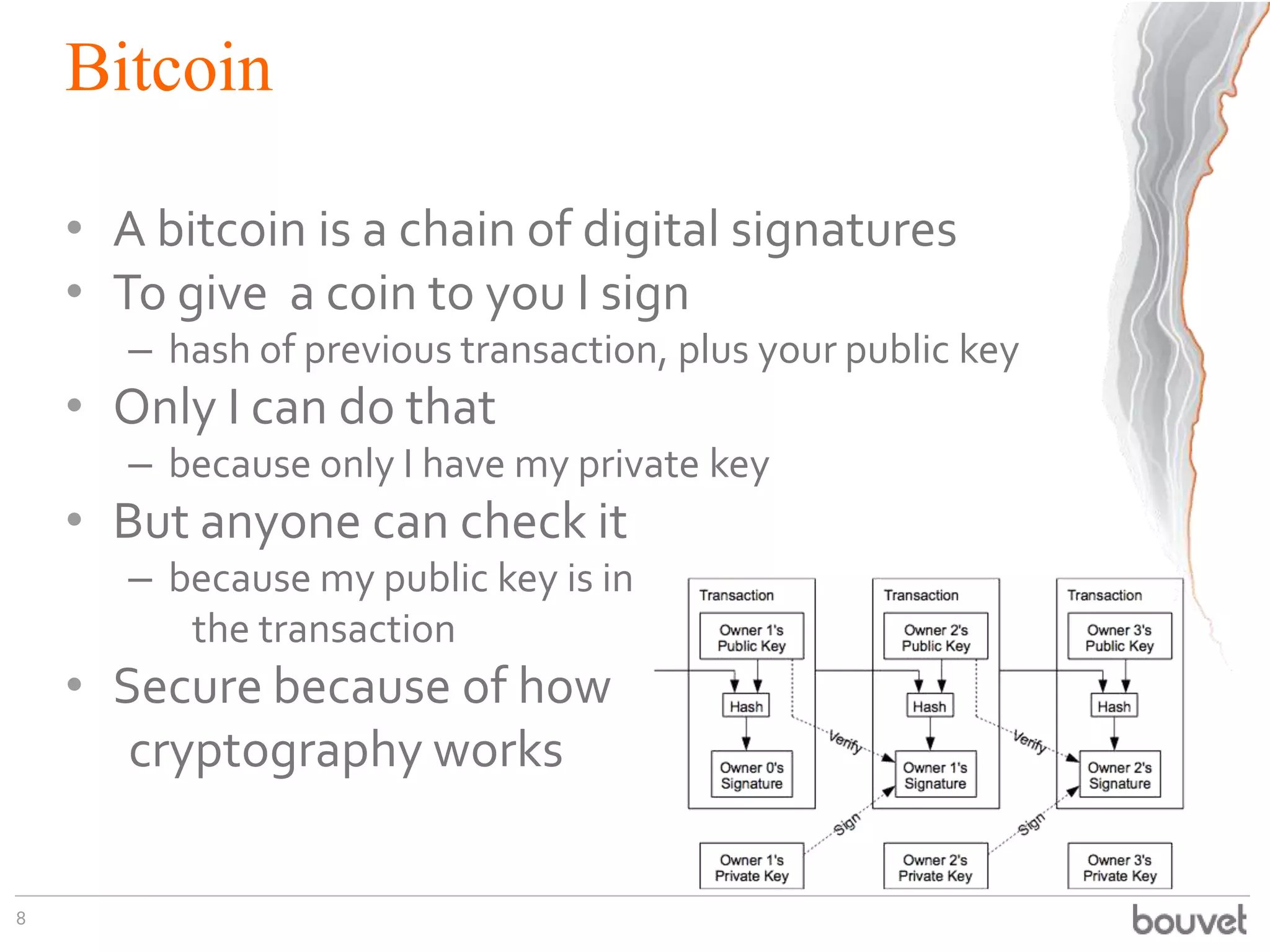

![Money without banks

26

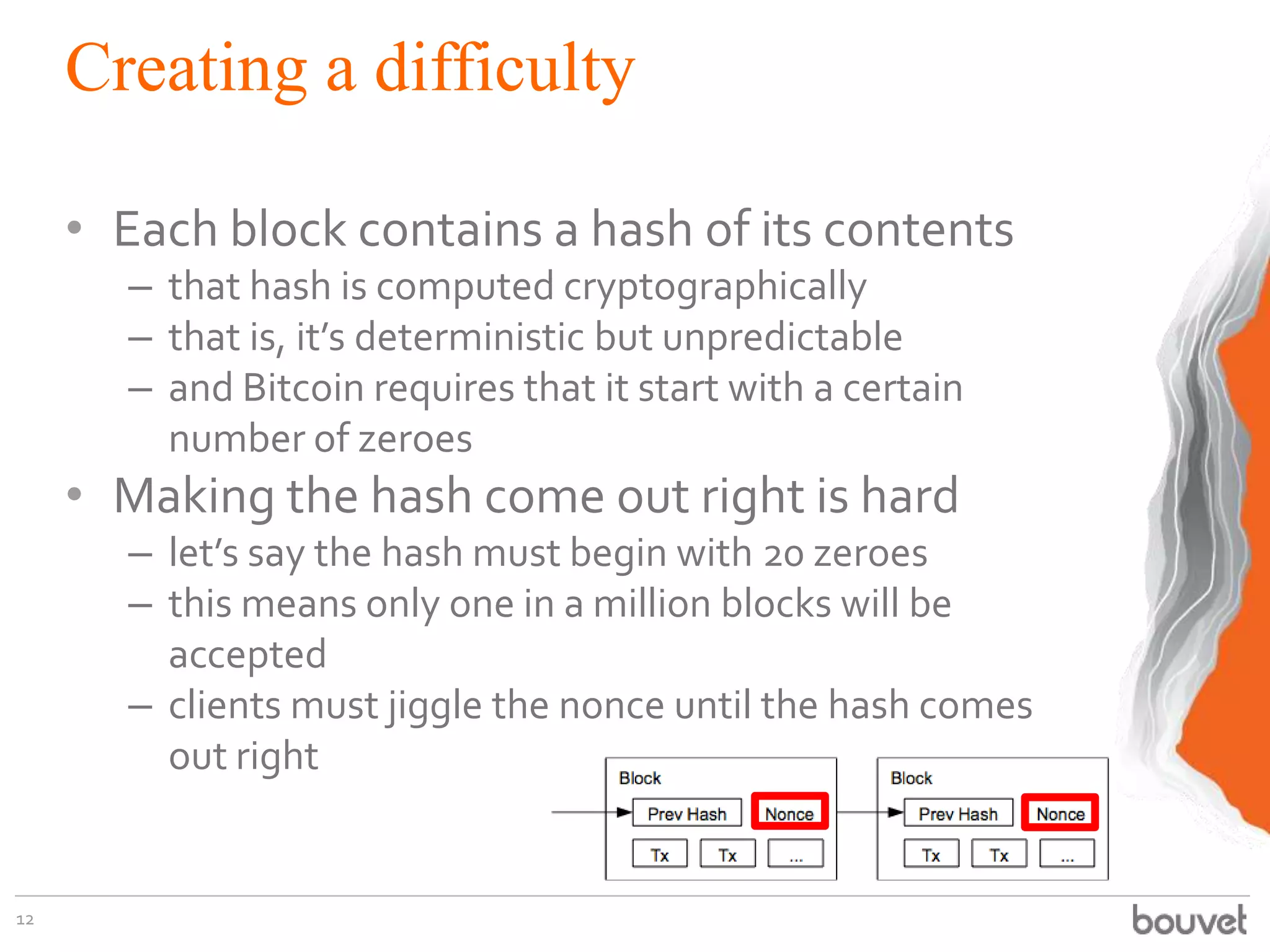

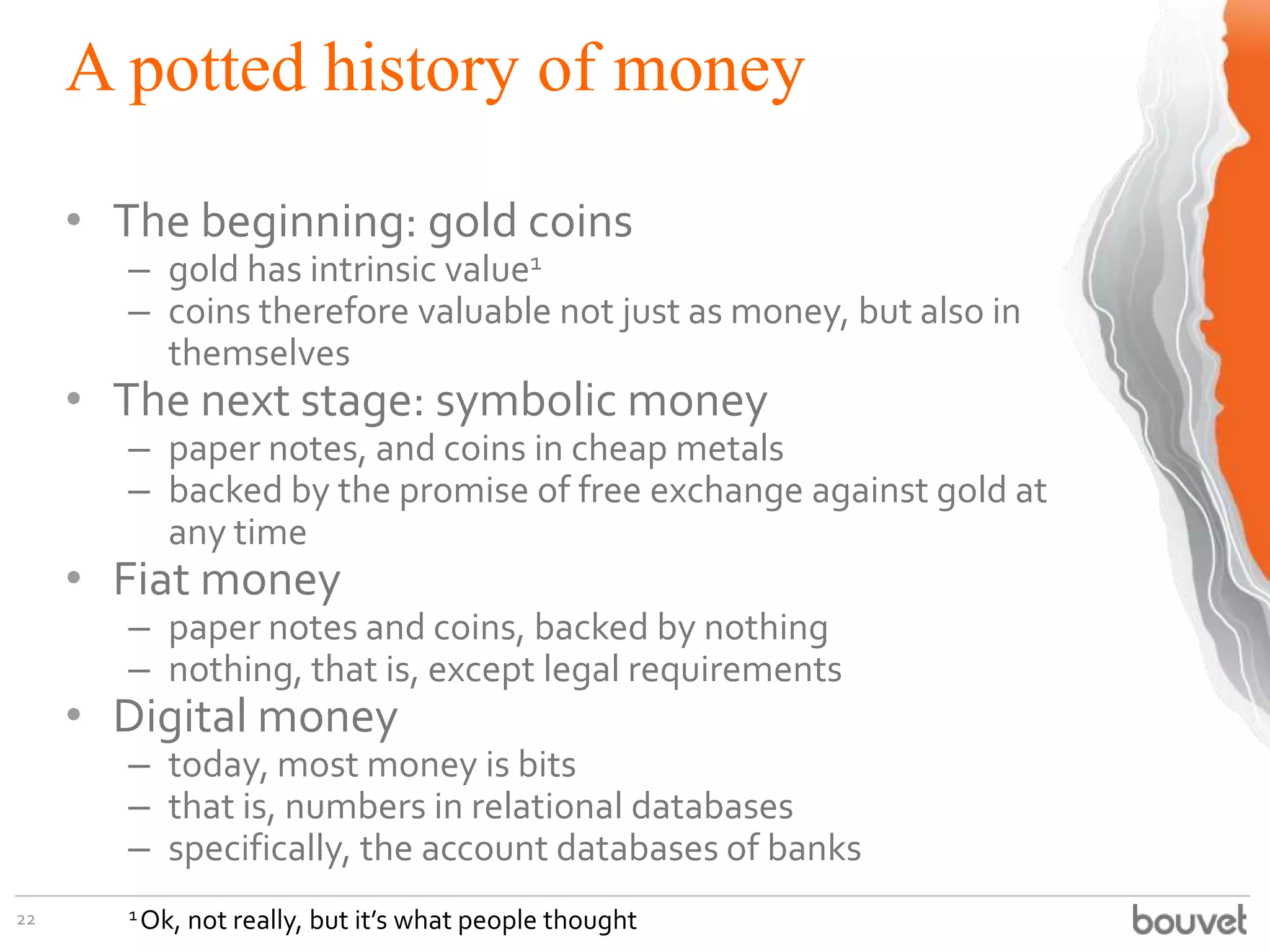

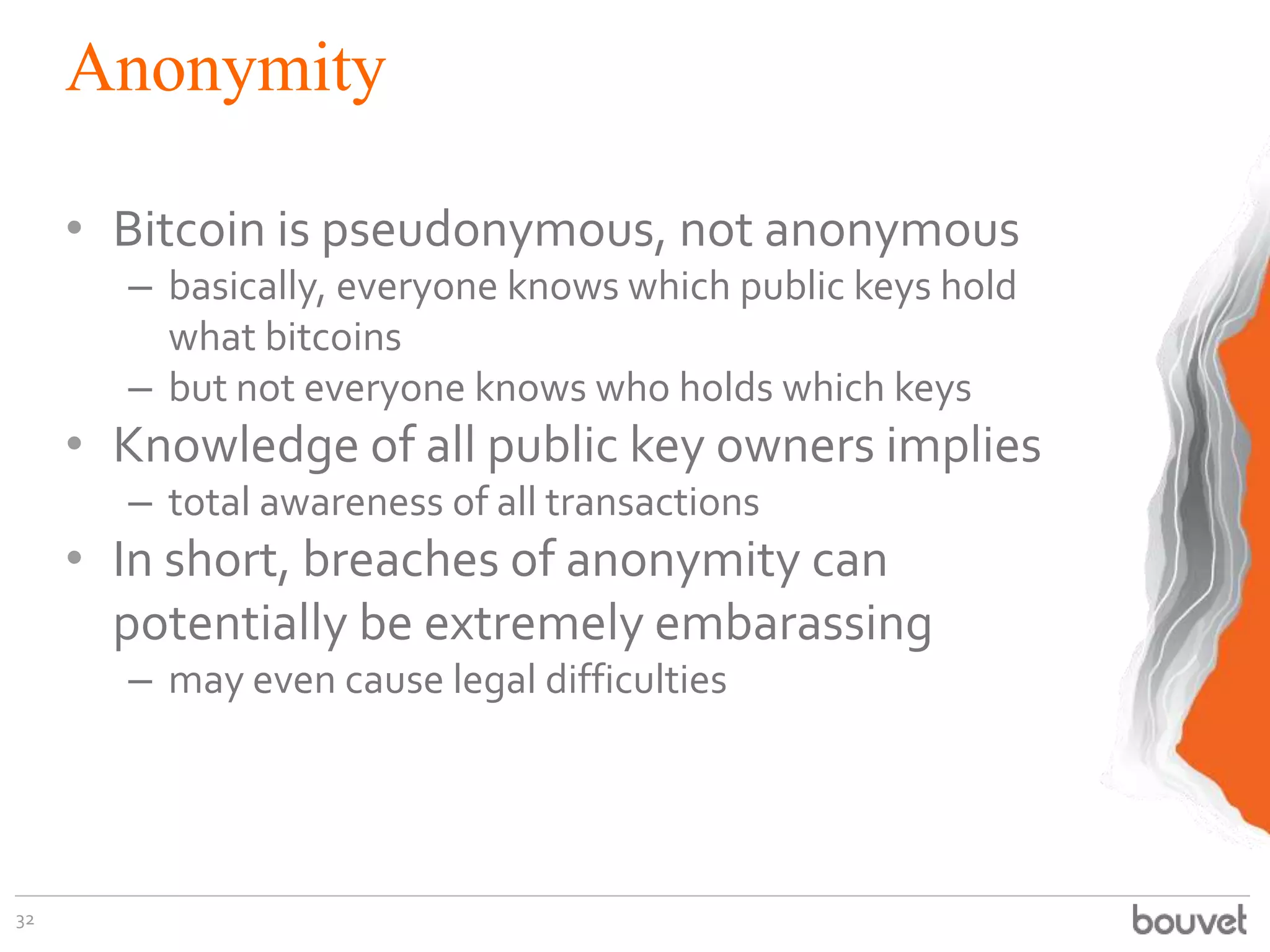

Following an industrial dispute, [Ireland]’s

banking system shut down for nearly seven

months, with customers unable to withdraw or

deposit money.Yet instead of the country

grinding to a halt as anticipated, people began

accepting cheques or IOUs based on their own

assessments of risk. So in a rich and developed

economy, albeit one with strong communal

links, institutionalised banking was replaced by a

personalised credit system – proving, he says,

“the official paraphernalia” of banks, credit cards

and notes, can disappear “and yet money still

remains”.

http://www.guardian.co.uk/books/2013/jun/09/money-biography-felix-martin-review](https://image.slidesharecdn.com/bitcoin-130620013853-phpapp01/75/Bitcoin-digital-gold-26-2048.jpg)

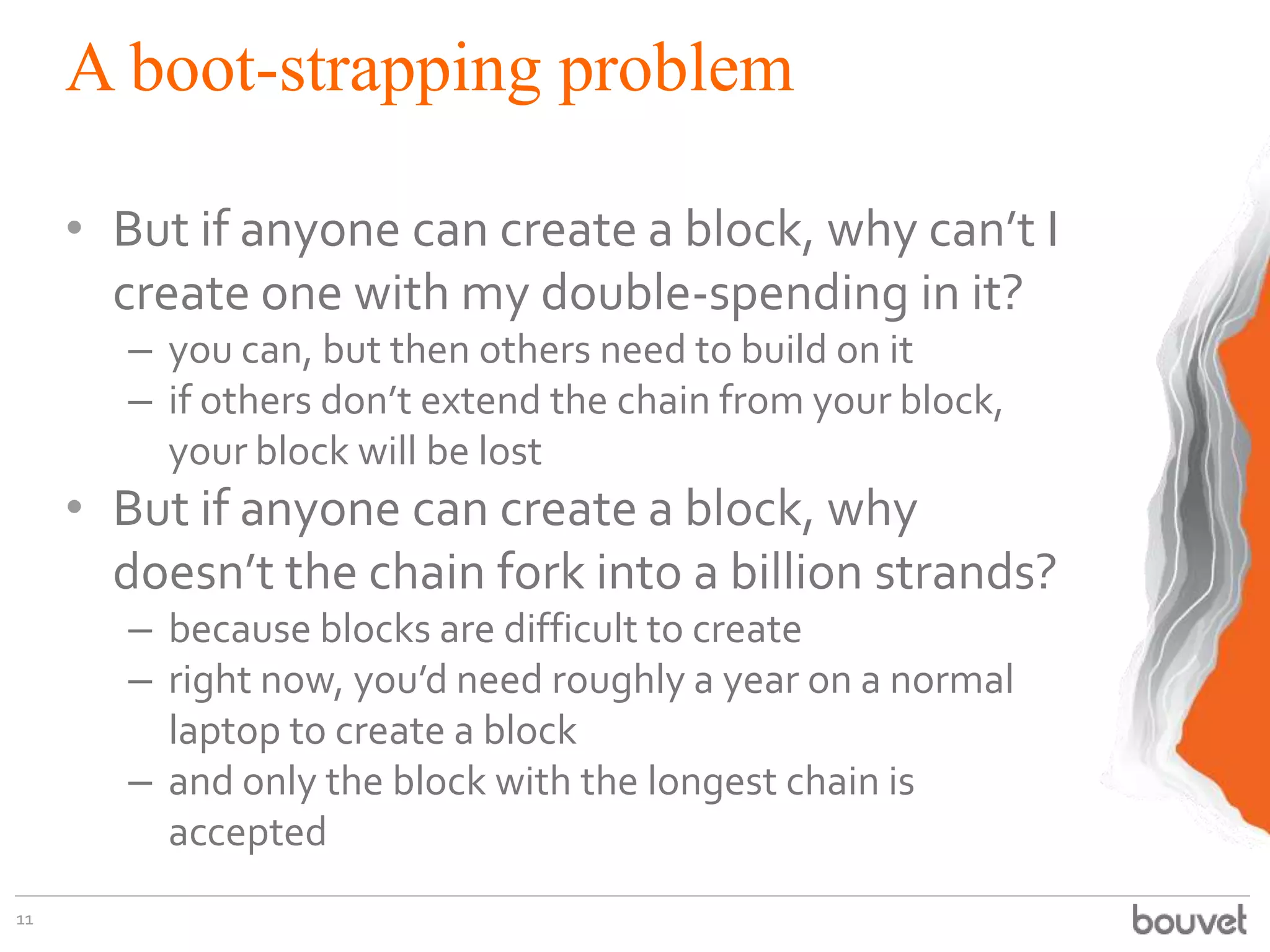

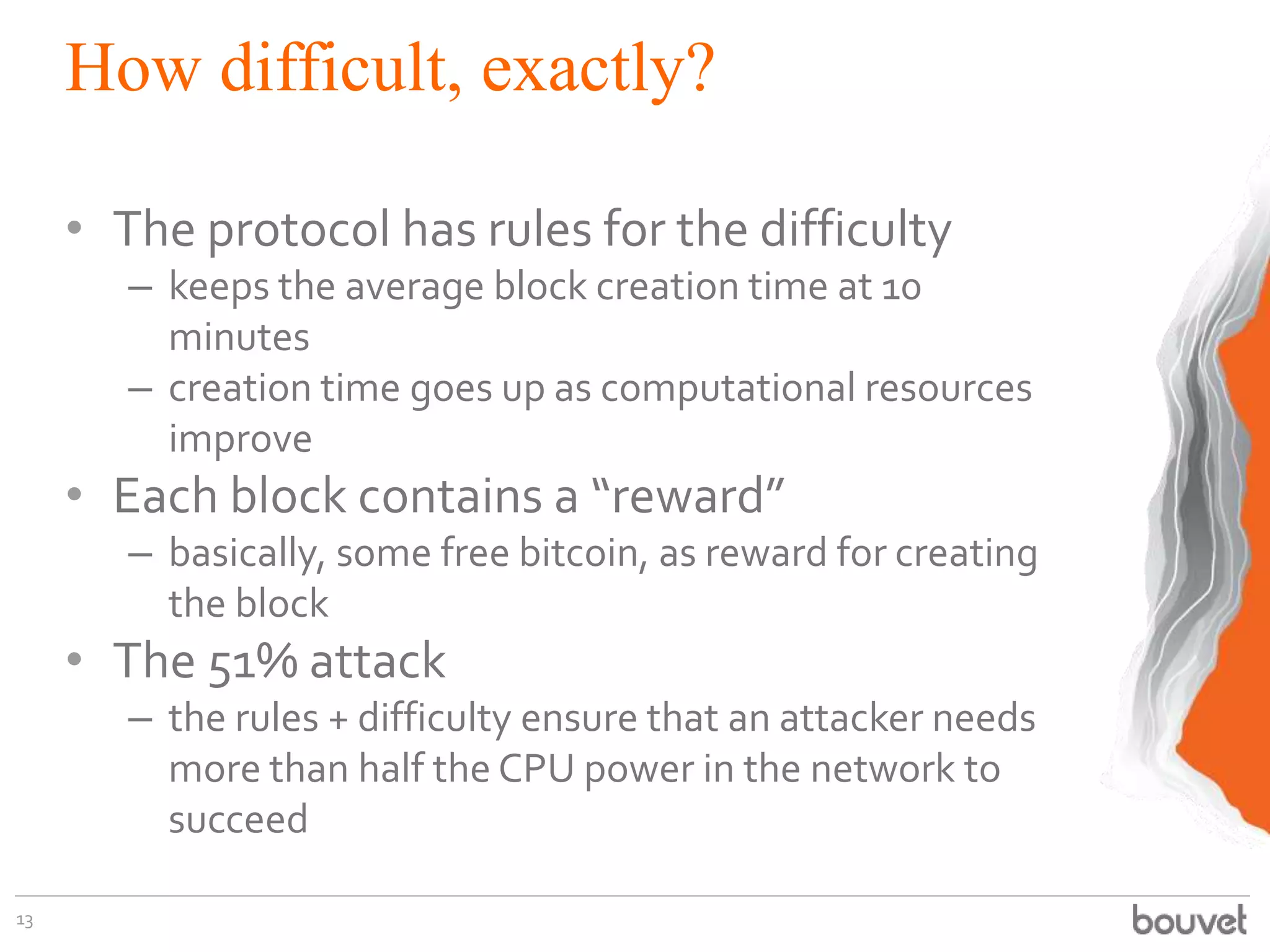

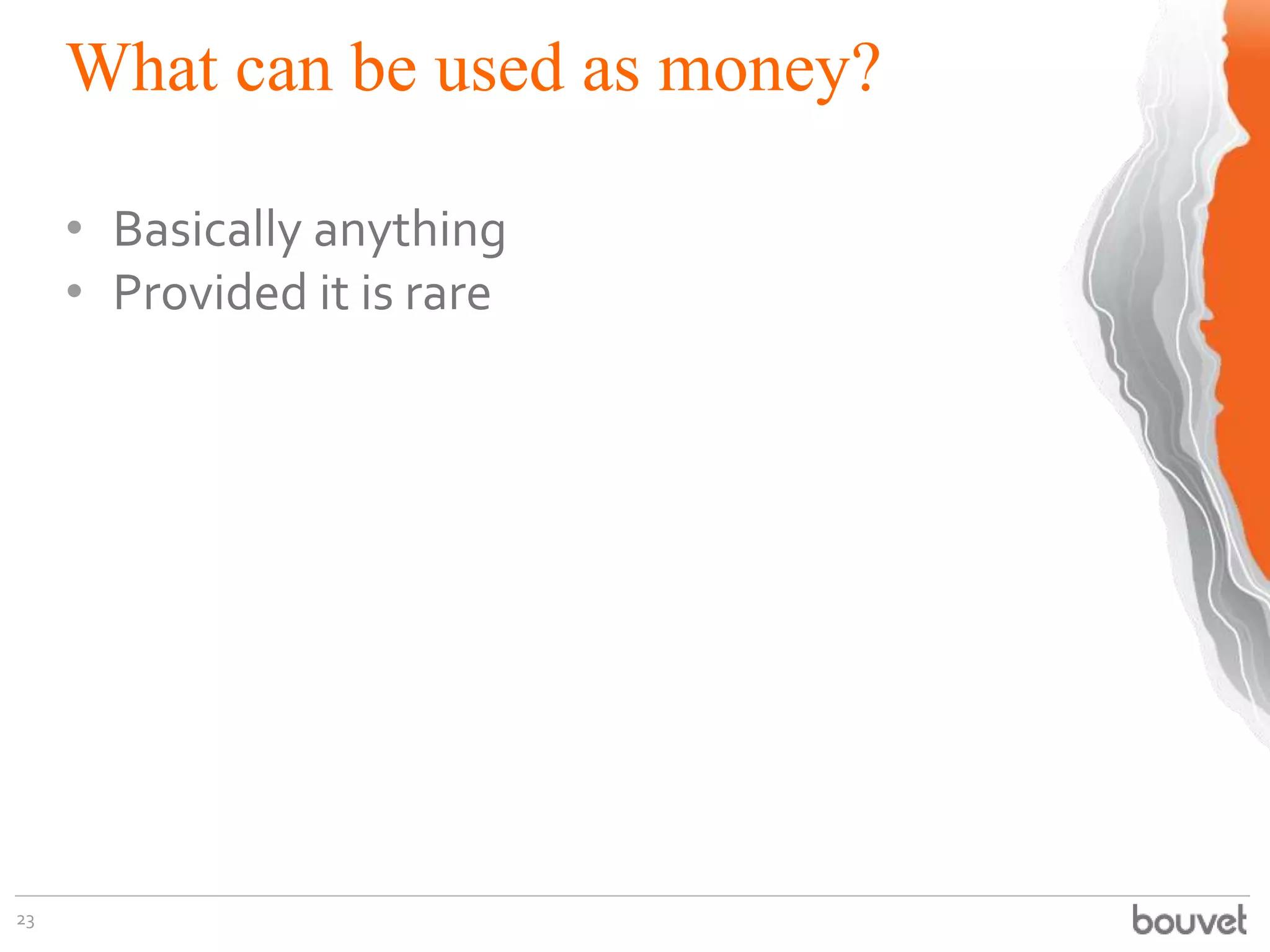

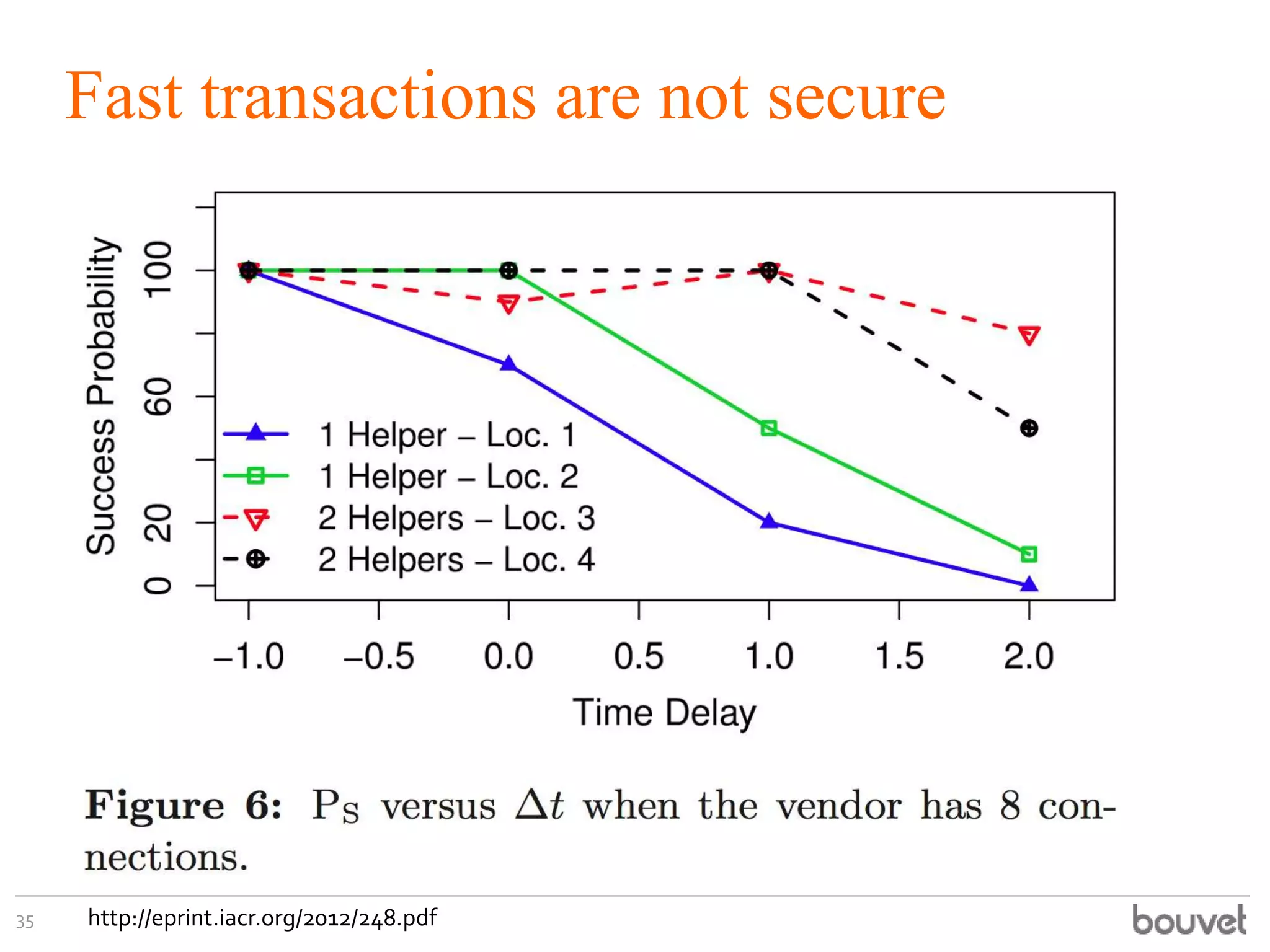

![But what about that pub?

36

• They accept fast payments

• So, basically, they’re taking

the chance that a customer

will double-spend

– probably this is fairly safe at the

moment

– and if they ever get scammed,

they only lose a few pounds

– the publicity is probably worth

more than that, anyway

• The customer is safe

– once the pubco’s servers see the

transaction, they get their beer

– double-spending attacks affect

the seller, not the buyer

http://www.wired.co.uk/news/archive/2013-06/17/london-bitcoin-pub

"By not waiting for a block, we are

vulnerable. On the other hand, my

attitude is if they do, they're standing

right here.They've got a pint in front of

them.You can go and take it off them.

People [in pubs] hang around after a

purchase, rather than walking out, so I

think the risk of a double spend is

minimal.” --Stephen Early, owner

“So far, his pubs have taken

around £750 in Bitcoin

payments in the few weeks

he's been accepting them.”](https://image.slidesharecdn.com/bitcoin-130620013853-phpapp01/75/Bitcoin-digital-gold-36-2048.jpg)